- Developer

- Brigit

- Version

- 1076.0

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.8

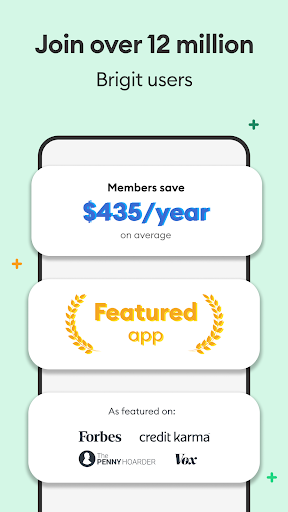

Brigit: Cash Advance & Credit — Your Friendly Financial Sidekick

Imagine having a trusted friend who's always there to lend a helping hand when your wallet feels a little light — that's exactly what Brigit strives to be, a reliable app that bridges the gap between paycheck and paycheck with its user-friendly cash advance and credit features.

An App Designed for Everyday Financial Flexibility

Developed by the innovative team at Brigit, Inc., this application aims to empower users with accessible financial tools that prevent paycheck-to-paycheck stress. Its core mission? Providing quick cash advances, credit monitoring, and budgeting assistance—all within a seamless, approachable platform.

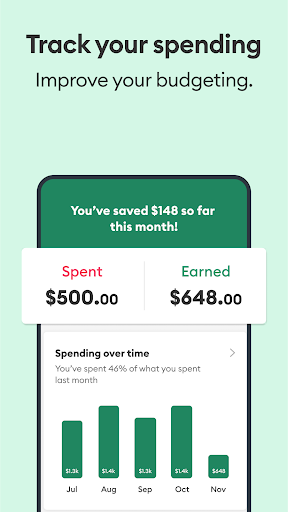

- Key Features:

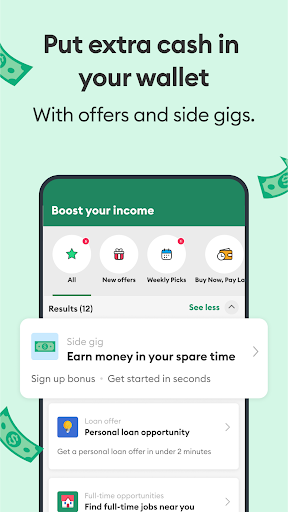

- Early paycheck access through cash advances

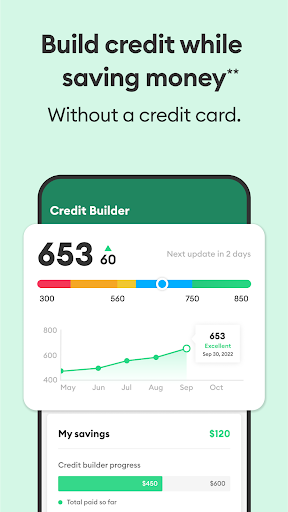

- Frequent credit score monitoring and tips

- Personalized financial insights and budgeting tools

- Automatic bill tracking and reminders

Designed mainly for individuals living paycheck to paycheck, those aiming to improve credit, or anyone needing short-term financial flexibility, Brigit offers a tailored experience for a broad spectrum of users seeking smarter money management.

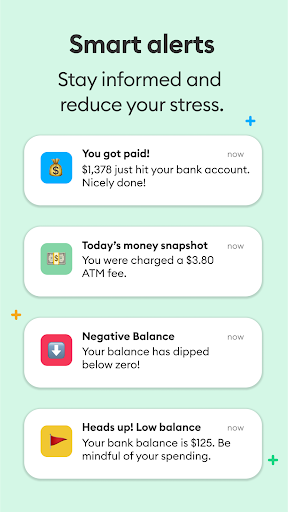

Engaging and Intuitive User Experience

Stepping into Brigit is akin to entering a well-organized toolbox—clean, inviting, and ready for action. The interface employs soft color palettes and simple icons that feel less intimidating and more like chatting with a knowledgeable friend. Navigating through cash advance options or checking your credit score is as effortless as a few taps, with each feature logically placed and explained without overwhelming jargon.

The app's operation flow is impressively smooth; transitions are quick, and responses are immediate. Even first-time users can get comfortable within minutes owing to guided onboarding and helpful tips integrated into the app. The learning curve is gentle, making financial management approachable rather than a daunting chore.

