- Developer

- American Express

- Version

- 7.25.1

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.9

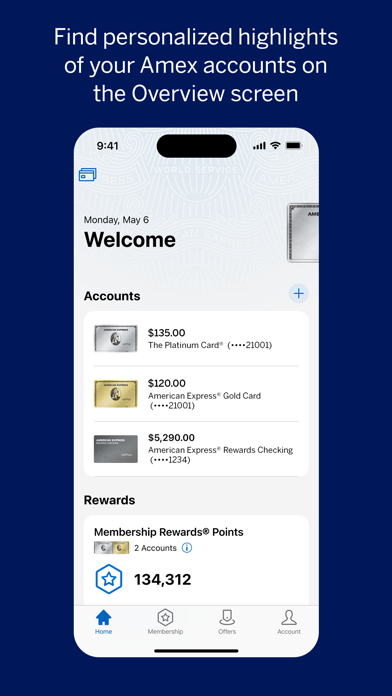

Introducing the Amex Mobile App: Your Comprehensive Financial Companion

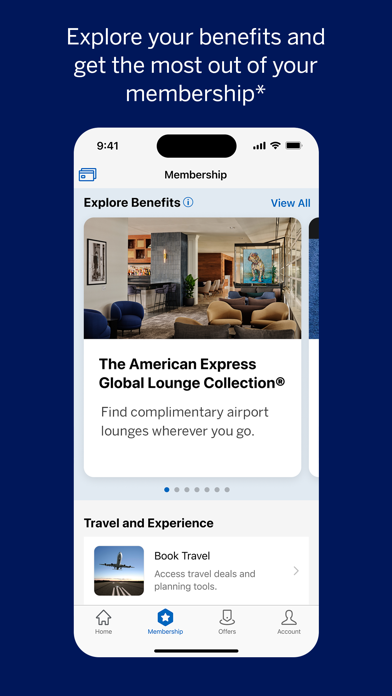

Designed by American Express, this app aims to streamline your financial life with a suite of powerful features tailored for both casual users and seasoned financially savvy individuals alike. Whether you're managing your credit card, tracking expenses, or ensuring transaction security, Amex's app positions itself as an essential digital partner for navigating modern finance with confidence.

A Closer Look: Core Features That Make a Difference

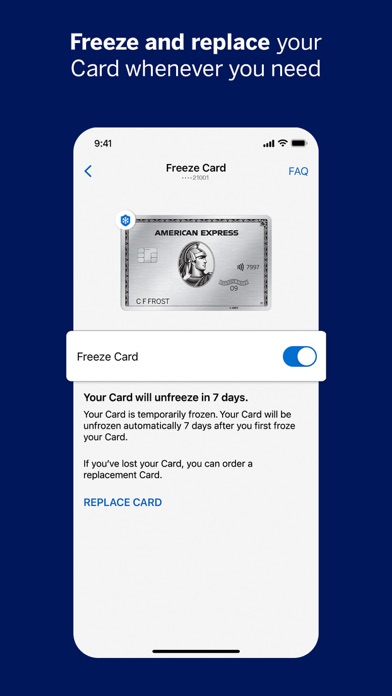

Built-in Security & Account Protection

One of the standout features of the Amex app is its robust security measures. With advanced encryption and real-time fraud alerts, the app acts like a vigilant security guard at your digital doorstep. The biometric login options—fingerprint recognition or facial ID—add an extra layer of protection, making unauthorized access nearly impossible. This feature reassures users that their sensitive account information remains private, offering peace of mind in today's increasingly digital banking environment.

Seamless Transaction Experience & Management

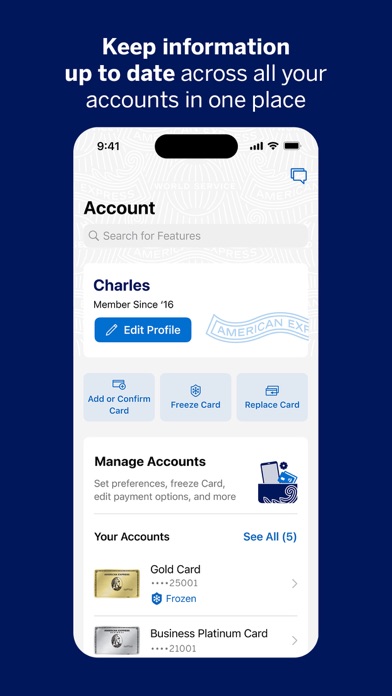

Performing and tracking transactions in the Amex app feels similar to having a personal financial assistant on hand. Its intuitive interface transforms complex billing histories into easy-to-understand visuals, highlighting recent spending categories and daily expenses. The app's instant notification system keeps you informed of every purchase, allowing swift action if needed. Plus, features like digital card management grant you control—freeze, unfreeze, or generate virtual card numbers—all with just a few taps. Compared to traditional banking apps, Amex's transaction experience stands out for its clarity and immediacy, turning financial management from a chore into a transparent, even enjoyable, activity.

