- Developer

- Ally Financial

- Version

- 25.24.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.4

Ally: Bank, Auto & Invest — Simplifying Your Financial World

Ally: Bank, Auto & Invest is a versatile financial app designed to integrate banking, auto financing, and investment management into a seamless digital experience, empowering users to take control of their financial journey with confidence and ease.

Meet the Developers: A Team Focused on User-Centric Financial Solutions

Developed by Ally Financial, a well-established leader in digital banking and auto finance, the app reflects their commitment to innovation, security, and customer empowerment. Their expertise ensures that users experience reliable and cutting-edge financial tools designed for everyday use.

Key Features That Make Ally Stand Out

- Unified Financial Platform: Combines banking, auto loans, and investment options under one intuitive app, reducing the need for multiple applications.

- Robust Security Measures: Implements advanced encryption and biometric authentication to secure account access and transactions, prioritizing user trust and safety.

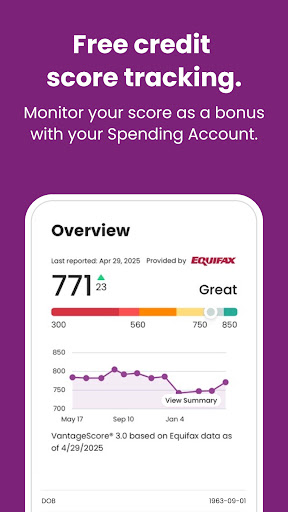

- Personalized Financial Insights: Provides tailored tips and real-time updates to help users optimize their savings, investments, and auto financing strategies.

- Smart Transaction Management: Features quick transfer options, automated bill payments, and transaction tracking designed for efficiency and clarity.

Spicing Up Your Financial Experience: An Engaging Look at Core Functionalities

Imagine sitting comfortably in your favorite cozy corner, your phone in hand, as Ally transforms complex financial tasks into simple, engaging activities—like having a friendly financial advisor right in your pocket. This app isn't just about numbers; it's about turning financial management into a less daunting, more approachable journey.

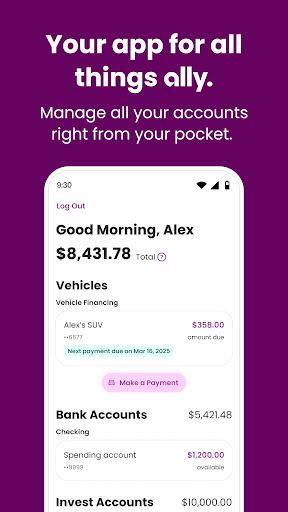

All-in-One Dashboard: Your Financial Command Center

The app's landing page acts as a dashboard, akin to the control panel of a sleek spaceship. It consolidates your checking, savings, auto loans, and investment accounts at a glance. The interface's clean layout, with vibrant icons and easy-to-read summaries, feels inviting rather than intimidating. Navigating between different sections is fluid, thanks to smooth transitions and minimal load times. This design ensures users of all tech levels can start mastering their finances quickly, making the learning curve surprisingly gentle for newcomers.

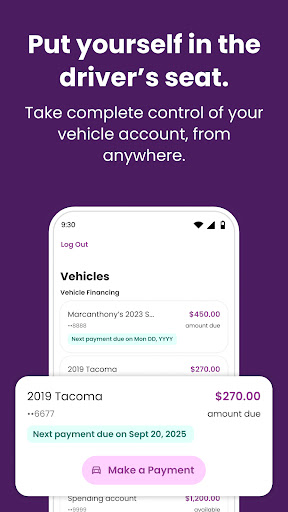

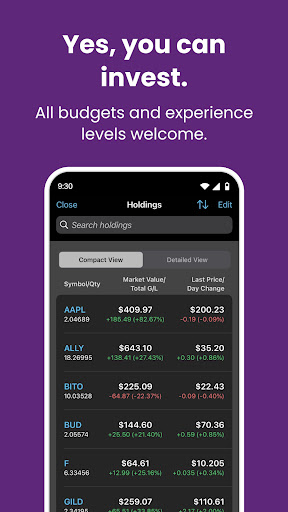

Auto & Investment Management: Fostering Financial Growth with a Click

The auto and investment modules are where Ally shines brightest. Auto loan application and management are streamlined—think of it as having a trusted car buddy guiding your auto financing journey. You can compare loan options, view payment schedules, and even schedule payments—all within a few taps. The investment section offers personalized portfolio suggestions based on your goals, risk appetite, and market trends. The app's intelligent algorithms proactively suggest rebalancing options, akin to a seasoned coach advising on your next move. This proactive, educational approach distinguishes Ally from other apps that often only display static data.

