- Developer

- B9 - Get Your Paycheck Early

- Version

- 3.32.1

- Content Rating

- Everyone

- Installs

- 0.50M

- Price

- Free

- Ratings

- 4.1

Pros

- User-friendly interface

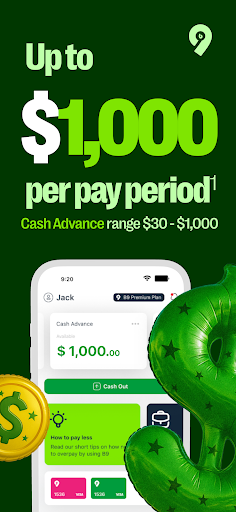

- Fast cash advances

- Competitive earning opportunities

- Secure transaction process

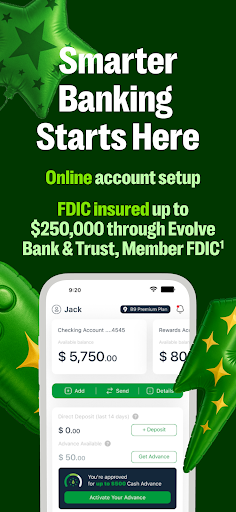

- Integrated banking services

Cons

- Limited financial product variety (impact: medium)

- Restricted customer support hours (impact: low)

- App stability issues reported occasionally (impact: medium)

- Fees for certain services are unclear (impact: low)

- Limited international expansion (impact: medium)

Frequently Asked Questions

How do I get started with B9 and set up my account?

Download the app, create an account, link a qualifying direct deposit, and follow prompts to activate your cash advance and banking features.

What types of income qualify for cash advances?

Qualifying income includes wages, gig earnings, SSI, or similar direct deposits. Link your direct deposit for eligibility and to start using advance features.

How can I access my cash advances and check my limit?

Open the B9 app, navigate to the 'Cash Advance' section, and view your available limit based on your direct deposit setup.

How do I make transactions with my B9 Visa Debit Card?

Activate your virtual or physical card, then use it for purchases or transfers directly in the app or at any Visa-accepting merchants.

How can I earn rewards and make extra money using B9?

Complete simple tasks like playing games or downloading apps, and use your B9 card to earn up to 5% cashback on purchases within the app.

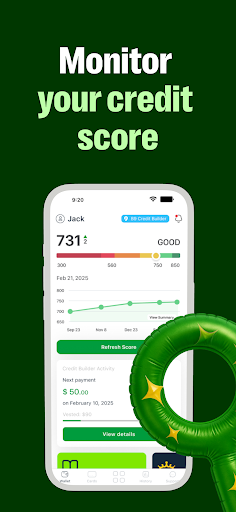

What features are available with the B9 Premium plan?

Premium includes higher cash advances (up to $750), credit monitoring, score tracking, a credit simulator, and loan options (California only).

How do I subscribe to or cancel a B9 plan?

Go to Settings > Subscription in the app. To cancel, follow the prompts to end your monthly plan; you can also pause or change plans there.

Are there any fees associated with using B9?

Basic features may be free with qualifications, but subscription plans have monthly fees unless conditions for waiver are met. Check Settings > Fees for details.

What should I do if I encounter issues with my card or transactions?

Use the app's Help or Support section to troubleshoot, contact customer service, or lock your card via Settings if it's lost or compromised.

Can I get a B9 loan if I live outside California?

Loan access is currently available only to residents in California through partner banks. Check your app or contact support for availability in your state.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4