- Developer

- Cleo AI

- Version

- 3.36.0

- Content Rating

- Teen

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.4

Discovering Financial Flexibility with Cleo AI: Cash Advance & Credit

In an era where managing financial health often feels like walking a tightrope, Cleo AI aims to be your steady balancing rod—offering quick cash advances and effortless credit management within a friendly, intuitive app environment. Developed by the innovative team at Cleo Tech Solutions, this application stands out in the crowded finance space by focusing on user security, seamless transaction experiences, and empowered budgeting features. Perfect for young professionals, students, or anyone navigating unpredictable expenses, Cleo AI promises a blend of accessibility and reliability to meet financial needs without the usual hassles.

Bringing Fintech to Your Fingertips: An Overview

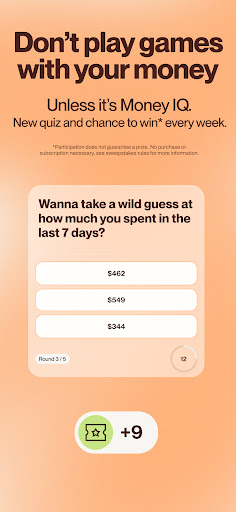

Imagine having your financial assistant right on your smartphone—ready to lend a helping hand whenever unexpected bills pop up or when you need a quick financial boost. That's what Cleo AI strives to deliver. Its sleek design and clever functionality aim to transform the way users approach daily financial management. From the moment you open the app, you're greeted with a friendly, approachable interface that's as inviting as a trusted advisor sitting beside you.

Main Features That Make Cleo AI Shine

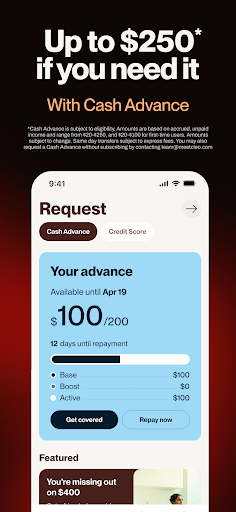

- Instant Cash Advances: Easily request short-term cash loans without intrusive paperwork or long approval waits, giving you quick access to funds directly within the app.

- Smart Credit Monitoring: Keep tabs on your credit score, receive personalized tips for improvement, and get transparent insights into your credit health, all in real-time.

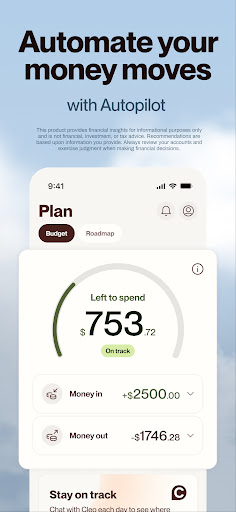

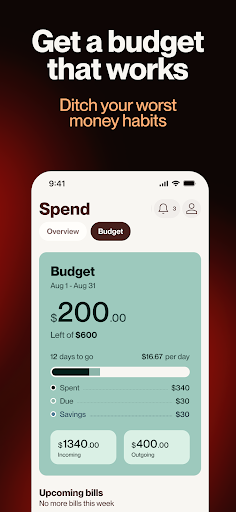

- Automated Budgeting & Spending Insights: With intuitive expense tracking and AI-driven suggestions, users can develop smarter spending habits and plan for future financial goals with less effort.

- Enhanced Security & Privacy: The app employs cutting-edge encryption methods, biometric authentication, and secure data handling to ensure your financial information stays protected.

In-Depth Evaluation: A Closer Look at Cleo AI

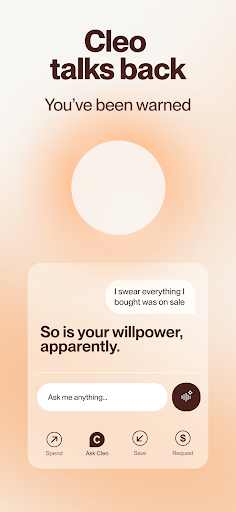

Stepping into the world of Cleo AI feels like entering a well-organized, friendly financial cockpit. The app's vibrant but professional color palette and intuitive layout make navigation feel natural—like chatting with a knowledgeable friend who's also a tech whiz. One of the standout features is how smoothly it operates; swiping between functions is swift, with minimal lag, even on mid-range devices. This fluidity ensures users don't get bogged down or frustrated, promoting frequent engagement and positive user habits.

