- Developer

- Credit Karma, LLC

- Version

- 25.50.1

- Content Rating

- Everyone

- Installs

- 0.05B

- Price

- Free

- Ratings

- 4.8

Intuit Credit Karma: Your Personal Financial Wellness Companion

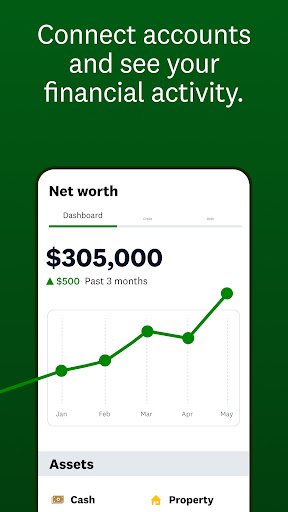

Imagine having a friendly financial advisor right in your pocket—that's what Intuit Credit Karma offers. This free app from Intuit is designed to help users monitor their credit scores, find personalized loan offers, and take proactive steps towards improving their financial health. Whether you're just starting to build credit or aiming to optimize existing financial strategies, Credit Karma acts as a comprehensive guide, making complex financial data accessible and actionable for everyday users.

Behind the Scenes: Who's Crafting This Financial Ally?

Developed by Intuit Inc., a powerhouse renowned for financial and accounting software like QuickBooks and TurboTax, Credit Karma benefits from a strong legacy of financial expertise and cutting-edge technology. The team behind the app combines data security with user-centric design, ensuring that your sensitive financial information remains protected while being easy to understand and use. Their goal is to democratize financial literacy, empowering users to make smarter money decisions with tools that are both robust and intuitive.

Key Features That Shine Bright

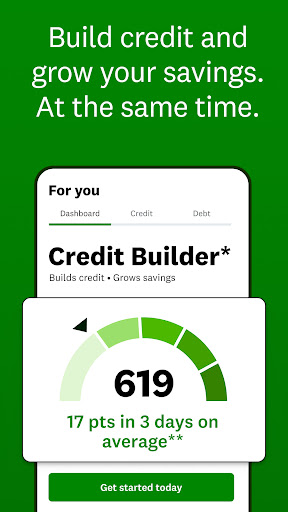

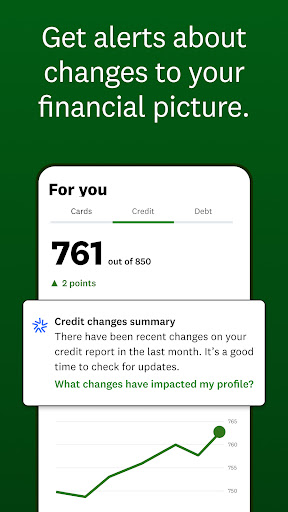

- Free Credit Score Monitoring and Reports: Regular updates on your credit score, accompanied by detailed reports, enable users to stay informed about factors influencing their scores. The transparency helps users identify areas for improvement without the pressure of hidden fees.

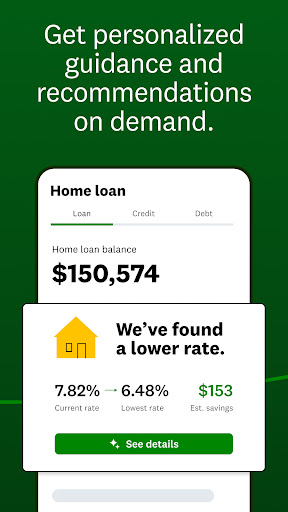

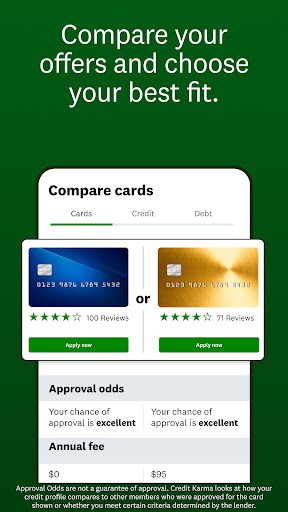

- Personalized Loan and Credit Card Recommendations: Based on your credit profile, the app suggests tailored financial products that meet your needs, saving time and reducing the guesswork when shopping for loans or credit cards.

