- Developer

- Chime

- Version

- 5.305.0

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.8

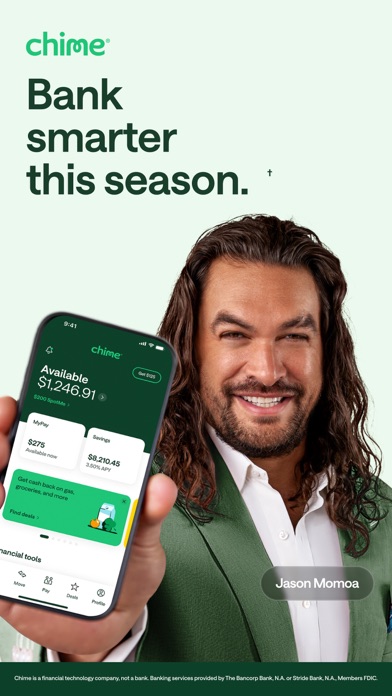

Chime – Mobile Banking: A Fresh Take on Digital Banking

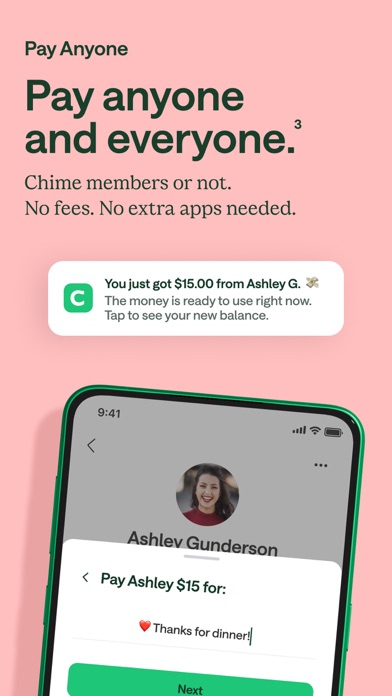

Chime is a modern mobile banking app designed to simplify financial management with user-centric features, seamless experience, and robust security measures. Developed by Chime Financial Inc., this app aims to democratize banking by removing traditional hurdles and offering a more accessible approach to everyday financial needs.

Key Highlights of Chime

The app distinguishes itself with features such as fee-free banking, early paycheck access, and automatic savings tools. Its intuitive interface caters to users seeking straightforward solutions without hidden charges. Targeted primarily at young adults, gig workers, and anyone tired of conventional banking friction, Chime strives to make managing money effortless and transparent.

A Bright Introduction to Chime's Charm

Imagine waking up to the gentle buzz of your phone, knowing that your banking experience is smoother than ever—no fuss, no confusing navigation, just pure financial clarity. Chime's sleek design and user-friendly layout create a calming digital environment, like having a friendly, efficient teller right in your pocket. This app isn't just about managing finances; it's about transforming how you perceive and handle your money in the digital age.

Core Functionality 1: Simplified Banking with No Hidden Fees

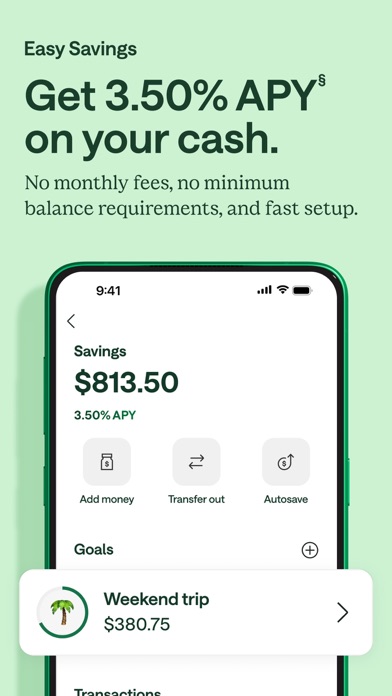

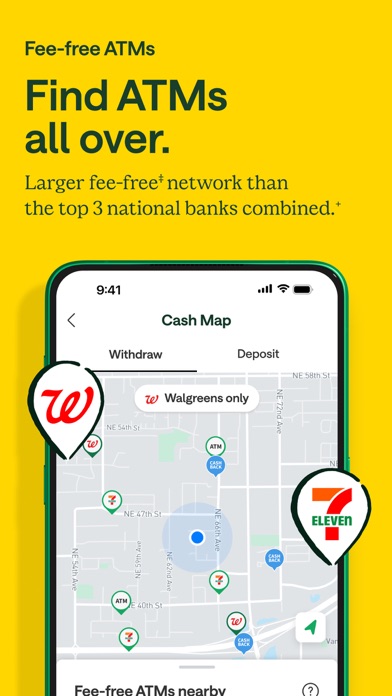

One of Chime's standout features is its fee-free banking structure. Unlike traditional banks that often surprise you with monthly maintenance fees or ATM surcharges, Chime promises transparent service. Your account comes without monthly fees, overdraft charges, or minimum balance requirements, making banking accessible and hassle-free. Plus, its extensive ATM network ensures you can withdraw cash conveniently without worrying about extra costs—imagine being in a new city, and your bank is still just a quick ATM visit away.

