- Developer

- Block, Inc.

- Version

- 5.30

- Content Rating

- Everyone

- Installs

- 0.10B

- Price

- Free

- Ratings

- 4.8

Cash App: A Seamless Gateway to Modern Financial Convenience

Cash App is a popular peer-to-peer mobile payment platform designed to simplify digital transactions, connect friends, and explore new financial opportunities—all within a sleek, user-friendly interface.

Who's Behind the Curtain?

Developed by Block, Inc. (formerly Square, Inc.), the team behind Cash App boasts a robust background in financial technology, emphasizing security, innovation, and user empowerment. Their commitment is to make managing money as effortless as possible—like having a banking partner in your pocket.

Key Features That Make Cash App Shine

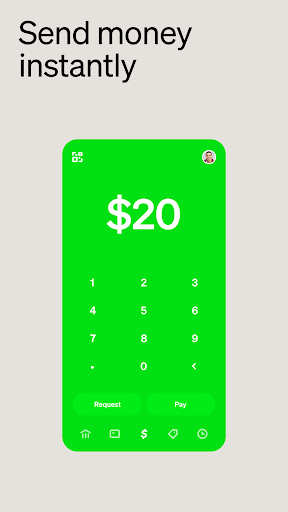

- Instant Peer-to-Peer Payments: Send and receive money instantly using just a username or phone number—no need to juggle cash or wait for bank transfers.

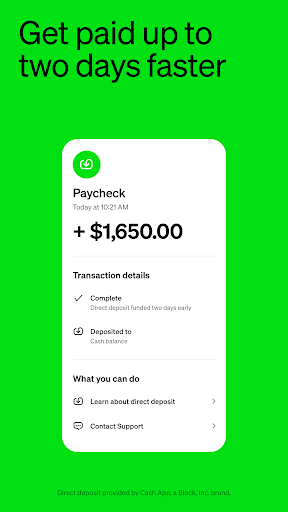

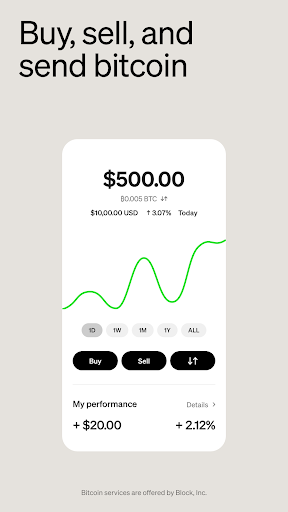

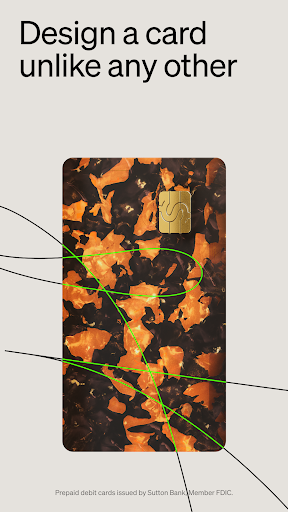

- Built-in Banking Functions: The app offers a customizable Visa debit card, direct deposit capabilities, and even the option to buy and sell Bitcoin—a step beyond typical payment apps.

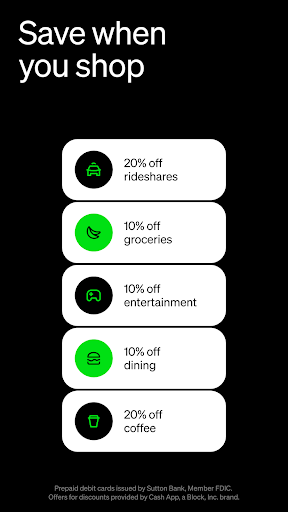

- Cash Boost and Rewards: Earn instant discounts at favorite stores through unique Boost perks, making everyday purchases more rewarding.

- Security & Identity Verification: Advanced encryption, biometric login options, and real-time fraud monitoring provide peace of mind for users concerned about security.

A Fun and Friendly Introduction: The Spirit of Cash App

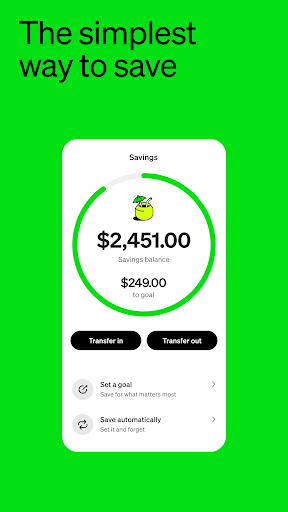

Imagine having a digital wallet that feels less like a clunky bank portal and more like a friendly assistant eager to help you manage your money effortlessly—whether splitting a pizza, saving for a concert, or investing in your future. Cash App's vibrant interface is like a well-organized toolbox, where every feature is just a tap away, inviting you to explore the nuances of personal finance with ease and confidence.

Core Functionality Deep Dive

Peer-to-Peer Payments Made Effortless

Cash App stands out with its speed and simplicity in transferring money between friends. Just tap 'Send', enter the recipient's username or phone number, input the amount, and voila—money moves instantly. Unlike traditional bank transfers that can take days, Cash App's real-time transactions feel like handing over cash in person, but with the added convenience of avoiding physical exchange. This feature is perfect for splitting bills, sharing rent, or sending a gift without fuss.

