- Developer

- National General Insurance

- Version

- 1.90.715

- Content Rating

- Everyone

- Installs

- 0.50M

- Price

- Free

- Ratings

- 4.7

Introducing Direct Auto Insurance: A Straightforward Approach to Car Coverage

In today's bustling world, managing insurance shouldn't feel like navigating a labyrinth. Direct Auto Insurance offers a streamlined, user-friendly platform dedicated to simplifying your auto coverage needs. Developed by a team committed to transparency and efficiency, this app aims to deliver quick quotes, personalized policies, and hassle-free claims processing. Whether you're a busy professional, a new driver, or someone seeking clarity in auto insurance, this app's core features are designed to serve a diverse range of users with clarity and confidence.

Seamless Quote Generation and Policy Customization: Your Insurance in a Nutshell

Imagine getting an insurance quote as effortlessly as ordering coffee on a busy morning—fast, simple, and without the clutter. Direct Auto Insurance's standout feature is its quick quote engine. Users input basic details about their vehicle and driving history, and within moments, the app presents multiple coverage options tailored to their profile. This real-time comparison tool helps users make informed decisions without wading through endless paperwork or waiting days for a response.

The customization aspect doesn't stop at initial quotes. Once a user selects a preferred plan, the app allows further adjustments—adding or removing coverages, setting deductibles, and even exploring optional protections. This modular approach acts like building your personalized insurance menu, giving users control and transparency about what they're paying for, helping avoid unwanted surprises later on.

Fast, Secure Claims Process: Making Accidents Less Stressful

Accidents are stressful enough; navigating the claims process shouldn't add to the chaos. Direct Auto Insurance streamlines this ordeal with its intuitive claims module. Users can report an incident directly through the app, upload photos, and track the claim status in real-time. What makes this feature remarkable is its emphasis on clarity and security. Every step is documented, with encryption ensuring sensitive information remains protected, making users feel like their data is under lock and key—much like a safety deposit box for your personal details.

This digital claims journey is akin to having a friendly guide beside you, walking you through each step without unnecessary complication. It reduces turnaround times, offers transparent updates, and minimizes stress—turning what used to be an ordeal into a manageable task.

User Interface and Experience: Friendly Navigation with a Professional Feel

Imagine walking into a well-organized workshop—everything is where you expect it to be, tools are easily accessible, and you don't need a degree to operate the machinery. That's the experience Direct Auto Insurance aims for with its interface. Its clean, modern design employs intuitive navigation and minimal clutter, making both tech-savvy users and less experienced ones feel at home.

The app responds swiftly to user inputs; animations are smooth, and transitions are seamless, creating a fluid experience that encourages exploration. Learning curves are gentle—comprehensive tutorials and clear guidance ensure users understand how to navigate features without frustration. Overall, it strikes an impressive balance between simplicity and functionality, making insurance management feel less like a chore and more like a personal assistant at your fingertips.

Unique Strengths: Security and Transaction Experience that Stand Out

In a crowded marketplace of finance apps, Direct Auto Insurance distinguishes itself with its focus on security and transaction transparency. Its account and fund security protocols are on par with banking standards, featuring multi-factor authentication and end-to-end encryption. This focus ensures that your sensitive information—vehicle details, personal identification, and payment data—is shielded from potential breaches.

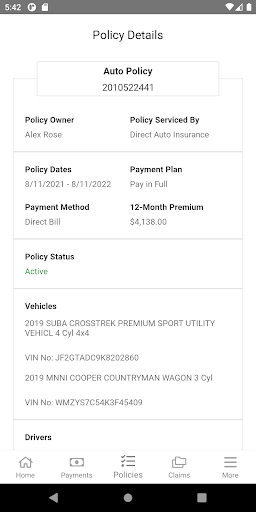

Moreover, the app's transaction experience is built around clarity and reliability. Unlike some competitors where payment processes feel opaque or convoluted, Direct Auto Insurance offers clear breakdowns of premiums, payments schedules, and policy details. Users can easily set up auto-pay, review previous transactions, and receive detailed receipts, fostering trust and confidence. This emphasis on security and transparency not only protects users but also builds a sense of reassurance that their auto insurance management is in safe hands.

Final Verdict: A Practical Choice for modern auto insurance management

All in all, Direct Auto Insurance stands out as a reliable, straightforward platform that prioritizes user control, security, and responsiveness. Its rapid quote engine and transparent claims process are particularly notable, making it suitable for those seeking efficiency without sacrificing clarity. While the app's features may not be packed with bells and whistles, its focus on core needs—secure transactions, easy navigation, and personalized coverage—makes it a smart choice for everyday users.

