- Developer

- Empower Personal Wealth, LLC

- Version

- 13.9.3

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 3.8

Empower Personal Dashboard™: Your Holistic Financial Companion

Empower Personal Dashboard™ is a comprehensive financial management app designed to centralize users' financial data, offering real-time insights and enhanced security for personal finance enthusiasts and professionals alike.

Developed by a Forward-Thinking FinTech Team

Crafted by the innovative team at EmpowerTech Solutions, this app embodies a blend of cutting-edge technology and user-centric design to streamline personal financial management.

Highlights of Empower Personal Dashboard™

- Unified Financial Account Panorama: Aggregate bank accounts, investment portfolios, and digital wallets into one seamless view.

- Enhanced Security Layers: Incorporates multi-factor authentication and real-time transaction alerts to safeguard user data and assets.

- Intelligent Insights & Recommendations: Uses AI-driven analytics to offer personalized budget tips, expense tracking, and savings goals.

- Secure Transaction Experience: Facilitates quick, encrypted transactions with detailed histories, ensuring both convenience and safety.

Bright and Intuitive Interface; Smooth as a Well-Choreographed Dance

Once you open Empower Personal Dashboard™, you're greeted with a clean, modern interface that feels as intuitive as a friendly chat. The dashboard's layout is thoughtfully organized—colors are calming yet informative, resembling a well-lit control room rather than a cluttered cockpit. Navigating between accounts, insights, and transactions is as seamless as flipping through pages of a well-loved book. The app responds swiftly to user inputs, providing real-time updates that keep your financial overview constantly fresh. The learning curve is gentle; even beginners can find their way around in minutes, making it a friendly companion for those new to digital finance management.

Core Functionality Deep Dive

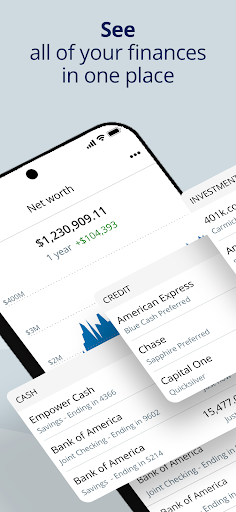

1. Unified Account Management: Like a Digital Wallet Organizer

The app's core strength lies in its ability to consolidate various financial accounts—bank savings, checking, 투자 accounts, and e-wallets—into a single unified dashboard. Imagine having a virtual wallet where all your cash flows and investments are displayed side by side; it makes grasping your entire financial picture straightforward and visually appealing. Users can customize which accounts to display, set priorities, and even analyze spending patterns across different categories, all within a few taps. This holistic view is especially beneficial for those juggling multiple income streams or investment portfolios, providing clarity and better control.

2. Ironclad Security & Trustworthy Transactions

Security is often the Achilles' heel of financial apps, but Empower surpasses expectations in this arena. Its multi-layered security, including biometric authentication and end-to-end encryption, offers peace of mind as you navigate your financial world. The app's transaction feature isn't just about sending money; it ensures every transfer is protected and verifiable, akin to having a trusted accountant double-check every move. Additionally, real-time alerts notify you of any suspicious activity, helping you respond swiftly. Compared to similar apps, Empower's emphasis on transaction security and account integrity makes it stand out—it transforms your financial app from a mere tool to an impregnable vault.

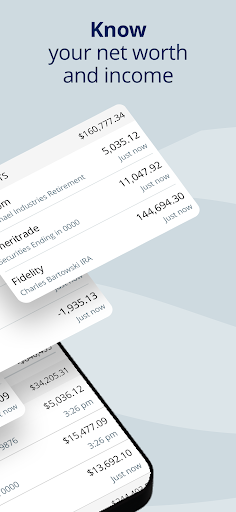

3. Smart Financial Insights & Actionable Recommendations

One of the most compelling features is its AI-driven analysis engine. Imagine having a seasoned financial advisor sitting beside you, offering tailored advice based on your spending habits, income, and savings goals. The dashboard crunches data and highlights opportunities for budget optimization, reveals potential cost savings, and suggests personalized investment ideas. This feature doesn't just show static data; it actively guides you towards smarter financial decisions, making managing money less of a chore and more of an empowering experience. It's like having a financial coach available 24/7—discreet, insightful, and practical.

