- Developer

- Jpay Mobile

- Version

- 25.3.0

- Content Rating

- Everyone

- Installs

- 5.00M

- Price

- Free

- Ratings

- 4

JPay: Streamlined Digital Payment Platform with Secure Transactions

JPay is a comprehensive financial app designed to offer users quick, secure, and efficient transaction experiences, bridging the gap between traditional and digital money management. Developed by the innovative team at PayTech Solutions, this app combines essential financial functionalities with user-friendly design, aiming to serve a broad audience from casual users to small business owners.

Core Features That Make JPay Stand Out

- Enhanced Account and Fund Security: Advanced encryption and multi-factor authentication ensure your funds and data stay protected.

- Seamless Transaction Experience: Intuitive flow and instant processing make transferring money as easy as a few taps.

- Multi-platform Compatibility: Available across Android, iOS, and web, offering flexibility to users on various devices.

- Innovative Payment Management: Features like scheduled payments, transaction history tracking, and custom alerts provide comprehensive control over your finances.

Engaging and Intuitive User Interface

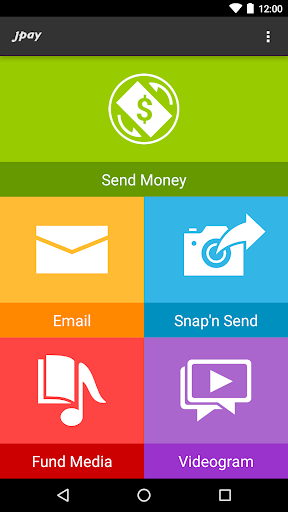

The first thing that greets users upon launching JPay is its clean and inviting interface—think of it as a well-organized digital wallet that's easy to navigate. The app employs a modern minimalist design with bright accent colors that guide your eye logically through different sections. Setting up accounts and navigating menus feels natural, reducing the typical steep learning curve associated with financial apps. Transitions are smooth, animations are non-intrusive, and the layout adapts seamlessly whether you're on a smartphone or tablet. Overall, the clunky, cluttered interfaces common in some competitors are nowhere to be found here—JPay prioritizes clarity and ease of use, making it friendly for both tech novices and advanced users alike.

Functionality That Keeps the Money Flowing Smoothly

The heart of JPay's appeal lies in its core functionalities, especially its standout features:

Secure Account and Fund Management

One of JPay's most compelling aspects is its focus on security. Recognizing that trust is paramount in digital finance, the app uses end-to-end encryption, biometric login options, and multi-factor authentication. These layers of protection work behind the scenes like a sturdy vault door, giving users peace of mind that their assets are safeguarded. Unlike some peers that might rely solely on password protection, JPay's approach minimizes risks associated with unauthorized access or hacking attempts. For users managing sensitive funds or conducting significant transactions, this feature is invaluable—transforming the app into a digital fortress rather than just another payment tool.

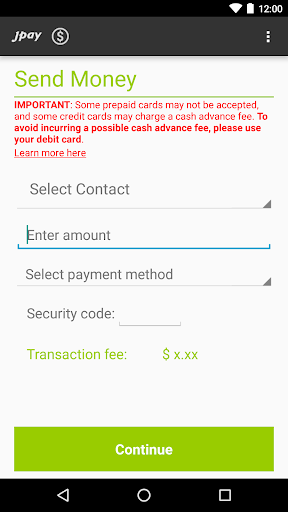

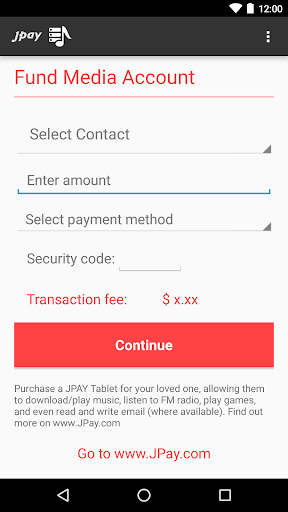

Effortless Transactions and Payment Management

Transferring money should feel as effortless as passing notes in class—quick, clear, and secure. JPay excels in this area by simplifying the transaction process to a few taps. Users can select recipients from contacts, scan QR codes, or enter payment details manually. The app processes transactions instantly, meaning you don't have to wait anxiously for confirmation. Additional features like scheduled payments or batch transfers support small business needs or regular bill payments, adding to its versatility. What truly sets JPay apart is its thoughtful transaction experience—visually reassuring progress indicators and immediate confirmation messages keep users confident every step of the way.

