- Developer

- FloatMe

- Version

- 8.6.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.6

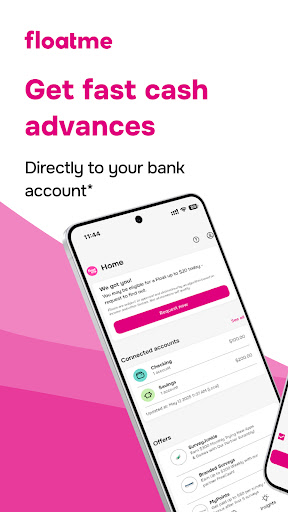

FloatMe: Budget & Cash Advance — A Trusted Companion for Your Financial Flexibility

FloatMe is a user-friendly financial app designed to help individuals manage their cash flow more effectively by offering affordable cash advances and budgeting tools, all crafted by a dedicated team committed to empowering everyday financial independence.

Developed by a Customer-Centric Team

This innovative app is developed by FloatMe Inc., a team focused on creating accessible financial solutions that bridge the gap between paychecks. Their mission is to provide consumers with flexible, transparent, and easy-to-use tools to navigate financial shortfalls without falling into debt traps.

Key Features That Make a Difference

- Earned Wage Access: Get access to your paycheck early, supporting smoother cash flow without costly overdrafts.

- Cash Advance with Low Fees: Request small, affordable advances without the high-interest rates often associated with payday loans.

- Smart Budgeting Tools: Helps users track expenses, set savings goals, and manage finances proactively.

Who Should Give It a Try?

FloatMe is ideal for individuals living paycheck to paycheck, gig workers, students, or anyone looking for a modest financial safety net during financial pinch points. Its straightforward approach suits users who value transparency and simplicity over complex financial planning features.

A Spark of Financial Flexibility: A Friendly Introduction

Imagine waking up on a chilly morning, realizing your rent is due in a couple of days, but your paycheck is still a week away. Feels stressful, right? Enter FloatMe—a virtual financial buddy ready to lend a helping hand without the heavy chains of traditional payday lenders. With this app, managing unexpected expenses becomes less daunting, transforming your financial worries into manageable steps—like having a reliable friend who's always there when you need them most.

Driving Ease: Core Features Explored

1. Affordable Cash Advances — A Safety Net at Your Fingertips

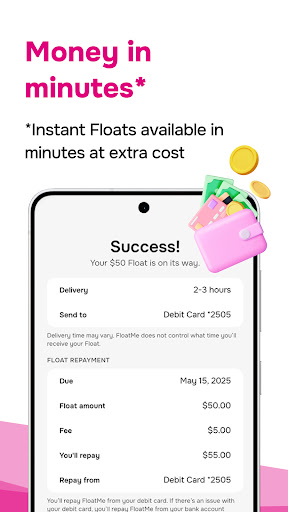

FloatMe's standout feature is its commitment to providing cash advances at a fraction of the cost of payday loans. Unlike traditional options that trap you with exorbitant interest rates, FloatMe allows users to borrow small amounts (usually up to $50 or $100) with minimal fees. This not only eases short-term cash crunches but also enables users to avoid overdraft fees from their bank accounts. The process is seamlessly integrated—you simply request an advance within the app, and fund transfer happens swiftly, often within minutes. It's like having a financial cushion that's lightweight but reliable, helping you keep your balance during tight spots.

2. Earned Wage Access — Access Your Paycheck Early

This feature is akin to having an advance on your future earnings—without any fancy strings attached. Once you link your employer or payroll account, FloatMe allows you to view your upcoming earnings and withdraw a portion of it ahead of your official payday. This proactive approach prevents the stress of waiting for the next paycheck and helps you keep your financial wheels turning smoothly. Its implementation is intuitive; you just authorize the linking process and choose how much of your upcoming wages you want to access. It's straightforward, transparent, and muscle-friendly for those living paycheck to paycheck.

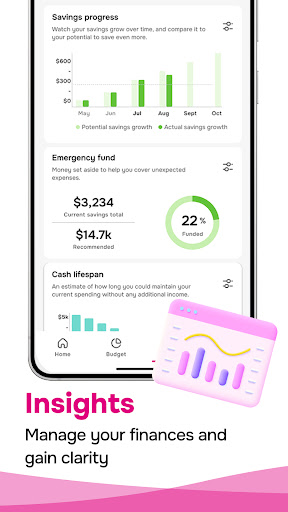

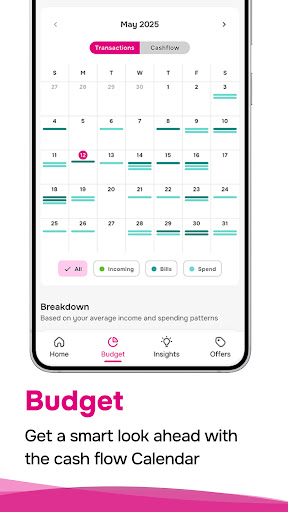

3. Smart Budgeting & Expense Management — Your Financial GPS

Beyond just providing cash, FloatMe doubles as a budgeting companion. Its user-friendly interface presents your transaction history, tracks recurring expenses, and offers simple insights into your spending habits. Users can set savings goals, understand where their money is going, and get gentle reminders to stay on track. It's like having a GPS for your financial journey—guiding you away from unnecessary detours and ensuring you reach your destination with fewer bumps along the way.

