- Developer

- Kikoff Inc.

- Version

- 1.155.2445

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.8

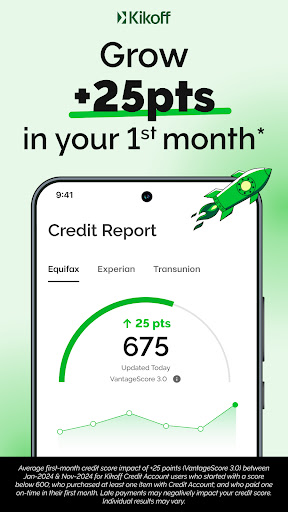

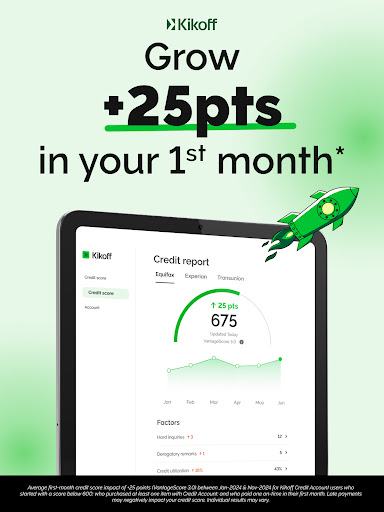

Introducing Kikoff - Build Credit Quickly: Your Friendly Financial Companion

Kikoff is a user-centric mobile application designed to help individuals establish and improve their credit scores through simple, accessible tools. Created by the innovative team at Kikoff Inc., this app targets those who are new to credit building or looking for a straightforward way to boost their financial health without the complexity often found in traditional credit services. Its standout features include a dedicated credit-building plan, an educational resource hub, and seamless transaction management, all tailored to empower users to take control of their financial future.

A Fresh Approach to Building Credit: A Bright Spot in the Financial Landscape

Imagine planting a tiny seed and watching it sprout into a robust tree—that's akin to how Kikoff nurtures your credit journey. Unlike many conventional apps that bombard you with jargon and complicated procedures, Kikoff offers a friendly, approachable pathway toward creditworthiness. Its intuitive design makes the process feel less like a chore and more like an empowering experience. Whether you're just starting out or trying to repair past credit issues, Kikoff positions itself as a supportive partner, offering a gentle yet effective push toward your financial goals.

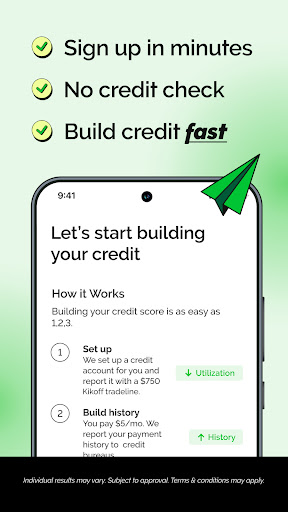

Core Feature 1: Tailored Credit Building Plan

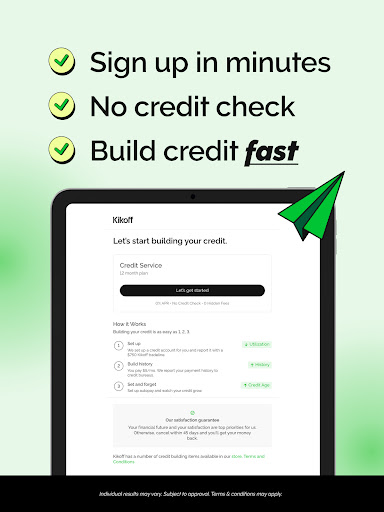

The heart of Kikoff lies in its personalized credit-building strategy. Upon setup, the app evaluates your financial profile and then crafts a plan that includes small, manageable transactions and reporting activities that influence your credit score. Think of it as a personalized workout plan, but for your credit—gradually increasing in intensity as your confidence and score grow. The app ensures that your actions—like responsible payments or paid-off accounts—are reported to major credit bureaus, helping you establish a solid credit history efficiently.

