- Developer

- Klover Holdings

- Version

- 4.89.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.6

Introducing Klover – Instant Cash Advance: Your Friendly Financial Sidekick

Klover is a user-centric app designed to provide instant access to cash advances, making short-term financial needs more manageable without the hassle of traditional credit checks or high-interest debts. Developed by a dedicated team committed to transparent and accessible financial tools, Klover stands out by prioritizing user privacy, security, and ease of use. Its core features include real-time cash advances with minimal friction, earning opportunities through survey participation, and personalized financial insights. This app is primarily aimed at young working adults, gig economy workers, and anyone seeking quick, straightforward financial relief without the complexities of conventional borrowing.

Engaging and Seamless: A Fresh Take on Financial Assistance

Imagine a friend who always has your back when unexpected expenses pop up — that's what Klover aims to be. Whether it's an urgent medical bill or an unexpected car repair, Klover offers instant financial breathers with just a few taps. Its intuitive design feels like chatting with a helpful buddy rather than navigating a complex financial portal. Let's delve deeper into what makes Klover a noteworthy participant in the crowded realm of financial apps.

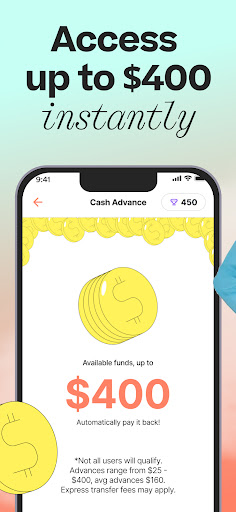

Core Functionality: Instant Cash, Zero Hassle

At the heart of Klover is its seamless cash advance feature. Unlike traditional lenders that demand mountains of paperwork and long approval times, Klover leverages alternative data and smart algorithms to evaluate eligibility swiftly. Users can request small advances—up to a few hundred dollars—directly through the app, with funds typically transferred into their bank account within minutes. The process is straightforward: set the amount, confirm your details, and voila — immediate cash in hand.

The standout here is the app's commitment to transparency. There are no hidden fees or predatory interest rates. Instead, users see a clear payback structure, and repayment is conveniently scheduled. This feature is especially valuable for gig workers or freelancers who lack access to traditional credit lines, offering a lifeline when they need it most.

Earn While You Use: Turning Time Into Money

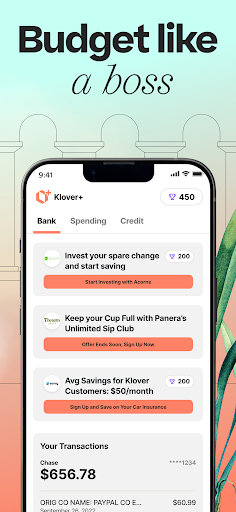

Beyond cash advances, Klover offers an innovative way to boost your income through surveys and market research activities directly within the app. This feature transforms idle moments into earning opportunities, akin to turning a coffee break into a mini side hustle. The app's interface makes participation simple and engaging, with frequent survey options tailored to user demographics. It's an excellent way to supplement income without any extra financial risk, making Klover more than just a borrowing tool—it's also a small earning platform.

This unique feature sets Klover apart from comparable finance apps that typically focus solely on lending. By incorporating micro-earnings, it encourages ongoing engagement and offers tangible value beyond just borrowing capabilities.

User Experience: Friendly Design Meets Practical Functionality

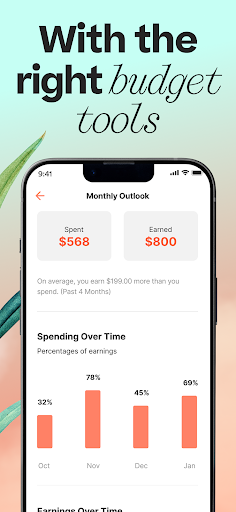

From the moment you open Klover, its warm, approachable aesthetic immediately feels less intimidating than traditional banking apps. The clean, colorful interface is like a well-organized workspace—each feature logically arranged, reducing the learning curve. Navigating through available options feels like flipping through a familiar menu rather than deciphering an unfamiliar code.

