- Developer

- Merrick Bank

- Version

- 4.36.6

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.5

Introducing Merrick Bank Mobile: Your Trusted Financial Companion

Merrick Bank Mobile is a comprehensive banking application designed to provide users with seamless access to their financial accounts, innovative tools for managing credit, and enhanced security features—all wrapped in a user-friendly interface. Developed by Merrick Bank, a reputable financial institution, this app aims to simplify everyday banking activities while ensuring peace of mind for its users.

Key Features that Make It Stand Out

- Real-Time Account Monitoring: Stay updated with instant notifications and balance updates.

- Secure Credit Management: Easily view and manage credit lines, monitor credit scores, and make payments.

- Robust Security Measures: Advanced authentication and fraud detection to safeguard user data.

- User-Centric Design: An intuitive interface tailored for both tech-savvy users and newcomers.

Engaging First Impressions: A Digital Pocket with a Personal Touch

Imagine having your financial universe at your fingertips—whether you're grabbing a quick coffee or planning a big purchase—Merrick Bank Mobile transforms your smartphone into a personal finance assistant. Its sleek interface and smooth flow make navigating your accounts feel natural, like turning the pages of a familiar book. As someone who appreciates effortless experiences, I found this app to be a reliable companion that respects my time and priorities, subtly turning complex banking tasks into simple gestures.

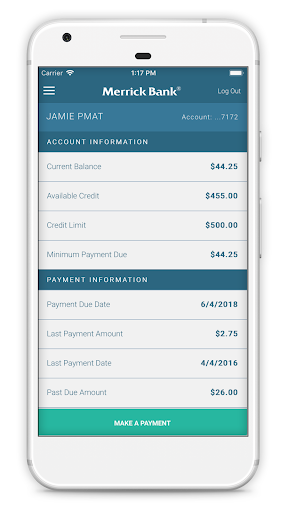

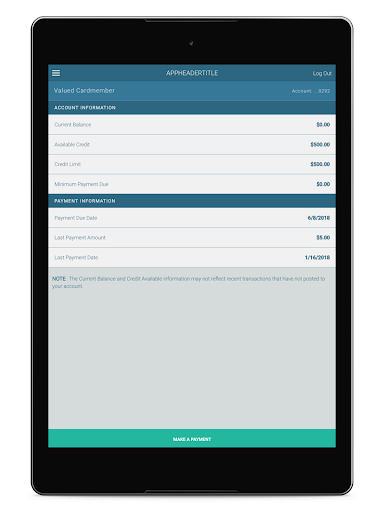

Account Overview and Transaction Tracking: Your Financial Dashboard

First up is the core bread and butter—account overview. The app organizes your balances, recent transactions, and pending activities in a clear, easy-to-scan format. The real-time updates mean no more guessing or refreshing multiple screens; it's like having a financial dashboard that breathes and keeps you in the loop at all times. Transactions are just a tap away, with detailed descriptions and categorization that help you understand your spending habits without extra effort. This level of transparency helps build confidence and makes financial tracking an empowering experience.

Compared to similar apps, Merrick Bank Mobile's emphasis on real-time alerts and transaction clarity elevates the user experience. It's particularly useful for users who want quick oversight without sacrificing detail or security—a perfect blend of simplicity and sophistication.

Credit Management with a Personal Touch

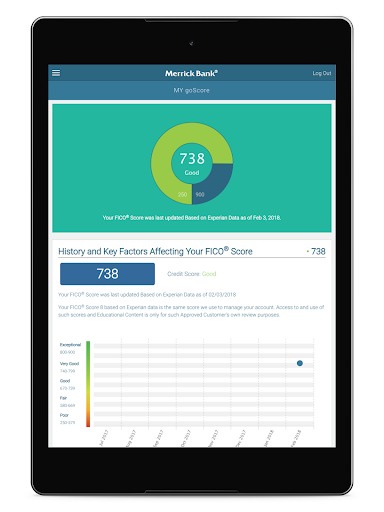

Perhaps the most compelling feature is the app's credit management tools. Users can effortlessly view their available credit, upcoming payments, and credit score updates—everything within a few taps. The app even offers personalized tips to improve credit health, turning the sometimes intimidating world of credit scores into an accessible, educational journey. The ability to manage payments directly through the app, coupled with alerts for due dates, reduces the risk of missed payments—a common headache in financial management.

This capability puts Merrick Bank Mobile ahead of many competitors, which often silo credit info or require separate portals. Its integrated approach offers a holistic view that helps users make smarter financial decisions without switching apps or digging through paper statements.

Security and User Experience: Trust and Ease Combined

Security is the backbone of any financial app, and Merrick Bank Mobile shines here. The app employs multi-factor authentication, biometric login options, and intelligent fraud detection algorithms—much like having a security guard watching your financial porch. These measures make it reassuring to perform sensitive actions, such as transferring money or updating personal info.

On the usability front, the app's layout is intuitive, with a clean design that feels reassuring and familiar. The learning curve is modest; most navigation flows are self-explanatory, reducing frustration for first-time users. Tasks that might take multiple steps in other apps are streamlined here, making routine activities quick and painless.

What Makes Merrick Bank Mobile a Particular Winner?

Among its peers, Merrick Bank Mobile's standout features are its focus on security and integrated credit management. Its ability to provide real-time transaction visibility combined with powerful yet straightforward tools to monitor and improve your credit profile makes it particularly valuable for users seeking both control and reassurance. Its seamless experience reduces cognitive overload, turning a potentially daunting financial management process into a straightforward, even enjoyable, activity.