User Experience & Unique Edge

The interface for this feature is clean, with visual progress bars and friendly prompts guiding you step-by-step. Operation is smooth, with minimal lag or confusing menus, making it accessible even for those new to financial apps. What sets Kikoff apart here is its focus on fostering trust and understanding—users aren't just executing commands; they're learning how each action impacts their credit, thanks to integrated educational insights that demystify credit-building fundamentals.

Core Feature 2: Simplified Transaction Management & Automatic Reporting

Traditional credit apps often make users jump through hoops to manually report or track payments. Kikoff simplifies this by enabling seamless transaction handling within the app—think of it as having your financial assistant. Users can schedule payments, view transaction histories, and have these activities automatically reported to credit bureaus, all without leaving the app environment. This reduces the chance of missed updates or delays, ensuring your efforts are consistently recognized.

User Experience & Unique Edge

The transaction interface is intuitive, resembling familiar banking apps but with a focus on credit-building transactions. The app's automatic reporting feature is a standout: it works quietly in the background, akin to a diligent assistant, ensuring your positive activities boost your score without extra effort. This transparency and automation offer a significant advantage over competitors that require manual reporting, giving users peace of mind and a reliable growth pathway.

Design, Usability, and Unique Benefits

Visually, Kikoff boasts a friendly and minimalistic design that reduces intimidation and promotes trust—think of it as the cozy corner café of finance apps. Navigation is straightforward; the main features are just a tap away, and the onboarding flows smoothly, making it easy for beginners to jump right in. Responsiveness is high—no annoying lag or crashes—and the app's learning curve is gentle, thanks to contextual tips and educational snippets embedded throughout.

Comparing Kikoff with other financial apps, its standout attribute is its dedicated emphasis on credit-building specifically for those with limited or poor credit histories. While many apps bundle multiple financial tasks, Kikoff hones in on the core mission—building credit—offering a more focused, trustworthy experience. Plus, its automatic reporting process enhances transaction experience by reducing hassle and ensuring timely updates, giving users a clear, steady path to improvement.

Final Verdict and Recommendations

In conclusion, Kikoff is a thoughtfully designed, user-friendly app that effectively bridges the gap between financial novices and their goal of a healthy credit profile. Its most notable feature—the automatic, ongoing credit reporting—sets it apart, making it a reliable tool for those starting fresh or rebuilding credit without the headaches of manual tracking or complex procedures. I recommend it for anyone looking for a straightforward, educational, and efficient way to build credit with minimal fuss.

Whether you're a young professional, a student, or someone aiming to repair credit, Kikoff offers a promising, approachable solution. Just remember, building credit takes time, but with consistent use of this app's features, your financial future can flourish like a well-tended garden. Keep patience, stay responsible, and let Kikoff guide you to your credit goals—it's like having a friendly financial coach right in your pocket.

Pros

- Effective Credit Building Tools

- No Credit Check Application

- Transparent Fee Structure

- Educational Resources

- Fast Credit Increase Potential

Cons

- Limited Credit Limits (impact: medium)

- Limited Credit Reporting Partners (impact: medium)

- No Debit Option (impact: low)

- Customer Support Accessibility (impact: low)

- Initial Credit Line Funding (impact: low)

Frequently Asked Questions

How do I get started with Kikoff and build my credit?

Download the app, sign up with basic info, choose a plan, and you'll receive a credit line to start using and paying responsibly to build your credit.

Is there a credit check needed to join Kikoff?

No, Kikoff doesn't require a credit check; you can sign up quickly and easily within a few minutes.

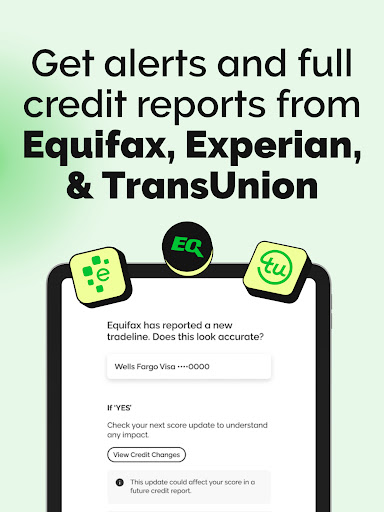

How does Kikoff report my payments to credit bureaus?