User Interface & Experience: Friendly and Fluid

Walking through the app feels like flipping through a well-organized, neatly illustrated handbook—everything is where you expect it to be. The clean, modern design employs calming blue tones paired with straightforward icons, making navigation pleasant for users of all ages. Operational speed is impressive; pages load swiftly, and actions like checking balances or paying bills execute without lag. The learning curve is gentle; even first-time users can quickly master core functions thanks to guided prompts and straightforward layout. This thoughtful design reduces frustration and encourages regular engagement.

What Sets Amex Apart from Its Competitors?

In the crowded landscape of financial apps, Amex distinguishes itself notably through its exceptional emphasis on security and transaction experience. Unlike some counterparts that merely provide basic security checks, Amex integrates continuous transaction monitoring with real-time alerts, effectively acting as a first line of defense against fraud. Its virtual card feature is a game-changer—allowing users to create temporary, disposable card numbers for online shopping, significantly reducing exposure to cyber risks. Additionally, the app's transaction interface bridges the gap between raw data and user understanding, employing clear categorizations and visual peaks that make financial patterns intuitive to spot. These features collectively elevate the Amex app from a simple account manager to a trusted financial partner.

Final Verdict and Usage Recommendations

Overall, the Amex mobile app presents a balanced blend of security, usability, and innovative features that cater to a broad user base. It's especially recommended for those who prioritize account safety and seek a transparent, straightforward transaction process. Business travelers, online shoppers, or anyone managing multiple spending categories will find its virtual card functionalities and detailed expense tracking particularly advantageous. For current American Express cardholders, this app is practically indispensable; for newcomers, it offers an easy entry point into a more organized financial lifestyle.

In summary, this app is a reliable companion that makes managing your finances not only manageable but also reassuring. Its standout features—particularly the real-time account security measures and flexible virtual cards—make it a noteworthy choice for modern users seeking control and confidence in their financial dealings.

Pros

- User-friendly interface

- Comprehensive transaction tracking

- Secure login features

- Real-time notifications

- Consistent performance updates

Cons

- Limited customization options (impact: low)

- Occasional app crashes during login

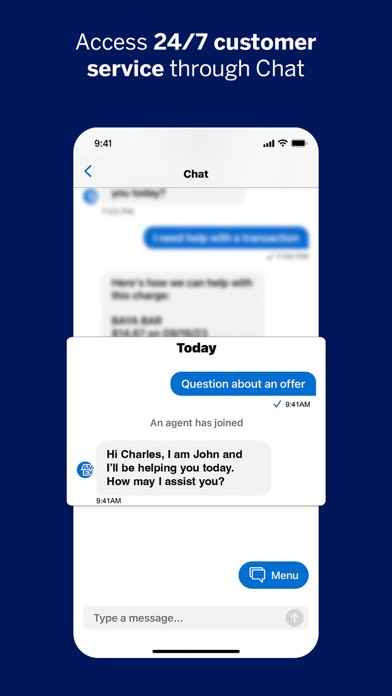

- Slow customer support response time

- Delayed transaction updates on some devices

- Limited integration with third-party financial apps

Frequently Asked Questions

How do I set up my Amex app for the first time?

Download the app from Google Play, open it, select 'Sign Up,' and follow the prompts to link your American Express card and complete your account setup.

Can I use biometric login to access the Amex app?

Yes, enable Touch ID or Face ID in Settings > Security within the app for quick, secure access without passwords.

How can I activate my new American Express card in the app?

Go to Settings > Card Management > Activate Card, then follow the on-screen instructions to activate your card efficiently.

What features help me track my spending in the Amex app?

