- Developer

- Fifth Third Bank

- Version

- 5.18.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.6

Fifth Third: 53 Mobile Banking — A modern banking companion with a focus on security and seamless experience

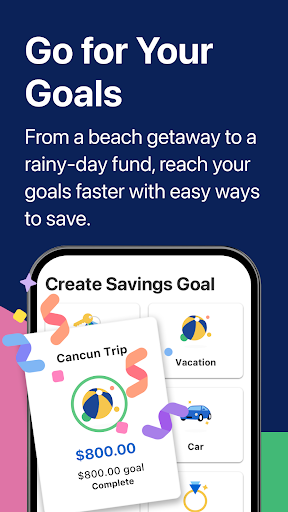

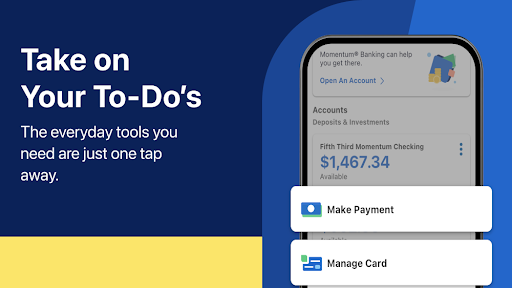

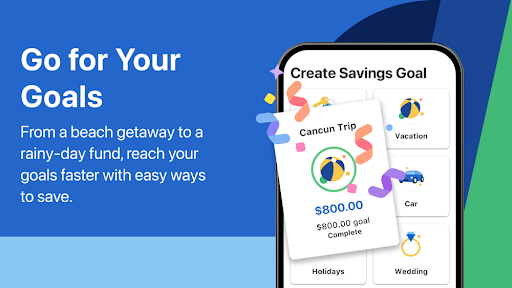

Fifth Third's 53 Mobile Banking app positions itself as a comprehensive digital banking tool designed for users seeking convenient access to their finances paired with robust security measures. Developed by Fifth Third Bank, a well-established financial institution, this app aims to streamline everyday banking tasks while ensuring user data remains protected. Its core strengths include intuitive account management, secure transaction processing, and innovative features for user protection, tailored primarily for tech-savvy customers and existing Fifth Third clients looking for a reliable banking experience.

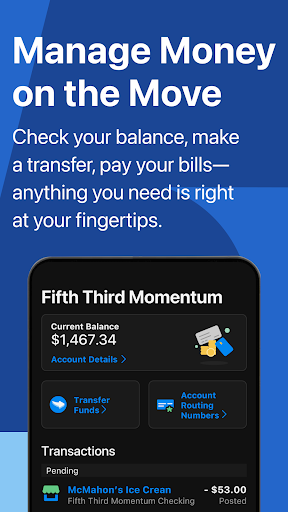

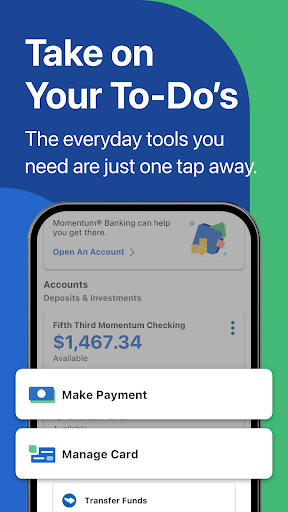

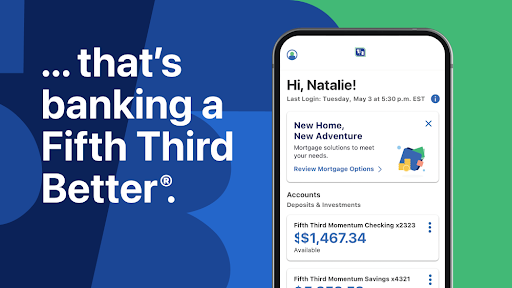

Engaging and User-Friendly Interface that Feels Natural

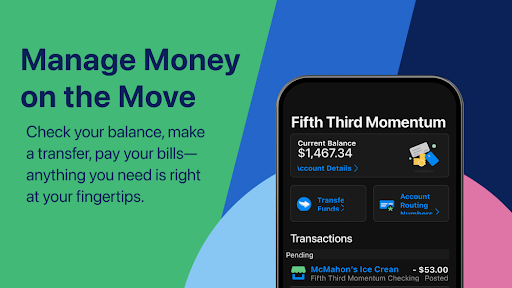

From the moment you open the app, the interface feels like a well-organized dashboard—clean, inviting, and intuitive. The visual design adopts a modern aesthetic with soothing blues and clear icons that guide you effortlessly through the various functions. Navigating between accounts, viewing transaction histories, or transferring funds is as smooth as sliding a credit card across a contactless reader—quick, responsive, and satisfying. Even for newcomers, the learning curve is gentle; most features can be discovered within minutes, thanks to thoughtful layout and helpful prompts. Overall, the app delivers an experience that's both engaging and accessible, making routine banking feel less like a chore and more like a personalized service.

