- Developer

- Current

- Version

- 8.1.0

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

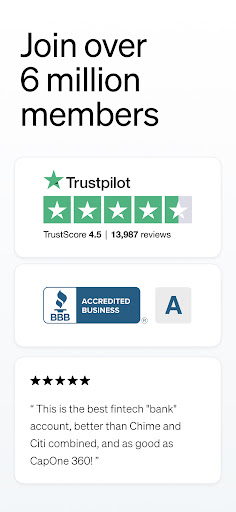

- Ratings

- 4.5

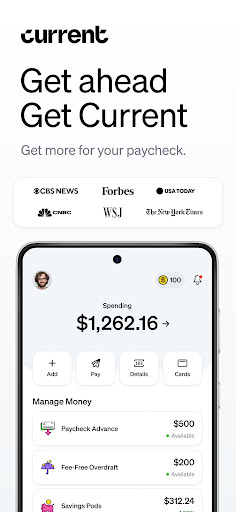

Introducing Current: The Future of Banking

Current is a modern digital banking application designed to redefine the way users manage their finances through innovative security and seamless transaction experiences. Developed by a forward-thinking team, this app combines advanced technology with user-friendly interfaces to serve a broad spectrum of consumers seeking efficient and secure financial management tools.

Core Features That Stand Out

Enhanced Security with Real-Time Fraud Detection

One of Current's flagship features is its sophisticated security system that utilizes real-time fraud detection algorithms. Unlike traditional banking apps that rely solely on PINs or passwords, Current continuously monitors transaction patterns, flagging suspicious activities instantly. This proactive approach gives users peace of mind, knowing their funds are protected by cutting-edge AI that acts faster than a flash in spotting anomalies.

Intuitive Transaction Experience

Current makes money transfers feel as smooth as gliding on ice. With a streamlined interface, users can swiftly send and receive funds, schedule recurring transactions, or split bills with friends—all in a few taps. The app's instant payment confirmations and clear transaction histories eliminate confusion, making financial interactions feel like chatting with a trusted friend rather than filling out complicated forms.

Personalized Financial Insights and Budgeting

Beyond basic banking, Current offers tailored financial insights that adapt to your spending habits, akin to having a personal financial coach by your side. The app categorizes expenses automatically, provides customized saving tips, and offers goal tracking features. This layer of personalization turns mundane money management into a more engaging and insightful experience.

User Experience: Design, Flow, and Learning Curve

From the moment you open Current, you're greeted with a clean, modern interface reminiscent of a well-organized digital workspace. The color palette is soothing yet vibrant, making navigation intuitive and inviting. The UI design feels like a carefully curated dashboard—each element strategically placed to minimize clutter and maximize clarity.

Operationally, the app boasts remarkable smoothness. Transitions between screens are buttery-smooth, and even complex actions like setting up multi-step transfers or analyzing detailed reports feel effortless. For first-time users, the onboarding process is straightforward, with guided tutorials that gently introduce core features without overwhelming. Seasoned users will find that remaining functionalities are just a few taps away, thanks to thoughtful layout design.

Compared to other finance applications, Current's learning curve is modest. Its intelligent prompts and contextual help reduce the friction often encountered by new users, making it accessible for technophobes and tech-savvy users alike.

What Makes Current Truly Unique

While many banking apps promise security and convenience, Current's standout aspect lies in its bond of these features with an innovative security framework that emphasizes proactive fraud prevention without sacrificing user experience. Its real-time monitoring system is like having a vigilant digital security guard always on patrol, which is a significant leap forward in safeguarding user assets. Furthermore, its transaction experience emphasizes speed and clarity, turning routine payments into seamless, almost conversational interactions.

Compared to traditional finance apps, Current's dual focus on security and user-centric design sets it apart. Its intelligent insights and personalized financial coaching add a layer of value that turns a simple app into a personal finance partner.

Final Recommendation and Usage Suggestions

Overall, Current is a highly recommended application for users who value security and ease of use in their digital banking experience. It's particularly suitable for young professionals, students, and anyone looking to modernize their financial management with a trustworthy and thoughtfully designed app. For those prioritizing secure transactions and personalized insights, Current offers compelling advantages that justify trying it out.

Nevertheless, users with highly specific banking needs or seeking extensive investment tools might find it beneficial to explore complementary apps. But for everyday banking simplicity combined with advanced security, Current stands as a robust and user-friendly choice—worth trying out as your new digital financial companion.