Operationally, the app boasts smooth transitions and minimal lag. Requests are processed quickly, and notifications help users stay informed about repayment deadlines or new survey opportunities. Even those inexperienced with financial apps should find it easy to adapt—thanks to clear prompts and helpful tips integrated into the experience.

Security-wise, Klover employs robust encryption standards, ensuring sensitive information remains protected. Unlike some apps that merely claim security, Klover's commitment is evident through transparent privacy policies and measures to prevent fraud or unauthorized access—further reinforcing trustworthiness.

What Makes Klover Stand Out? Unique Features You'll Love

While many financial apps offer cash advances, Klover's most distinctive feature is its combination of accessible borrowing with earning potential through micro-surveys. This dual approach transforms it from a mere loan provider into a progressive financial tool. Another key highlight is its focus on security; by avoiding invasive credit checks and prioritizing user data protection, Klover appeals to users cautious about privacy—an increasingly important concern today.

Furthermore, the app's transparent fee structure and repayment plans ensure users are never caught off guard, fostering a sense of trust and control. Its emphasis on simplicity and security creates a user experience that feels both empowering and safe.

Assessment and Recommendations

Overall, Klover delivers a reliable, user-friendly solution for those in need of quick cash without the complexities associated with traditional lending. Its standout features—instant cash access and earning opportunities—are well-implemented, making it an attractive option for a broad demographic. However, users should keep in mind that the cash advances are meant for short-term needs; long-term financial planning requires additional tools.

For individuals seeking a trustworthy, easy-to-use app that not only provides quick financial relief but also offers opportunities to earn, Klover is highly recommended. Beginners will appreciate its gentle learning curve, while more experienced users will value its security and transparency. As with all financial decisions, consider your own circumstances and use the app responsibly.

Final Thoughts: A Practical Friend in Your Pocket

In summary, Klover is much more than a typical cash advance app—it's a friendly financial companion that values transparency, security, and user empowerment. Its innovative blend of quick borrowing and earning opportunities makes it a standout choice for modern consumers who desire simplicity without sacrificing confidence. Whether you're facing a sudden expense or just looking to supplement your income during a busy week, Klover might just be the practical, trustworthy helper you've been seeking.

Pros

- User-friendly interface

- Instant access to funds

- No credit check required

- Financial management tools

- Clear fee disclosures

Cons

- Limited cash advance amount (impact: medium)

- Potential fee charges (impact: low)

- Availability varies by location (impact: medium)

- Limited credit-building benefits (impact: low)

- Dependence on mobile device (impact: low)

Frequently Asked Questions

How do I sign up and start using Klover?

Download the app, provide your basic info, link your bank securely via Settings > Account, and request your first cash advance within minutes.

What information do I need to link my bank account?

You need your bank login credentials or bank account details, which you can securely connect through the app during setup under Settings > Link Bank.

How do I request a cash advance in Klover?

Open the app, tap 'Request Cash', choose the amount up to $250, review any optional fees, and confirm your request in the main interface.

What is the maximum cash advance I can get with Klover?

You can receive up to $250, depending on your eligibility and account activity, processed quickly after your request.

How does Klover decide my eligibility for cash advances?

Eligibility is based on your linked bank data, earnings, and usage activity, assessed automatically without credit checks.

Are there any fees or interest for using Klover's cash advances?

No, Klover offers interest-free cash advances up to $250 with no late fees or interest charges; optional delivery fees may apply for faster service.

Can I earn rewards or points with Klover?

Yes, participate in surveys, watch ads, and complete savings milestones in Klover+ to earn points redeemable for larger advances or sweepstakes entries.

How do I access the budgeting tools and credit monitoring features?

These are accessible via the Klover+ section; go to Settings > Klover+ to set spending goals, track your credit score, and monitor savings progress.

Is Klover a loan provider and what are my repayment obligations?

Klover offers advance services, not traditional loans; repaid automatically when your next paycheck arrives, with no interest or fixed schedule.

What should I do if my cash advance request is delayed or not received?

Check your bank account and app notifications for status updates; if issues persist, contact Klover support via Settings > Help for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4