- Developer

- Four Technologies, Inc

- Version

- 1.17.51

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.6

Introduction: A Clearer Path to Flexible Payments

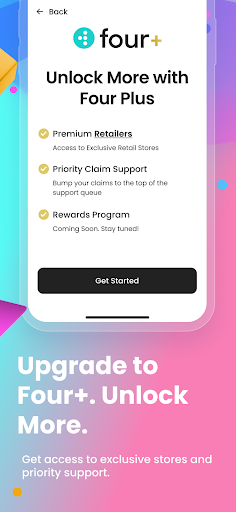

Four | Buy Now, Pay Later (BNPL) emerges as a sleek, user-centric financial app designed to bridge the gap between instant purchasing and manageable repayment options. Developed by a dedicated fintech team committed to transparency and security, this application aims to redefine how everyday consumers approach flexible payments.

Key Features That Set It Apart

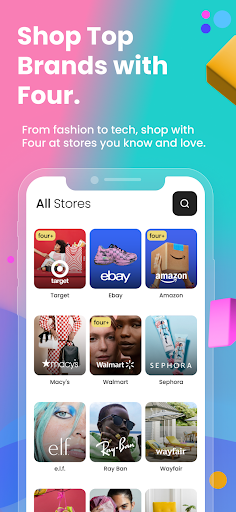

With its innovative approach, Four offers dynamic installment plans, affordability assessments, and a focus on security—all wrapped in an intuitive interface. Its standout features include seamless integration with major merchants, smart payment scheduling, and a transparent fee structure. These elements collectively create a smoother, more trustworthy BNPL experience tailored for the modern shopper.

Engaging User Experience and Interface Design

Imagine opening a well-organized personal finance dashboard—simple, inviting, and free of clutter. Four's interface is akin to a tidy workspace where navigation feels natural and responsive. Its visual design employs calming colors and clear icons, making users feel at ease whether they're checking upcoming payments or browsing partner stores. The app's operation flows smoothly, with quick response times and minimal steps required to complete transactions. Learning to navigate Four is straightforward; even first-time users can grasp its features within minutes without feeling overwhelmed.

Core Functionality Breakdown

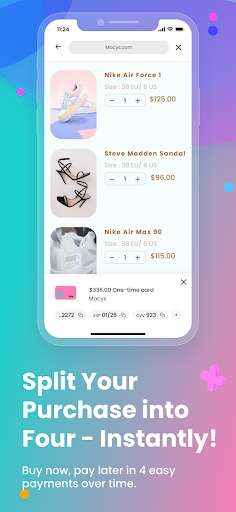

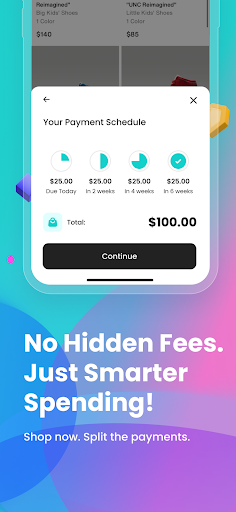

Flexible Installment Plans and Smart Scheduling

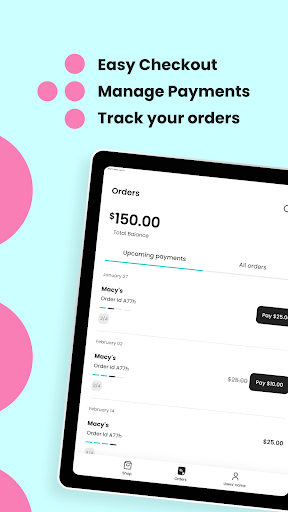

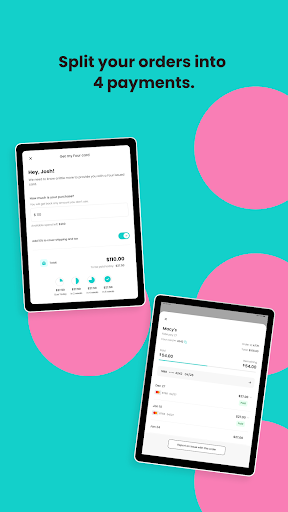

At the heart of Four is its ability to tailor payment plans to individual financial circumstances. Users can choose from multiple installment durations—ranging from a few weeks to several months—ensuring flexibility aligns with their cash flow. The app intelligently schedules upcoming payments, sending timely reminders to prevent missed deadlines. This adaptive scheduling acts like a personal finance assistant, helping users maintain control over their purchases without stress.

