- Developer

- Exto Inc.

- Version

- 4.9.12

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.5

Atlas - Rewards Credit Card: A Digital Companion for the Savvy Spender

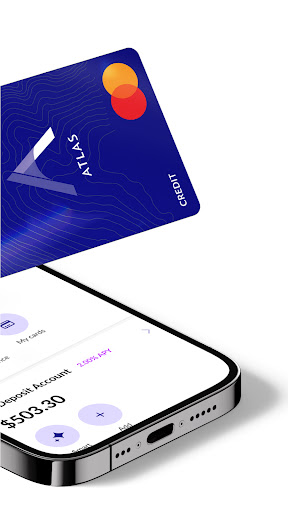

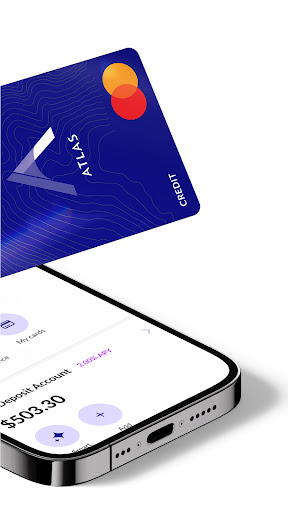

Atlas - Rewards Credit Card is a thoughtfully designed mobile application tailored for credit card holders seeking to optimize their rewards and manage their finances effortlessly. Developed by a dedicated team passionate about financial technology, this app aims to simplify credit management while offering unique security and transaction benefits to its users.

Core Functionality Highlights That Stand Out

At its core, Atlas offers an intuitive platform that merges reward tracking, secure transactions, and personalized financial insights—all wrapped into a sleek interface. The app's main strengths include real-time reward monitoring, enhanced security features, and a seamless transaction experience that transforms mundane banking into a smart, engaging activity.

Vivid Welcome: Navigating a World of Financial Ease

Imagine gracefully steering through a bustling marketplace with a personal assistant guiding you—Atlas is that silent partner, making your credit card journey smooth and rewarding. Whether you're a frequent traveler, an avid shopper, or just someone keen to maximize every dollar, this app turns routine credit management into an enjoyable experience. Its thoughtful design reduces the complexity of rewards programs and makes staying on top of expenses as effortless as a gentle breeze.

