- Developer

- Acorns

- Version

- 4.174.0

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.7

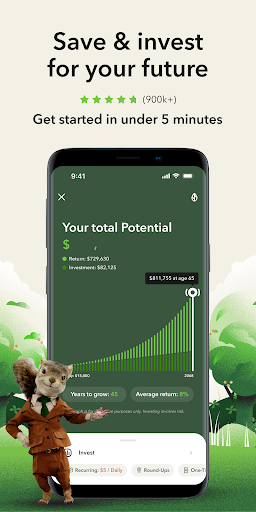

Introducing Acorns: Invest For Your Future — A Smart, Friendly Investment Companion

Acorns: Invest For Your Future is a user-centric investment app designed to simplify wealth-building through micro-investing and automated features, making investing accessible for everyone from beginners to seasoned savers.

Developers and Core Features

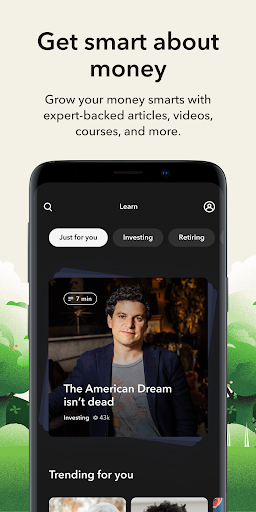

Developed by the passionate team at Acorns Grow Inc., this platform combines intuitive design with innovative financial tools. Its standout features include round-up investments that turn everyday spending into savings, professionally managed portfolios, and educational resources that empower users to make informed decisions. The app's goal is to democratize investing by lowering barriers to entry and fostering financial literacy.

Target Audience

Acorns appeals to young professionals, first-time investors, and anyone seeking to build savings effortlessly. Its simplicity suits those new to investing, while its robust features can also attract more experienced users looking for automated investment options and financial education.

A Vibrant Gateway to Simple Wealth Building

Imagine a friendly financial guide that whispers, “Hey, let's make investing effortless and fun!” That's what Acorns offers. Its approach transforms what can seem complex and intimidating into a seamless experience, much like having a personal assistant for your money. Whether you're saving for a vacation, a new gadget, or a rainy day, Acorns encourages a gentle, consistent step toward financial security.

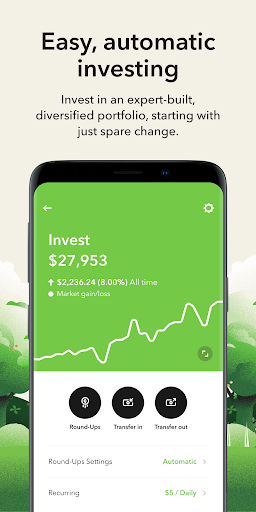

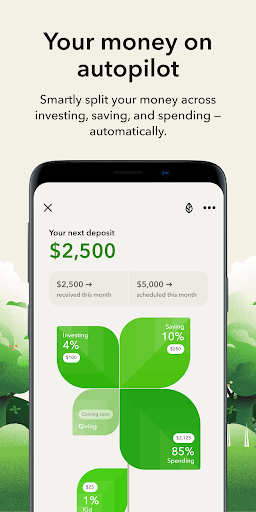

Round-Up and-auto Invest: Turning Spare Change into Growth Engines

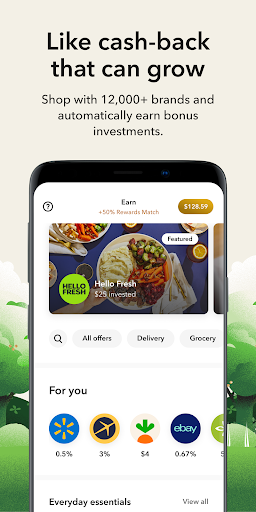

The core allure of Acorns lies in its innovative round-up feature. Every time you make a purchase with linked cards, the app rounds up your transaction to the nearest dollar and invests the spare change. It's like planting tiny seeds daily, which gradually grow into a thriving financial tree. Users can also set recurring investments, ensuring that saving becomes part of their routine without feeling burdensome. The automation behind this function creates an effortless pathway to wealth accumulation by leveraging everyday spending habits.

Smart Portfolio Management — Guided Investment Strategies

Acorns streamlines the complex process of managing an investment portfolio. Its smart algorithms allocate your funds across diversified ETFs based on your risk profile and goals. For beginners, this means you don't need to be an investing guru to set up a sensible plan. The app also offers personalized advice and insights, adapting to your progress over time. This feature embodies the “set it and forget it” ethos, making investing feel like tending a garden—patiently nurturing your assets rather than micromanaging every detail.

