- Developer

- Green Dot

- Version

- 4.68.0

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 3.6

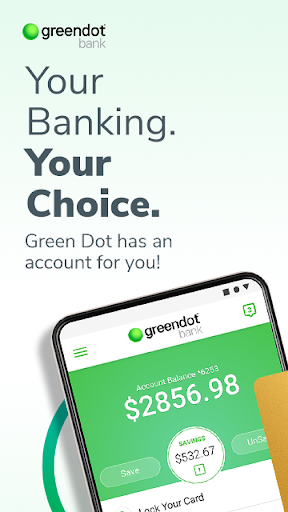

Green Dot - Mobile Banking: Your Modern Financial Companion

Green Dot's mobile banking app positions itself as a seamless and secure platform designed to simplify everyday banking tasks through innovative features and user-centric design. Developed by the seasoned team at Green Dot Corporation, this app aims to bridge the gap between traditional banking and the fast-paced digital world, making financial management more effortless and accessible.

Core Features That Shine Bright

At its heart, Green Dot's app is packed with practical features that cater to a wide spectrum of users—from busy professionals to students seeking simple money management solutions:

- Instant Card Lock/Unlock: Often, security is a concern when it comes to card management. Green Dot's app lets users instantly lock or unlock their debit cards with a tap, providing peace of mind if a card is lost or stolen.

- Real-Time Transaction Alerts: Stay on top of your finances with instant push notifications for every transaction, helping detect fraud promptly and keep tabs on spending habits.

- Budgeting & Savings Tools: Integrated features allow users to set savings goals, track expenses, and categorize transactions, fostering smarter financial habits without needing third-party apps.

- Seamless Reload & Transfer Options: Easily add funds through direct deposits, mobile check capture, or transfers from linked accounts, ensuring your money is always where you need it.

An Engaging User Experience

Imagine holding a financial control center right in your palm—that's precisely what Green Dot's app offers. The interface design is clean yet lively, with intuitive icons and a warm color palette that makes navigation feel like a conversation with a friendly guide. Executing tasks such as transferring money or checking balance takes just a few taps, and transitions are buttery smooth, reflecting thoughtful optimization under the hood.

From first launch, users find the learning curve gentle—no complex onboarding or jargon-heavy menus here. Even those new to digital banking can navigate effortlessly, thanks to contextual tips and straightforward language. It's like opening the door to a well-organized digital wallet that's ready to serve your needs without a steep learning ramp.

Standing Out in the Crowd

In a sea of financial apps, what makes Green Dot's mobile banking app peculiarly attractive? Two main aspects set it apart: transaction security and user-centric flexibility.

- Enhanced Security Features: Green Dot emphasizes account and fund security through features like instant card lock/unlock, suspicious activity monitoring, and biometric login options. Compared to some peers, the app's rapid response capabilities create a trustworthy environment for daily transactions.

- Intuitive Transaction Experience: The app simplifies the typically cumbersome process of managing multiple accounts and cards, making routine transactions feel like a friendly chat. Instant notifications and clear transaction histories foster transparency, reducing doubts often felt with digital financial services.

Final Verdict: A Solid Financial Partner Worth Trying

Overall, Green Dot's mobile banking app earns a genuine recommendation for users who seek a combination of security, ease of use, and practical features. Whether you're managing a daily budget, tracking expenses, or securing your card at a moment's notice, this app delivers reliably. It's particularly well-suited for those new to digital banking or anyone wanting a straightforward yet secure platform to handle their finances without the fuss. As with any financial tool, users should stay vigilant and understand all features thoroughly, but Green Dot makes that journey approachable and stress-free.

Pros

- User-Friendly Interface

- Rapid Transactions

- Robust Security Measures

- Comprehensive Account Management

- Customer Support Accessibility

Cons

- Limited International Banking Features (impact: Medium)

- Occasional App Crashes (impact: Low)

- Slow Response to Feedback (impact: Low)

- Navigation in Settings Menu Could Be Improved (impact: Low)

- Limited Customization Options (impact: Low)

Frequently Asked Questions

How do I activate my Green Dot card after receiving it?

Open the Green Dot app, go to 'Manage Card,' select 'Activate Card,' and follow the prompts to complete activation.

What are the steps to register for a Green Dot account?

Download the app, tap 'Sign Up,' enter your details, verify your identity with SSN, and follow the on-screen instructions.

How can I check my account balance and recent transactions?

Open the Green Dot app, log in, then view your account balance and transaction history on the home screen or 'Account' tab.

How do I set up direct deposit to receive my pay early?

Navigate to 'Settings' > 'Direct Deposit,' input your employer's information, and follow the prompts to enable early deposits.

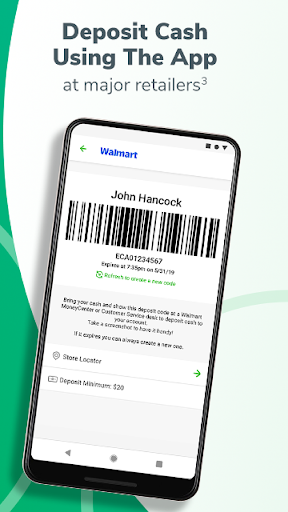

How do I load cash onto my Green Dot card?

Use the app to locate supported retail locations, then deposit cash at participating stores, paying the applicable service fee.

How can I enable or disable overdraft protection?

Go to 'Settings' > 'Overdraft' in the app, then opt-in or out of overdraft protection, and review any applicable fees.

How do I earn cashback on purchases?

Use your Green Dot Cash Back Visa® Debit Card for eligible online or mobile purchases; cashback is automatically credited based on your account terms.

What is the process to set up alerts for transactions or low balance?

In the app, go to 'Settings' > 'Alerts,' select the types of notifications you want, and customize your alert preferences.

Are there any monthly fees or subscription charges?

Fees may vary based on your account features; check 'Account Details' in the app for specific fee information and subscription options.

What should I do if I encounter a problem with my Green Dot card or app?

Use the in-app 'Chat Support' feature in the 'Help' section to contact customer service and get assistance promptly.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4