- Developer

- Citizens Bank, N.A.

- Version

- 26.1.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.8

Citizens Bank Mobile Banking: Your Personal Financial Companion

Citizens Bank Mobile Banking is a user-centric app designed to bring the bank's services directly into your pocket, helping you manage your finances conveniently and securely anytime, anywhere.

Who's Behind It and What Makes It Stand Out?

Developed by Citizens Bank, a reputable financial institution with a longstanding commitment to customer service, this app aims to simplify your banking experience. Its main highlights include intuitive account management, seamless transaction capabilities, robust security features, and insightful financial tools. Targeted at individual consumers, whether you're a busy professional, a student managing allowances, or someone planning for retirement, this app caters to a broad spectrum of banking needs with ease.

The Introduction: Banking at Your Fingertips

Imagine waking up on a busy morning, coffee in hand, checking your account balance while catching up on news—without the hassle of visiting a branch or logging into a clunky website. That's the promise of Citizens Bank Mobile Banking: transforming routine financial tasks into quick, effortless gestures. The app's clean layout, responsive design, and everyday functionality make banking feel less like a chore and more like a friendly chat with your financial assistant. Whether you're reviewing recent transactions or setting up a transfer, the app anticipates your needs with fluidity that feels almost intuitive.

Key Features That Make a Difference

Streamlined Account and Fund Management

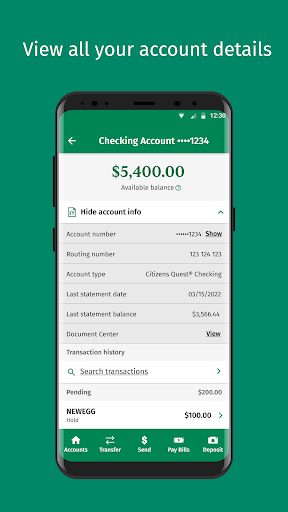

One of the app's standout features is its streamlined interface for viewing all your accounts—checking, savings, loans—in one consolidated view. You can easily monitor your balances, recent transactions, and upcoming bills. Additionally, the app's ‘Transfer' function is as smooth as sliding a card across a table, allowing instant fund movements between accounts or to other banks, all within a secure environment. Its real-time updates ensure you're always in the know, reducing the anxiety of unknown account statuses.

Top-Notch Security and Authentication

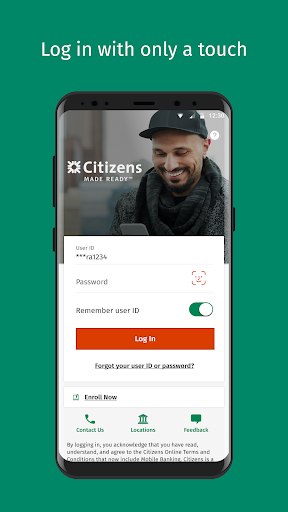

Security is paramount, especially when handling sensitive information. Citizens Bank Mobile Banking employs advanced encryption, biometric authentication (like fingerprint and facial recognition), and multi-factor verification, making unauthorized access akin to locking your treasures behind a vault door. What sets it apart is the proactive monitoring and alert system—if any suspicious activity is detected, the app immediately notifies you, allowing quick action to safeguard your assets.

Financial Insights and Personalization

The app doesn't just give you data—it provides context. Personalized dashboards offer insights into your spending habits, budget tracking, and goal setting. Imagine having a friendly financial advisor whispering advice based on your historical spending—helping you identify savings opportunities or alerting you before overspending. This capability elevates the app from a simple transaction tool to an essential partner in your financial journey.

Design, Usability, and Unique Selling Points

The interface of Citizens Bank Mobile Banking is like a well-organized city map—clear, logical, and easy to navigate, even for first-time users. The design employs gentle color schemes and familiar icons, making navigation feel natural. Swiping and tapping interactions are swift, with minimal lag, thanks to optimized performance that keeps the experience seamless even during peak usage times. The learning curve is gentle: most features are accessible after a few taps, and helpful prompts guide new users.

Compared to other financial apps, Citizens Bank's emphasis on security and personalized insights standout. Its multi-layered security ensures peace of mind, vital for trust in digital banking. Meanwhile, its financial insights act like a wise friend offering tailored advice—something many competitors lack. The combination of robust security and personalized guidance makes it not just a transactional app, but a trustworthy financial companion.

Final Verdict and Recommendations

All in all, Citizens Bank Mobile Banking earns a solid recommendation for its comprehensive feature set, user-friendly design, and commitment to security. It's especially suitable for users who want a dependable, safe, and insightful banking app—those who appreciate transparency, ease of use, and personalized support. If you're someone who prefers managing finances with minimal fuss but maximum control, this app is well worth integrating into your daily routine.

