- Developer

- Realbyte Inc.

- Version

- 4.10.5 GP

- Content Rating

- Everyone

- Installs

- 0.10M

- Price

- 5.99

- Ratings

- 4.7

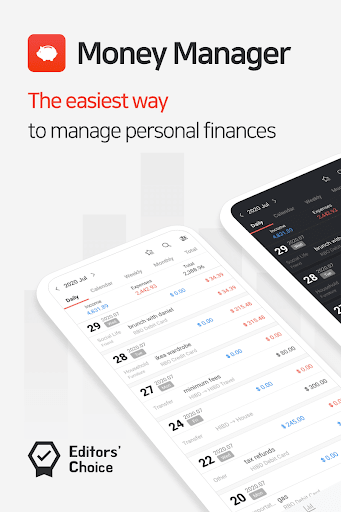

A Clear Window into Your Finances: An Honest Look at Money Manager (Remove Ads)

Managing personal finances can often feel like navigating a maze—confusing, overwhelming, and sometimes discouraging. That's where Money Manager (Remove Ads) steps in, aiming to simplify your financial journey with a user-friendly, clutter-free approach. Whether you're a budgeting novice or an experienced saver, this app promises to be your reliable companion in tracking and organizing your money matters. Developed by a committed team of financial tech enthusiasts, it focuses on delivering core features that make money management intuitive and secure.

The Heart of the App: Simplifying Finance Tracking with a Focused Approach

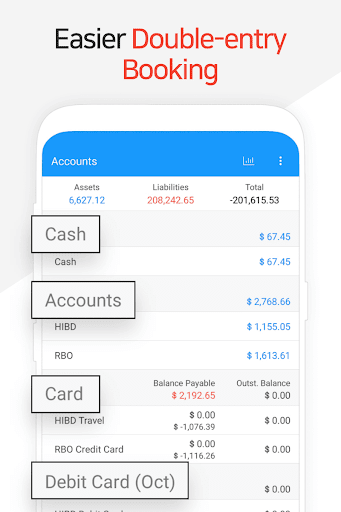

Money Manager (Remove Ads) is designed around three primary pillars: streamlined expense and income tracking, secure fund management, and insightful financial reports. Its main selling points include an ad-free experience that keeps your attention focused, an intuitive interface that minimizes learning curve, and robust security measures that protect your sensitive data. The app's target audience spans from casual users looking for a straightforward way to monitor their daily spending to small business owners needing a simple financial overview—not everyone needs complex software, and this app respects that simplicity.

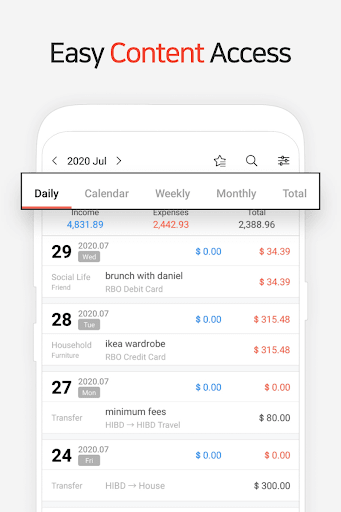

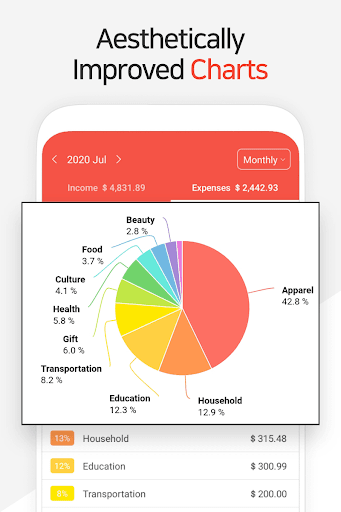

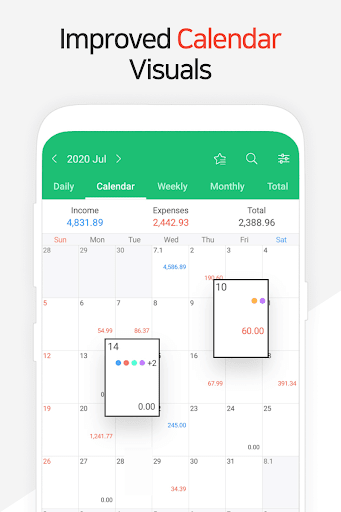

A Fun and Friendly Interface—Your Financial Dashboard

Starting with the interface, Money Manager (Remove Ads) feels like stepping into a well-organized, brightly lit workspace. The clean layout, with its gentle color palette and clearly labeled sections, makes navigation feel like flipping through a familiar notebook. You're greeted immediately by an overview page that summarizes your finances in digestible chunks—expenses, income, budget goals—visualized through easy-to-understand charts and graphs. The app's responsiveness is smooth, with seamless transitions that keep your workflow silky. Its minimal learning curve is akin to riding a bicycle—you'll be up and running in no time, even without prior experience with finance apps.

