- Developer

- Experian

- Version

- 4.2.6

- Content Rating

- Everyone

- Installs

- 0.01B

- Price

- Free

- Ratings

- 4.8

Discovering Financial Insights with Experian: An In-Depth Look

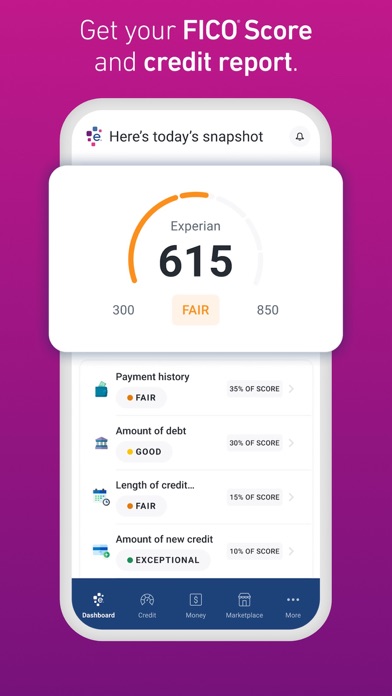

In today's digital age, managing and understanding one's financial health is more accessible than ever—thanks to innovative apps like Experian. Designed to empower users with comprehensive credit and financial information, Experian aims to demystify complex financial data into actionable insights. Developed by the global credit bureau Experian, this app integrates various features that cater to individuals seeking to improve their credit standing and safeguard their financial future. Its highlight features include real-time credit monitoring, tailored credit score improvements, and robust identity theft protection. Whether you're a young professional beginning your credit journey or a seasoned spender aiming to optimize your financial profile, Experian promises a user-friendly and insightful experience.

An Engaging Dive into Your Financial World

Imagine sitting comfortably on a cozy weekend morning, sipping your coffee, and effortlessly getting a panoramic view of your financial landscape—this is precisely what Experian strives to deliver. Its interface, bright yet professional, welcomes users with an intuitive dashboard that feels like a friendly financial assistant. The app turns the often-daunting task of monitoring credit into an engaging and manageable activity, much like tending a garden — nurturing your credit health with just a few taps. The user experience feels fluid, with smooth transitions and quick load times, making navigation through features a breeze, whether you're checking your credit score or scrutinizing a recent alert.

Core Features That Set Experian Apart

Real-Time Credit Monitoring and Alerts

One of Experian's most compelling offerings is its real-time credit monitoring service. Think of it as having a vigilant guardian watching over your credit profile 24/7. The app provides instant alerts for any significant changes—be it a new account, a credit inquiry, or suspicious activity—allowing you to respond promptly. This proactive approach is vital in today's fast-paced financial environment, where identity theft and fraud are risks lurking in every corner. Unlike other apps that offer periodic updates, Experian's real-time notifications ensure you're always in the know, helping you maintain control and peace of mind.

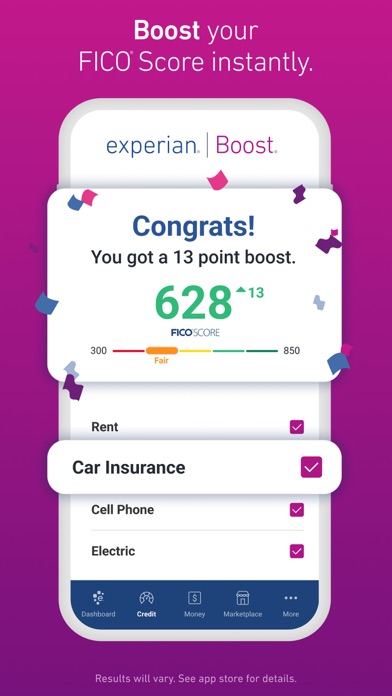

Personalized Credit Improvement Insights

Ever wondered how to boost your credit score effectively? Experian's tailored recommendations are like having a personal credit coach by your side. The app analyzes your current credit profile and provides actionable suggestions—for example, paying down specific debts or correcting inaccuracies—that can lead to measurable improvements. This feature demystifies credit optimization, making it accessible even for those new to managing finances. Its advice feels practical and achievable, turning abstract numbers into a clear pathway to better financial health.

Robust Identity Theft Protection

In an era where your digital footprint is vast, Experian offers a fortress of security. Beyond just monitoring your credit, it provides identity theft protection tools, including dark web scans and comprehensive fraud alerts. The standout feature is its dedicated recovery assistance, guiding users step-by-step if their identity is compromised. This level of support is akin to having a trusted bodyguard watching over your digital identity, ensuring you can respond swiftly to threats and regain control if needed. This focus on security distinguishes Experian from many competitors, emphasizing not just monitoring but active protection.

Evaluating User Experience and Differentiators

From a usability standpoint, Experian impresses with its clean, organized interface that removes the clutter often associated with financial apps. Navigation feels natural; buttons are intuitively placed, and the app offers quick access to crucial features without overwhelming the user. The learning curve is gentle—newcomers can quickly familiarize themselves, while seasoned users will appreciate the depth of insights available.