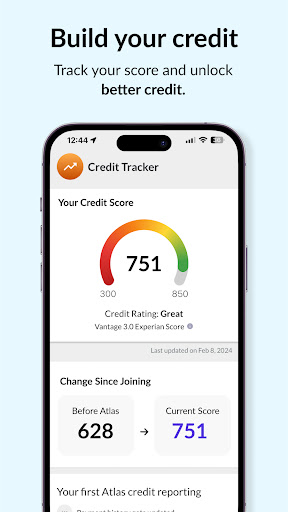

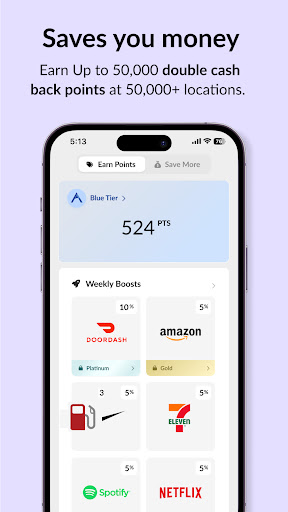

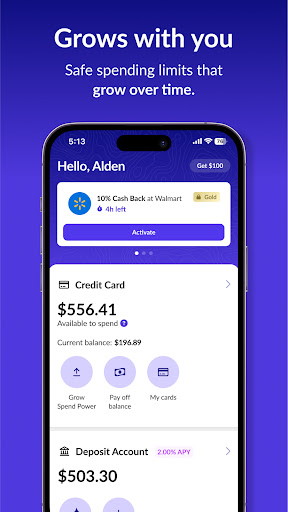

Reward Optimization at Your Fingertips

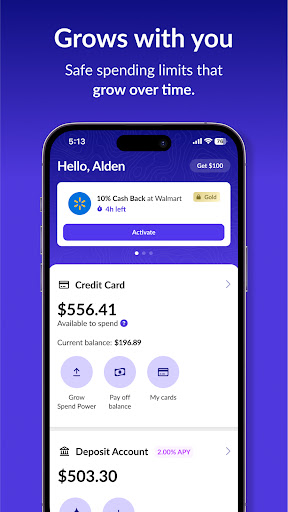

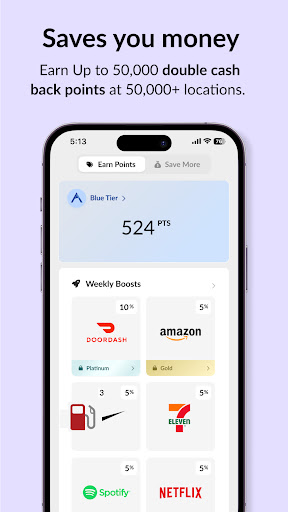

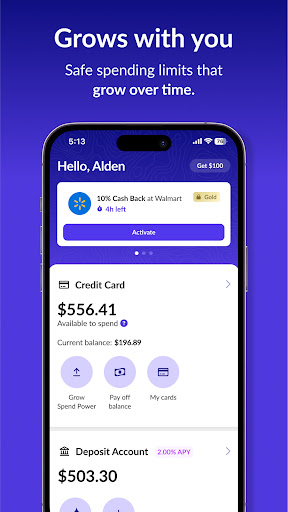

The centerpiece of Atlas is its real-time rewards dashboard. As you make transactions, the app dynamically updates your rewards points, cashback, or travel miles, providing instant visibility into your earning progress. This feature acts like a smart compass—guiding you to prioritize purchases that yield the highest returns. Unlike most financial apps that merely track expenses, Atlas emphasizes actively enhancing your benefits, encouraging smarter spending habits.

Additionally, the app offers tailored recommendations based on your spending patterns, alerting you to special promotions or bonus opportunities from your card issuer. This personalization helps users squeeze every ounce of value out of their credit cards without the hassle of manual tracking or flipping through dense statements.

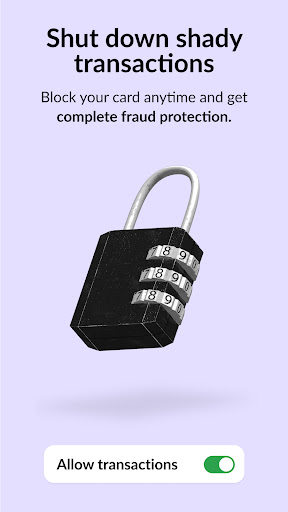

Security and Transaction Experience — Redefining Trust

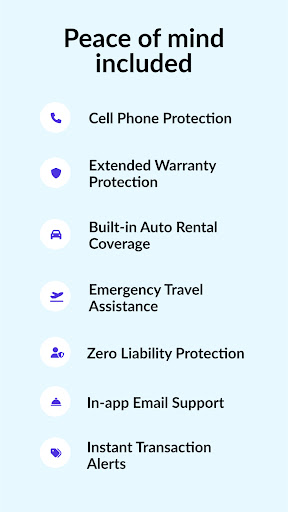

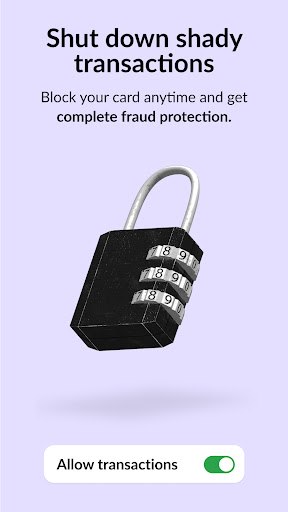

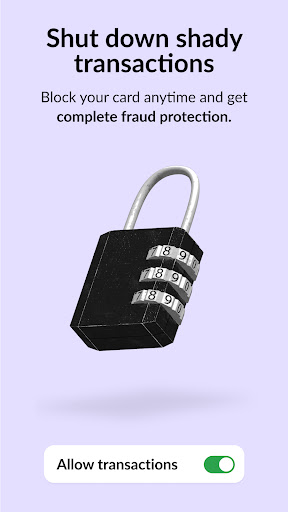

Security is the backbone of any financial app, and Atlas doesn't fall short here. It employs advanced encryption protocols, biometric authentication, and real-time fraud alerts, akin to having a vigilant security guard watching over your financial fortress. What sets it apart is its proactive approach—detecting unusual activity and prompting a quick response, ensuring peace of mind with every swipe.

Moreover, the app enhances the transaction process with features like instant transaction categorization and detailed spending analytics. This transparency allows users to understand their habits better and make informed decisions, much like having a diligent financial advisor at your side. The intuitive interface ensures these features are accessible even for first-time users, creating a balanced blend of security and user-friendliness.

