- Developer

- Activehours Inc.

- Version

- 16.29

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.7

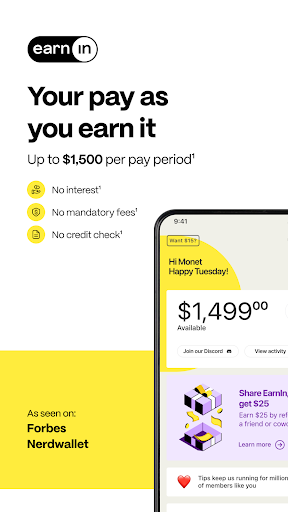

EarnIn: Why Wait for Payday? An In-Depth Review of the Innovative Payday Advance App

If you're weary of waiting two long weeks for your paycheck and want a smarter way to manage your cash flow, EarnIn offers a fresh approach that promises financial flexibility without the hefty interest rates. As a professional tech reviewer, I've taken a deep dive into this app's features, design, and user experience to see if it truly stands out in the crowded space of fringe financial services—and if it's worth integrating into your financial toolkit.

Fundamental Information: What is EarnIn?

Designed to bridge the gap between paychecks, EarnIn is a mobile application that allows users to access earned wages before their scheduled payday without traditional interest-based fees. Unlike payday loans or traditional payday advance services, EarnIn operates on a model that emphasizes transparency and user empowerment.

Developed by a dedicated team at EarnIn, a company committed to reshaping how people access their income, the app aims to provide flexibility while maintaining security and simplicity.

Its core standout features include:

- Automatically tracking work hours through seamless integration with your payroll and time-tracking systems.

- Providing users with access to a portion of their earned wages up to a predefined limit, typically $100 per day or $500 per pay period.

- Offering real-time notifications on wage balance and upcoming deductions, helping users plan their finances effectively.

- Ensuring transparency around fees—most usage is free, with optional tips or contributions—setting it apart from traditional high-interest payday lenders.

The target audience primarily includes hourly workers, gig economy participants, and anyone who needs flexible cash access prior to their scheduled payday.

Immersive Experience: How Does EarnIn Feel to Use?

Imagine standing at a bustling coffee shop, anxious about whether your paycheck will clear in time for an urgent bill—or perhaps just trying to avoid the dreaded overdraft fees. EarnIn comes across as your reliable financial buddy, quietly working behind the scenes, helping you bridge that temporary cash gap without the stress of hidden charges. The app's interface and features aim to make this process as smooth and reassuring as chatting with a knowledgeable friend.

User Interface and Design: Clean, Friendly, and Intuitive

From the moment you open EarnIn, the app greets you with a clean, minimalist design that feels approachable—even for first-time users. The dashboard prominently displays your current wage balance, upcoming scheduled access, and recent transaction history. Spotting key information is effortless thanks to well-organized menus and straightforward language. The colors and fonts are easy on the eyes—imagine a well-tailored suit that fits perfectly without trying too hard—just enough sophistication to inspire confidence.

Operational Flow and Learning Curve

One of EarnIn's stellar qualities is its user experience—getting started is quick, with a straightforward sign-up process that links to your bank account and payroll system (with clear instructions). Once connected, earning access is as simple as a few taps: check your wage amount, select how much you want to draw, and confirm. The entire operation feels like having a financial safety net that unfurls effortlessly if needed. Moreover, intuitive notifications keep you informed at every step, alleviating any worries about hidden fees or complicated procedures, which can often turn users away from financial apps.

Security and Differentiation: How EarnIn Stands Out

Compared to many similar financial apps, EarnIn places a strong emphasis on account security and transparent transaction experiences. It employs bank-level encryption and secure authentication protocols, ensuring your financial data remains protected—think of it as a vault with multiple locks rather than a loose purse on a busy street. Unlike high-interest payday lenders, EarnIn's model is built around shared tips and voluntary contributions, making its services accessible and fair. The app's seamless integration with payroll systems means transactions are quick, automatic, and often settle within one business day—like having an on-demand paycheck, but without borrowing from a lender's pocket.

Final Verdict: Is EarnIn Worth a Try?

Based on its user-centric design, transparent fee structure, and focus on security, EarnIn stands out as a trustworthy alternative to predatory payday lending and traditional overdraft services. Its most distinctive feature—free, on-demand wage access—resembles an safety valve for those juggling unpredictable expenses or simply wanting to better manage cash flow.

For individuals who prefer financial tools that empower rather than exploit, I would recommend giving EarnIn a solid trial. The app functions smoothly, feels secure, and respects your privacy and control. However, users should remember it is best suited for occasional use rather than a substitute for comprehensive financial planning.

