- Developer

- Creditly Corp

- Version

- 3.0.11

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.1

Introducing Credit Genie: Get Cash Advance – Your Friendly Financial Helper

Credit Genie is a user-centric mobile application designed to provide quick cash advances with an emphasis on safe transactions and a seamless user experience. Developed by a team committed to innovative financial solutions, this app aims to bridge the gap between urgent cash needs and responsible borrowing.

Core Features That Make a Difference

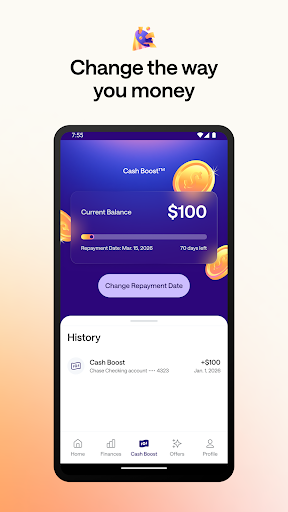

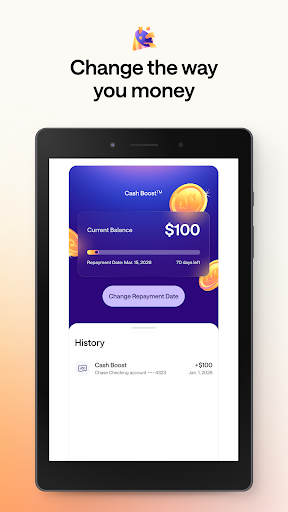

Rapid Cash Access at Your Fingertips

One of Credit Genie's standout features is its ability to facilitate instant cash advances. Whether you're facing unexpected expenses or just need a quick financial boost, the app enables users to request for small loans efficiently, often within minutes. This rapid access is akin to having a trusted friend ready with a helping hand when life throws a curveball—no complicated paperwork or long waiting periods.

Secure and Transparent Transactions

The app prioritizes security, utilizing advanced encryption measures to safeguard user data and transaction details. Plus, it offers transparent fee structures and repayment terms upfront, empowering users to make informed decisions. This focus on security and clarity ensures that users feel confident and in control, standing out from competitors that may obscure loan conditions or lack robust security protocols.