User Experience: Navigating with Ease and Confidence

Ally's thoughtful design extends to user experience, resembling a friendly guide rather than a daunting ledger. The interfaces are intuitive, with logical workflows and visual cues that reduce confusion. Transactions happen swiftly, and any delays are minimal, making for a seamless experience. The learning curve is shallow enough for a novice but also satisfies seasoned financiers seeking detailed insights. Overall, the app's responsiveness and clarity foster trust—users feel supported at every step, like having a well-informed financial partner by their side.

What Sets Ally Apart: Security and Transaction Experience

Among its peers, Ally stands out notably in two areas. First, its emphasis on Account and Fund Security sets a high standard—biometric logins, multi-factor authentication, and encrypted data exchanges make unauthorized access nearly impossible. Second, its Transaction Experience is streamlined and transparent. Funds transfer smoothly, with real-time confirmation and detailed histories that demystify every penny moved. Unlike some apps that hide transaction details behind layers of menus, Ally makes each operation clear and accessible, fostering confidence in its reliability.

Final Verdict and Recommendations

Ally: Bank, Auto & Invest deserves a strong recommendation for users looking for a comprehensive, secure, and user-friendly financial app. Whether you are a beginner wanting to get a grip on your budget or an experienced investor seeking smarter tools, this app offers a balanced mix of simplicity and sophistication. It's particularly well-suited for those who value security and seamless transaction flows—think of it as a trusty financial companion that adapts to your needs. For anyone eager to integrate their banking, auto financing, and investing into one intuitive platform, Ally provides a compelling and trustworthy choice.

Pros

- User-friendly interface

- Comprehensive financial tools

- Strong security measures

- Real-time transaction updates

- Personalized financial insights

Cons

- Limited international banking support (impact: medium)

- Occasional app crashes during peak usage (impact: low)

- Basic investment options for advanced traders (impact: medium)

- Customer service response time could be improved (impact: low)

- Some features are only available with premium subscription (impact: medium)

Frequently Asked Questions

How do I create an account and start using the Ally app?

Download the app from your app store, open it, and follow the registration process by providing your personal details and verifying your identity.

Can I link my existing bank accounts to the Ally app?

Yes, during setup, go to Settings > Accounts > Link Accounts to securely connect your bank accounts.

What core features does the Ally app offer for managing my finances?

The app provides banking, auto loan management, investment trading, and automatic savings tools for comprehensive financial management.

How can I deposit checks using the app?

Navigate to Banking > Deposit Check, then follow the prompts to snap a photo and submit your check for deposit.

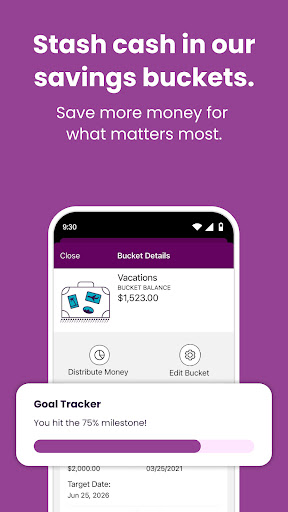

How do I set up automatic investing or recurring transfers?

Go to Investments > Recurring Investments or Savings > Automatic Transfers, then follow the instructions to customize your setup.

Are there any fees for using the Ally app's investment or banking services?

Basic banking features are free; some investment options may have advisory or trading fees. Check specific service details in the app settings.

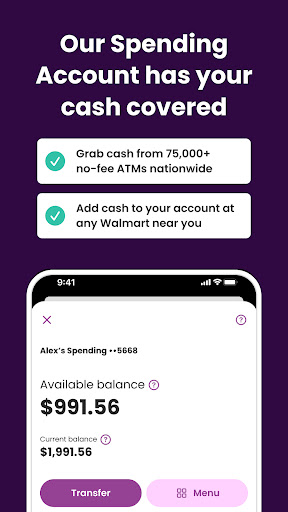

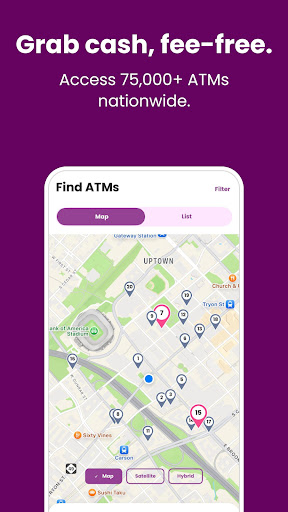

How can I find and use the Ally app's free ATM network?

Go to More > ATM Locator to find nearby Allpoint® and MoneyPass® ATMs and enjoy fee reimbursements up to $10 per statement cycle.

Does the app require any paid subscription, and how do I upgrade or cancel it?

Most features are free; premium advice services start at $100,000 managed. Manage subscriptions via Settings > Manage Services > Subscriptions.

What should I do if I experience login issues or the app crashes?

Try restarting your device, updating the app, or contacting Ally support via Settings > Help > Contact Support for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4