What Sets Brigit Apart in the Fintech Jungle?

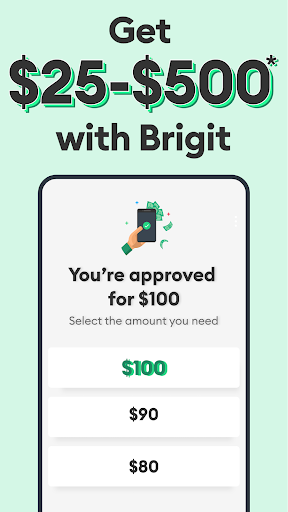

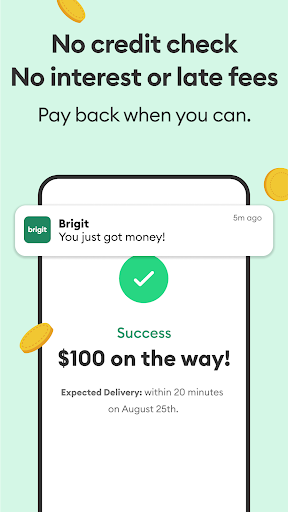

Many financial apps focus solely on budgeting or credit scores, but Brigit strikes a distinctive balance with its dual emphasis on quick cash solutions and credit health. Notably, its cash advance feature shines as the most distinctive offering—users can access up to $250 without hidden fees or complicated approval processes, directly linked to their upcoming paycheck. This feature feels like having a financial safety net that's always within reach, rather than an opaque or risky loan.

Furthermore, Brigit's commitment to account and fund security reassures users. With advanced encryption and fraud detection measures, your financial data remains private and protected—more akin to sealing your money vault with a high-tech lock. Additionally, the transaction experience is designed to minimize friction: transfers are prompt, transparent, and easy to track, creating a sense of trustworthiness that's often missing in other money management apps.

Final Verdict: A Practical Companion for Real-Life Finances

Overall, I'd recommend Brigit as a dependable and approachable friend in the often complicated world of personal finance. Its ease of use, combined with innovative features like the cash advance that feels more like a helping hand than a loan, makes it stand out. For anyone looking to ease financial tension without jumping into complex investments or high-interest loans, Brigit offers a balanced, user-centered solution.

If you're navigating tight budgets or seeking to keep your financial health on track with minimal fuss, this app is worth trying out. Just remember, while it provides quick fixes, it's always best to think of it as part of a broader financial strategy—not a permanent solution—but definitely a helpful tool to have at your fingertips.

Frequently Asked Questions

How do I sign up and start using Brigit?

Download the app, tap Sign Up, enter your details, and connect your bank account through Settings > Bank Accounts to begin managing your finances with Brigit.

Is there a free version of Brigit, and what features does it include?

Yes, Brigit offers a Basic Plan with free alerts, insights, and earn & save offers. Upgraded features like cash advances require a paid subscription from $8.99/month.

How do I request an instant cash advance?

Connect your bank account in Settings, select 'Cash Advance' from the menu, enter the amount ($25-$250), and confirm your request for quick funds.

Can Brigit help build my credit score?

Yes, activate the Credit Builder feature in the app, make on-time payments, and your good payment history is reported to major credit bureaus to improve your score.

What is the process for repaying a cash advance?

Repayments are flexible; you can pay back when you get paid or choose a convenient time via the app's repayment options in your account settings.

Does using Brigit cost me anything apart from the monthly fee?

No, taking cash advances has no interest or hidden fees. However, some premium features like credit building are included in the paid plans, starting at $8.99/month.

How can I cancel my Brigit subscription if I no longer need it?

Go to Settings > Subscription, select your plan, and tap Cancel Subscription. You can cancel anytime without penalties.

What should I do if I encounter technical problems with the app?

Try restarting the app, check your internet connection, or contact Brigit support through the Help section for further assistance.

Are there any restrictions on where I can use Brigit features?

Brigit is available in many states, but some features may have regional restrictions. Check the app's availability in your location before signing up.

How secure is my financial data with Brigit?

Brigit uses advanced security measures to protect your data, including encryption and identity theft protection tools, ensuring your information remains safe.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4