- Developer

- Dovly.com

- Version

- 7.0.14

- Content Rating

- Everyone

- Installs

- 0.50M

- Price

- Free

- Ratings

- 4.7

Introduction to Dovly: Grow Your Credit Score

In a world where your financial trustworthiness can be a gateway to life's biggest opportunities, Dovly offers an accessible way to understand and improve your credit health. Positioned as a smart credit management tool, this app is designed to guide users through the often complex landscape of credit scores and financial habits, making the journey toward better credit both manageable and even a little empowering.

Developers and Core Features at a Glance

Developed by the innovative team at Dovly, this app stands out in the crowded space of financial tools with its user-centric approach and focus on actionable insights. Its standout features include:

- Personalized Credit Improvement Plans: Tailored recommendations based on your specific credit profile.

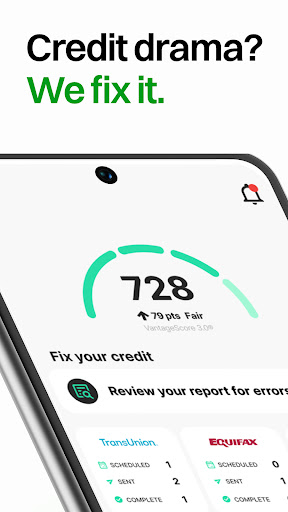

- Real-Time Credit Monitoring: Track your credit score and report changes as they happen, with alerts for significant shifts.

- Automated Dispute Assistance: Help in identifying and disputing inaccuracies on your credit report, simplifying an often daunting process.

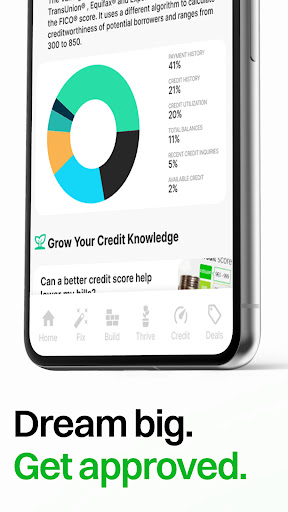

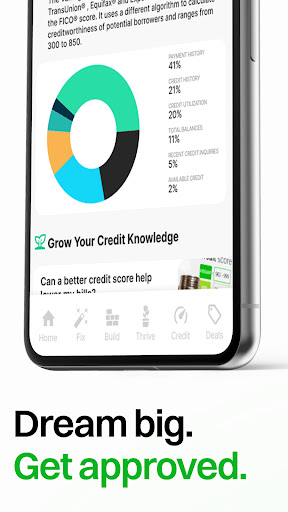

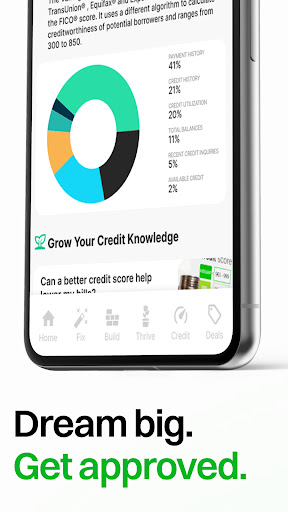

- Educational Resources: Dive into digestible lessons and tips that demystify credit concepts and best practices.

The target audience primarily comprises individuals seeking to understand and enhance their credit standing—whether they're repairing past mistakes, preparing for a major purchase, or simply wanting to maintain optimal financial health.

Exploring the App's Capabilities

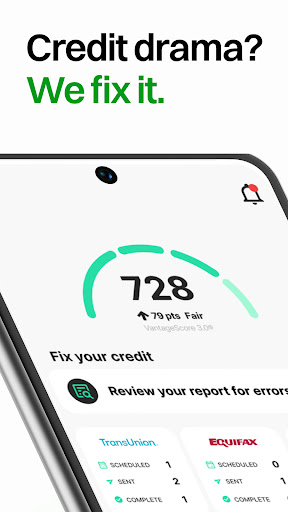

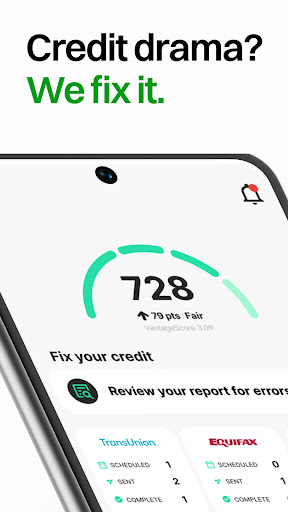

Journey Through the Credit Dashboard: Your Personal Credit Map

Once you open Dovly, you're greeted with a clean, inviting interface that resembles a well-organized dashboard rather than a sea of numbers. The layout intuitively displays your current credit score, recent changes, and personalized suggestions. Navigating through the app feels like flipping through a friendly, helpful guide—each click takes you closer to clarity and control. Smooth animations and responsive design contribute to an effortless experience, even for newcomers to credit management. The learning curve is gentle; within minutes, most users will be comfortable exploring features.

