- Developer

- Acima

- Version

- 4.5

- Content Rating

- Everyone

- Installs

- 0.50M

- Price

- Free

- Ratings

- 3.7

Introducing Acima Leasing: The Smart Way to Flexible Credit

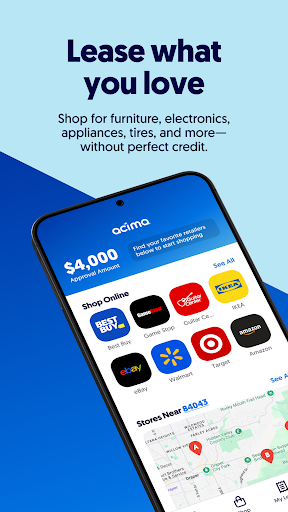

Acima Leasing is a dynamic financial app designed to offer consumers convenient, flexible leasing options for everyday purchases, transforming the way people access credit for big-ticket items without traditional credit checks.

Who Are the Creators? A Brief Look at the Team Behind Acima

Developed by Acima Holdings LLC, a forward-thinking financial technology company, the team comprises experienced professionals in fintech, consumer credit, and user experience design. Their goal is to democratize access to leasing solutions, making financing simpler and more transparent for a broad audience.

Top Features That Make Acima Stand Out

- Flexible Leasing Solutions: Enables users to lease a variety of products — from electronics to furniture — with customizable payment plans.

- No Traditional Credit Checks: Uses alternative data to assess eligibility, opening doors for those with limited or poor credit history.

- Seamless In-App Experience: Streamlines the approval process with quick approvals, integrated payments, and real-time updates.

- Buy Now, Pay Later Integration: Offers easy payment options that fit into users' budgets, making high-value purchases more accessible.

A Closer Look: Why Acima Is a Game-Changer in Fintech

Imagine walking into your favorite electronics store or furniture outlet, and instead of the usual credit approval nightmare, you're greeted with a simple, fast leasing option available right on your smartphone. That's the essence of Acima's appeal — it's like having a financial concierge in your pocket, simplifying complex credit decisions into a few taps.

Intuitive Interface and User Experience

Acima's app boasts a clean, modern interface designed to guide users effortlessly through the leasing journey. The onboarding process is straightforward, with clear instructions and visual cues guiding users from account creation to product selection. The app's navigation is logical — the main dashboard provides instant access to lease options, account details, and payment schedules. Transactions are smooth, with animations that give feedback upon actions, reducing any friction or confusion. For users new to leasing or credit options, the learning curve is gentle, thanks to integrated tips and FAQs seamlessly woven into the experience.

Core Features in Action

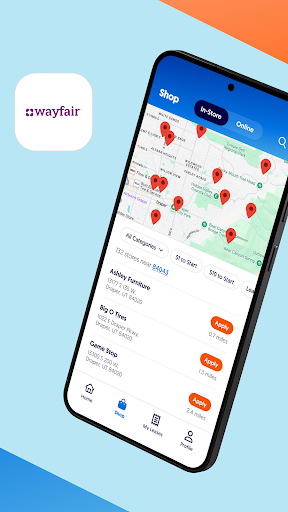

One of the main selling points is its leasing flexibility. Users can browse extensive catalogs within partner retailers directly through the app, and selecting an item triggers an instant pre-approval process. Unlike traditional credit checks, Acima assesses eligibility with an innovative approach, analyzing alternative data such as payment history and recent financial activity. This makes approval not only faster but more inclusive, especially for consumers who might be declined by banks or credit card companies. Once approved, setting up payment plans is a breeze, with the app allowing users to choose weekly, bi-weekly, or monthly options, giving them control over their budget.

Security is another major highlight. Acima leverages advanced encryption and secure onboarding protocols to ensure user data and transaction details stay protected. Compared to many other finance apps, its emphasis on transparency and account security reassures users that their financial information is in safe hands.

The transaction experience itself is noteworthy — the app offers real-time updates, seamless payment portals, and instant receipts. Users can schedule upcoming payments and get reminders, making managing leasing agreements less stressful than juggling bills — almost like having a financial assistant watching over your shoulder.

How Does It Differ from Other Finance Apps?

Many fintech apps focus solely on credit cards or traditional loans, often requiring lengthy approval processes and extensive credit checks. Acima breaks this mold by focusing on leasing and alternative data-based approval, which creates a more inclusive environment. Its most unique feature—the combination of leasing flexibility and enhanced security—sets it apart from competitors like Afterpay or Affirm, which primarily target single purchase financing.

The platform's emphasis on security and transparency — including clear lease terms, secure payment portals, and detailed account management — also differentiates it from less robust competitors. For users concerned about account and fund security, Acima's robust encryption and privacy measures offer peace of mind, making leasing a trustworthy alternative for financial flexibility.

Recommendation & Best Use Cases

Overall, I'd recommend Acima Leasing to consumers who seek a flexible, accessible alternative to traditional credit options — especially those who want to avoid the wait and hassle of bank approvals. It's ideal for purchasing durable goods, electronics, and furniture where immediate payment plans are desirable. Moreover, its user-friendly design makes it suitable for fintech newcomers.

For those who prioritize account security and transparent transactions, Acima's emphasis on these aspects is reassuring, making it a top choice among leasing applications. However, users should still read lease terms carefully, as total repayment amounts can sometimes be higher than upfront purchase prices.

In short, if you're looking for a reliable app that balances ease of use, flexible financing, and data security, Acima Leasing is a dependable option worth considering—like having an accessible financial partner always ready to help you make your purchase more manageable.

Pros

- User-friendly interface

- Transparent leasing options

- Quick application process

- Flexible lease terms

- Comprehensive account management

Cons

- Limited device compatibility (impact: medium)

- Occasional app stability issues (impact: low)

- Customer support response time (impact: low)

- Limited language options (impact: low)

- Payment reminder notifications may be delayed (impact: low)

Frequently Asked Questions

How do I get started with Acima Leasing?

Download the app from your app store, create an account, and explore available products and leasing options through the intuitive interface.

What information do I need to set up my lease?

You'll need basic personal details, such as your ID, contact info, and income verification, to complete the leasing application within the app.

How can I view and manage my lease details?

Navigate to 'My Leases' in the app dashboard to view, payment history, and make payments easily from the 'Manage Lease' section.

What types of products can I lease with Acima?

You can lease a variety of essential products including furniture, electronics, appliances, tires, and more from extensive retail partners.

How does the lease-to-own process work?

Select your products, approve lease terms in the app, and make scheduled payments, leading to ownership after fulfilling payment obligations.

What is the maximum amount I can lease through Acima?

You can lease products worth up to $4,000, with flexible payment plans based on your budget.

Are there any hidden fees or charges?

No, the app includes a payment calculator to show clear costs upfront, ensuring transparency for your lease agreement.

Do I need good credit to use Acima Leasing?

No, Acima offers solutions that do not require a credit check, making leasing accessible to many users.

How can I change my payment schedule or plan?

Visit 'Payment Settings' within the app to select, modify, or update your payment schedule according to your preferences.

What should I do if I have trouble with the app or my lease?

Contact customer support via 'Help' section in the app for assistance, troubleshooting tips, or to resolve any issues promptly.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4