- Developer

- Albert - Budgeting & Banking

- Version

- 10.0.23

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.6

Introducing Albert: Budgeting and Banking – Your Intelligent Financial Companion

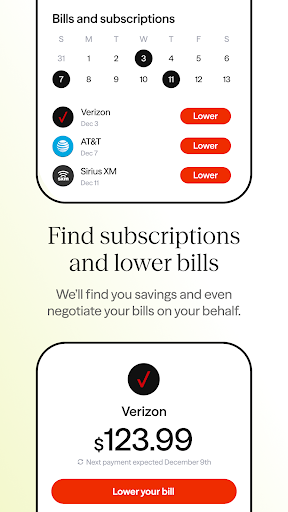

Albert is a comprehensive financial management application designed to help users budget smarter, track expenses effortlessly, and gain better control over their banking activities. Developed by a dedicated team passionate about making finance simple and accessible, this app integrates budgeting tools with banking features, aiming to empower everyday users to achieve their financial goals seamlessly.

A Closer Look at the Core Features

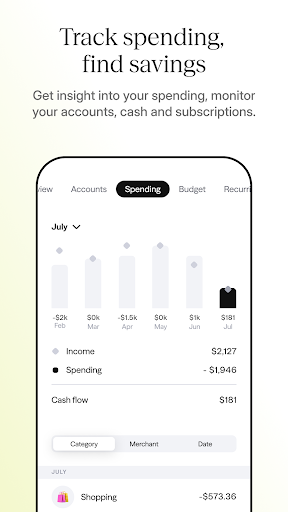

Smart Budgeting with Personalized Insights

At the heart of Albert lies its intelligent budgeting engine. Unlike traditional finance apps that just categorize expenses, Albert analyzes your income and spending patterns to craft personalized budgets. It doesn't just tell you how much you've spent; it provides tailored suggestions to optimize savings and prevent overspending. Imagine having a seasoned financial advisor sitting by your side, gently guiding your financial decisions based on your unique habits. The app's real-time notifications alert you when you're nearing your budget limits, ensuring you stay on track without feeling overwhelmed.

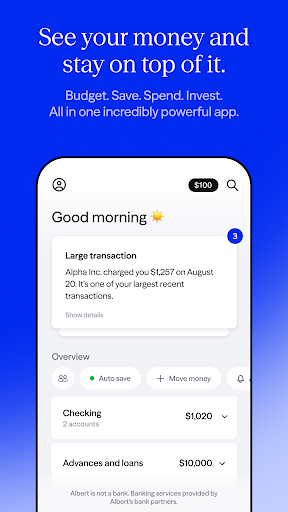

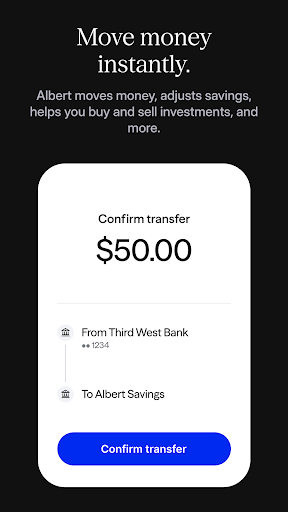

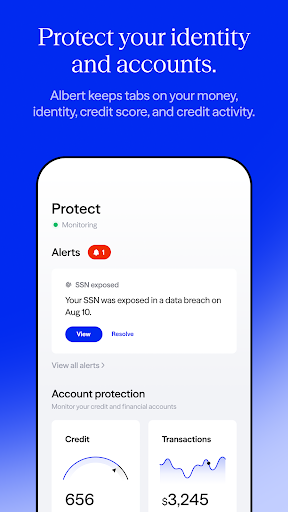

Secure Banking and Transaction Management

One of Albert's standout features is its seamless banking integration. The app connects securely with multiple banks, allowing users to view all accounts in one place, track transactions as they happen, and even initiate transfers directly within the app. Its security protocols are robust, employing end-to-end encryption to safeguard user data and transactions. This means you can manage your money confidently, knowing your financial information is protected—so there's no need to juggle multiple banking apps or worry about security breaches. The transaction experience is smooth and intuitive, much like flipping through a familiar digital wallet.