Core Functionality: Cash Advances and Credit Insights

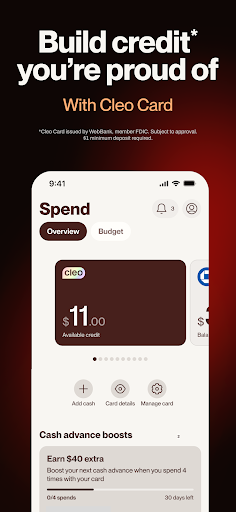

The real magic of Cleo AI lies in its cash advance feature, which functions much like a safety net—immediately catching you when you fall into unexpected expenses. The process involves a simple request button—no endless forms or waiting periods—and the app processes your eligibility and transfers funds swiftly, often within minutes. This immediacy can be a lifesaver during emergencies or tight crunch times. Additionally, Cleo's approach to credit monitoring is equally user-centric. Rather than just displaying scores, it offers actionable advice tailored to your financial behavior, making credit health an attainable goal rather than an obscure concept.

Design & User Experience: Friendly, Secure, and Effortless

From the cosmetic perspective, Cleo AI's interface combines playful visuals with crisp, professional elements, creating a pleasant environment that encourages frequent use. The onboarding experience is user-friendly—guiding newcomers through vital features without overwhelming technical jargon. Navigation flows logically, with key functions accessible within a couple of taps. Performance-wise, the app demonstrates high responsiveness; transitions are smooth, and load times minimal, ensuring that managing finances feels like a breeze rather than a chore.

Learning curves are gentle thanks to helpful prompts, in-app tutorials, and contextual tips. Whether you're a finance novice or a seasoned user, Cleo AI adapts seamlessly, allowing users to dive in confidently or gradually explore more advanced features.

What Sets Cleo AI Apart in the Fintech Space?

In a landscape crowded with financial apps, Cleo AI's standout qualities really come into focus with its dual emphasis on security and user-centric transaction experience. Unlike many competitors, Cleo employs biometric authentication and military-grade encryption, reassuring users that their money and data are shielded from malicious threats. Meanwhile, its transaction experience is optimized for speed and transparency—users see updates in real-time, with clear explanations of fees and limits, fostering trust and clarity. These features combine to offer not just functionality, but peace of mind, which is vital when handling sensitive financial matters.

Final Verdict: A Smart Choice for Your Financial Toolkit

If you're seeking an app that balances ease of use with powerful features, Cleo AI deserves serious consideration. Its most distinctive advantage—the ability to request cash advances swiftly while maintaining a robust focus on security and credit health—makes it a practical yet trustworthy assistant in managing daily money needs. For those who prefer a friendly, approachable interface combined with intelligent financial insights, Cleo AI stands out as a helpful partner rather than just another financial app. I recommend giving it a try, especially if you value a secure, seamless experience that truly supports your financial growth and stability.

Pros

- User-friendly interface

- Instant approval process

- Personal financial insights

- No hidden fees for basic services

- Customer support availability

Cons

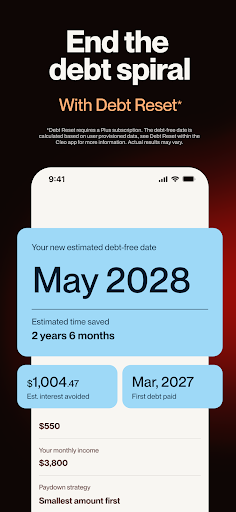

- Limited credit-building features (impact: medium)

- Potential high fees for certain transactions (impact: medium)

- Strict repayment deadlines (impact: low)

- Limited availability in some regions (impact: low)

- Data privacy concerns (impact: low)

Frequently Asked Questions

How do I set up my account and start using Cleo AI?

Download the app, sign up with your email, and connect your bank accounts via Settings > Bank Connections. Follow prompts to complete setup and start managing your finances easily.

How can I ask Cleo about my spending habits?

Open Cleo and type or say questions like 'How much did I spend on takeout last month?' in chat. Cleo provides quick insights based on your connected accounts.

What is the cash advance feature and how does it work?

Request an advance up to $250 via the app's Cash Advance section. Repay exactly the amount borrowed without interest or fees, with flexible repayment options available.

How can I improve my credit score using Cleo?

Navigate to the Credit section, access personalized coaching, and use the cash advance feature to build credit without a credit card, starting with as little as $1 deposit.

What is the highest savings rate offered and how do I start saving?

Cleo offers a 3.52% APY on its high-yield savings account. Sign up via Settings > Savings, then transfer money to begin earning interest on your savings.

How do I link my bank account securely?

Go to Settings > Bank Connections, select your bank, and follow the prompts to securely connect your account using Plaid in read-only mode.

Are there subscription options, and what do they include?

Yes, go to Settings > Subscriptions to view options like Cleo Grow, Plus, and Credit Builder, which add features such as credit insights, cash advances, and savings goals.

What is the cost of using cash advances, or are they free?

Cash advances are interest-free and have no fees. You pay back the borrowed amount, e.g., $40, exactly, with no hidden charges—just make sure to select the amount.

What should I do if I experience a technical issue with Cleo?

Try restarting the app, checking your internet connection, or reinstalling. If problems persist, contact Support via Settings > Help & Support for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4