- Developer

- Bright Money

- Version

- 1.58.3

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.6

Bright Money - AI Debt Manager: A Smart Companion for Your Financial Journey

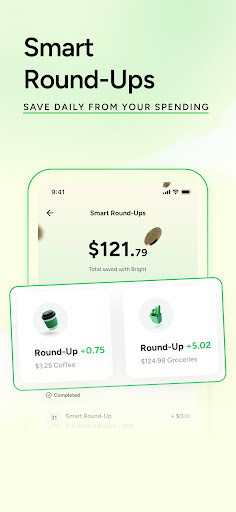

Bright Money's AI Debt Manager aims to transform how individuals handle debt by providing personalized, intelligent guidance that simplifies complex financial decisions. Crafted by a dedicated team of financial tech enthusiasts, this app combines cutting-edge AI with user-centric design to help users pay off debt more efficiently and regain control of their finances. Its key features include dynamic debt payoff planning, automated savings strategies, and comprehensive security measures, making it a compelling tool for those seeking to make smarter financial moves.

Engaging Users with Personalized Debt Solutions

Imagine having a financial expert sitting right beside you, constantly analyzing your spending habits and suggesting tailored repayment plans. That's the experience Bright Money aims to deliver. Its core strength lies in harnessing AI to craft customized debt payoff strategies that adapt as your financial situation evolves. Whether you're juggling multiple debts or aiming to clear a large balance, this app's intelligent algorithms optimize your repayment timeline and amounts, helping you save on interest and reduce stress. The more you use it, the better it understands your financial rhythm, making guidance increasingly precise and actionable.

Seamless and Secure User Experience

From the moment you open Bright Money, you're greeted with a clean, modern interface that feels intuitive like flipping through a familiar book. The onboarding process is straightforward, guiding users through linking their bank accounts and setting debt goals without overwhelming complexity. During operation, the app responds swiftly—no lag or confusing menus—making daily interaction smooth as silk. Additionally, Bright Money takes user security seriously—employing bank-level encryption and regular security audits to protect your sensitive data. This focus on security and ease of use reassures users, especially when handling vital financial information.

What Sets It Apart from Competing Apps?

While many financial apps focus on budgeting or investment tracking, Bright Money's standout feature is its AI-driven personalized debt management, which closely aligns with the user's unique financial status. Its “Smart Payoff Engine” adapts in real-time, adjusting repayment suggestions based on your changing circumstances—something most traditional apps lack. Another unique aspect is its emphasis on transaction security, ensuring that your bank details and payment data are closely guarded, setting it apart from competitors that may not prioritize this transparency. This blend of intelligent customization and robust security creates a distinct edge, particularly for users seeking a trustworthy yet adaptable debt management tool.

Final Thoughts and Recommendations

Bright Money is an excellent choice for users seeking an intelligent, user-friendly assistant to navigate their debt repayment journey. Its innovative AI-powered planning stands out, offering a personalized touch that traditional tools often lack. For those who are comfortable with digital interfaces and wish to see clear, data-backed strategies, this app is highly recommended. However, if you prefer extensive manual control or are wary of AI-driven suggestions, it might require some adjustment. Overall, for individuals determined to tackle debt with a smart partner, Bright Money provides a balanced combination of sophisticated tech and user-focused design—making it well worth exploring.

Pros

- AI-driven personalized debt management

- User-friendly interface with clear visuals

- Automated payment scheduling

- Progress tracking with real-time updates

- Educational insights and tips

Cons

- Limited integration with some banking institutions (impact: 中)

- Dependence on user data accuracy (impact: 中)

- Premium features require subscription (impact: 低)

- Limited multilingual support (impact: 低)

- Occasional delays in fetching real-time data (impact: 低)

Frequently Asked Questions

How do I get started with Bright Money?

Download the app, create an account, and follow the onboarding prompts to set up your financial goals and connect your banking information.

Is Bright Money suitable for beginners with no financial experience?

Yes, Bright Money offers user-friendly guidance and educational resources to help beginners manage their finances confidently.

What are the main features of Bright Money I should use first?

Start with Bright Builder to build credit and Bright Plan for personalized debt repayment strategies; these are core tools to improve your finances.

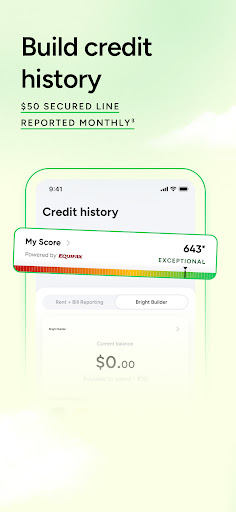

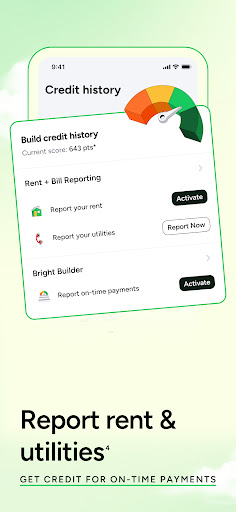

How does Bright Builder help improve my credit score?

Bright Builder lets you secure a credit line starting at $50 and reports on-time payments to credit bureaus, helping build your credit history.

How can I report my rent payments to improve my credit?

Enable rent reporting in the app under Profile > Credit Building > Rent Payments to have your rent history reported to bureaus.

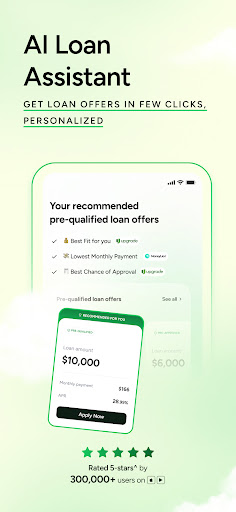

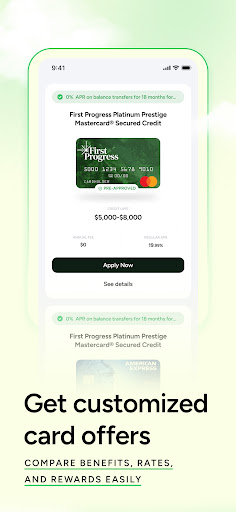

What options are available for personal loans on Bright Money?

Go to Loans > Apply for a Loan to view offers up to $10,000 with flexible terms; approval depends on your creditworthiness.

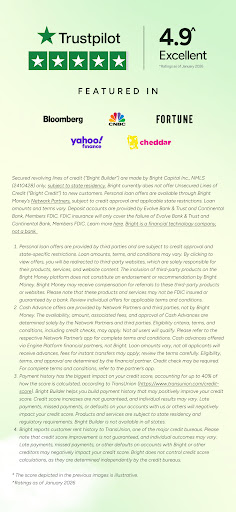

How much does a subscription cost, and what benefits do I get?

Plans range from $39 to $97 annually, unlocking features like advanced debt strategies and educational resources; cancel anytime in Settings > Subscriptions.

Can I upgrade to Premium Membership later?

Yes, you can upgrade in Profile > Membership > Upgrade to unlock extra features such as enhanced debt payoff plans.

Is there a free trial or a demo version available?

Bright Money does not specify a free trial; however, the basic features are accessible upon registration, with optional paid plans.

How do I contact support if I encounter issues with the app?

Use the in-app chat feature in Settings > Support for 24/7 assistance, or contact via email or phone during operational hours.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4