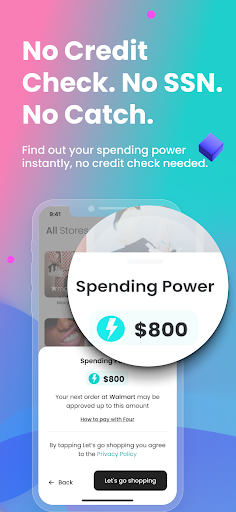

Enhanced Security and Trustworthiness

Security is paramount in any financial app, and Four takes it seriously. Unlike some BNPL services that may leave users anxious about data breaches, Four employs advanced encryption standards and rigorous identity verification. It offers transparent reporting of fees and terms upfront, similar to having a trustworthy financial advisor at your side. These features provide peace of mind, especially when making larger or recurring purchases, fostering a sense of security akin to having a sturdy safety net beneath your shopping habits.

Seamless Transaction Experience with Merchant Integration

One of Four's most compelling strengths is its seamless integration with participating merchants. When shopping, users can select Four as their payment method swiftly—think of it as a friendly cashier who instantly understands your needs. Transactions are processed swiftly, and the app updates the user's payment schedule automatically. This close-knit integration minimizes friction, making purchasing almost as effortless as handing cash—only now, with the convenience of the digital age.

Comparative Edge and Final Recommendations

Compared to other BNPL or financial apps, Four uniquely emphasizes user security and intelligent payment management. Its transparent fee disclosures and robust encryption set it apart, ensuring users aren't caught off guard by hidden charges or data vulnerabilities. The app's user experience is crafted to be accessible yet comprehensive, making it suitable for a broad demographic—from tech-savvy millennials to cautious new users seeking clarity.

We recommend Four for anyone seeking a reliable, easy-to-use BNPL solution with a focus on security and personalization. It's especially well-suited for shoppers who want flexibility without sacrificing peace of mind. For those new to buy now, pay later services, Four offers an inviting entry point—combining simplicity with the assurance that their financial details are safeguarded.

Overall, if you're looking for an app that balances flexible payments with transparency and security, Four is worth trying. It's like having a considerate financial ally right in your pocket, helping you shop smarter while staying in control.

Pros

- User-friendly interface

- Flexible payment options

- Instant credit approval

- Transparent fee structure

- Strong security measures

Cons

- Limited merchant acceptance (impact: medium)

- Potential for overspending (impact: high)

- Interest charges may accrue if payments are delayed (impact: high)

- Limited customer service channels (impact: medium)

- Regional availability restrictions (impact: low)

Frequently Asked Questions

How do I get started with using the Four app?

Download the app, create a free account via email verification, and browse partnered stores to start shopping and splitting payments into four interest-free installments.

Is there a minimum purchase amount to use Four?

There is no explicit minimum purchase requirement; however, eligible items are displayed within partnered stores, and qualifying purchases are split into four payments.

How can I view my upcoming payments and order history?

Open the Four app, go to 'Payments' or 'Order History' from the menu to monitor upcoming installments and review your past transactions easily.

Can I reschedule my payments if I can't make it on time?

Yes, you can reschedule upcoming payments within the app by navigating to 'Payments' and selecting 'Reschedule,' provided it is within the allowed time frame.

What stores are partnered with Four for shopping?

The app features an extensive list of partnered stores, including clothing, electronics, and home goods; browse the store directory within the app for options.

How do I make a purchase using Four?

Choose an eligible item in a partnered store, select Four at checkout, and authorize the split payments within the app to complete your purchase.

Are there any hidden fees or interest charges with Four?

No, Four offers interest-free payments as long as payments are made on time; always review payment schedules within the app for transparency.

Can I cancel or return an order I bought through Four?

Order cancellations or returns should follow each store's policies; manage cancellations through the store directly and notify Four for any payment adjustments if needed.

What should I do if I experience technical issues with the app?

Contact Four's customer support via 'Help' or 'Support' section in the app for troubleshooting assistance or to report any problems.

Is there a subscription fee to use Four?

No, downloading and creating an account with Four is free; the service charges only for the payment installments, which are interest-free if paid on time.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4