- Developer

- DailyPay Inc

- Version

- 41.0.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.7

DailyPay On-Demand Pay:Empowering Employees with Instant Access to Earnings

Imagine a world where you don't have to wait for your scheduled payday to settle urgent bills or handle unexpected expenses—DailyPay On-Demand Pay makes this possible by offering employees immediate access to their earned wages. Developed by the innovative team at DailyPay Inc., this app integrates seamlessly into the payroll ecosystem, providing financial flexibility with a few taps. Whether you're a busy professional, a gig worker, or someone seeking better payday management, this app aims to redefine how we perceive earning and spending.

Core Features That Make a Difference

Real-Time Wage Access with Transparent Fees

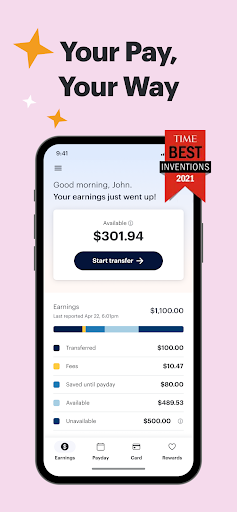

At the heart of DailyPay On-Demand Pay is the ability for users to instantly access a portion of their earned wages before the traditional payday. Unlike overdraft services or high-interest payday loans, DailyPay offers a transparent fee structure, allowing users to decide when and how much to withdraw. This flexibility helps employees manage cash flow without falling into debt traps, turning a payday into a daily, predictable event instead of a stressful monthly surprise.

Seamless Payroll Integration & Auto-Reconciliation

One of the app's standout traits is its smooth integration with employer payroll systems. This automation ensures that every earned dollar is accurately tracked in real-time, providing users with a clear picture of their available balance. For HR departments, it minimizes administrative overhead by auto-reconciling transactions, reducing errors, and enhancing trust in the system. For employees, it feels like having a personal financial assistant that's always on standby.

Enhanced Security & Privacy Protocols

Security isn't just an add-on; it's embedded into the core of DailyPay. Utilizing bank-level encryption and multi-factor authentication, the app offers a high level of security for user data and transactions. Compared to some competitors, which may sometimes compromise on security, DailyPay's approach ensures peace of mind, especially when dealing with sensitive financial information. This focus on safety positions DailyPay as a trustworthy companion in your financial journey.

User Experience: Smooth, Intuitive, and Friendly

Stepping into the app feels like entering a well-organized workspace—clean, straightforward, and inviting. The interface designs employ soft color palettes and logical navigation paths that make finding features instinctive. Whether you're a tech novice or a seasoned user, the learning curve is gentle; onboarding tutorials and contextual tips help new users get comfortable within minutes.

In terms of operation, the app runs smoothly, with responsive buttons and minimal lag. Transactions are processed swiftly—usually within seconds—making the experience nearly real-time. The clarity of transaction histories and notifications ensures users stay informed without feeling overwhelmed. Overall, DailyPay On-Demand Pay strikes a pleasing balance between functionality and simplicity, much like a reliable GPS guiding you effortlessly through your financial landscape.

Standing Out From the Crowd

While many financial apps focus solely on budgeting or savings, DailyPay's key innovation lies in its ability to integrate on-demand wage access with rigorous security measures, thus bridging the gap between convenience and trust. Its standout feature—offering real-time wage access with transparent fees—sets it apart from traditional payday loan providers and basic financial tools. Additionally, the app's high emphasis on security, including encryption and authentication, surpasses many competitors who sometimes overlook this critical aspect.

Compared to other finance apps that either restrict access to funds or lack seamless integration, DailyPay delivers a unified experience that addresses both usability and safety. This convergence makes it particularly appealing for employers wanting to offer added value to employees or individuals seeking smarter cash flow management.

Recommendation and Usage Suggestions

In conclusion, I'd recommend DailyPay On-Demand Pay for anyone looking to add a layer of financial flexibility without the risks associated with high-interest borrowing. It's especially beneficial for those with irregular income streams, gig workers, or anyone seeking to avoid the payday stress. The app's intuitive design and security protocols make it suitable for a broad demographic, from tech-savvy millennials to older professionals.

However, users should be mindful of the associated fees for instant withdrawals—like any service, it's best employed judiciously. For daily use, it offers a safe, trustworthy alternative to unauthorized or expensive short-term loans. If you value control over your earnings and a secure transaction environment, DailyPay On-Demand Pay deserves a serious look—it might just become your new financial sidekick.

Pros

- Immediate access to earned wages

- User-friendly interface

- Reduces financial stress

- Cost transparency

- Integration with payroll systems

Cons

- Limited free withdrawals (impact: medium)

- Potential over-reliance on on-demand pay (impact: low)

- Fees for instant transfers (impact: medium)

- Limited availability in some regions (impact: high)

- Customer service responsiveness (impact: low)

Frequently Asked Questions

How do I get started with DailyPay On-Demand Pay?

Download the app, register with your employer details, and link your bank account. Once set up, your Pay Balance updates as you work.

Can I access my earned wages anytime I want?

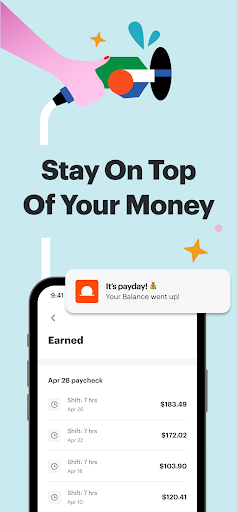

Yes, you can withdraw your Pay Balance anytime through the app, 24/7, including weekends and holidays.

What are the main features of DailyPay?

Key features include flexible money access, real-time balance updates, secure transactions with 256-bit encryption, and the option to transfer funds to various accounts.

How does the app show my current Pay Balance?

Your Pay Balance is displayed on the main dashboard after each work period, with notifications updating you in real time.

How do I transfer my earned wages to my bank account?

Go to 'Transfer Funds' in the app menu, select your bank account, input the amount, and confirm the transfer.

Is there a fee for using DailyPay's on-demand wage access?

Some transactions may incur fees depending on your employer or chosen transfer method. Check the fee details in Settings > Fees and Billing.

Can I subscribe to premium services within DailyPay?

To manage your subscription, go to Settings > Account > Subscriptions to view or upgrade your plan if available.

What should I do if I experience a transaction failure?

Try again later or contact customer support through the Help section in the app for assistance.

Are my personal and financial data safe on DailyPay?

Yes, DailyPay uses 256-bit encryption and complies with PCI and SOC II standards to ensure your data is secure.

Can I set up automatic transfers or alerts for my Pay Balance?

Yes, navigate to Settings > Notifications and Transfers to customize automatic transfers and balance alerts.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4