- Developer

- Dave Operating LLC

- Version

- 3.89.0

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.8

Introducing Dave - Fast Cash & Banking: Your All-in-One Financial Companion

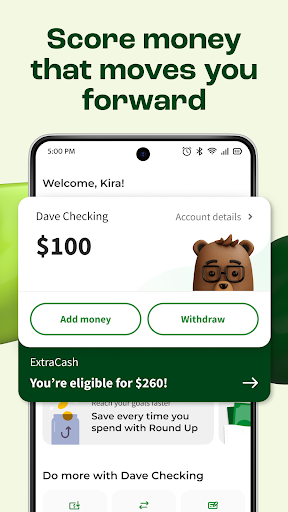

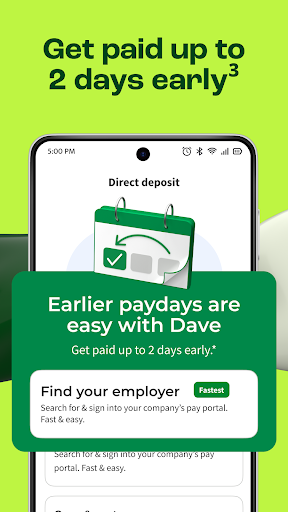

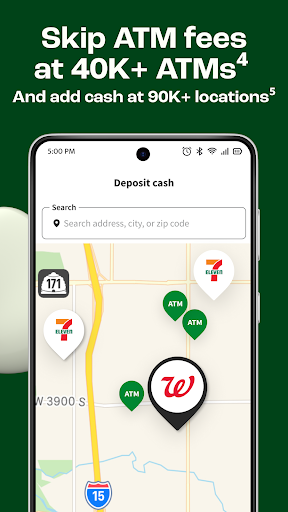

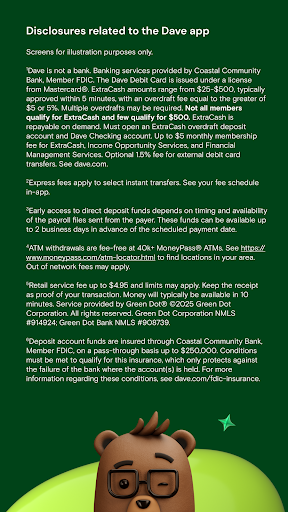

Searching for a seamless way to manage your money and enjoy quick access to cash? Look no further than Dave - Fast Cash & Banking, a sleek financial app designed to empower users with fast loans, budgeting tools, and secure banking features—all wrapped in a user-friendly package. Developed by Dave Inc., this app aims to bridge the gap between traditional banking and modern digital convenience, especially targeting young adults and anyone seeking a straightforward financial management solution.

A Fresh Take on Personal Finance

Imagine opening a wallet that not only helps you keep track of your spending but also offers you instant financial relief when life's unexpected expenses hit. Dave positions itself as a friendly financial partner, blending innovative features with a clean, intuitive interface to make managing money less of a chore and more of a smart, stress-free experience. Its core appeal lies in offering quick cash advances, personalized budgeting, and robust security measures—making financial management accessible to a broader audience.

Fast Cash at Your Fingertips

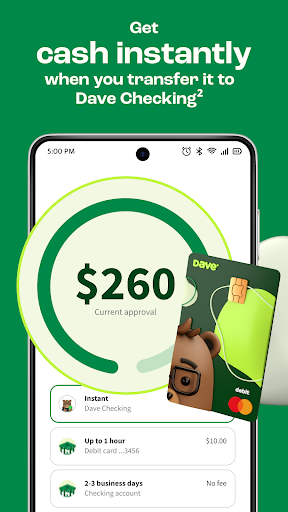

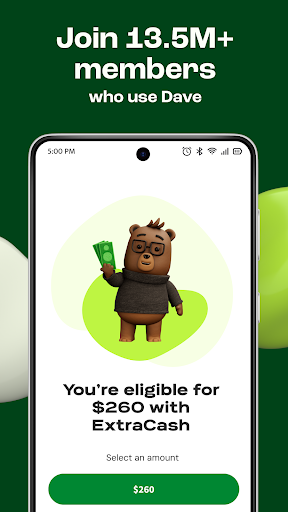

One of Dave's standout features is its ability to provide users with small cash advances to tide over tight periods. Unlike traditional payday lenders, Dave assesses your financial profile to offer you an interest-free or low-interest fund, somewhat akin to a friendly neighbor lending you a helping hand. This feature is particularly handy for sudden expenses like medical bills or car repairs, without the lengthy approval processes of conventional banks.

Smart Budgeting and Spending Insights

Managing personal finances can sometimes feel like juggling flaming torches—scary and complicated. Dave makes it easier with its built-in budgeting tools that engage users with clear visuals and easy-to-understand insights. It helps you set spending limits, track transactions, and provides nudges to save more effectively. Think of it as having a financial coach whispering advice in your ear each day, guiding you toward better money habits without overwhelming you with jargon.

