- Developer

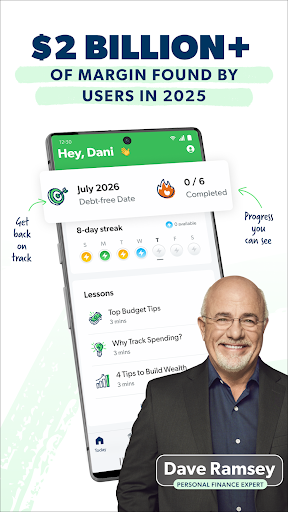

- Ramsey Solutions

- Version

- 2026.2.20

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.3

Introducing EveryDollar: Your Friendly Budgeting Companion

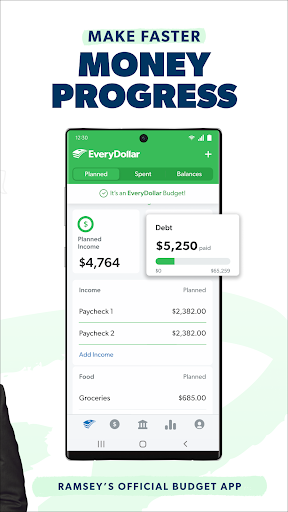

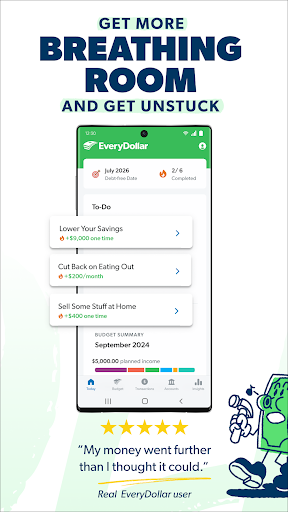

EveryDollar is a user-centric budgeting app designed to simplify personal finance management through intuitive planning and tracking tools. Developed by Ramsey Solutions, it aims to empower users to take control of their finances with ease and clarity. Its key features include zero-based budgeting, customizable expense categories, and seamless bank account synchronization. The target audience encompasses individuals seeking straightforward financial organization, from budgeting novices to those looking to refine their money management skills.

An Engaging Experience in a Crowded Financial World

Picture this: you're sitting at a cozy café, pen in hand, ready to draft your monthly budget—EveryDollar brings this feeling of simplicity and control to your digital device. Whether you're aiming to save for a dream vacation or just trying to keep your bills from piling up unnoticed, this app makes the journey feel less like a chore and more like a personal strategy session. Its clean interface and engaging design make financial planning approachable rather than intimidating.

Core Functionality: Zero-Based Budgeting Made Simple

One of EveryDollar's standout features is its implementation of zero-based budgeting. This method pushes you to assign every dollar a specific purpose—be it expenses, savings, or debt repayment—so that your income and expenses perfectly balance out to zero. Think of it as an artist carefully allocating colors to each section of a canvas; this deliberate approach ensures no money is left unaccounted for, improving accuracy and financial mindfulness. The app provides guided prompts to help users plan each month's budget, fostering discipline without overwhelming complexity.

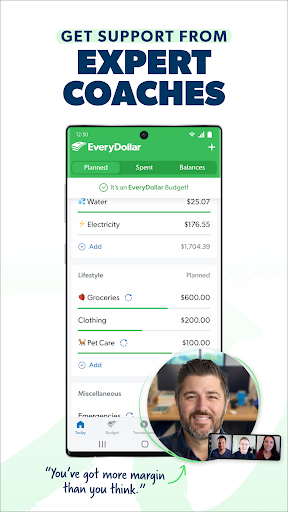

Customization and Cash Flow Tracking: Tailored and Transparent

EveryDollar excels in allowing users to create personalized expense categories that mirror their real-life spending habits. Whether it's a line-item for your weekly coffee runs or a monthly allocation for car maintenance, customization turns a generic tool into a personal financial dashboard. Paired with real-time transaction tracking—either manual entry or bank sync—this feature offers a transparent view of cash flow, helping users spot spending patterns and adjust accordingly. The app's design ensures these tasks are straightforward, reducing the learning curve and encouraging consistent updates.

Bank Sync and Security: Your Data's Safe Sanctuary

One of the most critical concerns when using financial apps is data security. EveryDollar addresses this head-on with bank account synchronization capabilities that utilize bank-grade encryption standards. Unlike some competitors that rely solely on manual entries or third-party integrations, EveryDollar's secure connection ensures your sensitive information remains confidential. It acts like a trustworthy vault, giving you confidence that your financial data is protected while providing the convenience of automatic transaction updates. This focus on security makes it stand out among budgeting tools, often a key worry for users considering digital financial management.