In essence, EarnIn is a helpful, user-friendly companion that aligns well with modern, digital-first lifestyles. If cash flow flexibility is what you need without the burdensome fees often associated with short-term borrowing, EarnIn deserves a spot in your financial app arsenal.

Pros

- Early access to earned wages

- No interest or fees for basic usage

- Simple and user-friendly interface

- Supports financial flexibility

- Integration with existing bank accounts

Cons

- Limited withdrawal amount (impact: medium)

- Availability depends on employer integration (impact: high)

- Potential over-reliance on early wage access (impact: medium)

- Limited financial education resources (impact: low)

- Possible delay in fund transfer during technical issues (impact: low)

Frequently Asked Questions

How do I get started with EarnIn?

Download the app from your store, sign up with your phone number, link your bank account, and verify your employment to enable features.

Is there a fee to use EarnIn?

EarnIn is free to use; you can cash out your earnings and access other features without hidden fees. Tips are optional and at your discretion.

How do I access my earnings early?

Open the app, navigate to 'Cash Out,' enter the amount you'd like to access, and confirm the transfer. Funds typically arrive within minutes for a small fee.

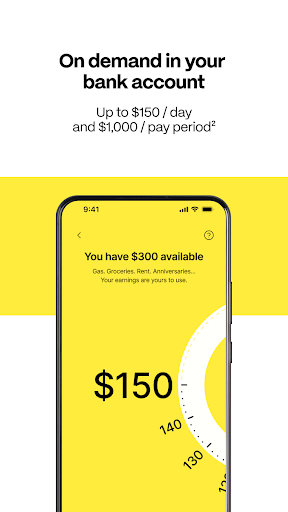

What's the daily and pay period limit for cash outs?

You can cash out up to $150 per day and $750 per pay period through the 'Cash Out' feature, set after your account setup.

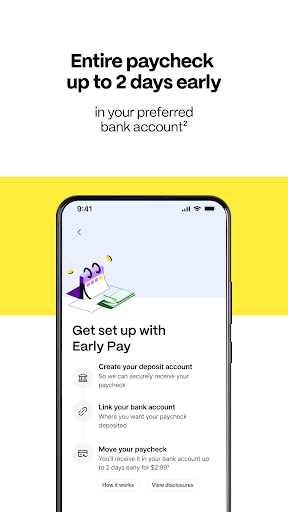

How does the 'Early Pay' feature work?

Select the 'Early Pay' option, pay a $2.99 fee, and earn your paycheck up to two days early, with the transfer typically completed quickly.

How can I prevent overdraft fees using EarnIn?

Enable 'Balance Shield' in settings, set automatic transfers from your paycheck, and receive alerts to avoid overdrafts—find this in 'Settings > Balance Shield.'

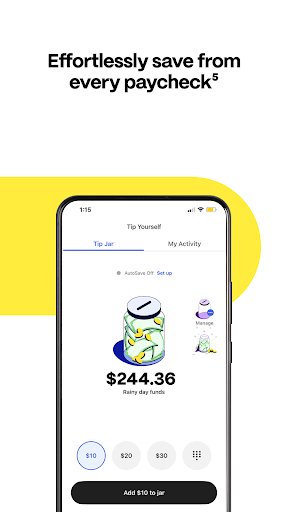

Can I set up savings goals within the app?

Yes, use 'Tip Yourself' to automatically transfer small amounts into savings, helping you build emergency funds or save for future expenses in the 'Savings' section.

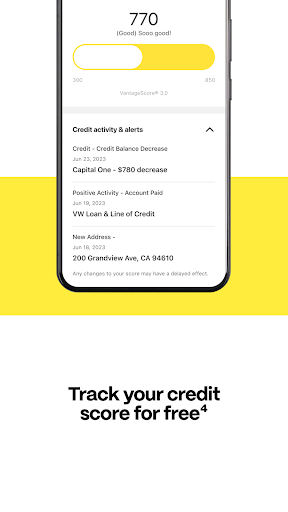

Does EarnIn help monitor my credit?

Yes, access free credit score monitoring with VantageScore 3.0® from Experian in the 'Credit Monitoring' section to stay informed about your credit.

Are there any subscription plans or premium features?

EarnIn does not require a subscription; most features are free, with optional tips. The app's core services are available at no cost.

What should I do if I experience issues with my cash outs?

Contact EarnIn's customer support via in-app chat under 'Help' or 'Support' for assistance and troubleshooting.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4