- Developer

- Credit Sesame, Inc.

- Version

- 7.23

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.7

Unlocking Your Financial Potential: An In-Depth Look at Credit Sesame's "Grow Your Score"

In the vast world of personal finance, understanding and improving your credit score can sometimes feel like navigating a maze. Credit Sesame's "Grow Your Score" app steps in as a friendly guide, offering users straightforward tools and insights to take control of their financial health and build a stronger credit profile.

Basic Information: What the App Brings to Your Financial Journey

Credit Sesame: Grow Your Score is a personal finance application designed to empower users with credit monitoring and improvement tools. Developed by the reputable team at Credit Sesame, the app combines data-driven insights with user-friendly features to help individuals manage and enhance their credit health effectively.

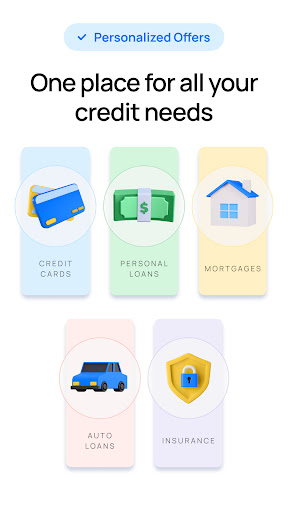

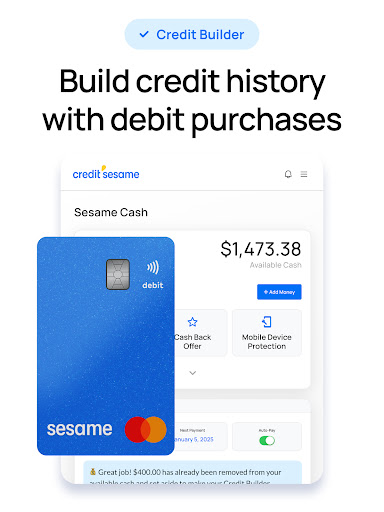

- Primary Functionality: Personalized credit score tracking, actionable tips for score improvement, credit report insights, and financial product recommendations.

- Highlights: Real-time score updates, comprehensive credit analysis, and tailored advice for credit growth.

- Target Users: Anyone looking to understand their credit standing better, improve their score, or explore financial products suited to their credit profile.

Engaging and Intuitive Interface: Making Credit Management Less Daunting

From the moment you open "Grow Your Score," you're greeted with a clean, inviting dashboard that feels more like a friendly financial assistant than a sterile data portal. The interface employs calming colors with clear icons, making navigation intuitive even for those new to credit management. The flow of information is logical—your current credit score is front and center, supplemented by easy-to-understand insights and personalized recommendations.

Operation is seamless; swiping and tapping feel responsive, with data loading swiftly across different sections. The app employs a gentle learning curve—users are gradually introduced to deeper features as they become more comfortable, transforming what could be an overwhelming topic into an empowering experience. Whether you're checking your score has improved or exploring a new credit card offer, the process remains smooth and predictable.

Core Features That Stand Out: Building Credit with Confidence

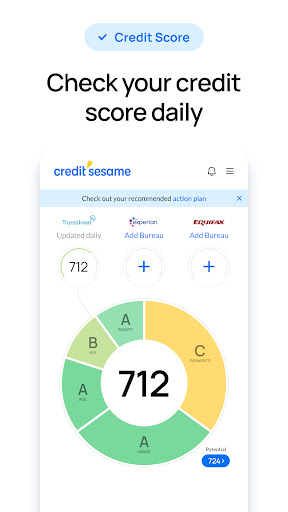

Personalized Credit Score Monitoring and Insights

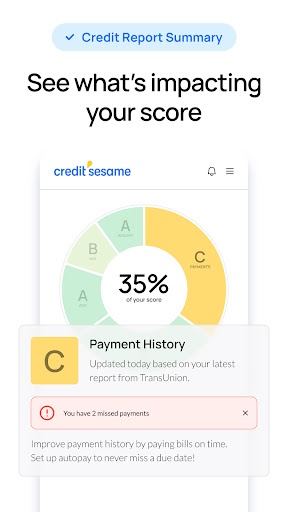

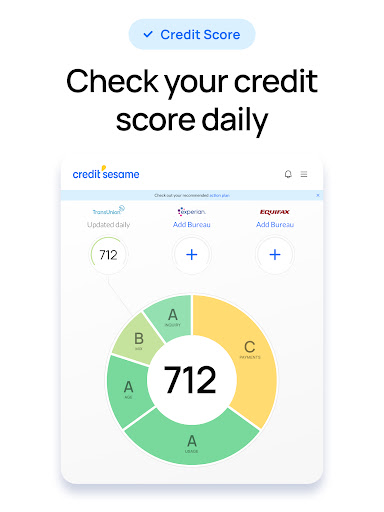

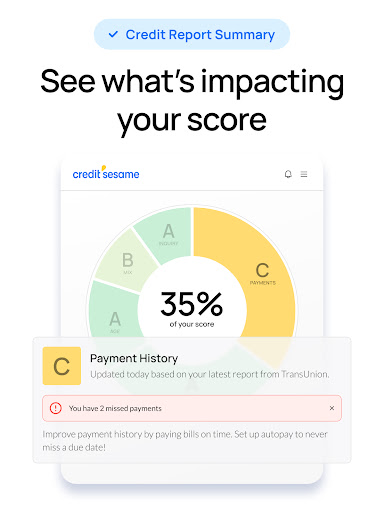

The heart of the app lies in its ability to not only present your credit score but to contextualize it. Through vivid graphs and simple language, "Grow Your Score" explains what factors have influenced your score, such as payment history, credit utilization, or recent inquiries. This transparent breakdown helps users understand their credit profile, much like consulting a friendly expert who patiently points out areas for improvement.

