- Developer

- BMO Bank National Association

- Version

- 26.1.90

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.6

Introducing BMO Digital Banking: Your Friendly, Secure, and Smart Financial Companion

Imagine having a bank that feels like a trusted friend—helping you manage your finances smoothly, securely, and intuitively. BMO Digital Banking, developed by the Bank of Montreal, offers a comprehensive digital solution designed to put control back into your hands, whether you're tracking expenses or making investments. With a focus on security, user experience, and innovative features, this app stands out in the crowded fintech landscape, especially for users seeking reliability coupled with innovative functionalities.

Core Features Spotlight: Security, Personalization, and Seamless Transactions

Robust Account and Fund Security

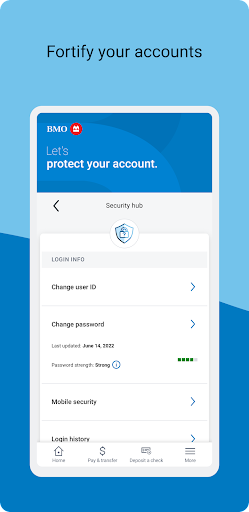

Security is the cornerstone of BMO Digital Banking. Utilizing advanced encryption protocols and biometric authentication—such as fingerprint and facial recognition—the app ensures your financial data stays private and protected. Think of it as having a digital vault that only your fingerprint can open, offering peace of mind whether you're checking balances or transferring funds. The app also provides real-time alerts for suspicious activity, making it easier to act swiftly if needed.

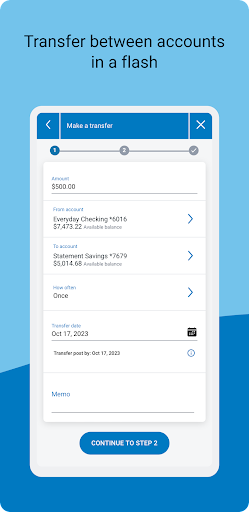

Intuitive Transaction Experience

Transacting with BMO Digital Banking feels like having a conversation with a knowledgeable friend. Transferring money between your accounts or to third parties is streamlined through a user-friendly interface that guides you step by step. Features like instant payees, scheduled payments, and even split bills make managing money straightforward and less stressful. Plus, the app's predictive text and intelligent recommendations help speed up routine operations, making banking less like a chore and more like a breeze.

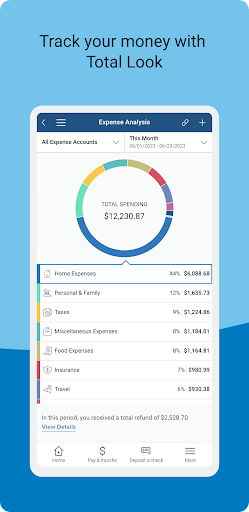

Personalized Financial Insights and Tools

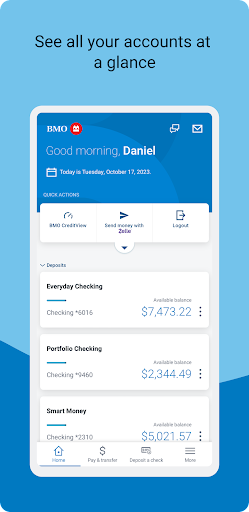

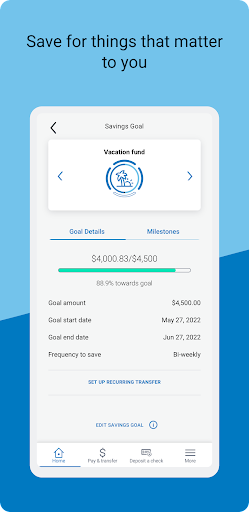

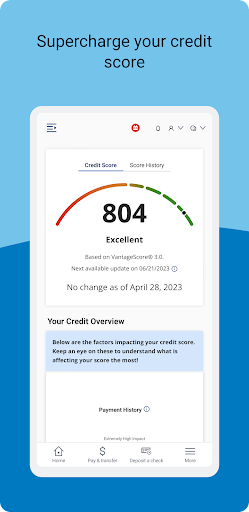

Beyond basic banking, this app offers tailored insights into your spending habits, savings goals, and investment opportunities. Visual dashboards present your financial health at a glance—think of it as a smartwatch for your money, constantly analyzing and providing actionable suggestions. Whether it's setting a savings target or reviewing your recent transactions, BMO Digital Banking turns complex data into clear, helpful stories, empowering you to make smarter financial decisions.