Final Recommendations: Is It for You?

If you value security, straightforward access to your financial data, and integrated credit tools in a user-friendly package, Merrick Bank Mobile is worth trying out. It's especially suitable for users who prefer to keep things simple but expect depth when needed—like having a reliable financial buddy that's always ready to help. For those who are already Merrick Bank customers or those considering their services, this app offers a cohesive, trustworthy platform that enhances everyday banking experiences.

Pros

- User-Friendly Interface

- Quick Account Access

- Secure Login Features

- Comprehensive Financial Tools

- Responsive Customer Support

Cons

- Limited Card Management Options (impact: Medium)

- Some Users Experience App Crashes

- Delayed Transaction Updates (impact: Low)

- Minimal Budgeting Features (impact: Low)

- Limited Customization Options (impact: Low)

Frequently Asked Questions

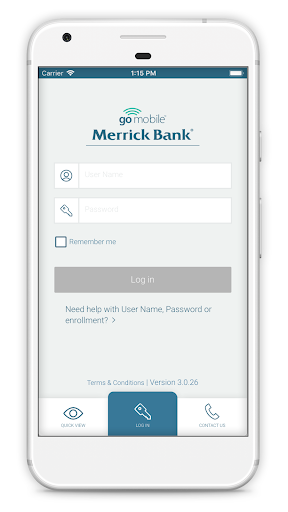

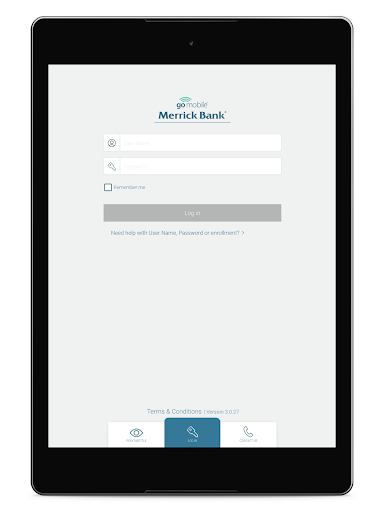

How do I get started with the Merrick Bank goMobile app?

Download the app from Google Play, then log in using your existing Cardholder Center credentials or sign up at merrickbank.com. The app will sync automatically for easy access.

Is the Merrick Bank goMobile app free to use?

Yes, the app is completely free. Simply download and register to enjoy secure mobile banking features without extra charges.

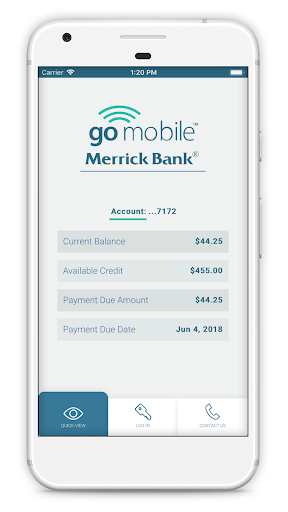

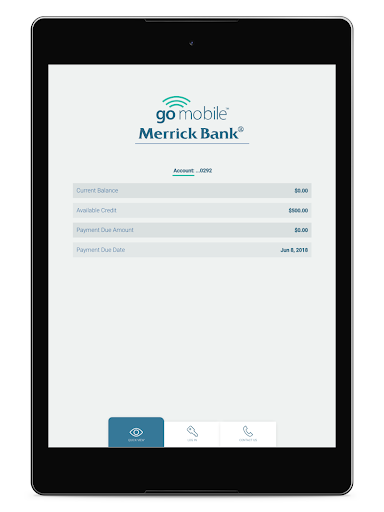

How can I check my account balance and recent transactions?

Open the app, log in, then navigate to the 'Accounts' tab to view your current balance and recent transaction history easily.

How do I set up alerts for transactions and account activities?

Go to Settings > Notifications in the app, then enable alerts for transactions, payments, and other account activities according to your preferences.

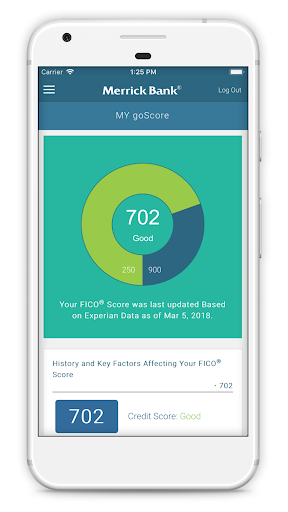

How can I monitor my FICO® Score through the app?

Access goScore® feature by navigating to the main menu under 'FICO® Score' to view your credit health anytime.

How do I deposit checks using the mobile check deposit feature?

Select 'Deposit Checks' from the main menu, snap clear photos of the check's front and back, then submit for deposit directly into your account.

Can I freeze or unfreeze my card via the app if I suspect fraud?

Yes, go to 'Card Controls' in the app, then select the option to temporarily freeze or unfreeze your card instantly.

Are there any subscription fees or charges to use the app's features?

No, the Merrick Bank goMobile app is free; however, check your account for any standard transaction or banking fees.

What should I do if the app crashes or I encounter errors during mobile check deposit?

Try restarting your device, ensure the app is updated, or contact customer support if issues persist for assistance.

Does the app support fingerprint or biometric login for added security?

Yes, enable Fingerprint ID under Settings > Security in the app for quick and secure access to your account.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4