Actionable Tips and Recommendations

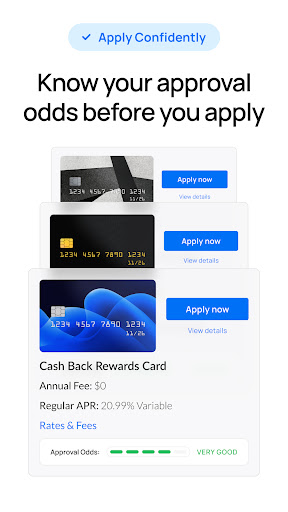

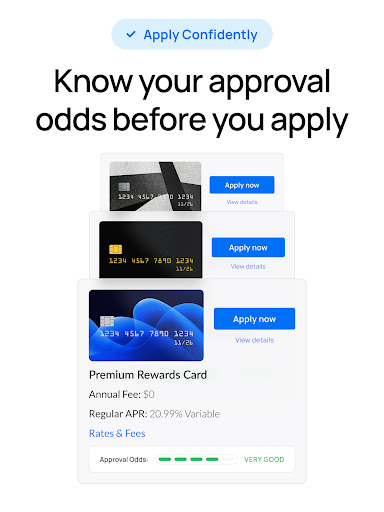

What sets this app apart from many generic financial trackers is its proactive advice system. Based on your unique credit data, it suggests specific actions—like reducing credit card balances or paying certain bills—to help elevate your score. Think of it as having a coach who not only points out what needs fixing but also guides you step-by-step, making the path toward better credit less intimidating and more achievable.

Security and Transaction Experience

Unlike some competitors, Credit Sesame emphasizes the security of your sensitive information. The app uses bank-grade encryption, safeguarding data during transmission and storage, giving users confidence that their financial information is in safe hands. Additionally, the app seamlessly integrates with your existing financial accounts for real-time updates, creating a transaction experience that feels as effortless as flipping through your bank statements—no complicated logins or data mishandling to worry about.

Why Choose "Grow Your Score"? A Fair and Practical Recommendation

For those eager to take charge of their credit health, "Grow Your Score" offers a balanced, no-nonsense approach. Its standout features—especially personalized insights and security-oriented design—make it an excellent companion in your financial journey. While it doesn't promise overnight miracles or overly optimistic promises, its clear, practical guidance makes it a trustworthy tool for consistent credit improvement.

My advice? If you're seeking a user-friendly app that demystifies credit scores and provides tangible steps to improve them, this app is worth trying. Particularly for newcomers or those cautious about security, the app's thoughtful design and focus on transparency make it a sensible choice.

Final Thoughts: A Friend in Your Financial Corner

With "Grow Your Score," credit management transforms from a daunting task into an accessible, engaging experience—like having a knowledgeable friend staying by your side, cheering you on as you build a better financial future. Its focus on personalized advice, combined with robust security features, sets it apart in the crowded field of finance apps. For anyone looking not just to monitor, but actively grow their credit profile, this app is certainly worth a look—practical, secure, and refreshingly approachable.

Pros

- User-Friendly Interface

- Comprehensive Credit Monitoring

- Personalized Tips for Improvement

- Free Service with No Hidden Fees

- Additional Financial Tools

Cons

- Limited Credit Score Updates (impact: medium)

- Inconsistent Data Reporting (impact: medium)

- Ads and Promotions (impact: low)

- Limited Credit Monitoring for Non-US Users (impact: low)

- Basic Educational Content

Frequently Asked Questions

How do I get started with Credit Sesame for free?

Download the app from your app store, sign up with basic info, and instantly access your free credit score and report summaries for ongoing monitoring.

Can I check my credit score daily for free?

Yes, Credit Sesame allows you to refresh and view your credit score daily within the app for real-time tracking.

How do I access my credit report summary and Sesame Grade?

Navigate to the dashboard, then tap on 'Credit Report' to view weekly summaries and your Sesame Grade for easy credit insights.

What features are included with Credit Sesame's premium subscription?

Upgrade via Settings > Subscription to access 3-bureau scores, credit simulator, dispute support, rent reporting, and personalized offers.

How do I upgrade to Credit Sesame Premium?

Go to Settings > Account > Subscription, then select 'Upgrade to Premium' and follow the prompts to subscribe.

Does Credit Sesame support credit dispute or error correction?

Yes, with a premium subscription, you can identify inaccuracies and access dispute support through the app under 'Dispute Assistance.'

Are the credit alerts and monitoring real-time?

Credit Sesame provides real-time alerts for any major changes in your credit report to help you stay informed and secure your profile.

What should I do if the app isn't updating my credit score?

Try refreshing the app or reinstall it. If issues persist, contact support via Settings > Help & Support for assistance.

Is there a fee for accessing my free credit score and report summaries?

No, credit score refreshes, report summaries, and alerts are free features in the app's basic version.

Can Credit Sesame help me improve my credit score?

Yes, it offers personalized tips, credit score simulations, and tools like rent reporting to help you build and enhance your credit.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4