- Developer

- Concora Credit

- Version

- 3.0.8

- Content Rating

- Everyone

- Installs

- 0.50M

- Price

- Free

- Ratings

- 3.7

Concora Credit: A Smart Companion for Financial Clarity

Concora Credit positions itself as a comprehensive yet user-friendly tool that empowers users to manage their credit scores and financial health effectively. Developed by a dedicated team of fintech enthusiasts committed to transparency and security, this app aims to demystify the complex world of credit management. Its key features include real-time credit monitoring, personalized financial insights, and robust security measures to protect user data. Targeted at consumers seeking to understand and improve their credit standing, Concora Credit offers an intuitive platform for both beginners and seasoned financial mavens.

Engaging Your Inner Financial Detective

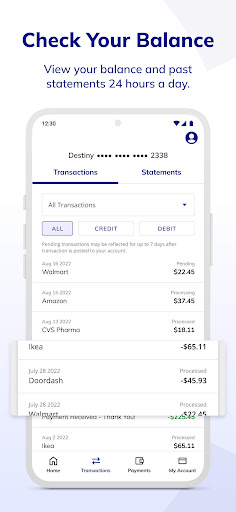

Imagine having a seasoned financial advisor in your pocket, always alert to changes in your credit profile and ready to provide actionable advice—this is what Concora Credit strives to be. Its interface is sleek yet inviting, making what could be dull data feel like a friendly chat. Navigating through the app feels as smooth as gliding on ice; no lagging or confusing menus to frustrate your quest for financial wisdom. Whether you're tracking your credit score or reviewing transaction history, the experience is seamless, with a gentle learning curve that doesn't drown you in jargon or complexity.

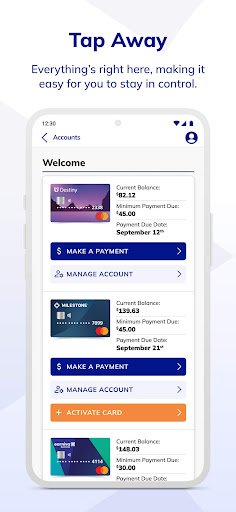

Intuitive and Informative Dashboard

The heart of Concora Credit's appeal lies in its well-organized dashboard. Users are greeted with a clean visual layout showcasing their current credit score, recent activity, and key indicators like credit utilization and payment history. Dynamic graphs and color-coded alerts make it easy to grasp your financial health at a glance, transforming what was once a chore into an engaging, interactive experience. This approachable design encourages regular checking without overwhelming newer users, owing to its straightforward layout and helpful tip prompts.

Personalized Financial Insights and Tips

One of Concora Credit's standout features is its ability to analyze your credit behavior and generate tailored recommendations. For instance, if your credit utilization is creeping up, the app might suggest paying down specific debts or avoiding new credit inquiries. These insights function like a friendly coach whispering in your ear—encouraging healthier habits and helping you navigate the sometimes murky credit terrain. Unlike generic alerts from other apps, Concora Credit's insights are deeply personalized, considering your unique financial profile for more effective guidance.

Security and Transaction Experience: Protecting What Matters Most

In the world of finance apps, trust is everything. Concora Credit distinguishes itself with bank-grade security protocols, including multi-factor authentication and encrypted data transmission, resembling a digital vault protecting your sensitive information. The app's transaction processes—such as disputing errors or updating contact details—are designed to be straightforward yet secure, giving users peace of mind when interacting with their credit data. This focus on security sets it apart from many competitors that may prioritize ease of use at the expense of data protection, making Concora Credit a reliable choice for those serious about safeguarding their financial identity.

Final Thoughts: A Reliable Partner for Your Financial Journey

Overall, Concora Credit strikes a commendable balance between user-friendliness, insight depth, and security. Its most notable innovations—personalized insights and top-tier security—serve as our guiding stars, illuminating the path toward better credit management. We recommend this app for anyone eager to gain more control over their financial profile without being drowned in complexities. Whether you're just starting out or looking for a trustworthy companion to monitor your credit, Concora Credit deserves a spot on your smartphone. Keep in mind, like any tool, its true value is unlocked when used consistently—think of it as your friendly neighborhood financial guide, always ready to assist you on the road to financial health.

Pros

- User-friendly interface

- Comprehensive credit analysis tools

- Real-time updates

- Secure data protection

- Personalized insights

Cons

- Limited free features (impact: medium)

- Occasional app crashes (impact: medium)

- Data synchronization delay (impact: low)

- Limited customer support channels (impact: low)

- Localization options are limited (impact: low)

Frequently Asked Questions

How do I create an account on Concora Credit app?

Download the app, open it, and tap 'Sign Up.' Follow the prompts to enter your personal details and verify your identity from the home screen or settings > account.

Can I link multiple credit accounts in one app?

Yes, after logging in, go to 'Accounts' to add and view all your credit and retail accounts supported by Concora Credit.

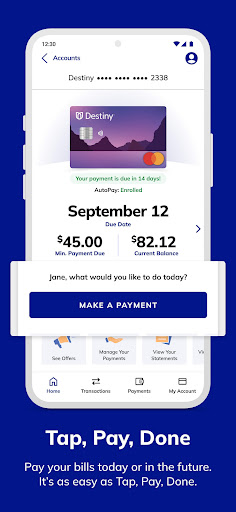

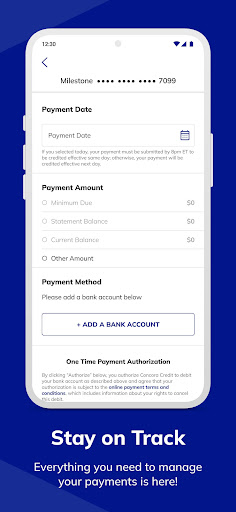

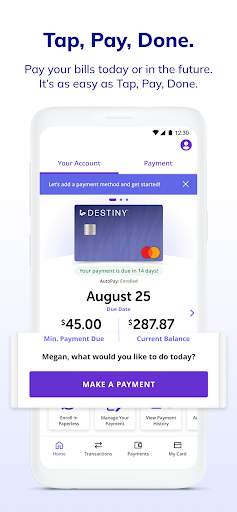

How do I make a payment through the app?

Navigate to 'Payments' or 'Manage Accounts,' select your account, and follow the prompts to schedule or make a one-time payment securely.

How can I apply for a quick line of credit?

Open the app, go to 'Apply for Credit,' fill out the application form, and submit. The app uses algorithms for a quick approval process.

What features help me manage my repayments?

In 'Account Management,' you can view your repayment schedule, choose flexible plans, and make payments to stay in control of your debt.

How secure is my personal information on Concora Credit?

The app employs advanced encryption and security measures. You can also enable two-factor authentication in 'Settings > Security' for extra protection.

Are there any costs or subscription fees for using Concora Credit?

The app is generally free to download and use. Check 'Settings > Payments' for any specific fees related to transactions or credit applications.

Can I customize notification preferences?

Yes, go to 'Settings > Notifications' to adjust alert frequency, such as due date reminders and promotional offers, to your preference.

What should I do if I can't activate my account or login?

Try resetting your password via 'Forgot Password' on the login screen, or contact customer support through 'Help > Support' for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4