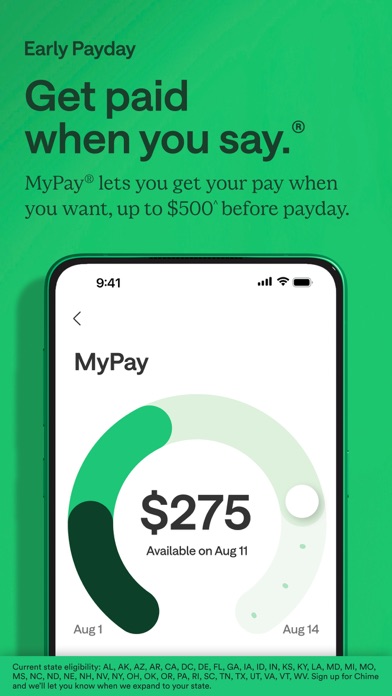

Core Functionality 2: Early Paycheck Access & Automatic Savings

Chime's innovative direct deposit feature allows users to access their paychecks up to two days early, akin to having a financial head-start each pay period. This can be particularly beneficial for those living paycheck to paycheck or managing tight budgets. Furthermore, its 'Save When You Get Paid' feature automatically rounds up transactions or transfers a percentage into a separate savings account, making saving effortless—like having a virtual piggy bank that's always ready to grow. These features combine to give users a proactive grip on their financial futures.

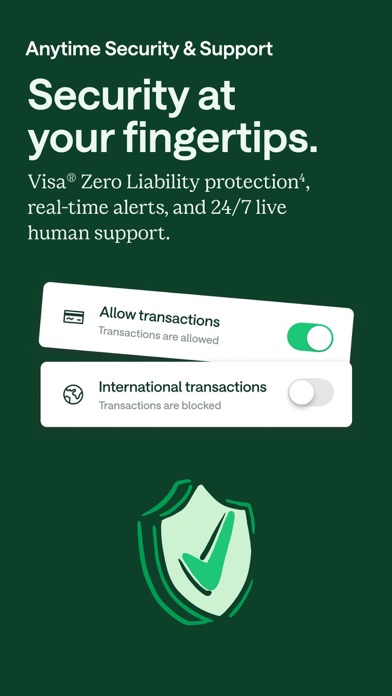

Core Functionality 3: Robust Security and User Experience

Security is a pillar of Chime, employing bank-level encryption, instant transaction alerts, and the ability to freeze your card instantly via the app—think of it as having a security guard watching over your money at all times. The interface is designed with clarity in mind; intuitive menus, simple navigation, and clear transaction histories make managing finances feel like a breeze. The learning curve is minimal, even for those new to digital banking, transforming what might be a daunting digital landscape into a friendly neighborhood shop.

What Sets Chime Apart from Other Financial Apps?

While many financial apps focus on investment or budgeting, Chime's true magic lies in its emphasis on security and seamless transaction experience. Its early paycheck feature acts like a financial cushion, giving users access to their earnings sooner, which is not always guaranteed elsewhere. The automatic savings function is like having a dedicated financial coach quietly boosting your savings without requiring extra effort. Compared to traditional banks or semiautomated fintech solutions, Chime's approach highlights transparency—no fees, no fine print—paired with sophisticated security practices, making it a trustworthy companion for everyday banking.

Recommendation and Usage Tips

Overall, I'd recommend Chime to anyone who values transparency, convenience, and security in banking. It's especially suited for young professionals, students, or those exploring digital-only banking options for the first time. For users who primarily need a safe, fees-free account with quick access to funds and automatic savings, Chime can become an essential financial tool.

To maximize its benefits, users should leverage its early deposit feature and automatic savings options, making financial discipline feel less burdensome. Also, pairing Chime with good financial habits enhances its utility, turning it from a mere banking app into a genuine financial ally.

In conclusion, Chime's blend of innovative features, user-friendly design, and unwavering focus on security makes it a standout in the crowded arena of mobile banking apps. With its approachable interface and thoughtful functionalities, it's like having a friendly, reliable financial partner right in your pocket—an approachable solution for a smarter, stress-free financial life.