Pros

- Intuitive User Interface

- Comprehensive Financial Tools

- Advanced Security Measures

- Personalized Financial Insights

- Excellent Customer Support Integration

Cons

- Limited International Support (impact: medium)

- Occasional App Speed Delays (impact: low)

- Mobile Check Deposit Cap Limit (impact: low)

- Some Features Not Available on Older Devices (impact: low)

- Learning Curve for New Users (impact: low)

Frequently Asked Questions

How do I quickly set up my account and start using Current?

Download the app, open it, and follow the on-screen instructions to register with your personal details. The setup is quick and straightforward, allowing you to access features within minutes.

Is there a minimum balance required to open an account with Current?

No, Current does not require a minimum balance to open an account. You can start using the app immediately after registration without any initial deposit.

How can I view my real-time transaction notifications?

Enable notifications in Settings > Notifications within the app. You'll receive instant updates for deposits, transactions, and important account activity.

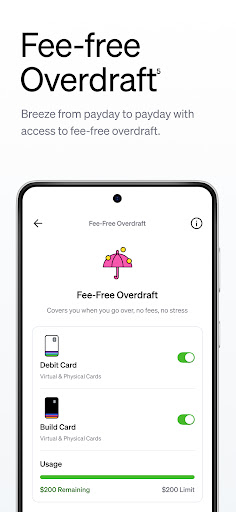

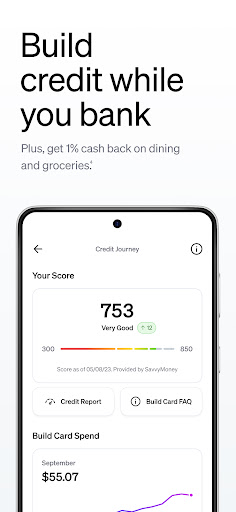

What features help me build my credit using Current?

Use the Build Card feature, which helps improve your credit profile without checks. You can find it in the Accounts or Cards section of the app.

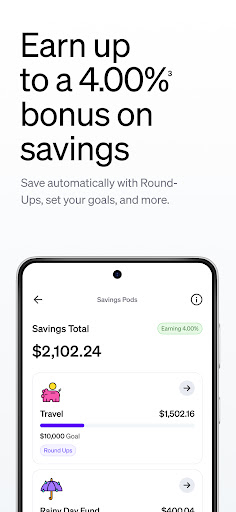

How do Savings Pods work and how can I set one up?

Go to the Savings section and select 'Create Savings Pod.' Set your goal, amount, and savings period to start saving smarter towards your goals.

How do I earn rewards points and redeem them?

Spend at grocery stores and restaurants to earn points automatically. Redeem points in the Rewards section for gift cards or other benefits.

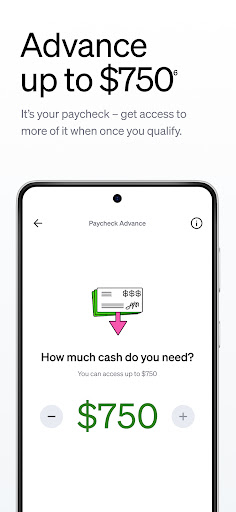

What is the process to qualify for overdraft protection and paycheck advances?

Enable overdraft and paycheck advance features via Settings > Features. Qualify based on account activity and direct deposit setup, with no extra fees required.

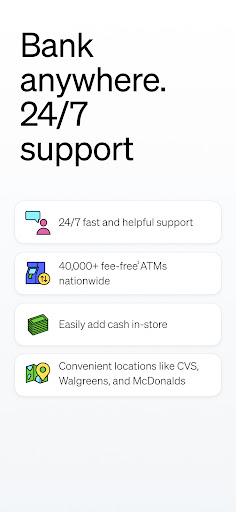

Are there fees for ATM withdrawals with Current?

Enjoy fee-free ATM withdrawals at over 40,000 Allpoint ATMs. Out-of-network ATM fees may apply; check the ATM location for potential charges.

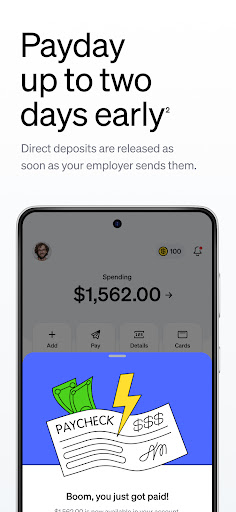

How early can I receive my paycheck with Current's direct deposit feature?

Your direct deposit can arrive up to two days earlier than traditional banks, available automatically when your employer deposits into your account.

How can I get customer support if I encounter issues?

Access 24/7 support through the Help section in the app by messaging customer service for assistance with your account or features.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4