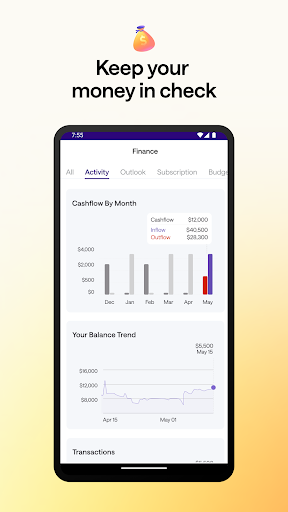

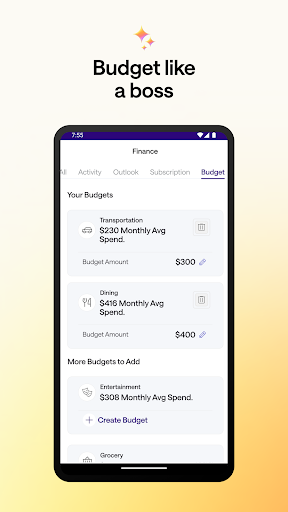

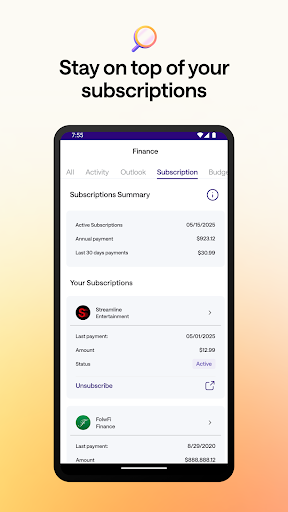

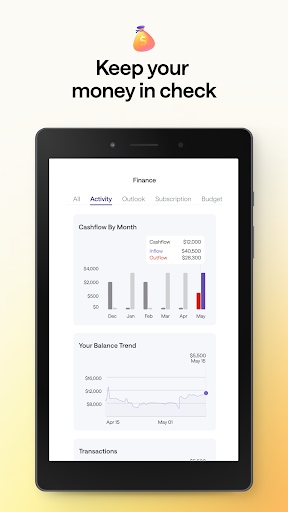

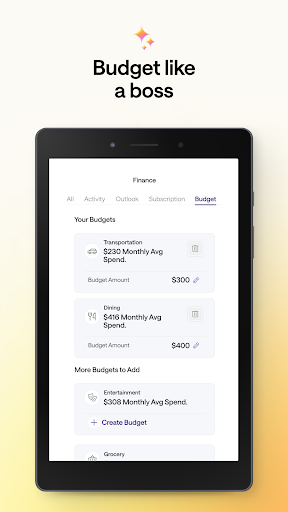

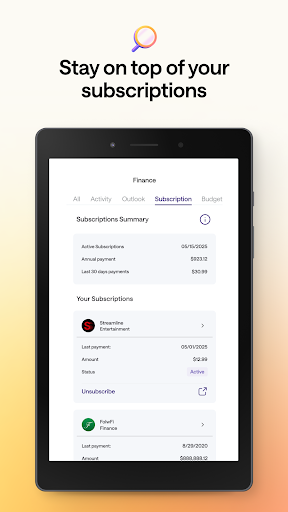

Smart Borrowing Management and Notifications

Credit Genie doesn't just lend money—it helps you manage your borrowing proactively. Features like personalized repayment reminders, borrowing limits based on your financial profile, and real-time transaction notifications ensure that users stay on top of their financial commitments. Imagine having a considerate financial assistant guiding you through every step of your cash needs, reducing uncertainty and stress.

Evaluating User Experience: Design, Ease, and Intuitiveness

The app boasts a sleek, minimalistic interface that feels welcoming rather than intimidating, similar to greeting a friendly concierge rather than a complex machine. Navigating through the app is a breeze, thanks to clear menu structures and logical workflows. Even users new to financial apps can pick up Credit Genie within minutes; the learning curve is pleasantly gentle.

Operational fluidity is notable—requests are processed swiftly, and responses are immediate, creating a real-time experience that mirrors chatting with a helpful friend. This responsiveness keeps users engaged and reassured during every interaction. Moreover, the app's design adapts well to various devices, ensuring a consistent experience across platforms.

What Sets Credit Genie Apart from Its Peers?

While many financial apps focus solely on offering borrowed sums, Credit Genie's emphasis on comprehensive security and user-centric transaction experience creates a distinct niche. Its encryption protocols act like an invisible security guard, silently protecting your sensitive information, which is not always a focus among competitors. Additionally, its intuitive guidance system makes borrowing less akin to navigating a maze and more like following a clear path laid out by a trusted guide.

The app also stands out with its proactive borrowing management tools—reminders and notifications that feel like a personal financial assistant watching over your shoulder, ensuring you never miss a repayment or overlook key details. These features combine to foster trust and transparency, critical factors in financial decision-making.

Final Verdict: Is Credit Genie the App for You?

If you're seeking a straightforward, secure, and user-friendly way to access cash quickly, Credit Genie earns a solid recommendation. Its most compelling advantage—the emphasis on transaction security combined with an easy-to-use interface—makes it especially suitable for users wary of risks but in need of emergency funds. For those who prioritize clarity and peace of mind while managing borrowing, this app offers a thoughtful solution.

However, if your need involves larger loan amounts or more complex financial planning, you might consider other options. Yet, for everyday quick cash needs, Credit Genie is like having a dependable, friendly financial buddy at your side—always ready when you need a helping hand.

Pros

- Easy and quick cash advance process

- User-friendly interface

- Transparent fee structure

- No collateral needed

- Potential credit score improvement

Cons

- Limited loan amounts for some users (impact: medium)

- High interest rates compared to traditional lenders (impact: high)

- Potential for recurring fees if not managed carefully (impact: medium)

- Limited availability in certain regions (impact: low)

- Risk of over-reliance on short-term borrowing (impact: medium)

Frequently Asked Questions

How do I get started with Credit Genie and set up my account?

Download the app, sign up with your details, and connect your bank account through Settings > Account to start using features easily.

What is the maximum cash advance I can get with Credit Genie?

You can access up to $150 in cash advances after initial approval, with amounts based on your banking profile and repayment history.

How do I request a cash advance within the app?

After logging in and connecting your bank, navigate to 'Cash Advance,' enter the amount, choose delivery speed, and confirm your request.

How does the repayment process work for cash advances?

You can select flexible repayment dates from 3 to 90 days in the app, with no fixed schedule. Repay by transferring funds from your bank account.

What are the fees associated with using Credit Genie?

There are no interest charges or late fees. A biweekly Bank Connection Fee of $4.99 applies, which you can cancel anytime in Settings > Fees.

Are there any subscription plans or hidden charges?

The app charges a small biweekly connection fee, but there are no subscriptions or hidden interest fees—just transparent, up-front costs.

How do I cancel my bank connection or recurring fee?

Navigate to Settings > Fees > Bank Connection and you can cancel or modify your bank connection anytime to stop recurring charges.

What should I do if I encounter technical issues or app errors?

Try restarting the app, ensure your internet connection is stable, and contact Support from Settings > Help for further assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4