For anyone who prefers a no-nonsense, professional approach to auto insurance, this app comes recommended. Whether you're switching providers or managing your policies, it offers a balanced mix of usability and security that aligns well with today's digital expectations. Just like a trusted mechanic who gets the job done reliably, Direct Auto Insurance is a practical tool worth having in your digital arsenal.

Pros

- User-Friendly Interface

- Instant Quotes and Policy Management

- Fast Claims Processing

- Personalized Insurance Offers

- 24/7 Customer Support Integration

Cons

- Limited Coverage Details (impact: low)

- Occasional App Crashes (impact: medium)

- Slow Loading Times on Certain Devices (impact: low)

- Incomplete Claim Submission Guidance (impact: medium)

- Limited Payment Options (impact: low)

Frequently Asked Questions

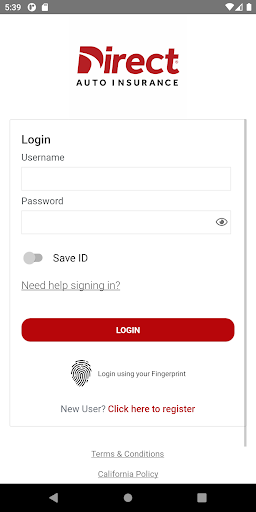

How do I sign up and create an account in the Direct Auto Insurance App?

Download the app, open it, and select 'Sign Up.' Follow the prompts to enter your details and set your preferences under Settings > Account.

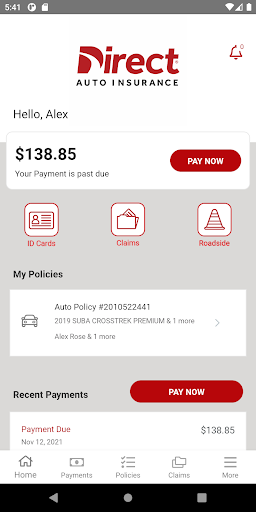

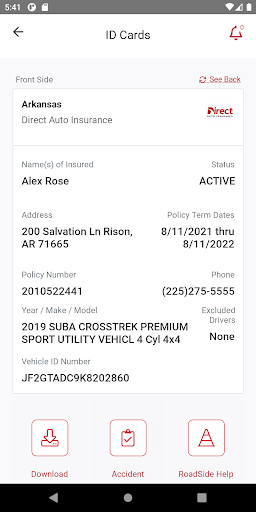

Is it easy to access my insurance ID cards through the app?

Yes, just log in and navigate to 'My Policies' to view or download your ID cards instantly.

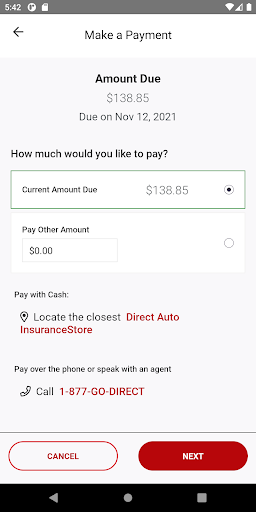

How can I quickly pay my insurance premiums using the app?

Go to 'Payments,' select your policy, choose your payment method, and complete the transaction securely within the app.

Can I get a real-time quote for a new policy within the app?

Yes, tap on 'Get Quote' on the home screen and provide the necessary details to receive an instant insurance estimate.

How do I renew or reinstate my insurance policy on the app?

Navigate to 'My Policies,' select the relevant policy, then choose 'Renew' or 'Reinstate' and follow the prompts to complete the process.

How do I request roadside assistance during an emergency?

Tap 'Roadside Assistance' from the main menu, provide your location, and request help, which will be dispatched promptly.

How can I file a claim through the app?

Select 'File a Claim,' enter incident details, add photos if needed, and submit the claim for processing.

Is there a way to view my policy coverage details and documents?

Yes, go to 'My Policies' and select the specific policy to view coverage info and download official documents.

Are there any subscription fees for using the app's premium features?

Most features are free, but for additional services like policy renewal reminders or priority support, check Settings > Subscriptions for options.

What should I do if the app crashes or encounters errors?

Try restarting your device, update the app via your app store, or reinstall the app if needed. Contact support if issues persist.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4