Pros

- User-friendly interface

- No monthly fees

- Early direct deposit

- Automatic savings features

- Integrated budgeting tools

Cons

- Limited ATM network (impact: medium)

- No physical branches (impact: low)

- Delayed customer support response (impact: medium)

- Basic lending options (impact: low)

- Security concerns with mobile apps (impact: medium)

Frequently Asked Questions

How do I sign up for Chime Mobile Banking?

Download the app, tap 'Sign Up,' and follow the prompts to enter your personal information and verify your identity via official documents.

Can I access Chime on multiple devices?

Yes, download the app on all your devices and log in with your credentials to access your account anywhere securely.

How do I set up direct deposit to receive my paycheck early?

Go to Settings > Payments > Direct Deposit, then enter your employer's deposit info to enable early paycheck access.

What features help me save money automatically?

Use the 'Save When You Get Paid' feature in Settings > Savings to set automatic transfers to your high-yield savings account.

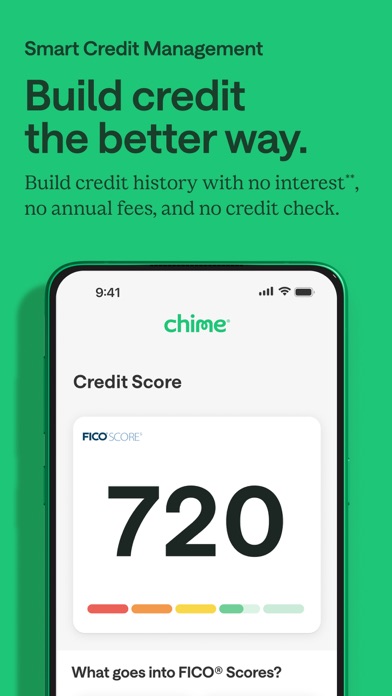

How does Chime help me build credit?

Your on-time spending and payments are reported to credit bureaus via the Credit Builder feature, found under Settings > Credit.

Are there any fees for using Chime's in-network ATMs?

No, Chime offers free in-network ATM withdrawals; you can find ATM locations within the app's ATM locator feature.

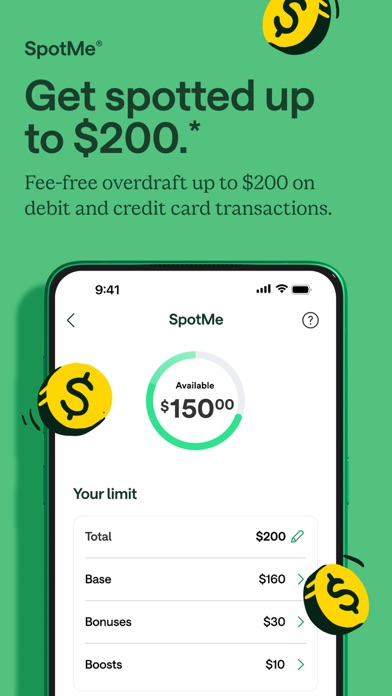

What is the SpotMe® feature and how do I activate it?

SpotMe® provides fee-free overdraft up to $200. Enable this in Settings > Overdraft Protection to help during emergencies.

Can I get an early access to my paycheck, and how?

Yes, set up direct deposit in Settings > Payments, and you'll receive your paycheck up to two days early.

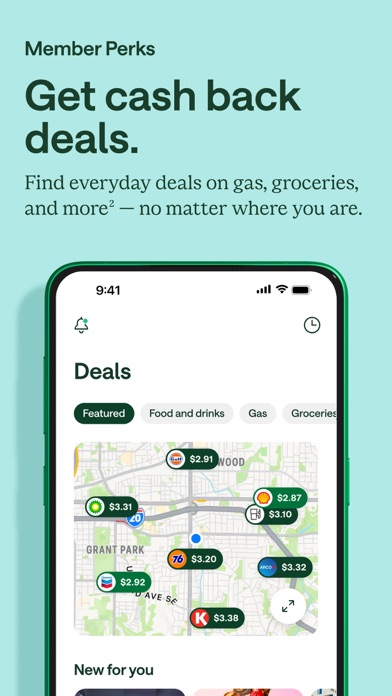

How do I access member perks and exclusive deals?

Open the app, navigate to the 'Perks' section on the home screen to browse and redeem exclusive discounts.

What should I do if my transaction alerts are not working?

Check your notification settings in the app and device settings to ensure transaction alerts are enabled for real-time updates.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4