In comparison to other finance apps, Experian's standout advantage is its focus on **Account and Fund Security** combined with **Transaction Experience**. Its real-time alerts and identity protection tools go beyond mere credit reporting, framing the app as a comprehensive financial security suite. Additionally, its personalized advice engine tailors insights based on your unique profile—something many competitors lack. This individual-centered approach makes Experian not just a monitoring tool but a partner in your financial journey.

Final Thoughts and Recommendations

Considering its thoughtful features, user-friendly design, and focus on security, Experian earns a solid recommendation for a broad audience—from newcomers to seasoned financial players. If your goal is to understand your credit better, safeguard your identity, and receive actionable insights without friction, this app is a trustworthy companion.

However, for users seeking advanced investment tracking or extensive budgeting features, Experian may need to be supplemented with other apps focused solely on those areas. Overall, I suggest giving Experian a try—especially if credit security and personalized improvement tips are your top priorities. It's like having a knowledgeable financial friend in your pocket, ready to guide you through the intricate world of credit and finance with confidence.

Pros

- Comprehensive Credit Monitoring

- User-Friendly Interface

- Real-Time Alerts

- Additional Credit Tips

- Free Basic Service

Cons

- Limited Depth in Credit Details (impact: Low)

- Occasional App Stability Issues (impact: Medium)

- Premium Features Require Subscription (impact: Low)

- Limited Credit Score Calculations (impact: Low)

- Localized Content Is Sparse (impact: Low)

Frequently Asked Questions

How do I get started with the Experian app on my device?

Download from App Store or Google Play, open the app, register with your details, and follow the prompts for easy setup and access to your financial information.

Is my personal information secure while using Experian?

Yes, Experian uses advanced encryption and security protocols to protect your personal data and ensure your information remains confidential.

How often can I check my credit score for free?

You can check your free FICO® Score and report once every 30 days through the app without any impact on your credit.

How can I improve my credit score using Experian?

Access personalized tips, use Experian Boost® to include bill payments, and monitor your credit regularly for insights on improving your score.

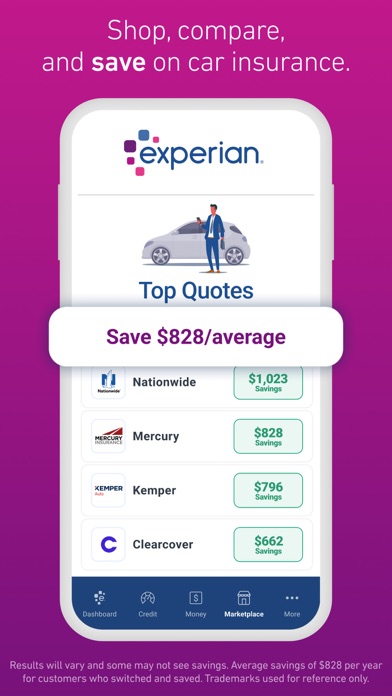

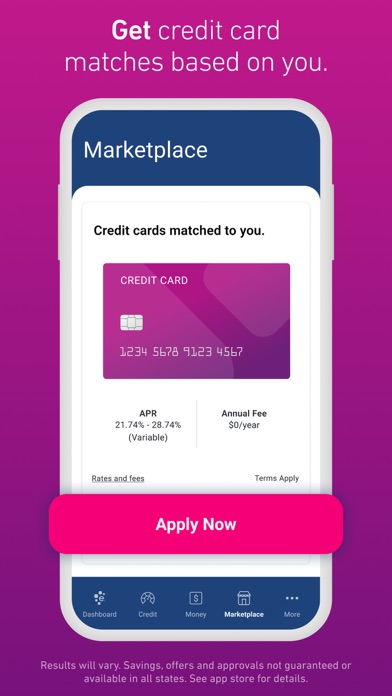

What features are available to help me compare loan or insurance options?

Navigate to the Marketplace section within the app to compare personalized credit card, loan, and auto insurance quotes.

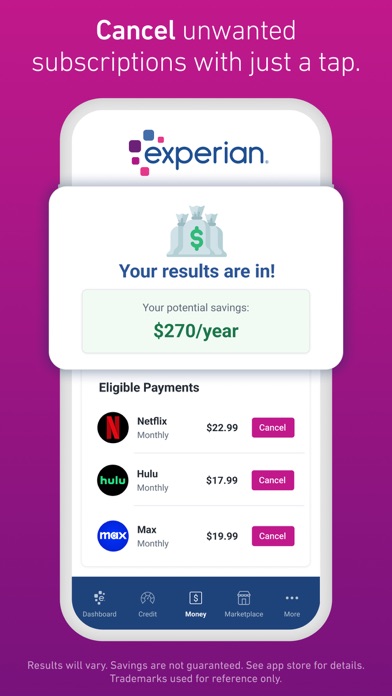

Are there any costs for premium features like bill negotiation?

Yes, premium services such as bill negotiation and subscription cancellation may involve fees—check the app's Premium section for details.

How do I subscribe to Experian's premium services?

Go to Settings > Subscriptions within the app, select the service you want, and follow the prompts to subscribe and manage payments.

Can I cancel my subscription to Experian premium features easily?

Yes, you can cancel in Settings > Subscriptions anytime to stop future payments, following the platform-specific cancellation process.

What should I do if the Experian app isn't working properly?

Try restarting your device, updating the app, or reinstalling. If issues persist, contact Experian support through the Help or Support section.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4