- Developer

- Green Dot

- Version

- 3.0.0

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4.5

Introducing GO2bank: Mobile Banking – Your Modern Financial Companion

GO2bank, developed by Green Dot Corporation, positions itself as a user-friendly, secure, and innovative mobile banking platform designed to meet the needs of today's digital-savvy consumers. With a focus on accessible banking solutions, it offers a suite of features aimed at simplifying money management for a broad audience, especially those seeking affordable and straightforward banking options.

Key Features that Make GO2bank Stand Out

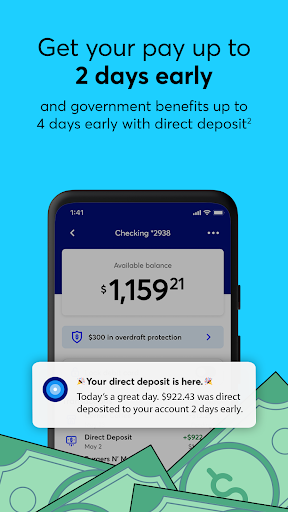

1. **Early Direct Deposit with No Fees:** Get access to your paycheck or government benefits up to two days earlier, allowing you to manage your cash flow more effectively.

2. **Robust Security Measures:** Incorporating advanced account and fund security features, including biometric login and real-time fraud monitoring, providing peace of mind to users.

3. **Cash Back and Savings Incentives:** Unique rewards like cashback on qualifying purchases and tools that help users automatically save spare change, making everyday banking rewarding.

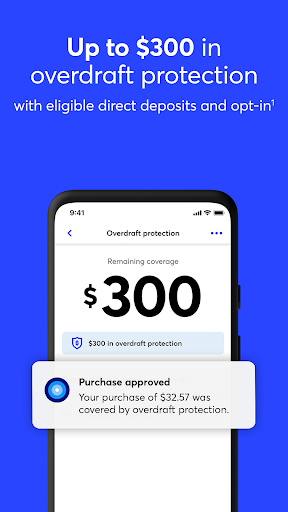

4. **No Overdraft Fees and Transparent Fee Structure:** Designed with affordability in mind, GO2bank keeps fees low and transparent, reducing surprises often associated with traditional banks.

A Fresh and Engaging User Experience

Imagine opening your banking app feels like greeting an old friend—friendly, intuitive, and efficient. That's the vibe GO2bank aims for, with a clean interface that's as approachable as a well-organized workspace. The onboarding process is straightforward, guiding you through setup with minimal fuss. Navigating through the app feels like flipping through a well-designed magazine—smooth transitions, clear icons, and easily accessible features ensure a seamless experience from first tap to last.

Core Functionality: Banking that Moves with You

The heart of GO2bank lies in its core functionalities, designed to serve the daily financial needs of users. One of the standout features is the early direct deposit capability. Imagine waking up and finding your paycheck already deposited—like receiving an early birthday gift every pay cycle. This feature reduces dependence on payday anxiety and enhances financial flexibility.

Another pillar is the security ecosystem. Using biometric authentication—fingerprint or facial recognition—GO2bank makes logging in quick and safe. Coupled with real-time alerts on suspicious activities, it acts like a vigilant security guard that's always watching, making it ideal for those concerned about fraud and account safety.

The rewards system adds a fun twist to everyday spending. Cashback opportunities on popular merchants and automated savings functions turn routine transactions into opportunities for growth or savings—think of it as turning your simple errands into a mini-investment in your financial well-being.

Running Smoothly: Interface, Usability, and Learning Curve

The design philosophy of GO2bank centers on clarity and simplicity. Its interface is akin to a well-tuned orchestra—each element in harmony, making navigation intuitive even for beginners. Onboarding is an easy, step-by-step process that minimizes learning time. The app's response time is quick, with fluid transitions that feel like gliding on smooth ice rather than slogging through molasses—every tap feels purposeful.

Compared to other mobile banking tools like Chime or Ally, GO2bank's interface stands out for its minimalistic yet informative layout, lowering the barrier for new users. Security features, such as fingerprint login, add an extra layer of ease, making quick access an effortless part of your daily routine.

On the downside, some advanced features like budgeting tools may take a bit of exploration for absolute beginners. However, for everyday banking, the learning curve is shallow, and most users can start managing their finances almost immediately.

How GO2bank Differs from Similar Apps

Where GO2bank truly shines is in its balanced approach to security and transactional convenience. Its proactive security features go beyond standard measures, offering real-time alerts and biometric login, making it one of the safest options on the market. Unlike some competitors that simply provide basic security, GO2bank's focus on fraud protection helps users feel more confident in their digital money management.

Additionally, its early fund availability upon direct deposit is a game-changer—imagine waking up to find your paycheck already in your account, ready to be used for those morning coffee runs or urgent bill payments. This feature is a strategic advantage over traditional banks that typically need a day or two to process deposits.