- Credit Score Simulator and Financial Health Tools: Want to see how paying off debt or opening a new account might impact your score? The app's simulation tools provide insights, making it easier to plan future financial moves with confidence.

- Identity Theft and Fraud Protection: Built-in alerts and monitoring services help safeguard your identity, adding an extra layer of security to your financial journey.

Engaging the User Experience: Smooth and Friendly

Credit Karma's interface resembles a well-organized, friendly dashboard—think of it as your financial command center. The color palette is calming, with intuitive icons guiding you seamlessly through various sections. Navigating from your credit score overview to personalized recommendations feels as effortless as flipping through a well-loved magazine. The app's responsiveness is commendable; tasks like updating your report or viewing new loan offers happen swiftly, making you feel in control rather than bogged down by complexity.

Learning curve? Fairly gentle. New users quickly grasp how to interpret their credit reports thanks to straightforward language and helpful tooltips. Even those unfamiliar with credit metrics will find it accessible, thanks to step-by-step explanations and visual charts illustrating each component of their credit profile.

What Sets Credit Karma Apart: Security & Transaction Experience

While many financial apps emphasize tools and offers, Credit Karma distinguishes itself with a dual emphasis on security and user trust. Its credit report data is sourced directly from major credit bureaus, ensuring accuracy and timeliness—akin to having a reliable compass in the often foggy terrain of personal finance. Moreover, the app encrypts all data and adheres to strict privacy standards, which is crucial given the sensitive nature of credit information.

Another notable edge is its seamless integration of educational content within the transactional experience. Instead of just presenting offers or scores, Credit Karma provides contextual insights—such as explaining what factors are dragging down your score or how specific actions can help improve it. This layered approach transforms the app from a mere monitoring tool into an active financial coach.

Recommendation & Usage Suggestions

Overall, I'd recommend Credit Karma as a must-have tool for anyone interested in maintaining or improving their credit health without extra cost. Its user-friendly interface, personalized recommendations, and focus on security make it a standout among free financial apps. For users who are proactive about their finances or just beginning to explore credit management, this app functions like a helpful GPS—guiding you steadily toward your financial destination.

However, keep in mind that while Credit Karma provides valuable insights and recommendations, it's wise to supplement it with other financial planning tools or professional advice for comprehensive wealth management. Use it as your starting point, a safe and informative companion that demystifies your credit landscape and helps you stay on course.

Pros

- Comprehensive Credit Score Tracking

- Free Credit Reports and Monitoring

- Personalized Financial Tips

- User-Friendly Interface

- Identity Theft Protection Features

Cons

- Limited Loan and Credit Product Offers (impact: low)

- Occasional Data Sync Delays (impact: medium)

- Feature Limitations for Free Users (impact: low)

- Notification Overload (impact: low)

- Data Privacy Concerns (impact: medium)

Frequently Asked Questions

How do I get started with Intuit Credit Karma on my phone?

Download the app from App Store or Google Play, open it, and sign up with your basic personal information for quick setup.

Is it free to use all features of Credit Karma?

Yes, most features like credit monitoring and account connections are free; optional premium services may require a subscription.

How do I link my bank accounts to the app?

Go to Settings > Accounts > Link Bank Accounts, then follow prompts to securely connect your financial accounts.

How can I check my credit score regularly?

Your credit score updates automatically; access it on the Home Screen or under the Credit Score section for real-time updates.

Where can I see what's affecting my credit score?

Navigate to the Credit Report Card in the app to see factors impacting your score, with straightforward explanations.

How can I explore loan options and compare rates?

Visit the Loan Offers section in the app to view tailored loan options and interest rates suited to your profile.

Can I open a bank account within Credit Karma?

Yes, you can open Credit Karma Money Spending and Savings accounts directly through the app under the Banking section.

Does Credit Karma offer insurance comparisons?

Yes, go to the Insurance section to compare policies like car insurance, helping you find affordable options.

Are there any costs for premium features or upgrades?

Premium features are available for a fee; however, the core credit monitoring and financial tracking are free.

What should I do if the app isn't updating my credit score?

Force close the app and reopen, or check your internet connection; if issues persist, contact support via Settings > Help & Support.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4