Design & User Experience: Friendly, Flowy, and Intuitive

FloatMe's interface feels like a well-organized dashboard—clean, colorful, and designed with the user in mind. Navigating through features is akin to flipping through a well-curated magazine; everything is located where you'd expect and presented clearly. The app's operation is smooth, with quick load times and responsive interactions that make borrowing or budgeting feel effortless—like chatting with a knowledgeable friend over coffee. Its learning curve is gentle: even first-time users find themselves comfortable after a few taps. Moreover, the app's transparency regarding fees and security reassures users that their sensitive data, including account and fund security, is a top priority. Unlike some competitors, FloatMe emphasizes straightforward transactional experiences, minimizing surprises and promoting trust.

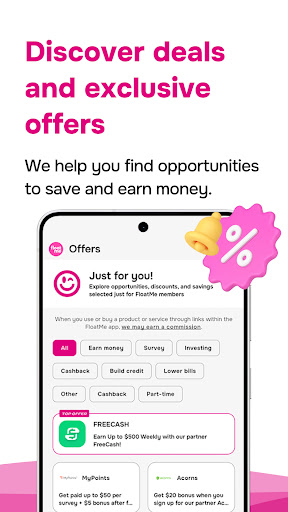

What Sets FloatMe Apart? The Unique Edge in the Crowd

While many financial apps focus on investments or complex financial planning, FloatMe zeroes in on genuine short-term liquidity needs with a transparency-focused approach. Its standout features—particularly the Earned Wage Access coupled with low-cost cash advances—serve as a critical differentiator. Additionally, the app's seamless integration with payroll systems enhances the transaction experience, making early wage access feel natural and frictionless. Its strong emphasis on security means users can trust that their personal and financial data are shielded — a vital feature in today's digital age where account and fund security are paramount. In essence, FloatMe offers a balanced blend of accessibility, affordability, and safety, making it an attractive choice for everyday financial management.

Final Verdict & Recommendations

Overall, FloatMe proves to be a reliable, user-friendly app catering to a very specific need: short-term financial flexibility without the pitfalls of high-interest payday loans. Its most remarkable feature—affordable cash advances and earned wage access—serves as a compassionate financial safety net offering peace of mind. For anyone seeking a practical, transparent tool to manage unpredictable expenses, FloatMe warrants a solid recommendation.

That said, users should view it as a supplementary resource rather than a primary financial planning tool. It's best suited for those who need occasional cash supports or want to establish better budgeting habits. If you prioritize ease of use, low fees, and a secure experience, FloatMe could be a valuable addition to your financial toolbox.

Pros

- User-Friendly Interface

- Free Budgeting Tools

- Cash Advance Availability

- Instant Notifications

- Credit Building Support

Cons

- Limited Fund Amounts (impact: medium)

- Potential Fees for Premium Features (impact: low)

- Dependence on Data Connectivity (impact: low)

- Customer Support Response Time (impact: low)

- Inconsistent Credit Score Impact (impact: medium)

Frequently Asked Questions

How do I get started with FloatMe for quick cash advances?

Download the app, sign up, connect your bank account securely via Plaid, and subscribe to a plan to access cash advance features and tools.

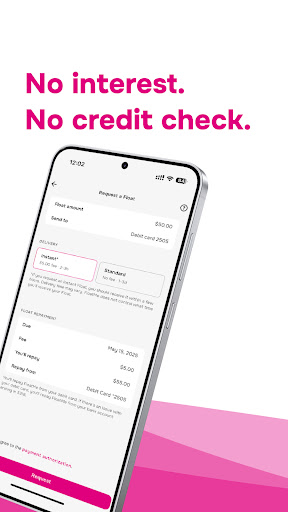

Is there a fee to use FloatMe and how does the cash advance process work?

FloatMe charges a $4.99/month subscription, with optional instant float fees ($1-$7). You request cash via the app, and funds are transferred after approval, with no interest charged.

How can I request a cash advance through FloatMe?

Open the app, go to 'Cash Advances,' select the amount you need (up to your limit), and submit your request. Funds are typically available within minutes if approved.

What are the main features of FloatMe's budgeting tools?

FloatMe offers a cash flow calendar, projected balances, and low balance alerts to help you track expenses and manage your finances effectively within the app.

How does FloatMe ensure the security of my bank account information?

FloatMe uses the Plaid Portal with 256-bit encryption, connecting securely to over 10,000 banks, ensuring your data remains private and protected.

Do I need to be a member to access cash advances, and what are the costs?

Yes, a $4.99/month subscription is required to access cash advances. The subscription grants full access to features; no interest or hidden fees apply.

Can I cancel my subscription easily if I no longer want to use FloatMe?

Yes, you can cancel anytime within the app via Settings > Account > Subscription or by contacting support; there are no long-term commitments.

What should I do if I experience technical issues with the app?

Try reinstalling the app, ensure your device is updated, and contact FloatMe support through the help section for assistance.

Are there any regional restrictions for using FloatMe?

Yes, FloatMe is not available in Connecticut, District of Columbia, and Nevada. Check the app or website for the latest supported regions.

Does FloatMe charge interest on cash advances like traditional loans?

No, FloatMe offers interest-free cash advances as part of your subscription, with no repayment interest or hidden charges involved.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4