Furthermore, the app's rewards and savings incentives are more integrated and user-centric, encouraging users to engage regularly with their finances without complicated setups. The transparent fee structure and absence of overdraft fees keep the experience stress-free, unlike some other platforms where hidden charges lurk around the corner.

Final Recommendations and Usage Tips

Overall, GO2bank earns a strong recommendation for anyone seeking a reliable, secure, and intuitive mobile banking app. It is particularly well-suited for students, gig workers, or anyone looking to avoid traditional banking fees while enjoying modern conveniences. If you value quick access to your funds, strong security, and occasional rewards, GO2bank should be top on your list.

For best results, new users should explore all the features—especially the early direct deposit option and automatic savings tools—and set up security measures like biometric login early on. While it covers the essentials effectively, users seeking comprehensive budgeting tools might supplement it with dedicated financial planning apps. Nonetheless, for everyday transactions, bill payments, and savings goals, GO2bank offers a compelling, user-friendly solution.

Pros

- User-Friendly Interface

- Zero Monthly Fees

- Early Payday Access

- Robust Security Features

- Comprehensive Financial Tools

Cons

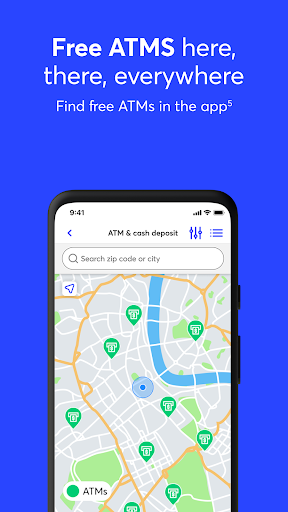

- Limited ATM Network (impact: Medium)

- No Physical Branches (impact: Low)

- Customer Support Response Time (impact: Medium)

- Spending Limits for New Users (impact: Low)

- Occasional App Glitches (impact: Low)

Frequently Asked Questions

How do I open a GO2bank account for the first time?

Download GO2bank from your app store, then follow the on-screen instructions to sign up with your mobile number, SSN, and email verification.

What do I need to verify to start using all features?

Complete mobile number verification via text message and email registration, and provide your SSN for identity verification.

Can I access my account through the website or only via the app?

Currently, GO2bank is primarily a mobile app; online access is via the app. For support, visit GO2bank.com for assistance.

How does early direct deposit work with GO2bank?

Eligible direct deposits can be received up to 2 days early, allowing faster access to your paycheck; ensure your payroll provider is setup correctly.

What are the main features of GO2bank?

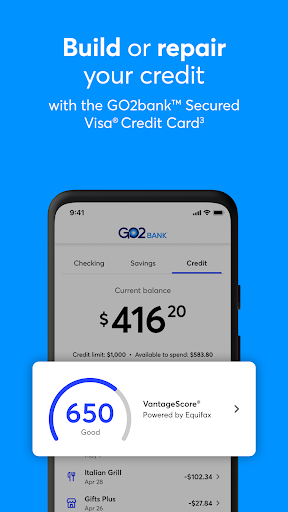

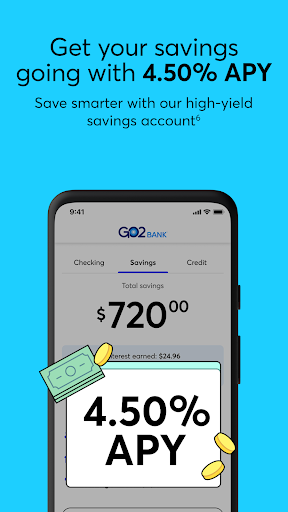

It offers no hidden fees, early deposits, ATM cash withdrawals, interest on savings, overdraft protection, and credit-building options like the Secured Visa card.

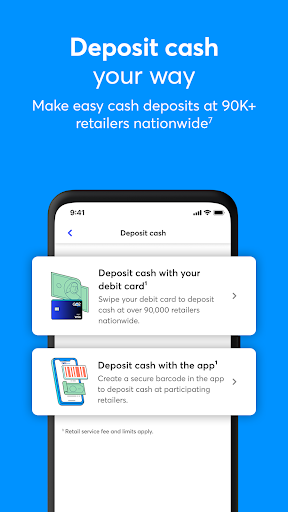

How do I deposit cash into my GO2bank account?

Visit retail locations across the country that partner with GO2bank and deposit cash directly into your account, or use bank ATMs for withdrawals.

Will I be charged if I use an ATM outside the network?

Yes, out-of-network ATM usage may incur fees. Use the extensive nationwide ATM network to avoid additional costs.

Is there a fee for maintaining a GO2bank account?

No, there are no monthly fees for eligible direct deposit users; otherwise, a $5 monthly fee applies.

How does GO2bank help improve my credit score?

Use the GO2bank Secured Visa Credit Card, which has no annual fee or credit check, to steadily build or improve your credit profile.

What should I do if I encounter a security issue or suspect fraud?

Use the card lock/unlock features through the app and contact GO2bank support immediately for assistance and fraud alerts.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4