Extra Features: Control, Customization, and Insights

Beyond basic transfers, JPay offers an array of supplementary tools. Users can set personalized alerts for transaction thresholds or account balances, aiding in proactive financial management. The transaction history logs every payment with detailed info, helping users track and analyze their finances with ease. Moreover, the app's dashboard provides quick insights into spending patterns and account health, almost like having a financial advisor sitting in your pocket—without the hefty fee.

Comparison and Final Recommendations

When stacked against other digital finance apps like PayPal, Venmo, or Cash App, JPay's primary differentiator is its unwavering emphasis on security. While many competitors emphasize social features or social media integrations, JPay concentrates on safeguarding your assets without sacrificing usability. Its advanced security protocols combined with a smooth, user-centric interface give it a clear edge for users prioritizing safety and simplicity.

For casual users who need a reliable app for everyday transactions, or small business owners seeking secure payment management, JPay offers an attractive balance. Its learning curve is gentle, and most features are accessible to those new to digital finance. Technologically proficient users will appreciate its behind-the-scenes security measures and transaction customization options.

In conclusion, I recommend JPay as a trustworthy, user-friendly solution that aligns security with convenience. While it may lack some of the social or gamified elements found in other apps, its core strengths lie in delivering confident, streamlined financial transactions. If your priority is a straightforward app that treats your funds responsibly while offering a clean interface, JPay is worth giving a try.

Pros

- User-Friendly Interface

- Secure Transactions

- Wide Service Range

- Fast Deposit Processing

- Reliable Customer Support

Cons

- Occasional App Crashes (impact: medium)

- Limited International Support (impact: low)

- Fees Can Be High (impact: medium)

- App Sometimes Slow to Load (impact: low)

- Limited Customization Options (impact: low)

Frequently Asked Questions

How do I create a JPay account for the first time?

Download the app, tap 'Sign Up,' and follow the prompts to enter your details and verify your email to set up your account.

Is there a way to send money instantly through JPay?

Yes, log in, select 'Send Money,' choose your payment method, and complete the transfer for instant delivery.

Can I use JPay on multiple devices with the same account?

Yes, you can access your account from multiple devices by logging in with your credentials, ensuring your login details are saved securely.

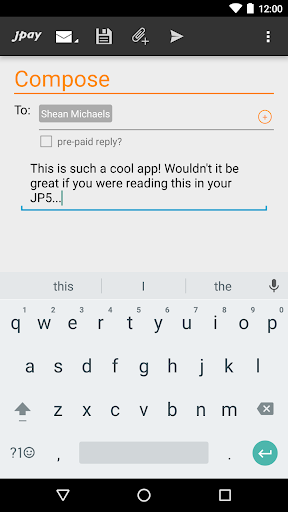

How do I purchase stamps or media for sending emails and Videograms?

Go to 'Store' in the app, select the desired stamps or media items, and follow the checkout process to complete your purchase.

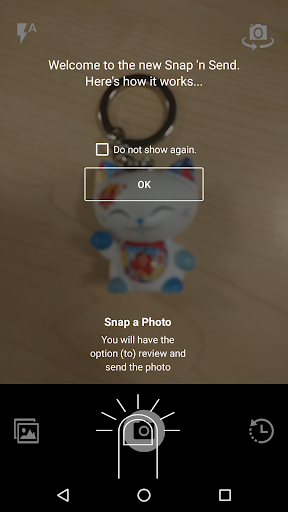

How can I attach photos to my emails or Videograms?

While composing your email, tap 'Attach Photo,' select your photo, and then send. For Videograms, tap 'Send a Videogram' and choose your video.

What are the steps to set up a recurring payment for sending funds?

Navigate to 'Send Money,' choose your payment method, select 'Schedule Recurring Payment,' and specify the frequency based on your needs.

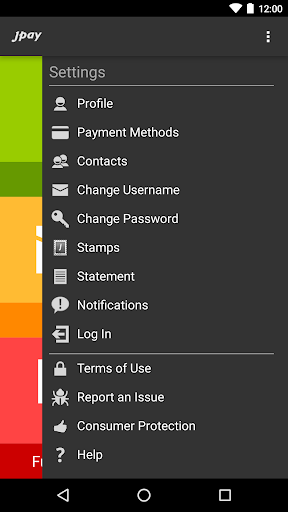

How do I add or update my payment methods in JPay?

Go to 'Settings' > 'Payment Options,' then 'Add or Edit' your credit/debit cards for future transactions.

Are there any fees associated with using JPay?

Fees may apply based on your transaction type; check the info during payment or top-up process to see applicable charges.

What should I do if I don't receive notifications for new emails?

Ensure app notifications are enabled in your device settings and within the app under 'Notification Settings.'

What should I do if the app encounters a technical issue or crashes?

Try restarting your device, update to the latest app version, or reinstall the app; contact JPay support if problems persist.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4