- Developer

- NetSpend

- Version

- 7.0.4

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.6

Unlocking Financial Simplicity with Classic Netspend

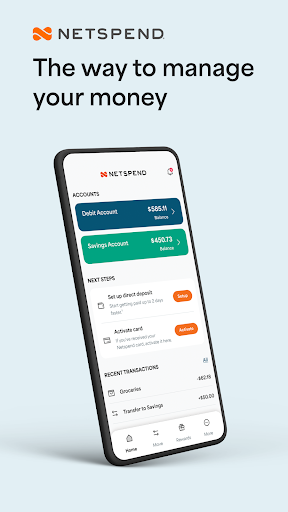

Classic Netspend is a user-friendly mobile application designed to manage prepaid debit cards seamlessly, blending convenience with security to empower everyday financial control.

Developed by a Team Focused on Financial Accessibility

Created by Netspend, a renowned leader in prepaid financial solutions, this app aims to bridge the gap between traditional banking and modern digital finance, making financial tools accessible to a broad audience.

Key Features That Make a Difference

- Real-Time Transaction Monitoring: Instantly track all card activities, giving users complete control and awareness of their spending.

- Secure Account & Fund Management: Advanced security protocols protect users' funds and personal data, offering peace of mind with every transaction.

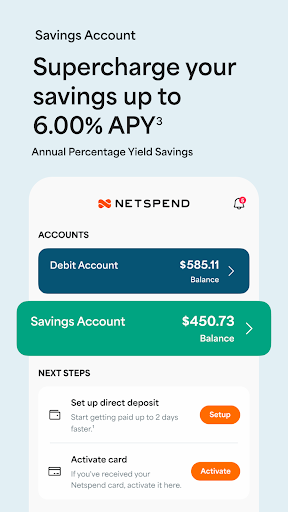

- Inclusive Financial Tools: Features like direct deposit setup and budget tracking turn the app into a comprehensive financial companion.

- User-Friendly Interface: Intuitive design reduces learning curves, making it easy for users of all ages to navigate financial services.

Experience the Financial Journey: From First Tap to Secure Spend

Imagine opening your pocket to reveal a trusted financial sidekick—ready to assist you anytime, anywhere. That's exactly what Classic Netspend aims to be: a companion that simplifies money management without sacrificing security or ease. The app's vibrant interface invites users into a world where managing your prepaid card feels like handling a digital wallet curated just for you.

Navigating Core Functionalities

Let's dive into the heart of the app, starting with its transaction management. When a purchase hits your account, the notification pops up like an alert from a trusted friend, keeping you informed and confident about your spending habits. The real-time updates eliminate surprises and help you stay on top of your finances effortlessly. For those who prefer planning, the budgeting tools function like a compass, guiding your expenses and helping set achievable savings goals.

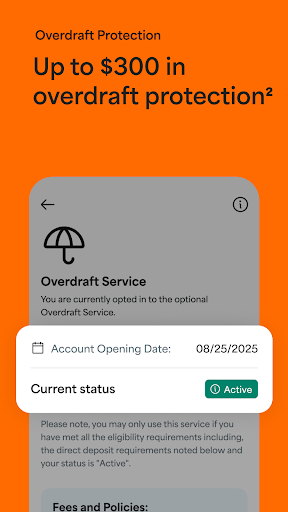

The security aspect is another shining star. With multifactor authentication, biometric login options, and encryption standards comparable to those used by banks, the app ensures your funds are guarded. Unlike some fintech solutions that treat security as an afterthought, Netspend's rigorous protection measures make it stand out. Users can rest assured that their money is shielded from unauthorized access, and any suspicious activity triggers instant alerts—like having a vigilant guardian watching over your accounts.

User Experience: Smooth Sailing or Rough Waters?

The design of Classic Netspend strikes a delicate balance between visualization and function. The interface is crisp, colorful, and straightforward, reminiscent of navigating through a well-organized digital wallet. The user journey from opening the app to completing a transaction is seamless, with minimal clicks and clear pathways — akin to walking along a well-paved path rather than tripping over unfamiliar terrain.

For new users, the learning curve is gentle; onboarding walkthroughs and contextual tips help facilitate quick adaptation without frustration. More experienced users will appreciate the efficient layout that allows rapid access to detailed transaction logs or security settings, making daily use feel like operating a finely tuned machine.

What Sets Classic Netspend Apart?

While many financial apps focus on one or two components—be it budgeting, security, or transaction speed—Netspend's standout feature lies in its integrated security combined with a transparent transaction experience. Its ability to provide real-time risk detection while maintaining an intuitive, uncluttered interface means users are not only protected but also empowered to manage their finances with confidence. This dual focus on security and usability creates a distinctive niche that outshines many competitors in the prepaid card management sphere.

Final Verdict and Recommendations

Overall, Classic Netspend proves to be a reliable and accessible tool for anyone managing a prepaid card, whether for everyday expenses, travel, or budgeting. Its core strengths—robust security, real-time tracking, and user-friendly design—make it a solid choice for users seeking peace of mind and convenience in their financial routines.