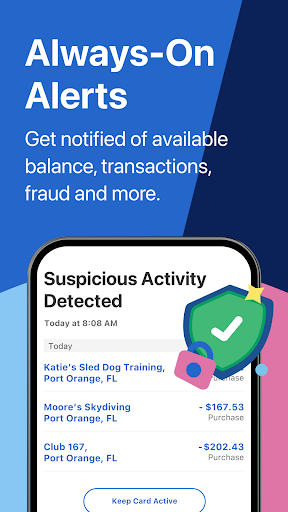

Distinctive Features: Security First & Transaction Experience

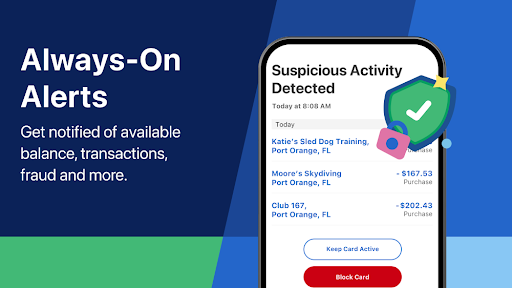

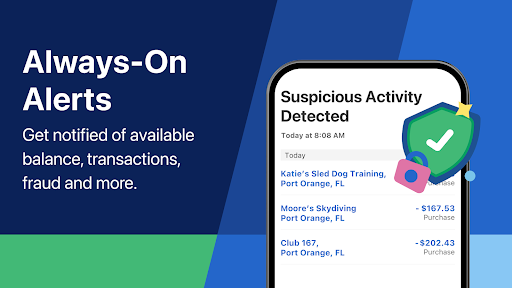

One of the app's standout qualities is its emphasis on account and fund security. Fifth Third has integrated advanced multi-factor authentication options, biometric login (fingerprint and facial recognition), and real-time fraud alerts, creating a layered shield around your assets. Unlike many competitors that settle for basic login procedures, 53 Mobile Banking offers peace of mind, ensuring your financial information remains confidential and protected against unauthorized access.

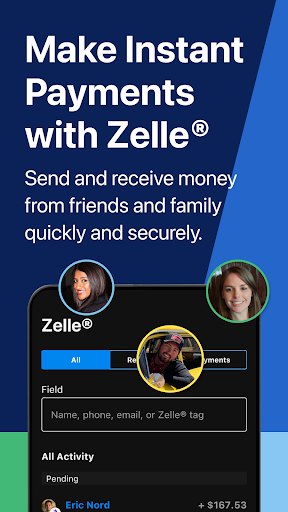

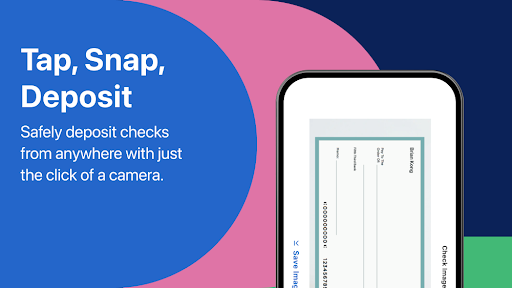

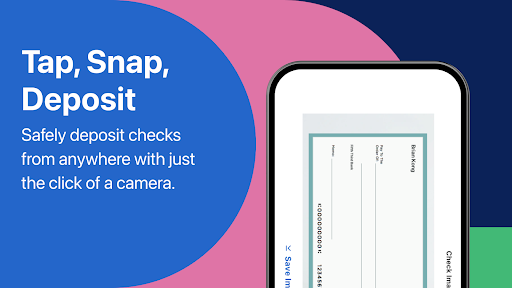

Complementing its security measures, the transaction experience is streamlined and transparent. Transferring funds, paying bills, or depositing checks via mobile capture happens rapidly, with clear confirmation screens and progress indicators. The app also supports scheduled transactions and recurring payments, which can be set up with just a few taps—making it feel as effortless as planning your routine. These features not only enhance convenience but promote a sense of control and confidence in managing finances on-the-go.

Comparing with Other Finance Apps: What Sets It Apart?

While many banking apps focus primarily on basic account access, Fifth Third's 53 Mobile Banking distinguishes itself with its blend of security-enhanced features and user-centric transaction flow. Its biometric safeguards and real-time fraud alerts top the list of measures that build trust, especially in an era of cyber threats. Furthermore, the app's design minimizes friction during transactions—akin to having a friendly financial assistant guiding your every move. Unlike some competitors that may bombard users with complex menus or overly technical security features, this app maintains a balance that favors reassurance without hindering usability.

