- Developer

- Tilt Finance

- Version

- 7.26.0.796

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.7

Empower: Advance & Credit — A Fresh Approach to Financial Management

Empower: Advance & Credit is a comprehensive financial app designed to help users better understand and manage their credit and advance needs through innovative tools and a user-friendly interface. Developed by Empower Financial Technologies, this app aims to streamline credit monitoring, empower users with educational resources, and facilitate smoother transaction experiences—all within a single platform.

Core Features Sparkling Bright

At its heart, Empower combines core functionalities that set it apart in the bustling world of finance apps:

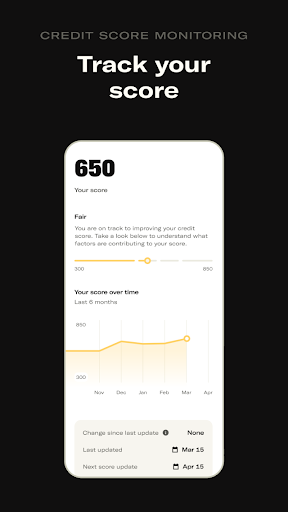

- Smart Credit Monitoring and Insights: Provides real-time credit score updates and personalized tips to improve financial health.

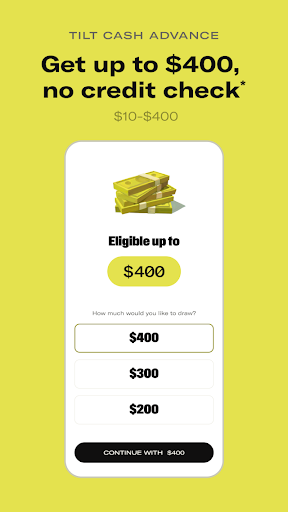

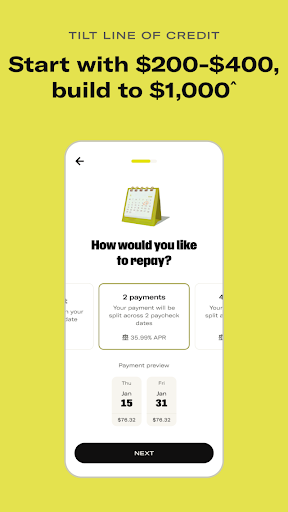

- Advance Management and Application Handling: Enables users to request and manage advances seamlessly, with transparent processing and clear repayment plans.

- Enhanced Security and Transaction Experience: Implements advanced security measures, including biometric authentication and encrypted transactions, ensuring peace of mind during every financial move.

- Educational Resources & Guidance: Offers a wealth of learning materials about credit management, helping users make informed decisions.

Journey Through the App: An Engaging Experience

Imagine opening a financial app that feels like chatting with a trusted friend—easy, reassuring, and insightful. Empower's interface is clean and inviting, with a palette that's both professional and welcoming. The onboarding process is smooth; first-time users are gently guided through key features without feeling overwhelmed. Navigating through different modules is intuitive, thanks to a well-thought-out menu structure and straightforward icons. The app's responsiveness is notable, with smooth transitions and quick load times that keep the user engaged without frustration. Learning curves are gentle; even those new to credit tools find it simple to get started, thanks to contextual tips and helpful prompts integrated throughout the app.

Uniqueness in a Crowded Market

While many financial apps focus solely on basic credit scores or transaction tracking, Empower elevates the experience through its dual focus on security and user empowerment. Its standout feature is the detailed credit insights combined with proactive suggestions, giving users actionable steps to improve their credit score—much like having a personal financial coach in your pocket. Moreover, its advance management system isn't just about requesting funds; it also provides clarity on repayment schedules, interest rates, and repayment history, promoting transparency and trust.

Another differentiator lies in its transaction experience. Powered by cutting-edge encryption and biometric verification, Empower ensures that every payment or advancement is secure and effortless—think of it as having a sturdy digital vault that opens with a simple fingerprint. This attention to security not only reassures users but sets it apart from competitors that may overlook the importance of seamless, safe transactions.

Recommendations and Best Use Cases

Considering its features and user experience, Empower: Advance & Credit earns a solid recommendation rating. It's particularly suited for young professionals, students, and anyone building their credit profile who want a trustworthy, all-in-one app to handle their financial activities. If you value transparency, security, and educational support, this app could become your trusty sidekick in navigating the Credit journey.

To maximize its benefits, newcomers should take advantage of the educational resources to understand credit dynamics better. Regularly monitoring credit scores and using the advance functionalities responsibly can help improve financial stability over time. For those moving from basic banking apps to more sophisticated financial management, Empower offers an inviting, secure, and truly empowering experience that is worth exploring.

Pros

- User-friendly interface

- Comprehensive credit management tools

- Real-time credit updates

- Secure data encryption

- Educational resources

Cons

- Limited international availability (impact: medium)

- Occasional sync delays (impact: medium)

- Basic customer support (impact: low)

- Limited free features (impact: low)

- Occasional app crashes on older devices (impact: low)

Frequently Asked Questions

How do I get started with Empower: Advance & Credit?

Download the app from your app store, sign up with your personal details, and follow the onboarding prompts to set up your account and explore features.

Is there a minimum credit score requirement to use Empower's services?

No, Empower's credit tools have no minimum credit score requirement, making them accessible to all users. Simply sign up and start building or monitoring your credit.

How can I request a cash advance with Empower?

Open the app, navigate to the 'Cash Advances' section, enter the amount ($10–$400), and choose instant delivery if needed. Confirm your request to receive funds.

What steps do I take to build my credit using Empower?

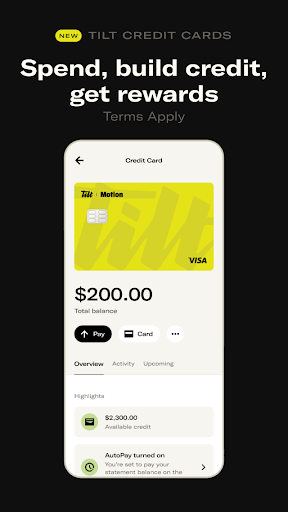

Apply for Empower's credit card or line of credit, make on-time payments, and monitor your credit score regularly via the app to see your progress.

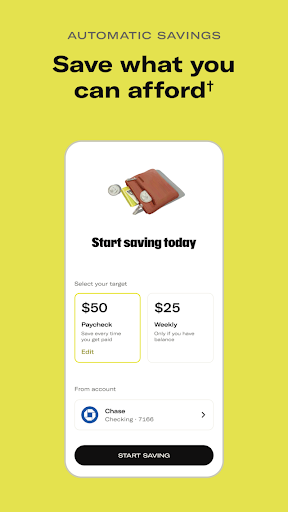

How does the automatic savings feature work?

Go to Settings > Savings, set your goals and schedule, then enable 'Automatic Savings'. The app will transfer funds from your bank account based on your preferences.

Can I check my credit score for free within Empower?

Yes, you can view your credit score anytime in the app under the 'Credit Monitoring' tab without any additional cost.

Are there any fees for using the cash advance feature?

Fees may apply for instant delivery of cash advances, but there are no interest or late fees. Review the terms during your request for detailed info.

How do I upgrade or manage my subscription plan?

Go to Settings > Account > Subscription to view or change your plan, update payment methods, or cancel if needed.

What should I do if I experience technical issues with the app?

Try restarting the app or your device. If problems persist, contact Empower support via the in-app chat or email for assistance.

Is my personal data safe when using Empower?

Yes, Empower uses bank-level encryption to protect your data, and your login details are never stored or shared without your consent.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4