If you're someone who values transparency, security, and simplicity, this app is worth trying out. For those already using Netspend or similar prepaid solutions, it offers an enhanced experience that marries technology with trust. As a friendly recommendation, start with small transactions to familiarize yourself with its features, and gradually explore its security settings and budgeting tools — you might find your financial journey becoming significantly smoother.

Pros

- User-friendly interface

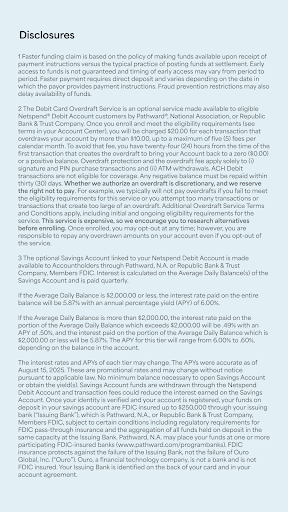

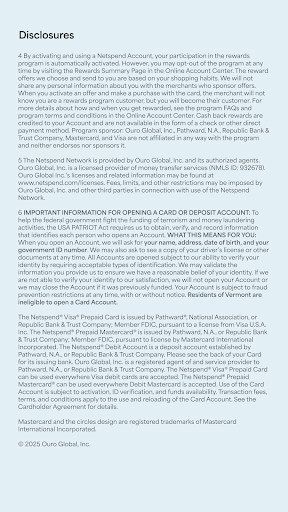

- Low fees and transparent pricing

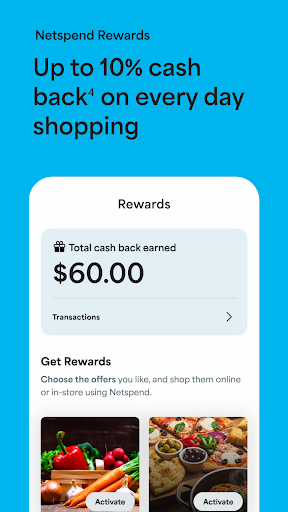

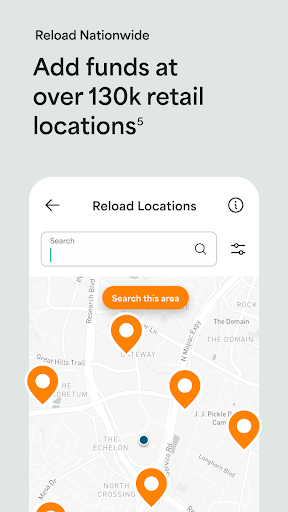

- Wide availability of reload options

- Robust security features

- Good customer support

Cons

- Limited investment options (impact: low)

- Occasional app crashes during peak hours (impact: medium)

- Delayed transaction notifications at times (impact: low)

- Limited international support (impact: medium)

- In-app budgeting tools are basic (impact: low)

Frequently Asked Questions

How do I set up my Classic Netspend account for the first time?

Download the app for Android or iOS, open it, follow the guided registration steps, enter your personal details, and link your bank account through the app's prompts.

Can I link multiple bank accounts to Classic Netspend?

Yes, you can link multiple bank accounts during setup or via Settings > Bank Accounts to manage your finances more flexibly.

What are the main features to help me budget with Classic Netspend?

It offers real-time expense tracking, spending limits, and savings goals to help you manage your money effectively from the main dashboard.

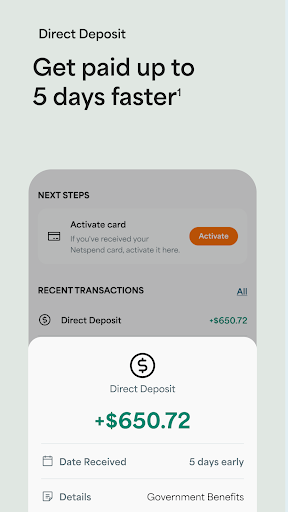

How do I receive my direct deposits earlier with the app?

Enable direct deposit in Settings > Payments, and your paycheck can arrive up to two days early, providing quicker access to funds.

How can I send money to friends and family with Classic Netspend?

Navigate to the Send Money feature in the app, enter the recipient's details, and follow prompts to quickly transfer funds securely.

What security features does Classic Netspend offer to protect my money?

The app includes biometric login options, instant suspicious activity alerts, and secure encryption to keep your funds safe.

Is there a fee for using certain features or making transactions on Classic Netspend?

Some transactions like reloads or international transfers may have fees. Check the Fees section in Settings > Help for details on specific costs.

Are there any subscription plans or premium features I should pay for?

The app offers basic free services; some premium or expedited services may require a paid plan, accessible via Settings > Membership or Subscriptions.

How do I manage or cancel my subscription within the app?

Go to Settings > Subscriptions, select your plan, and follow the prompts to modify or cancel your subscription as needed.

What should I do if I encounter technical issues with the app?

Contact customer support through Settings > Help > Contact Support for quick assistance or visit the help center online for troubleshooting tips.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4