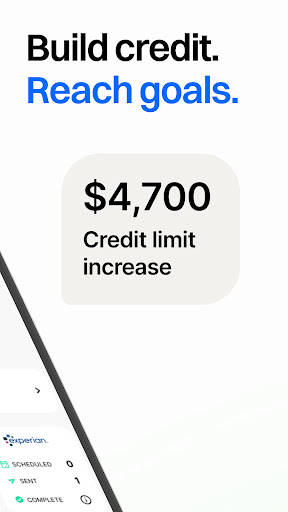

Empowering Your Credit Growth with Personalized Plans

The app's core strength lies in its personalized credit improvement plans. After analyzing your credit report, Dovly crafts a step-by-step roadmap tailored to your financial situation. Whether it suggests paying down certain debts, opening or closing specific accounts, or disputing inaccuracies, this feature acts like a knowledgeable financial coach whispering advice directly into your ear. The recommendations are presented with clear explanations, so users aren't left in the dark about the ‘why' and ‘how,' fostering better understanding and commitment. This targeted approach significantly enhances effectiveness compared to generic advice offered by some other financial apps.

Real-Time Monitoring and Dispute Automation: Your Credit Guardian

Continuous monitoring keeps your finger on the pulse of your credit health, alerting you to changes that might otherwise go unnoticed. Its real-time updates are like a trusty alarm system, offering peace of mind. The dispute assistance is particularly notable—the app provides guided procedures for contesting erroneous entries, even populating dispute letters and offering step-by-step instructions. This automation transforms a traditionally laborious process into a straightforward, less intimidating task. Such features make Dovly more than just a tracking app; it's an active partner in your credit journey.

User Experience and Differentiation

The overall user experience leans heavily into simplicity, clarity, and trustworthiness. Visually, the app employs a friendly, professional aesthetic that invites users to engage without feeling overwhelmed. Functionally, the design ensures swift navigation with minimal loading times, reinforcing reliability.

Compared to other financial applications, Dovly's standout advantage is its focus on account security and transaction transparency. Its proactive alerts and dispute automation not only help you improve your score but also safeguard your credit report from unwarranted damage—much like a vigilant guardian watching over your financial reputation. Unlike some competitors that merely display data, Dovly actively assists in correcting inaccuracies and offers tailored, actionable advice, which enhances user confidence and fosters a sense of control.

Recommendation and Usage Suggestions

Based on its features and user-friendly design, I confidently recommend Dovly to anyone serious about improving their credit score. It's particularly suitable for those who appreciate a guided, educational journey and prefer automation to manual efforts. While it's not a substitute for consulting financial professionals in complex situations, it serves as a reliable, empowering tool for everyday credit management.

If you're at the threshold of a big financial decision—buying a home, refinancing, or just aiming for better financial health—integrating Dovly into your routine can make a tangible difference. Regular monitoring, combined with personalized advice and dispute assistance, turns the often opaque world of credit into a transparent and manageable process. As your financial knowledge grows, you'll find yourself not just maintaining your credit score but actively boosting it with confidence.

Pros

- User-friendly interface

- Effective credit score monitoring

- Personalized credit improvement tips

- Clear and comprehensive reports

- Secure data protection

Cons

- Limited free features (impact: medium)

- Credit scoring models may vary (impact: low)

- Slow customer support response (impact: medium)

- Limited international availability (impact: low)

- Minor bugs in alerts (impact: low)

Frequently Asked Questions

How do I get started with Dovly and create my account?

Download Dovly from your app store, open it, and follow the on-screen prompts to sign up with your email and link your credit report for monitoring.

Is Dovly free to use, and do I need to pay anything?

Yes, Dovly is completely free to use with no credit card required; it offers essential credit monitoring and tools at no cost.

How can I monitor my credit score regularly with Dovly?

Go to the home screen and select 'Credit Monitoring' to view your monthly TransUnion credit score and report updates automatically.

What features help improve my credit score effectively?

Dovly's key features include AI dispute resolution, personalized tips, credit monitoring, and fraud protection—access these via the main menu.

How does the AI dispute tool work in Dovly?

Navigate to 'Dispute' from the menu, select the negative items to challenge, and let the AI generate dispute letters for quick processing.

Can I get personalized credit advice using Dovly?

Yes, go to 'Guidance' in the app to receive tailored tips and recommendations based on your credit profile and financial habits.

Is there a subscription fee for premium features?

Dovly is free; currently, it does not offer paid plans, but check app settings under 'Account > Subscription' for any updates.

How do I set up or change my credit lock and fraud protection?

In the app, go to 'Security' or 'Protection' settings to activate credit lock or enable fraud alerts for your profile.

What should I do if I notice errors in my credit report?

Use the AI dispute feature by selecting the errors via 'Dispute' in the app, and follow instructions to challenge and resolve inaccuracies.

What should I do if the app isn't working properly?

Try restarting the app, ensure your device has internet access, and check for updates in your app store; contact support if problems persist.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4