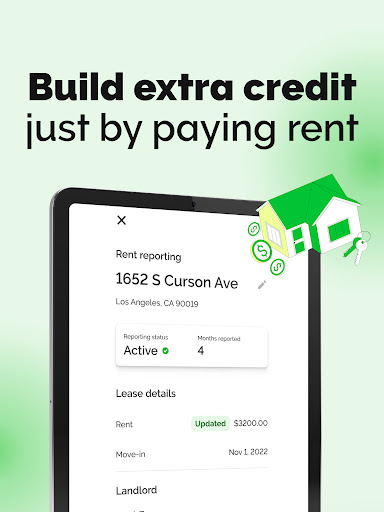

Your on-time payments are reported monthly to Equifax, Experian, and TransUnion, via your active credit account, helping improve your credit score.

What is the difference between the Basic and Premium plans?

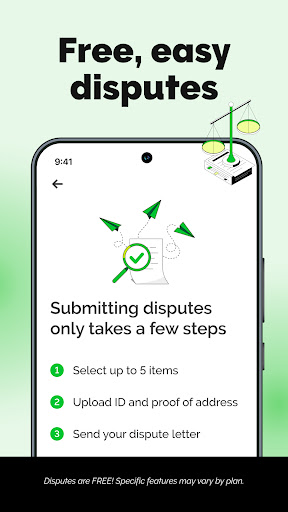

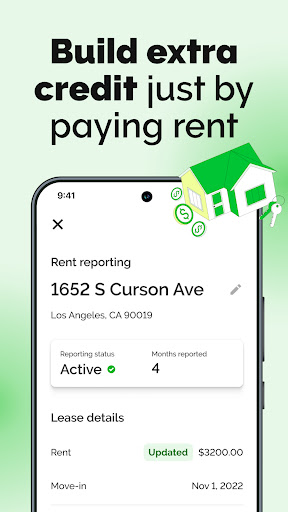

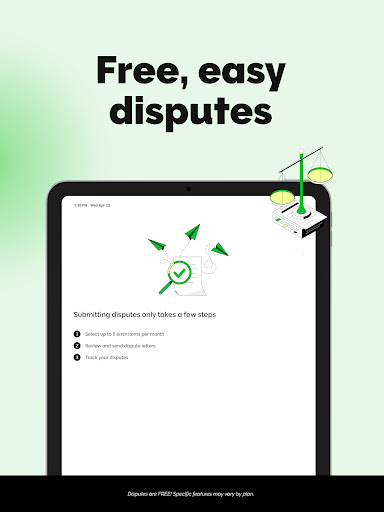

The Basic plan costs $5/month, while the Premium plan is $20/month and offers additional features like Rent Reporting and error flagging on your credit report.

How can I ensure I use Kikoff responsibly to build credit?

Make small purchases using your credit line and pay them on time — enabling AutoPay helps automate timely payments and maintain low utilization.

Can I set up automatic payments with Kikoff?

Yes, you can turn on AutoPay in the app settings (Settings > AutoPay) to automatically pay your balances on schedule.

What features does Kikoff have to help me track my progress?

Kikoff provides insights into your credit score evolution, displays your payment history, and offers tips to improve your financial health within the app.

How do I upgrade or change my subscription plan on Kikoff?

Go to Settings > Account > Subscription to upgrade or modify your plan; changes typically take effect immediately or on your next billing cycle.

Are there any hidden fees or interest charges with Kikoff?

No, Kikoff is transparent—pay only what you owe for purchases, with no interest or hidden fees involved.

What should I do if I encounter errors on my credit report or the app?

Report errors through the app's support section (Settings > Support) and contact customer service for assistance in resolving issues.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4