- Developer

- Barclays US

- Version

- 8.5.9

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.7

Introducing Barclays US: A Robust Financial Companion at Your Fingertips

In an era where financial agility is paramount, Barclays US emerges as a comprehensive app designed to streamline your banking and investment needs seamlessly. Developed by the globally renowned Barclays team, this application aims to empower users with secure, intuitive, and innovative financial tools, all within a user-friendly interface. Whether you're managing personal finances, tracking investments, or seeking sophisticated banking functionalities, Barclays US positions itself as a one-stop solution tailored for both tech-savvy investors and everyday banking users.

Core Features that Make Barclays US Stand Out

The app's standout features revolve around security, personalized experience, and seamless transaction flow. Notably:

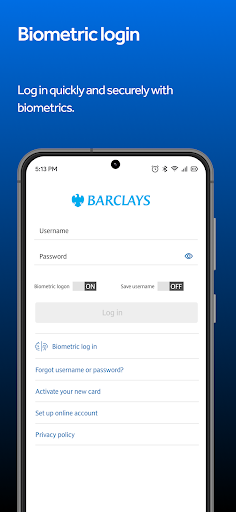

- Enhanced Account and Fund Security: Cutting-edge encryption protocols and biometric authentication ensure your assets are protected against unauthorized access, offering peace of mind in every interaction.

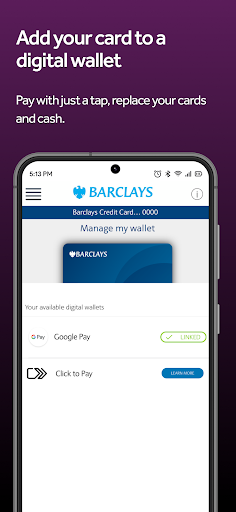

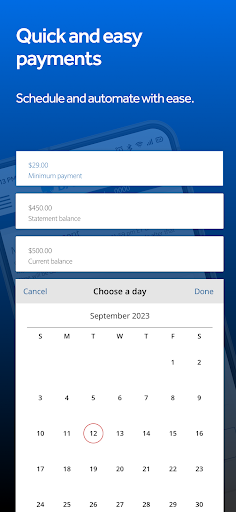

- Intuitive Transaction Experience: Streamlined transfer and payment processes make managing finances feel like a breeze—think of it as having your financial concierge right in your pocket.

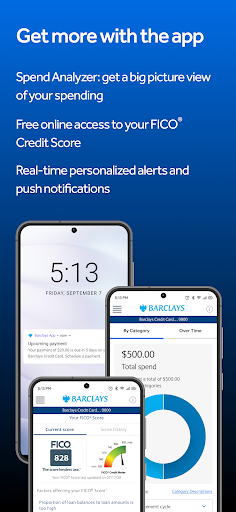

- Personalized Financial Insights: Smarter analytics and customized alerts help users make informed decisions, transforming complex data into actionable insights.

- Investment Management Tools: Advanced yet accessible features allow users to monitor and adjust portfolios with confidence, bridging the gap between novice investors and seasoned traders.

A Pleasant User Experience: The Interface and Usability

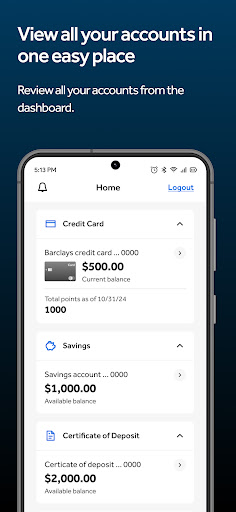

From the moment you open Barclays US, you're greeted with a sleek, modern interface that feels more like a well-designed dashboard than a typical banking app. The layout emphasizes clarity, with well-organized sections and vibrant icons guiding users effortlessly through different functionalities. Navigation is smooth—swiping between accounts, transferring funds, or checking notifications is buttery-smooth, akin to gliding across a flawlessly paved road.

Learning to navigate the app is straightforward, thanks to thoughtful onboarding and contextual help tips. Even first-time users find themselves able to perform core actions within minutes, with minimal confusion. The design minimizes clutter, focusing on what matters most, which makes managing your financial life less intimidating and more accessible.

Breaking the Mold: How Barclays US Differs from Other Financial Apps

Unlike many of its peers, Barclays US emphasizes the dual pillars of security and user-centric transaction flow. Its biometric authentication is not just a standard feature but is integrated smoothly into daily interactions, making logging in feel like opening a familiar, secure vault instead of passing through an unnecessarily complicated gate.

What truly sets this app apart is its commitment to **Account and Fund Security**, which is woven into the fabric of the user experience. The app employs multi-layered security measures that feel nearly invisible but provide robust peace of mind. This focus is especially beneficial in today's digital landscape, where data breaches are a real concern.

