- Developer

- Afterpay

- Version

- 1.128.1

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4

Afterpay: Pay over Time — A Smarter Way to Shop

Imagine shopping seamlessly and splitting your payments into manageable chunks without the hassle of interest or hidden fees—that's what Afterpay delivers. It's a digital financial buddy that transforms the way you pay, making splurges more affordable and budgeting more flexible.

A Fresh Approach from a Trusted Name

Developed by Afterpay Limited, a prominent fintech company known for its innovative buy now, pay later (BNPL) solutions, the app aims to bridge the gap between convenience and financial transparency. Unlike traditional credit cards or loans, Afterpay simplifies the process, allowing users to enjoy their immediate shopping thrill while spreading payments over defined periods. The app features sleek, user-focused designs that cater to young professionals, students, and those seeking smarter payment options—basically, anyone who loves shopping but prefers to keep finances in check.

Key Features That Make Afterpay Stand Out

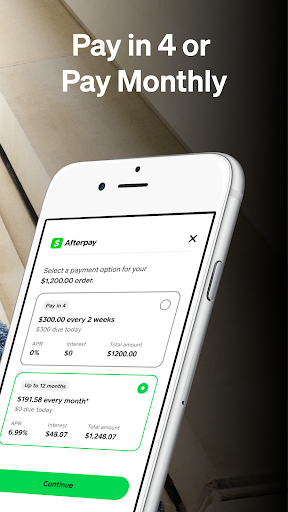

Split Payments Made Simple

The core allure of Afterpay is its “pay over time” model, letting users split their purchase amounts into four equal installments paid every two weeks. This structure feels less intimidating than a lump-sum payment, especially when dealing with bigger ticket items. What's refreshing is that there's no interest accrued, provided payments are made on schedule—offering a transparent alternative to credit-based shopping.

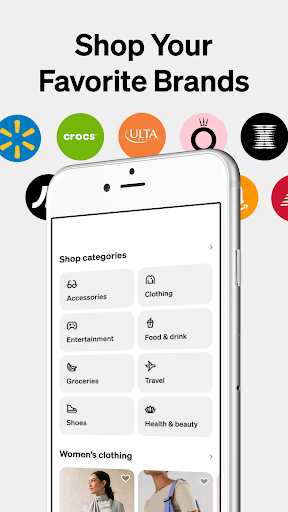

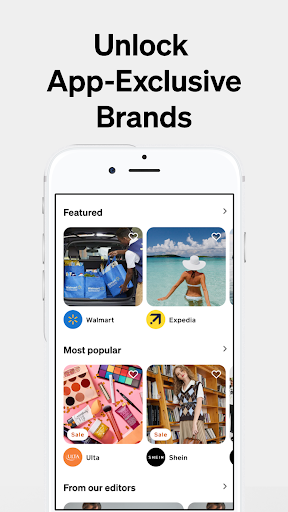

Seamless Shopping Experience & Wide Retail Support

With integrations across thousands of retailers—ranging from fashion outlets, electronics stores to beauty brands—Afterpay acts like a digital VIP pass, giving users access to a broad array of shopping options. Its in-app catalog displays curated deals, upcoming sales, and exclusive offers, helping users discover new brands effortlessly. The app's interface is intuitive, mimicking the simplicity of swiping through a social media feed—just more practical, less distracting.

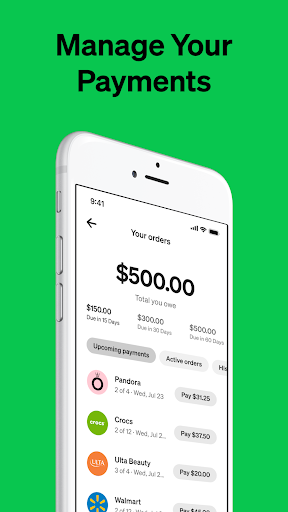

Smart Budget Management & Alerts

The app isn't just about enabling purchases; it's a budgeting partner. Afterpay provides real-time notifications for upcoming payments, helping users avoid late fees and stay on top of their financial commitments. Additionally, the “spend limit” feature acts like a helpful guardrail, preventing overspending and fostering responsible shopping habits. It's like having a financial coach whispering ‘easy does it' as you shop.