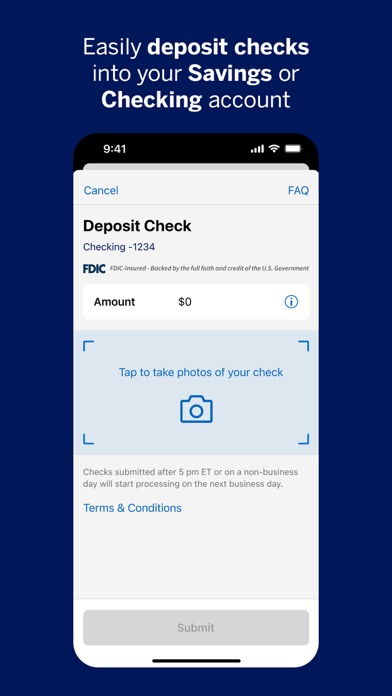

Check your account balance, view pending transactions, review PDF statements, and filter charges by category for detailed spending insights.

How do I set up AutoPay for my Amex bill?

Navigate to Payments > AutoPay, select your preferred payment amount and date, then confirm to activate automatic monthly payments.

How can I receive real-time alerts for transactions?

Go to Settings > Notifications, enable purchase and fraud alerts to stay informed about your account activity instantly.

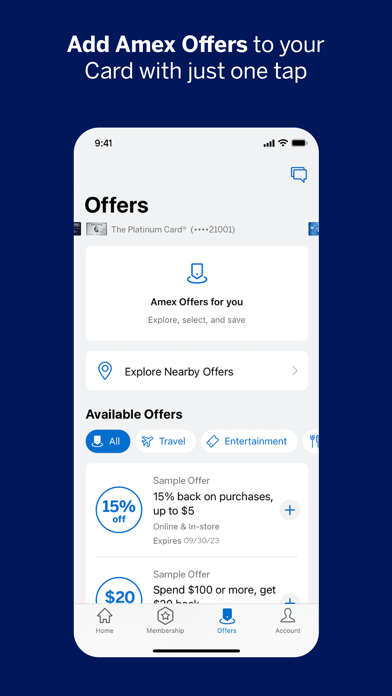

How do I redeem my Membership Rewards points?

Open Rewards > Redeem Points, choose your preferred reward (gift cards, statement credits), and follow prompts to transfer points.

What should I do if the app crashes or isn't loading properly?

Try restarting your device, update the app to the latest version, or reinstall it if issues persist for optimal performance.

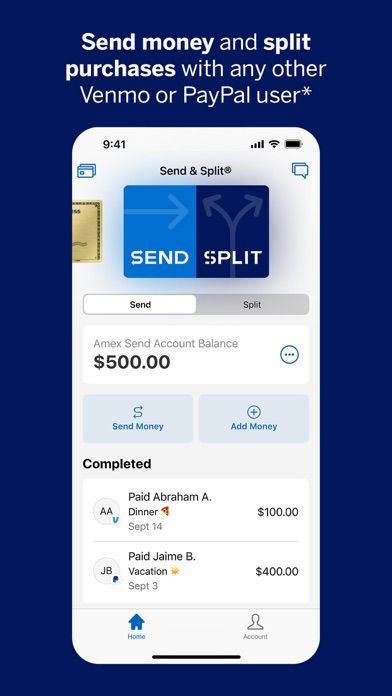

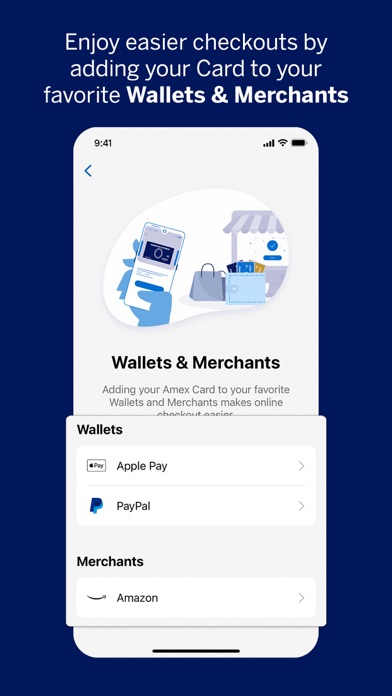

How do I link my Amex account with PayPal or Venmo for payments?

Go to Send & Split > Link Payment Accounts, follow prompts to connect your PayPal or Venmo account for seamless payments.

Can I access my account and manage my Amex card details offline?

Most features require an internet connection; however, you can view downloaded PDF statements offline, but account management needs online access.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4