Moreover, the **Transaction Experience** goes beyond basic money transfers. The app intelligently predicts common user behaviors and pre-fills information, reducing friction and saving time. Whether you're paying a friend or setting up automatic bill payments, the process feels natural and efficient, much like having a trusted financial assistant guiding you.

Recommendation and Usage Tips

Overall, Barclays US earns a solid recommendation for users seeking a trustworthy, easy-to-use, and secure financial app. Its strengths lie in safeguarding your assets while simplifying complex transactions—especially appealing to those who value peace of mind without sacrificing functionality.

For best results, new users should explore the personalized insights feature to better understand their spending habits, and leverage security settings to tailor protection levels to their preferences. Experienced investors will appreciate the portfolio tools, but even casual users can benefit from the straightforward payment and transfer features, making everyday money management less of a chore.

In conclusion, Barclays US strikes a thoughtful balance between advanced security, user-friendly design, and innovative transaction flows. It's a dependable digital companion—one that combines the familiarity of traditional banking with the efficiency and security expected of modern financial technology. Whether you're managing savings, investments, or simple transactions, this app stands out as a practical and secure choice worthy of your consideration.

Pros

- User-Friendly Interface

- Robust Security Features

- Comprehensive Account Management

- Real-Time Updates

- Functional Mobile Deposit

Cons

- Occasional App Crashes (impact: Medium)

- Limited Budgeting Tools (impact: Low)

- Slow Customer Support Response (impact: Medium)

- Minor Interface Glitches on Older Devices (impact: Low)

- Limited International Transaction Options (impact: Low)

Frequently Asked Questions

How do I get started with the Barclays US app as a new user?

Download the app from your app store, then follow the on-screen instructions to create an account and complete setup easily, even if you're new to digital banking.

Can I use the Barclays US app if I already have a Barclays savings or credit card account?

Yes, existing account holders can simply log in with current credentials or set up online access through the app for seamless management.

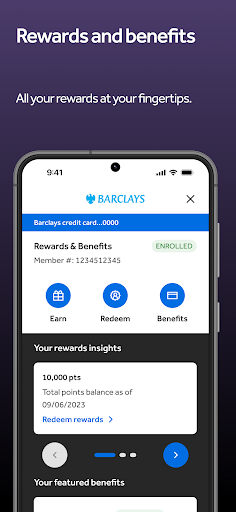

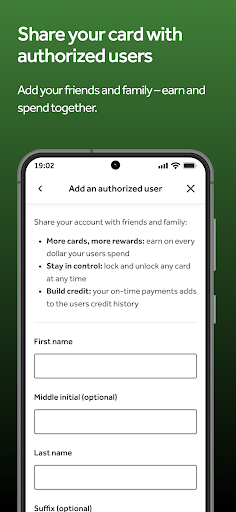

What are the main features of the Barclays US app for everyday banking?

Key features include mobile wallet integration, biometric login, online transfers, direct deposits, rewards overview, spend analysis, and free FICO score access.

How can I make quick payments or transfers with the app?

Use the 'Transfers' or 'Payments' section in the app to move funds or set up automatic deposits, accessible via the main menu for fast transactions.

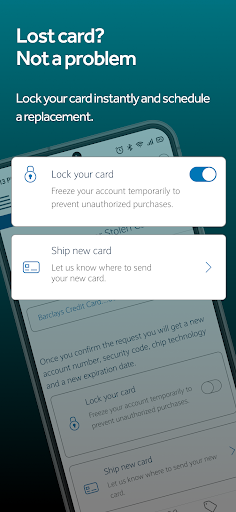

How does the app ensure the security of my financial information?

The app offers secure online access, real-time notifications, biometric login, and card control features like instant card locking for enhanced security.

What should I do if I forget my login credentials for the Barclays US app?

Use the 'Forgot Password' or 'Forgot User ID' options on the login screen to reset your credentials securely through the app or website.

Can I access my credit score for free through the Barclays US app?

Yes, navigate to the 'Credit Score' or 'FICO Score' section in the app to view your free credit score and monitor your credit health.

What are the steps to lock or unlock my card via the app?

Go to 'Card Controls,' select your card, and choose 'Lock' or 'Unlock' to prevent unauthorized use or reactivate your card instantly.

Are there any subscription or premium features available in the Barclays US app?

The app primarily offers free features like account management, rewards, credit score access, and security controls—there are no subscription fees for basic services.

What should I do if I experience technical issues or the app crashes?

Try updating the app, restarting your device, or reinstalling it. If problems persist, contact Barclays customer support through the app or website for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4