User Experience: Intuitive, Smooth, and Learning-Friendly

The ride with Acorns feels less like navigating a maze and more like cruising along a well-paved road. Its interface is clean, colorful, and inviting—think of it as strolling through a friendly, digital orchard. The onboarding process is straightforward, guiding newcomers gently through setup without overwhelming them with jargon. The app operates smoothly across devices, with quick responses and seamless transitions. For users eager to learn, Acorns offers bite-sized educational content that feels like friendly tips from a knowledgeable companion, lowering the learning curve.

Differentiation from Other Financial Apps

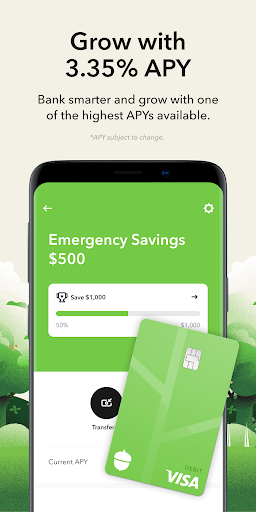

While many investment apps emphasize high-tech features and aggressive marketing, Acorns distinguishes itself through its unparalleled focus on security and transaction experience. The app employs bank-level encryption, FDIC insurance for certain investments, and secure account integrations, ensuring peace of mind. What truly sets it apart is its commitment to transforming everyday spending into a steady growth engine without compromising ease or security. Unlike some apps that require complicated account setups or lack transparency, Acorns provides clear information about fees, investments, and account status, empowering users to trust their financial journey.

Final Thoughts: Worth a Try for the Zestful Saver

In essence, Acorns functions as a friendly savings companion, gently nudging you toward your financial goals with minimum fuss. Its strongest points—auto-investment through round-ups and tailored portfolio management—are especially powerful features that make small steps feel impactful. For those who want a simple, reliable way to start investing without feeling overwhelmed, Acorns is a compelling choice. It's best suited for newcomers and casual savers seeking an easy entry into the world of investing, but its thoughtful design ensures even seasoned investors can find value in its automated approach. Overall, it's a highly recommended app for anyone looking to turn everyday habits into meaningful future gains—trust me, your future self will thank you for it.

Pros

- User-Friendly Interface

- Automatic Round-Ups

- Educational Resources

- Diversified Investment Portfolio

- No Minimum Balance

Cons

- Limited Investment Options (impact: Low)

- Monthly Fees for Small Accounts (impact: Medium)

- Limited Cryptocurrency Exposure (impact: Low)

- Potential Over-Reliance on Automatic Features (impact: Low)

- Market Volatility Impact on Small Portfolios (impact: Medium)

Frequently Asked Questions

How do I get started with Acorns as a beginner?

Download the app, sign up with your email, link your bank account, and set up Round-Ups or recurring investments under Settings > Investing.

Can I invest with just my spare change?

Yes, enable the Round-Ups feature in the app to automatically invest your spare change from everyday purchases.

How does the Round-Ups feature work?

It rounds up your purchases to the nearest dollar and invests the spare change into your diversified portfolio; activate it in Settings > Round-Ups.

What investment options are available in Acorns?

You can choose diversified ETF portfolios, allocate up to 5% in Bitcoin-linked ETFs, or add individual stocks via your account settings.

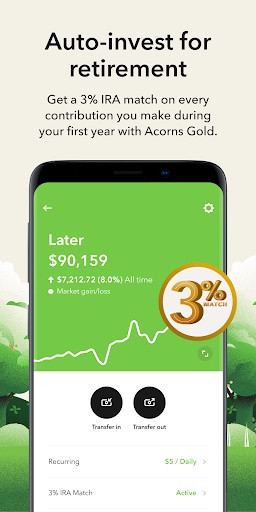

How do I set up an IRA or retirement account?

Navigate to Accounts > Set Up Retirement, choose Acorns Later, and follow the prompts to start saving for retirement.

What are the differences between the subscription plans?

Bronze ($3/month) is basic, Silver ($6/month) adds IRA match and courses, Gold ($12/month) offers full features including kids' accounts and insurance; review Plans in Settings > Subscription.

Can I switch my subscription plan later?

Yes, you can upgrade or downgrade plans anytime via Settings > Account > Subscription, with changes applying immediately or at your next billing cycle.

Are there any hidden fees or costs?

No, Acorns provides transparent monthly plans with no hidden fees; all costs are clearly outlined during sign-up.

What should I do if I encounter app issues or errors?

Try restarting the app or reinstalling it. For persistent issues, contact Acorns Support via Settings > Help or their website.

Is my money secure with Acorns?

Yes, your funds are protected by industry security measures, SIPC insurance (up to $500,000), and FDIC-insured checking accounts up to $250,000.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4