- Developer

- Fast Online Loans

- Version

- 2.0.7

- Content Rating

- Everyone

- Installs

- 0.50M

- Price

- Free

- Ratings

- 4.5

Instant Cash Advance Loan App: Your Quick Financial Partner

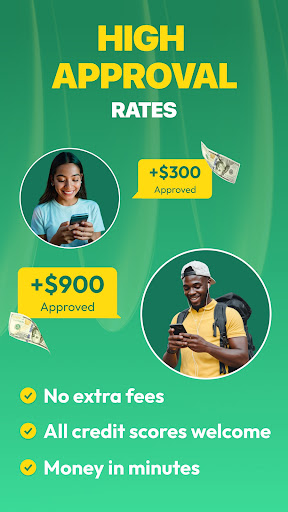

Instant Cash Advance Loan App is a straightforward tool designed to provide immediate short-term financial relief through easy-to-access cash advances, catering especially to those facing unexpected expenses or cash flow gaps. Developed by a dedicated team committed to fast and secure lending, it shines with features aimed at simplicity and security, making it an appealing choice for users seeking quick credit solutions.

A Clear Snapshot of the App

Positioned as an accessible and user-friendly short-term loan platform, the Instant Cash Advance Loan App aims to streamline borrowing processes without the usual hurdles of traditional lending. Created by a team of fintech enthusiasts with backgrounds in secure payment systems, the app offers a seamless experience tailored for busy individuals who need quick financial assistance. Its standout features include instant approval, flexible repayment options, and robust security measures to protect user data. The primary target audience encompasses working professionals, freelancers, students, or anyone facing urgent financial needs without lengthy approval processes.

Engaging and Easy Lending Experience

Imagine finding a lifebuoy in the chaotic sea of sudden expenses — that's exactly what Instant Cash Advance Loan App attempts to be. With its intuitive interface and smooth navigation, users are gently guided from entering their details to receiving funds, making the borrowing experience feel less like a chore and more like chatting with a knowledgeable friend. The app stands out with its lightning-fast approval process, often conferring funds within minutes, which is particularly vital during emergencies.

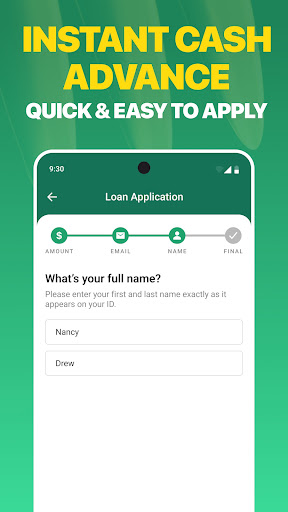

User-Centered Interface and Navigation

The app adopts a sleek, minimalist design, emphasizing clarity and ease of use. Icons and menus are logically organized, ensuring that even first-time users can quickly understand how to navigate. The interface employs friendly color schemes that reduce stress, which can often accompany financial dealings. The overall layout minimizes unnecessary steps, enabling users to access funds with just a few taps. The learning curve is shallow — most users can understand and operate the app without reading lengthy guides, making it suitable for digital novices and veterans alike.

Core Functionalities: Speed and Security at the Forefront

Perhaps the app's most striking feature is its speed. Once applications are submitted, the backend algorithms quickly evaluate the user's eligibility, leveraging real-time data analytics. Funds are transferred rapidly — sometimes within five minutes — a critical advantage over many competitors. Additionally, the app adopts advanced security protocols, including encrypted data transmission and multi-factor authentication, ensuring that users' personal and financial information remains safe. Unlike some peer apps that may compromise security for speed, Instant Cash Advance Loan App balances both efficiently, inspiring trust and confidence in its users.