Design and User Experience: Friendly Yet Efficient

Overall, Afterpay boasts a clean, minimalistic interface that resembles a stylish dashboard rather than a complex banking platform. Navigation is straightforward: establishing your account, browsing supported stores, and managing payments can be done within a few taps. The app loads swiftly, with fluid transitions making the experience feel seamless—no frustrating lags or confusing menus here. Its learning curve is gentle; even first-timers can get comfortable within minutes, making it accessible for a broad audience.

What Sets Afterpay Apart?

While many other shopping apps focus solely on product variety or discounts, Afterpay's distinct advantage lies in its dual focus on diversity and financial transparency. Its categorization isn't just about putting items into neat folders—it's about offering flexibility in how you pay for those items. Another standout is its straightforward pricing transparency. Unlike some BNPL services that hide interest or fees in fine print, Afterpay's system emphasizes clarity: four equal installments, no interest if paid on time, and no hidden charges—this honesty builds trust.

Compared to traditional credit cards or other BNPL apps, Afterpay doesn't lock users into long-term debt or variable interest rates, making it a safer, more predictable choice for those wary of accruing large debt. Plus, its partnerships with major retailers mean it's not confined to a niche; it's a versatile tool that adapts to your shopping habits rather than forcing you into a specific ecosystem.

Should You Give It a Try?

Based on its user-friendly design, transparency, and flexibility, I'd recommend Afterpay to anyone who frequently shops online and wants to manage payments better without accruing interest. It's particularly well-suited for young adults, students, or anyone who values clear financial boundaries without sacrificing shopping enjoyment. However, like all financial tools, it's essential to use responsibly—never overspend just because a payment plan makes it easier.

In conclusion, Afterpay isn't just another checkout option; it's a thoughtfully designed financial companion that strives for transparency while adding convenience. Whether you're splurging on a special occasion or spreading out everyday purchases, it's a practical, modern solution worth considering in your digital toolkit.

Pros

- Easy, interest-free installment payments

- Quick application process

- Wide acceptance among merchants

- Built-in budget management tools

- No impact on credit score for approval

Cons

- Potential for overspending (impact: Medium)

- Late fees may be incurred (impact: High)

- Limited repayment period for some plans (impact: Medium)

- Merchant acceptance still growing (impact: Low)

- No rewards or cashback incentives (impact: Low)

Frequently Asked Questions

How do I get started with Afterpay?

Download the app, create an account, and link your payment method. Browse participating stores and choose Pay Later options at checkout to begin shopping.

Is my first purchase with Afterpay interest-free?

Yes, your first four payments are interest-free when paid on time, making it a cost-effective way to shop now and pay gradually.

How can I see my upcoming payments and order history?

Open the app, go to 'Orders' or 'Payments' section to view current, past, and manage your payment schedules easily.

What stores and brands are available with Afterpay?

The app features a wide range of stores across fashion, beauty, tech, and more; discover new brands and deals daily within the app.

How do I split a large purchase into extended payment plans?

At checkout, select the ‘Extended Payments' option and choose 3, 6, 12, or 24 months based on your order amount.

Can I shop in-store with Afterpay?

Yes, add your virtual Afterpay card to your digital wallet, tap to pay at participating in-store retailers, and enjoy seamless checkout.

How do I increase my spending limit with Afterpay?

Use the app responsibly, make timely payments, and over time your spending limit will increase automatically.

What should I do if I miss a payment?

Contact support via in-app chat immediately to discuss options; timely payments help avoid late fees and account restrictions.

Are there any fees for using Afterpay?

If you pay on time, there are no interest or late fees. However, missed payments may incur fees as specified in the terms.

How do I change my payment schedule or pause payments?

Go to 'Orders' in the app, select the specific order, and choose options to modify your payment plan or pause payments temporarily.

SHEIN-Shopping Online

Shopping 4.6

Temu: Shop Like a Billionaire

Shopping 4.7

Amazon Shopping

Shopping 4.8

AliExpress - Shopping App

Shopping 4.7

Wish: Shop and Save

Shopping 4.7

Alibaba.com - B2B marketplace

Shopping 4.4

IKEA

Shopping 4.7

Zara

Shopping 4.8

adidas: Shop Shoes & Clothing

Shopping 4.9

Nykaa Fashion – Shopping App

Shopping 4.8

Lenskart : Eyeglasses & More

Shopping 4.6