Banking and Investment Features

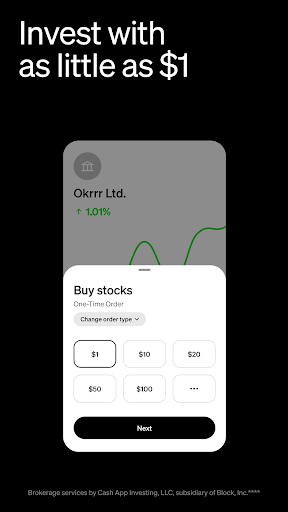

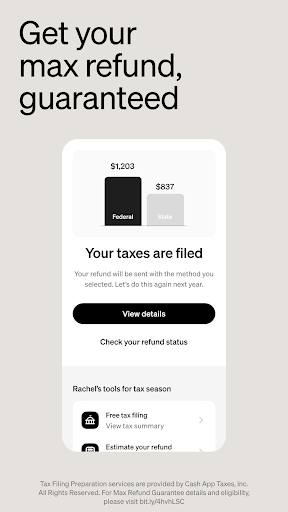

Beyond simple transactions, Cash App positions itself as a mini-bank in your pocket. Its integrated Visa debit card enables seamless spending and ATM withdrawals, while direct deposit allows you to receive your paycheck upfront. The addition of Bitcoin buying and selling also introduces a layer of investment that's accessible to beginners—imagine dipping your toes into cryptocurrency waters without diving headfirst into complex exchanges. This combination of banking and investment makes Cash App more than just a payments tool—it's your financial co-pilot.

Security and User Experience

The app's interface resembles a sleek dashboard—clear, colorful, and uncluttered. Navigating between features is intuitive, even for first-time users. The onboarding process includes straightforward verification steps to reinforce account security without overwhelming users. Cash App employs biometric authentication—like fingerprint or Face ID—adding a personalized security layer. Compared to other finance apps, Cash App's emphasis on rapid, secure transactions with straightforward controls makes managing money a less stressful and more trustworthy experience.

Distinctive Advantages Over Similar Finance Apps

While many mobile finance platforms focus on payments and banking, Cash App takes subtle yet significant strides in account security and transaction experience. Its dynamic security measures—such as real-time fraud detection and biometric login—are designed to guard your money like a loyal guardian. Additionally, the seamless integration of investment options directly into the app's interface sets it apart, allowing users to transition smoothly from payments to investing without changing platforms. These features collectively provide a sense of confidence and convenience that can be hard to find in other applications.

Final Verdict: Should You Give It a Shot?

If you're looking for a straightforward, secure, and versatile financial app that acts like a friendly financial companion, Cash App is definitely worth exploring. Its most notable strengths lie in the speed of transactions and integrated investment options—making it particularly appealing for users seeking both everyday payments and a gentle introduction to investing. For those who prioritize security and simplicity without sacrificing innovation, Cash App comes highly recommended as a reliable digital wallet. Whether you're splitting dinner bills, saving for your next adventure, or dabbling in cryptocurrencies, this app provides a balanced and accessible platform to support your financial journey.

Pros

- User-friendly interface

- Fast and secure transactions

- Multiple financial services

- No hidden fees

- Integration with banking systems

Cons

- Limited customer support options (impact: medium)

- Inconsistent transaction processing times (impact: medium)

- Limited availability in some countries (impact: high)

- Risk of unauthorized access (impact: high)

- Inconsistent fee notifications for certain services (impact: low)

Frequently Asked Questions

How do I sign up and start using Cash App?

Download the app, register with your phone number or email, verify your identity, and link a bank account to begin managing your finances easily.

Is Cash App safe to use for sending money?

Yes, Cash App uses encryption and fraud monitoring to protect your transactions; always enable security features and avoid sharing your PIN.

How can I send money to friends or family?

Tap 'Send', enter recipient's $Cashtag, phone number, or email, input amount, and confirm; transactions are instant and free within the platform.

How do I set up my Cash App Card?

Go to the 'Banking' tab, select 'Get Card', choose virtual or physical, customize if desired, and follow prompts to activate.

Can I invest in stocks or Bitcoin with Cash App?

Yes, navigate to the 'Investing' tab, choose stocks or Bitcoin, and follow instructions to buy or sell, with no commission fees.

How do I enable direct deposit for my paycheck?

Go to Banking > Direct Deposit, find your account info, then share this info with your employer to receive early payments.

What discounts and rewards does Cash App provide?

Use the 'Cashback' feature during purchases at select merchants to get discounts; check offers regularly on the app.

Are there any fees for using Cash App?

Basic transactions like peer transfers are free; ATM withdrawals with at least $300 deposit monthly are waived; some services may have fees.

How do I resolve a transaction error or app issue?

Tap 'Profile' > 'Support' for help, or contact Customer Service directly through the app for troubleshooting assistance.

Can I cancel a payment I sent by mistake?

Instant payments are usually final; contact support immediately if needed, but note that once accepted, transactions can't be canceled.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4