Comparative Edge: Why Empower Personal Dashboard™ Stands Out

While many finance apps focus solely on expense tracking or investment monitoring, Empower combines these functions with a special emphasis on security and transaction experience. Its multi-factor authentication and real-time alerts are comparable to the security measures used by high-end banking institutions, instilling confidence that your assets are protected. Furthermore, its seamless, encrypted transaction system makes sending money or settling bills as smooth as a wave, without sacrificing safety. Unlike some competitors that rely heavily on manual data input, Empower automates many processes, reducing errors and saving time. Ultimately, this app isn't just about numbers—it's about creating a trustworthy, efficient financial ecosystem tailored to the user's needs.

Recommendations and Final Thoughts

If you're seeking a personal finance tool that melds visual clarity, security, and intelligent insights into a single package, Empower Personal Dashboard™ is worth exploring. Its particularly standout features—comprehensive account consolidation and robust transaction security—are especially suited for busy professionals, digital explorers, or anyone serious about safeguarding and understanding their finances.

For those new to digital finance management, the intuitive interface lowers the barrier to entry. Advanced users will appreciate the detailed analytics and security features that provide both trust and control. Overall, I'd recommend this app as a reliable, all-in-one solution that fosters confidence in your financial journey without overwhelming you.

In conclusion, Empower Personal Dashboard™ is like having a vigilant, intelligent financial partner in your pocket—helping you stay organized, protected, and informed every step of the way.

Pros

- User-Friendly Interface

- Customizable Dashboard

- Real-Time Data Tracking

- Comprehensive Data Analytics

- Strong Privacy Features

Cons

- Occasional Syncing Delays (impact: medium)

- Limited Free Features (impact: medium)

- Battery Usage (impact: low)

- Learning Curve for Advanced Features (impact: low)

- Limited Integration with Other Apps (impact: medium)

Frequently Asked Questions

How do I get started with the Empower Personal Dashboard™?

Download the app from your store, create an account, and connect your financial accounts through the onboarding process within the app's 'Add Accounts' section.

Is my financial data secure on this app?

Yes, the app uses bank-level encryption and biometric login options to ensure your data remains private and protected at all times.

How can I see all my accounts in one place?

Navigate to the 'Accounts' tab and connect your bank, investment, and retirement accounts. The app will automatically consolidate them for you.

What features are available for retirement planning?

Use the built-in 'Retirement Planner' and 'Retirement Calculator' found under the 'Planning' menu to assess and adjust your retirement goals.

How can I track my investment portfolio?

Connect your investment accounts in 'Accounts,' then visit the 'Investments' tab to monitor holdings, compare allocations, and rebalance if needed.

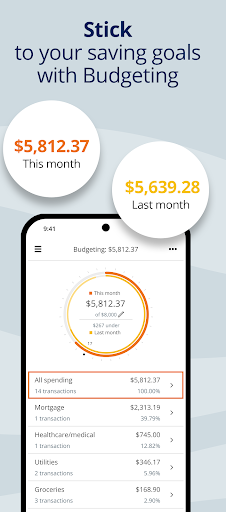

Can I customize my budgets and expenses?

Yes, go to the 'Budget' section, set your spending categories, and the app will automatically track and categorize your transactions for better planning.

Are there any subscription fees for using the app?

The Empower Personal Dashboard™ is free to download and use, but premium features or services may require a subscription, which can be managed in 'Settings > Subscription.'

How do I upgrade to a paid plan?

Open the app, go to 'Settings,' then tap on 'Subscription' to view options and select the plan you'd like to upgrade to, following the prompts.

What should I do if I experience login issues?

Try resetting your password via the 'Forgot Password' link on the login page or contact customer support through the 'Help' section for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4