As a piece of advice, spend some time exploring the financial insights and security configurations—they can significantly enhance your experience and peace of mind. While it's a mature app, ongoing updates promise improvements and new features, so staying current is advisable. Overall, Citizens Bank Mobile Banking is like having a reliable banking partner in your pocket—ready to support your financial goals whenever needed.

Pros

- User-Friendly Interface

- Robust Security Measures

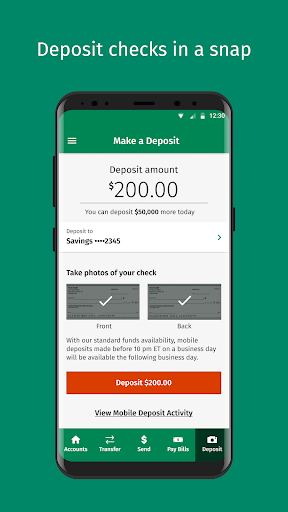

- Mobile Deposit Functionality

- Bill Pay and Transfer Options

- Real-Time Account Updates

Cons

- Limited Customization Options (impact: low)

- Occasional App Crashes (impact: medium)

- Slow Customer Support Response (impact: low)

- Limited Credit Card Management Features (impact: low)

- Offline Access Not Available (impact: low)

Frequently Asked Questions

How do I log in for the first time on the Citizens Bank Mobile Banking app?

Download the app from App Store or Google Play, open it, and enter your existing online banking credentials to log in.

Can I use the app on multiple devices with the same account?

Yes, simply download and log in with your credentials on each device to access your account securely.

How do I deposit checks using the app?

Select 'Deposit Checks', take clear photos of your check front and back, and submit. Funds are credited same business day if before 10 pm ET.

How can I transfer money between my accounts?

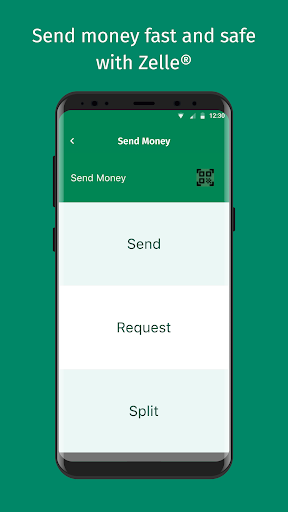

Go to 'Transfers', choose the accounts, enter the amount, and confirm. You can also send funds to non-Citizens or use Zelle® for quick payments.

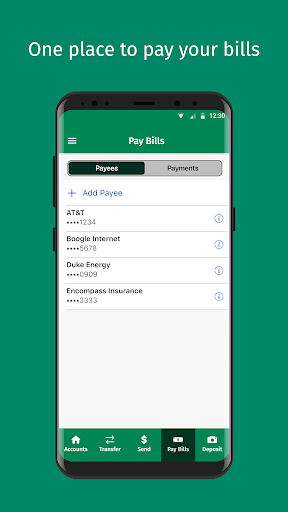

How do I pay my bills with the app?

Navigate to 'Bill Pay', add payees, review bills, and set up automatic payments or make one-time payments through the interface.

How are my banking security and data protected in the app?

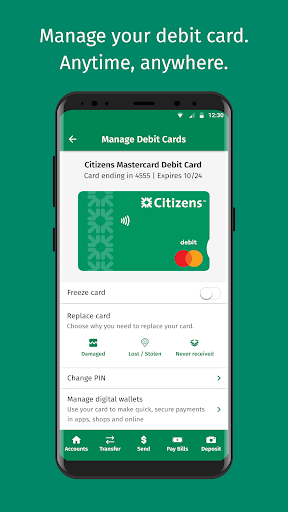

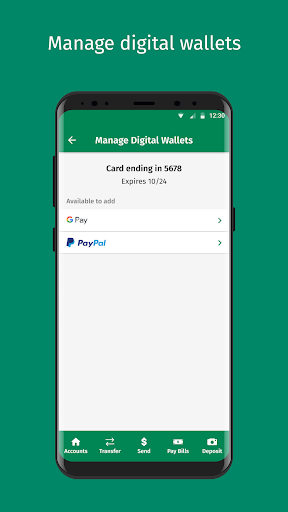

The app uses advanced encryption, secure login, and allows you to lock your card instantly through 'Card Controls' for added security.

Are there any fees for using mobile banking features?

Most basic banking features are free; check account-specific fees in the app or via your bank's terms, especially for optional services.

How do I set up alerts for my account activities?

Go to 'Settings' > 'Notifications', choose your alerts preferences for transactions or balances, and activate push notifications.

What should I do if I experience technical issues with the app?

Try restarting your device, update the app, or contact Citizens Bank support via 'Help' in the app for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4