Design, Usability, and Unique Insights

From a design perspective, Atlas presents a clean, modern aesthetic with clear icons and a calming color palette—no visual clutter here, only a purpose-driven layout. Navigation is fluid; swipes and taps feel natural, making the learning curve gentle even for less tech-savvy users. The onboarding process is straightforward, with helpful tooltips guiding you through key features without overwhelming you.

In contrast to many finance apps that focus solely on expense tracking or basic rewards, Atlas combines these with security-focused features and personalized recommendations, making it a comprehensive financial management tool. Its focus on transaction accuracy and account security creates a significant edge—especially important in today's digital landscape where security concerns are top of mind. The app's ability to seamlessly integrate reward management with robust security measures makes it a standout choice among peer apps.

Final Thoughts: Is Atlas Worth Your Time?

If you're looking for an app that does more than just record your spending—one that actively boosts your rewards, keeps your accounts safe, and provides a smooth, engaging experience—Atlas should definitely be on your shortlist. It's particularly well-suited for users who want a holistic view of their financial health without the hassle of juggling multiple apps or risking security lapses. I'd recommend giving it a try if you value smart rewards, top-tier security, and a user-friendly interface that makes everyday financial tasks feel less like chores and more like a smart, connected experience. For those already comfortable with digital banking, Atlas offers an extra step in efficiency and security that's worth exploring."

Pros

- Excellent rewards program

- User-friendly interface

- Real-time notifications

- Robust security features

- Excellent customer support

Cons

- Limited reward categories in some regions (impact: medium)

- Occasional app crashes during high traffic (impact: low)

- Delayed reward updates (impact: low)

- Limited overseas use flexibility

- Basic budgeting tools lacking advanced features (impact: low)

Frequently Asked Questions

How do I apply for the Atlas Rewards Credit Card?

Download the app, tap 'Apply Now,' fill in your details, and receive instant approval within the app in minutes.

Can I use the Atlas card if I have no prior credit history?

Yes, Atlas offers higher approval rates, even for users with limited or no credit history, making it accessible for many new borrowers.

What steps should I take to start earning rewards with the Atlas card?

Simply use your card for purchases at participating locations; rewards are automatically accumulated and can be viewed in the app.

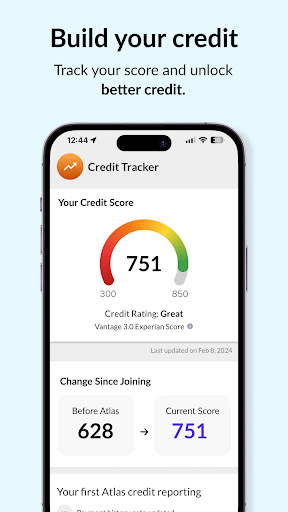

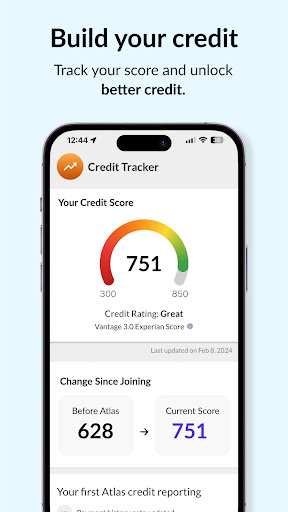

How can I check my credit score and credit report on the app?

Go to the 'Credit' section in the app to view your real-time credit score and credit report from all three major bureaus.

What is the process to set up automatic payments?

Navigate to 'Settings' > 'Payments,' then enable 'Auto-Pay' and choose your preferred payment method.

Are there any fees besides the $8.99 biweekly or $89 annual fee?

No, the app provides transparent pricing with no hidden fees; the only cost is the fixed subscription fee.

How do I maximize my savings using the app's offers?

Visit the 'Offers' tab to view and activate current discounts at supported stores like Starbucks, Nike, and more.

What should I do if I experience an issue with my card or app?

Contact customer support via the app's help chat or support center for quick troubleshooting and assistance.

Can I cancel my subscription at any time?

Yes, you can cancel anytime in the 'Settings' > 'Subscription' section without penalties.

How secure is the Atlas app and card against fraud?

The app uses industry-leading security features, including transaction blocking and instant card shutdowns, backed by Mastercard and Patriot Bank.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4