- Developer

- Mission Lane, LLC

- Version

- 10.0.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.8

Mission Lane: A Fresh Take on Personal Finance Management

In a landscape flooded with financial apps, Mission Lane stands out by combining user-friendly design with robust security features, aiming to help individuals build credit and manage their finances with confidence and ease.

Developed by a Committed FinTech Team

Created by Mission Lane Inc., a dedicated financial technology company focused on providing accessible credit-building solutions, the app is built with the goal of empowering users to achieve financial stability through transparency and innovative tools.

Key Features That Make a Difference

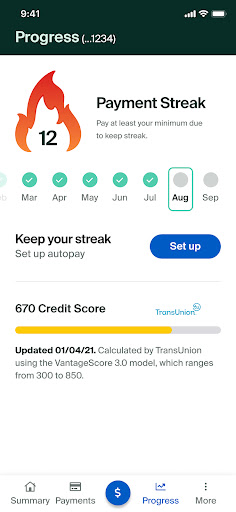

- Credit Building Focus: Designed specifically to help users improve their credit scores through responsible borrowing and timely payments.

- Enhanced Security Measures: Incorporates advanced account and fund security protocols, giving users peace of mind about their financial data.

- Intuitive Transaction Experience: Provides a seamless and transparent way to monitor and manage transactions, making financial tracking straightforward and stress-free.

- Personalized Financial Insights: Offers tailored advice based on users' financial behavior to promote responsible money habits.

Stepping Into the Mission Lane Experience

Imagine opening a financial app that feels like having a trusted friend guiding your money journey—friendly, clear, and insightful. Mission Lane delivers on this promise with an interface that welcomes users with simplicity while hiding powerful features beneath the surface. It's like walking into a well-organized workspace where every tool and button is thoughtfully placed—making your financial management not just effective but also enjoyable.

User Interface: Clean, Clear, and Friendly

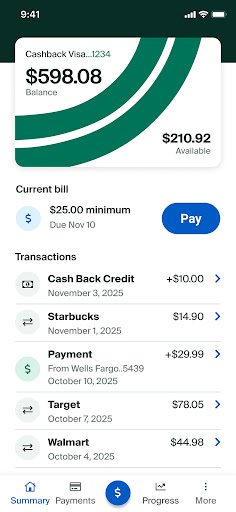

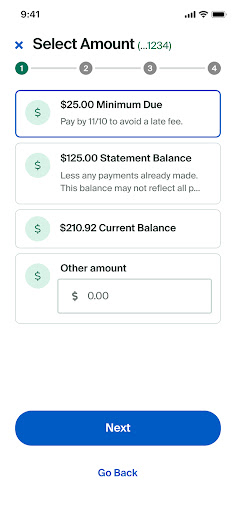

One of the app's standout qualities is its uncluttered user interface. Designed with minimalism in mind, it employs soothing color schemes and intuitive icons that make navigation feel natural. Whether you're a financial novice or seasoned budgeter, the interface reduces cognitive load and invites you to explore. Fitness trackers for your credit score, transaction history, or personalized tips are just a tap away, and the visual data representations—charts and graphs—are both appealing and easy to interpret.

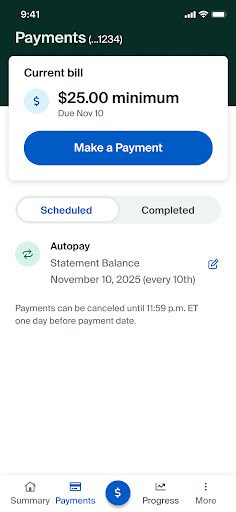

Core Functionality: Building Trust and Monitoring Progress

The heart of Mission Lane lies in its dedicated credit-building tools. Users can see their credit score evolve in real-time, understanding how each payment influences their profile. The app provides clear explanations for credit score changes, turning a potentially opaque process into a transparent learning experience. Its transaction monitoring feature organizes expenses into categories, enabling users to see where their money goes, fostering better financial habits. Transactions are updated swiftly, with notifications that keep users informed without overwhelming them—making the app feel like a personal financial assistant whispering updates into your ear.

Security and Transaction Experience: Like a Digital Fortress

Security is a cornerstone of Mission Lane. Its use of multi-layered encryption, biometric authentication, and real-time threat detection mirrors the durability of a fortress built to defend your digital assets. Unlike some apps that treat security as an afterthought, Mission Lane integrates these measures seamlessly into its user experience. The transaction process is smooth, with instant confirmation and easy dispute resolution options, ensuring users can manage their funds confidently. This kind of security-focused design is especially vital in today's environment where digital threats are ever-evolving.

Comparing Mission Lane: What Sets It Apart?

While many financial apps focus on spending tracking or investment portfolios, Mission Lane's prime highlight lies in its dedicated credit-building features paired with high-tier security. Its real-time credit monitoring and tailored educational content help users demystify their credit profiles—something most apps only touch upon superficially. Additionally, the app's security protocols are like having a personal security guard—integrated, unobtrusive, and reliable—ensuring your financial data remains safe without complicating your experience.

Would I Recommend Mission Lane?

If you're someone who cares about building or improving your credit and values a secure, hassle-free interface, Mission Lane is an excellent choice. Its combination of educational insights, transparent transaction monitoring, and robust security makes it suitable for new credit users as well as more experienced individuals looking to refine their understanding of personal finance. I'd suggest giving it a try if you're ready to take proactive steps towards financial health, especially since its clear display of progress can be quite motivating.

In conclusion, Mission Lane isn't just another app—it's a practical financial companion that balances sophistication with simplicity. Its standout features, especially its real-time credit insights and state-of-the-art security, are the key reasons I recommend it for anyone seeking to manage their money wisely and confidently. So, why not give it a shot? Your future financially self will thank you.

Pros

- User-friendly interface

- Fast approval process

- Flexible credit options

- Minimal fees

- Good customer support

Cons

- Limited credit building tools (impact: Medium)

- Higher interest rates for some users (impact: High)

- Restricted to certain states (impact: Medium)

- Limited financial education resources (impact: Low)

- In-app features are somewhat basic (impact: Low)

Frequently Asked Questions

How do I create an account and get started with Mission Lane?

Download the app from your app store, open it, and follow the registration prompts by providing your personal information to set up your account.

Is Mission Lane easy to use for someone new to financial management?

Yes, Mission Lane offers a user-friendly interface designed for all experience levels, guiding you through features effortlessly.

What core features does Mission Lane provide for credit monitoring?

Mission Lane offers real-time credit score updates, credit health insights, and personalized advice accessible via the 'Credit' section in the app.

How can I review my spending habits and analyze my expenses?

Navigate to the 'Expenses' tab within the app for detailed insights and trend analysis of your spending patterns and habits.

How does Mission Lane give personalized financial advice?

Go to the 'Recommendations' section; the app analyzes your financial data and offers tailored tips to improve your credit and budgeting strategies.

Can I set up notifications for bill reminders and credit updates?

Yes, go to Settings > Notifications to enable alerts for bill reminders, credit score changes, and other important updates.

Is there a subscription fee to access all features of Mission Lane?

Mission Lane offers free features, but some advanced options may require a subscription, which you can manage in Settings > Subscription.

How do I subscribe or upgrade my plan within the app?

Open the app, go to Settings > Subscription, and follow the prompts to choose or upgrade your plan securely.

What should I do if the app crashes or experiences lag?

Try restarting the app, updating to the latest version, or reinstalling. If issues persist, contact support via Settings > Help or Feedback.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4