Experience and Usability: Smooth Sailing for All Users

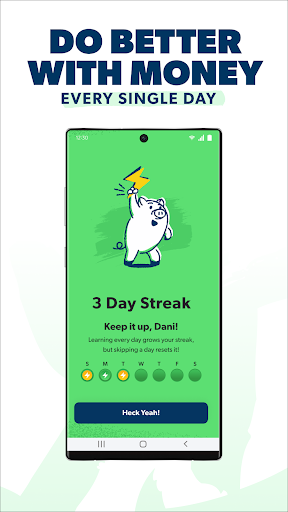

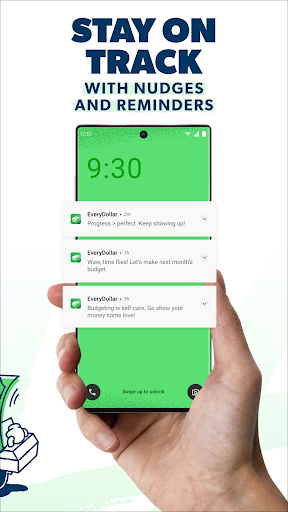

From the moment you open EveryDollar, it feels like slipping into a well-tailored suit—comfortable, intuitive, and designed to fit your needs. The user interface is uncluttered, with vibrant icons and clear prompts guiding you through setup and daily management. The app runs smoothly across devices, responding swiftly to taps and inputs, which means less frustration and more motivation to stay on top of your finances. Its learning curve is gentle, making it accessible to newbies, yet robust enough for those who want to dive deeper into financial planning. For example, users transitioning from basic spreadsheets will find it a natural step up, thanks to its guided workflows and visual progress indicators.

The Unique Edge: Security and Transaction Experience

Compared to other finance apps, EveryDollar's most distinctive strengths lie in its commitment to transaction security and seamless bank connectivity. While many apps require cumbersome third-party integrations or expose users to potential security lapses, EveryDollar ensures your data remains encrypted and protected at all times. Its streamlined bank sync not only updates transactions swiftly but also reduces manual entry errors, turning what could be a tedious chore into a quick sync session—almost like having a knowledgeable assistant handling your latest expenses.

Final Thoughts: Is EveryDollar Worth Your Trust?

All in all, EveryDollar offers a compelling combination of simplicity, customization, and security—making it a solid choice for those wanting an approachable yet effective budgeting tool. Its standout zero-based budgeting feature helps users grasp their financial reality and develop disciplined spending habits, while its focus on data security reassures users concerned about privacy. While some advanced features may require upgrading to a paid plan, its core functionalities provide enough value to justify the investment. If you're someone seeking a friendly nudge towards better money management without the hassle, EveryDollar is definitely worth a try—think of it as your personal financial GPS, guiding you toward your goals with clarity and confidence.

Pros

- Intuitive User Interface

- Robust Expense Tracking

- Goal Setting and Tracking

- Secure Data Encryption

- Syncs Across Devices

Cons

- Limited Free Features (impact: medium)

- No Investment Tracking (impact: low)

- Less Customization Options (impact: low)

- Offline Mode Not Fully Supported (impact: medium)

- Learning Curve for Advanced Features (impact: low)

Frequently Asked Questions

How do I start using EveryDollar for the first time?

Download the app, create an account, and follow the setup guide to input your income and expenses to start your budget.

Can I customize my budget categories?

Yes, go to Settings > Budget Categories to add, delete, or modify categories to suit your financial needs.

How does EveryDollar help me track my expenses?

Use the Expense Tracker feature to input or link transactions, categorize spending, and monitor your expenses in real-time.

What features are available for goal setting and tracking?

Navigate to Goals > Create New Goal to set savings targets, track progress, and visualize your path to financial milestones.

How do I connect my bank accounts to automate transactions?

Go to Settings > Accounts > Link Bank Account to securely connect your accounts and sync transactions automatically.

Are there any educational tips for beginners?

Yes, the app provides financial tips and a virtual coach accessible via the Help section or Settings > Financial Tips.

What is the difference between the free and paid versions?

The free version offers core budgeting tools; upgrading to Plus unlocks bank account linking, detailed reports, and additional features. Set this in Settings > Subscription.

How do I upgrade my subscription to access premium features?

Go to Settings > Subscription and follow the prompts to choose a plan and enter your payment details.

Can I cancel my subscription if I no longer need it?

Yes, go to Settings > Subscription > Cancel to cancel your plan at any time; cancel before billing date to avoid charges.

What should I do if the app is not syncing with my bank accounts?

Try disconnecting and reconnecting your bank accounts via Settings > Accounts > Link Bank Account, or contact support if issue persists.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4