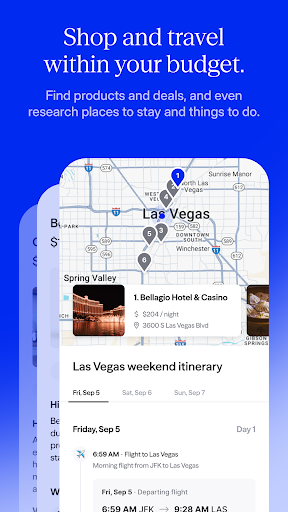

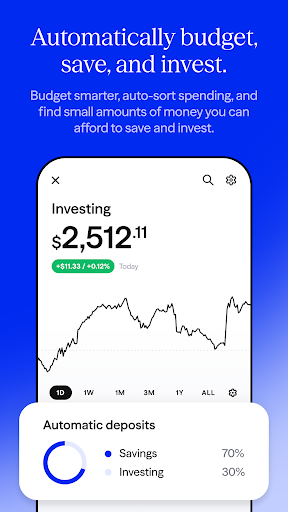

Automation and Goal Setting for a Stress-Free Future

Albert doesn't just help you see where your money goes; it actively helps you plan for the future. With features like automatic savings transfers—think of it as having a digital piggy bank that fills itself—and personalized goal setting, users can set targets like saving for a vacation, emergency fund, or a big purchase. The app automates the process, making saving feel less like a chore and more like a strategic step towards your dreams. The intuitive interface and straightforward setup help users quickly grasp these functions, making long-term financial planning accessible regardless of financial literacy levels.

User Experience and Unique Selling Points

Albert's interface is sleek yet friendly, resembling a well-organized dashboard rather than a complex financial spreadsheet. The design employs calming colors and simple icons, reducing the intimidation often associated with financial apps. Navigating between budgeting, banking, and goal-setting features is effortless—interactions are snappy, with minimal loading times. The learning curve is gentle; even users new to personal finance tools can become proficient in minutes, thanks to clear tutorials and guided setup processes.

What truly sets Albert apart from similar finance apps is its focus on security and transaction experience combined with intelligent automation. Unlike some competitors, which often require multiple logins and scattered interfaces, Albert consolidates both banking and budgeting under a single, secure platform. Its real-time transaction updates and ability to initiate transfers within the app simplify banking workflows, making it feel like a personal banking assistant rather than just a tracking tool. For users who prioritize security and seamless banking integration, Albert provides a competitive edge with its robust encryption and intuitive transaction handling.

Recommendation and Usage Scenarios

Overall, Albert earns a strong recommendation for individuals seeking an all-in-one financial app that emphasizes security, smart budgeting, and easy banking management. It's particularly suited for busy professionals, young adults managing their first budgets, or anyone looking to streamline their financial landscape without hassle. For users who value automated savings, personalized financial insights, and a secure transaction environment, Albert offers a trustworthy and effective solution.

In conclusion, whether you're aiming to tighten your budget, save for big milestones, or simply keep better tabs on your finances, Albert combines thoughtful design with powerful features, making your financial journey less daunting and more manageable. Think of it as having a friendly, knowledgeable companion guiding you toward a smarter, more secure financial future.

Pros

- User-Friendly Interface

- Automated Transaction Categorization

- Real-Time Spending Insights

- Secure Bank Integration

- Custom Budget Goals

Cons

- Limited Investment Tools (impact: low)

- Offline Access Not Available (impact: medium)

- Basic Expense Categories (impact: low)

- Limited Budget Sharing Options (impact: low)

- Customer Support Response Time (impact: medium)

Frequently Asked Questions

How do I get started with Albert and link my bank accounts?

Download the app, create an account, then navigate to Settings > Link Bank Accounts to connect your bank securely.

Is Albert free to use, and what features are included without paying?

Yes, basic budgeting, expense tracking, and cash account access are free. Premium features like financial advice require a subscription via Settings > Subscription.

How can I set up a budget in Albert?

Open the app, go to Budget > Create New Budget, then link your accounts and set your monthly spending goals for categories.

What features help me save money automatically?

Use the Automatic Savings feature in Settings > Savings, enable it, and customize transfer amounts to help build your savings effortlessly.

How do I invest using Albert, and what investment options are available?

Navigate to Investing > Get Started, then choose stocks, ETFs, or managed portfolios according to your risk preference.

How does Albert's online banking work and what are its benefits?

Set up direct deposit or link your accounts in Settings > Banking. You can get paid earlier and use the debit card for quick access to funds.

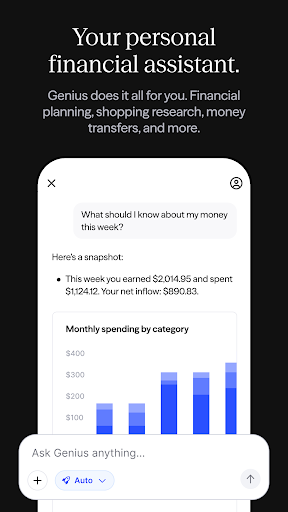

What is Albert Genius, and how do I subscribe?

Albert Genius offers access to financial advisors. Subscribe via Settings > Premium > Subscribe, with plans from $14.99/month.

How do I cancel or manage my Albert subscription?

Go to Settings > Subscription, then select Cancel or modify your plan; auto-renewal is available if you want to continue.

What should I do if I experience difficulty linking my bank account?

Check your internet connection, ensure your bank supports integrations, then go to Settings > Link Bank Accounts and retry or contact support.

Does Albert offer customer support if I need help?

Yes, access support via Settings > Help & Support, where you can find FAQs or contact customer service for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4