User Experience: Seamless, Learning-friendly, and Visually Appealing

The app boasts a sleek, modern interface that resembles a well-organized digital workspace—minimalist yet packed with information. Navigating through various features is like flipping through a well-curated magazine; intuitive icons, consistent design language, and logical workflows make exploration enjoyable. The learning curve is gentle; even newcomers can find their footing quickly thanks to guided onboarding and clear prompts.

Operation speed is impressive, with instant responses and smooth animations adding a touch of polish. The app adapts well to both smartphones and tablets, optimizing screen layouts to fit different devices without losing clarity or functionality. For users accustomed to traditional banking, BMO Digital Banking's layout might initially seem complex—yet, within a short time, users find themselves exploring features like predictive analytics and biometric logins effortlessly.

What Sets BMO Digital Banking Apart: Security and Transaction Innovation

Compared to other finance apps, BMO Digital Banking's paramount focus on security—particularly its biometric authentication and real-time threat alerts—is a major highlight. These features act like a digital fortress, giving users confidence that their assets are safe from cyber threats. Additionally, its transaction experience leverages intelligent automation—predictive suggestions, smart payees, and scheduled transfers—that make routine banking tasks feel almost automatic, reducing manual input and potential errors.

Recommendation and Usage Advice

For those who value security and are looking for a banking app that combines modern functionality with robust safety measures, BMO Digital Banking is a commendable choice. It's especially suitable for users already banking with BMO or those seeking an app that balances straightforward usability with advanced features. Novice users may appreciate the guided onboarding process, while experienced users will enjoy the app's smart transaction tools and insightful dashboards.

Overall, I would confidently recommend BMO Digital Banking as a reliable, innovative, and user-centric solution. Whether you're managing everyday expenses, preparing for future investments, or simply wanting a smarter way to bank on the go, this app proves to be both a practical tool and a trustworthy digital partner. Just remember to stay mindful of your security settings and regularly review your account alerts—the fortress is only as strong as its vigil.

Pros

- User-Friendly Interface

- Strong Security Measures

- Real-Time Notifications

- Excellent Customer Support Integration

Cons

- Limited International Banking Features (impact: medium)

- Occasional App Crashes During Peak Hours (impact: medium)

- Slow Loading of Certain Features (impact: low)

- Limited Customization Options for Notifications (impact: low)

- Offline Access Is Restricted (impact: low)

Frequently Asked Questions

How do I get started with BMO Digital Banking on my Android device?

Download the app from Google Play Store, open it, and log in with your existing credentials. No complicated setup is needed, and you'll be ready to access your accounts quickly.

Can I access all my accounts in one place?

Yes, the app displays checking, savings, and credit card accounts together. Just log in, and you'll see all your accounts on the main dashboard for easy management.

How do I transfer funds between my BMO accounts?

Navigate to 'Transfer' in the app menu, select the accounts, input the amount, and confirm. Transfers are quick and can be done anytime directly within the app.

How can I pay bills using the BMO Digital Banking app?

Go to 'Bill Pay' in the menu, add your billers, schedule payments, and confirm. You can manage multiple bills easily within the app.

Does the app support sending money to friends and family?

Yes, through Zelle® in the app. Go to 'Send Money,' enter recipient details, amount, and confirm to complete the transfer instantly.

How secure is the BMO Digital Banking app?

The app uses multi-factor authentication, provides real-time alerts, and allows you to turn your cards on/off instantly for enhanced security.

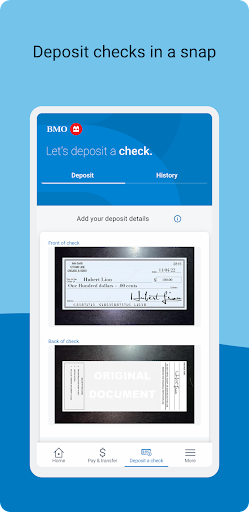

Can I deposit checks remotely with the app?

Yes, select 'Deposit Checks,' take clear pictures of your check's front and back, enter the amount, and submit. Funds are usually available quickly.

How do I set up account activity alerts?

Go to 'Settings' > 'Notifications' > 'Account Alerts' within the app to customize alerts for transactions and account activity.

Are there any subscription or fee charges for using the app?

The app itself is free to download and use. However, standard account or transaction fees may apply according to your banking account terms.

What should I do if I encounter login issues?

Try resetting your password via 'Forgot Password' on the login screen or contact customer support if issues persist for further assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4