Unique Differentiators: Prioritizing Account Security and Transaction Experience

In a crowded market of digital loans, the app distinguishes itself by focusing relentlessly on account and fund security. It employs biometric verification methods and continuous transaction monitoring to prevent unauthorized access. Moreover, the transaction process is designed to be transparent — users receive real-time notifications at every step, from approval to fund transfer, akin to having a personal financial assistant keeping you updated. This level of security and transparency fosters peace of mind, especially for users wary of digital financial scams or data breaches. Compared to other finance apps that may only offer basic security measures, this app's dual emphasis on speed and safety makes it a standout choice.

Final Verdict: Is It Worth Your Time?

Overall, the Instant Cash Advance Loan App presents a compelling option for those in need of quick, secure financial aid. Its most noteworthy features — rapid approval and rigorous security — are truly beneficial in emergency scenarios. The user experience is smooth and intuitive, minimizing barriers to quick access to funds. However, as with any short-term borrowing tool, users should be mindful of repayment terms to avoid unnecessary debt traps. I recommend this app highly for users prioritizing speed and security, especially when facing urgent financial needs. For casual or infrequent borrowers, it's a practical companion that offers peace of mind through its focus on protecting user data and providing a hassle-free experience.

Pros

- Quick approval process

- User-friendly interface

- Transparent fee structure

- Minimal documentation required

- Flexible repayment options

Cons

- Limited loan amount range (impact: medium)

- High interest rates for short-term loans (impact: high)

- Potential for hidden fees (impact: low)

- Limited availability in some regions (impact: medium)

- Risk of over-borrowing

Frequently Asked Questions

How do I get started with the Instant Cash Advance Loan App?

Download the app from your app store, sign up, and link your bank account through Settings > Account. The process is quick and easy to set up.

Is my personal data secure while using this app?

Yes, the app uses 128-bit SSL encryption to protect all data transmissions ensuring your information remains confidential and secure.

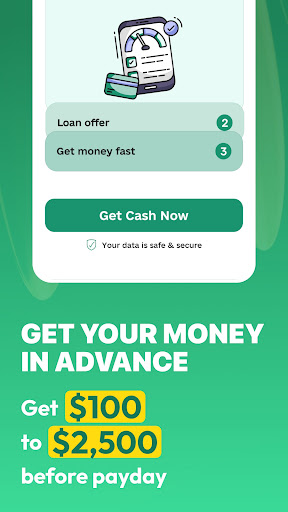

How do I apply for a cash advance?

Open the app, complete the quick application form, connect your bank, and submit. You will typically receive approval within minutes.

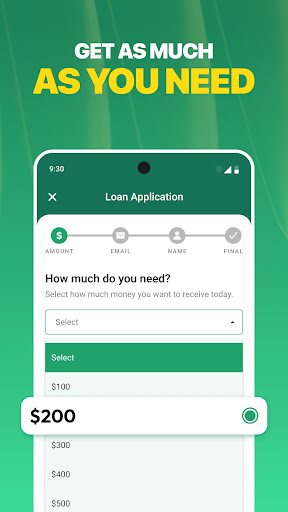

What determines my borrowing limit on this app?

Your limit is based on income, spending habits, and borrowing history. The app analyzes your profile to recommend an appropriate amount.

How long does it take to receive the funds after approval?

Funds are usually transferred almost instantly into your bank account after approval, ensuring quick access to cash.

How do repayment options work?

Repayments are automatically deducted on your scheduled pay date. You can select flexible plans in Settings > Repayment Schedule.

Are there any fees or interest I should be aware of?

Yes, the app discloses the APR rates before you borrow. Typical rates range from 6.63% to 35.99%, with detailed costs shown during application.

Can I borrow even if I have a poor credit score?

Yes, the app assesses your overall financial situation holistically, making it accessible to users with bad or no credit.

Is there a subscription fee for using the app?

The app itself is free to download and use; however, loan fees and interest are paid based on your borrowing terms, not a subscription.

What should I do if I encounter a technical issue?

Contact our support team through Settings > Help & Support for troubleshooting assistance or further guidance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4