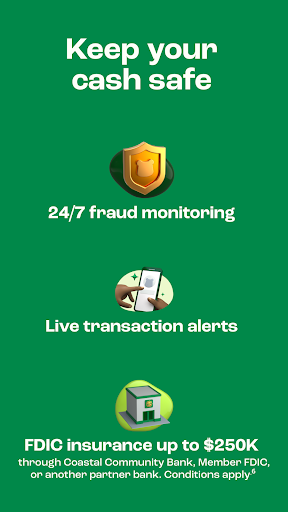

Secure Banking and Transaction Experience

Security is often the elephant in the room with financial apps, and Dave takes it seriously. It employs bank-level encryption, biometric login options, and proactive alerts to ensure your funds and data are protected. The transaction experience is fluid and responsive, mimicking the ease of making payments with familiar touches like instant transfers and real-time notifications. Unlike many competitors, which can sometimes feel clunky or overly complicated, Dave's interface streamlines your banking activities into a simple, enjoyable flow, removing the typical friction associated with managing multiple accounts or transfers.

User Experience: Navigating with Ease and Confidence

From the moment you open the app, Dave's design feels like flipping through a well-organized, stylish magazine—clean, colorful, and inviting. The interface emphasizes readability and ease of navigation, making even first-time users feel at home quickly. The operational flow is smooth; screens transition seamlessly, and actions such as requesting a cash advance or viewing your budget are just a tap away. The learning curve is gentle, with onboarding guidance and tooltips to help new users understand the more advanced features without feeling overwhelmed.

What Sets Dave Apart from Its Peers?

When comparing Dave with other financial apps, several unique facets come into focus. Its most remarkable trait is the emphasis on community-oriented borrowing—offering interest-free advances when you need them—positioning it less as a traditional lender and more as a partner in your financial journey. Furthermore, its security protocols, combined with a focus on transparency about fees and repayment terms, foster trust that many newer fintech apps struggle to build.

Additionally, the transaction experience stands out because it mimics the fluidity of real-world banking—fast, reliable, and straightforward. Unlike some apps that bombard users with options or require multiple steps for basic tasks, Dave keeps things simple, ensuring users remain confident in handling their money without second-guessing operations.

Final Verdict and Recommendations

Overall, Dave - Fast Cash & Banking earns a solid recommendation for those who seek a friendly yet reliable financial app that combines quick access to funds with practical budgeting tools. It's an especially good fit for young adults just starting their financial independence or individuals looking for a hassle-free way to keep their finances organized and accessible. While it isn't a replacement for a full-service bank for heavier banking needs, its focus on ease, security, and community support makes it a standout choice in the modern fintech landscape.

If you're someone who values transparency, convenience, and a sense of partnership in managing your money, Dave is definitely worth exploring. Just remember to use its cash advance feature responsibly, and you'll find it an invaluable companion on your financial journey.

Pros

- User-friendly interface

- Fast transaction processing

- Wide range of banking services

- Strong security measures

- 24/7 customer support options

Cons

- Limited international compatibility (impact: medium)

- Occasional app crashes (impact: low)

- Basic budgeting tools (impact: low)

- Dependence on internet connection (impact: medium)

- Update frequency (impact: low)

Frequently Asked Questions

How do I sign up and start using Dave for the first time?

Download the app, open an account via the sign-up process, link your bank account, and set up your preferences to start managing your finances easily.

Is there a minimum balance requirement to use the app's features?

No, there is no minimum balance requirement. You can freely access cash advances, savings, and banking features without maintaining a specific balance.

How does the cash advance (ExtraCash™) work, and is it safe?

Request an advance up to $500 within the app, approved in 5 minutes or less, interest-free and no credit check. Just ensure your account is linked properly.

How can I set up savings goals and earn high-yield interest?

Navigate to the Goals tab, create a savings goal, set a deposit schedule, and enjoy a 4.00% APY on your balances through the app's savings accounts.

What steps are involved in linking my bank account for transactions?

Go to Settings > Connections > Link Bank, select your bank, and follow the prompts to securely connect your account for seamless transactions.

How can I earn extra income using the app's Side Hustle features?

Access the Side Hustle board from the main menu, browse available gigs or surveys, and link your debit card to receive payouts directly into your Dave account.

What is the monthly fee for using Dave, and what features are included?

The app charges a small monthly fee that grants access to all features like cash advances, savings, bill alerts, and side hustle opportunities. Check the app for current pricing.

How do I subscribe or cancel my membership?

Go to Settings > Membership > Manage Subscription, where you can upgrade or cancel your plan easily within the app.

Are there any hidden fees or charges with Dave?

No, Dave is transparent about its fees. The monthly subscription covers all services, and cash advances are interest-free; always review the fee details in the app.

What should I do if the app isn't working properly or I encounter errors?

Try updating the app, restarting your device, or uninstalling and reinstalling it. For further help, contact customer support through the app's Help section.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4