Recommendation and Usage Scenario

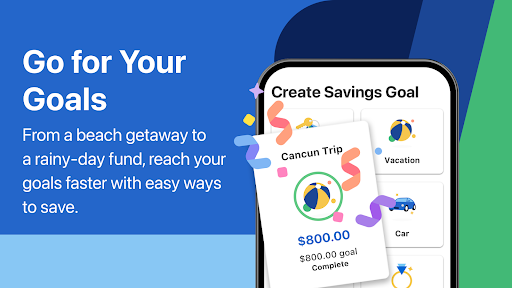

Overall, I would rate the 53 Mobile Banking app as highly suitable for existing Fifth Third customers who prioritize secure, straightforward, and reliable digital banking. It's particularly recommendable for users who value quick access to account information, efficient transaction capabilities, and peace of mind through advanced security. For occasional users or those new to the bank, the app offers a gentle onboarding experience, making everyday banking feel less like a chore and more like a trusted service partner. However, users seeking extensive investment tools or complex financial planning features might find the app's offerings somewhat limited. For most day-to-day banking needs, this app strikes a fine balance between simplicity and sophistication.

Pros

- Intuitive User Interface

- Robust Security Features

- Comprehensive Account Management

- Quick Funds Transfer

- Reliable Customer Support Access

Cons

- Occasional App Crashes (impact: medium)

- Limited Budgeting Tools (impact: low)

- Slow Transaction Processing at Times (impact: low)

- Navigation Can Be Slightly Clunky (impact: low)

- Offline Access Is Limited (impact: low)

Frequently Asked Questions

How do I get started with the Fifth Third Mobile Banking app?

Download the app from your device's app store, open it, and follow the on-screen instructions to create an account or log in using your existing Fifth Third credentials.

Is it secure to use Fifth Third Mobile Banking on my phone?

Yes, the app uses encryption and multi-factor authentication to protect your data, ensuring secure access to your accounts and transactions.

How can I check my account balance and recent transactions?

Log into the app, tap your account name to view your balance, transaction history, and detailed account information within the main dashboard.

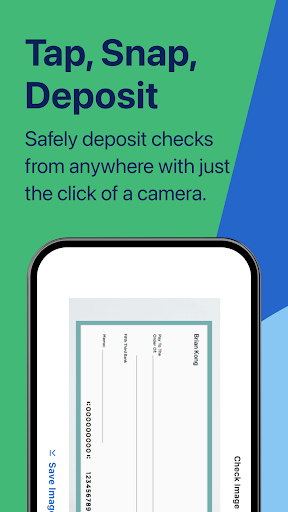

How do I deposit a check using the mobile app?

Select Mobile Check Deposit, follow the prompts to photograph your check, choose the account, and submit before 8 PM ET for same-day processing.

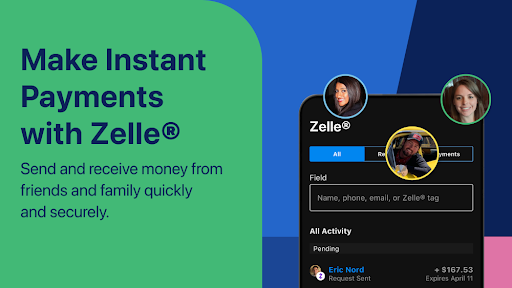

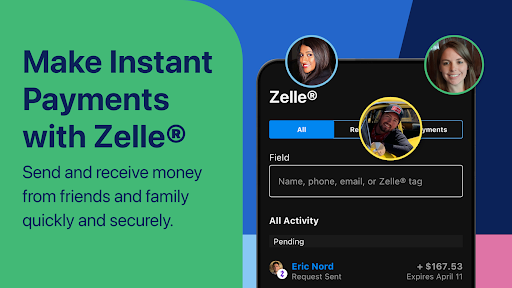

How can I transfer money to friends or family?

Use the Transfer Funds feature or ZELLE® within the app, add payees if needed, and follow prompts to send or receive money securely and quickly.

How do I pay bills through the app?

Navigate to Bill Pay, add payees, enter payment details, and schedule payments directly from your linked accounts for convenient bill management.

Can I temporarily lock my debit or credit card if it's lost?

Yes, go to Account Settings > Card Management, select the card, and choose the lock or unlock option to prevent unauthorized use.

How do I set up alerts for my transactions?

Go to Your Profile > Alerts menu, customize notification preferences for debit, credit, or ATM transactions via phone or email.

Is there a way to update my account information without calling customer support?

Yes, access the app, go to Account Settings, where you can update personal details, preferences, PINs, and activate or lock your cards easily.

What should I do if the app crashes or I encounter technical issues?

Try restarting your device, update the app to the latest version, or contact Fifth Third customer support for further assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4