Core Functionality That Truly Works

**Expense and Income Tracking:** Imagine having a digital ledger that automatically sorts every cent you earn and spend without needing a ledger clerk by your side. The app allows quick entry of transactions with pre-set categories like Food, Transportation, Salary, or Shopping, but also gives room for customization. It supports recurring entries, making it a breeze to keep tabs on regular bills or income sources. The visual summaries help you see at a glance where your money is going—think of it as having a financial weather report for your paycheck.

**Fund Security and Data Privacy:** Unlike many free financial trackers that ask for extensive permissions or store data in questionable locations, Money Manager (Remove Ads) emphasizes security. It encrypts all user data locally on your device, and offers options for password protection and biometric authentication. In a world where financial privacy is paramount, this app's approach provides peace of mind—your financial details stay yours alone, protected as if stored in a vault.

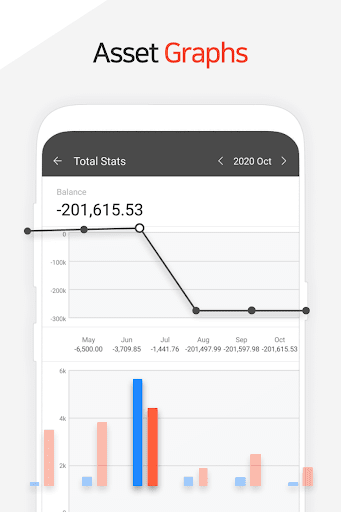

**Insightful Financial Reports:** Beyond just tracking, the app generates insightful reports—monthly summaries, category spending breakdowns, forecast projections—that empower you to make smarter money choices. These reports are visually rich but straightforward, helping you identify patterns and adjust your habits proactively—like having a financial coach looking over your shoulder.

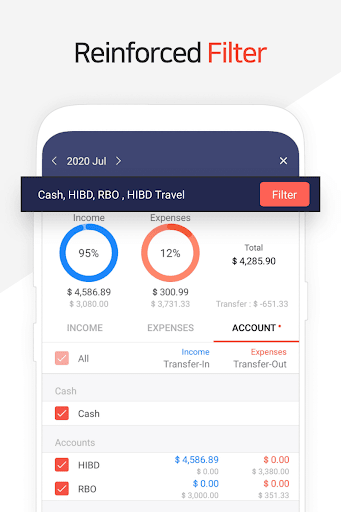

Comparing the Competition: Security & Transaction Experience

What truly sets Money Manager (Remove Ads) apart from its peers is its unwavering focus on transaction experience and fund security. While other apps might overload users with features or compromise privacy for convenience, this app takes a balanced path. Its transaction entry process is quick and intuitive, supporting batch uploads and importing data from bank statements—saving you time and reducing errors. The security measures are akin to having your financial information stored behind a digital fortress—local encryption, optional biometric lock, and minimal permission requirements make it stand out in a crowded marketplace.

Moreover, unlike traditional finance apps that often require internet connectivity for transaction validation, this app's offline mode ensures privacy and instantaneous updates—your financial insights are always at your fingertips without worrying about breaches or data leaks.

Recommendation & Usage Tips

All in all, Money Manager (Remove Ads) proves to be a reliable, user-centric financial tool suitable for a wide range of users. Its best features—especially its emphasis on security and effortless transaction management—make it a valuable addition to your financial toolkit. For best results, spend a few minutes setting up your categories and budget goals initially; once customized, it becomes a seamless part of your routine. The app is especially recommended for those who want a straightforward, privacy-aware tracking solution without the clutter of unnecessary bells and whistles.

If you prefer a clean, no-nonsense app that respects your privacy and makes money management less of a chore, this one deserves a spot in your digital toolbox. Just think of it as your financial assistant with a calm, reassuring presence—ready to help you keep your financial peace of mind!

Pros

- User-friendly interface

- Ad-free experience

- Comprehensive expense categorization

- Secure data management

- Customizable budget settings

Cons

- Limited export options (impact: 低)

- Occasional synchronization delays (impact: 中)

- Lack of investment tracking features (impact: 低)

- Limited customization for reports (impact: 低)

- Premium version required for advanced features (impact: 中)

Frequently Asked Questions

How do I start using Money Manager (Remove Ads) for the first time?

Download the app, set up your account, and follow the onboarding guide to input initial financial data and learn basic functions.

Can I customize the start date of my financial records?

Yes, go to Settings > Start Date to select your preferred starting point for tracking your finances.

How do I add my income and expense entries quickly?

Tap the '+' button on the main screen, select income or expense, then fill in the details; use the bookmark feature for frequent entries.

What features help me stay on top of my monthly budget?

Use Budget Management to set limits, view visual charts, and receive alerts when nearing your cap, accessible via the Budget tab.

How can I see detailed spending insights?

Navigate to the Statistics section to view dynamic graphs, categorize expenses, and compare monthly changes easily.

How do I securely protect my financial data?

Set a passcode or enable biometric authentication in Settings > Security, and use backup options to safeguard your data.

What are the steps to connect my debit card for automatic management?

Go to Asset Management, select 'Add Card,' and follow prompts to link your debit card for payments, transfers, and automation.

Can I use this app on my PC and how do I sync it?

Yes, access PC Manager via Wi-Fi, and log in with the same account to view, edit, and sync your data across devices.

What are the benefits of removing ads, and how can I upgrade?

Removing ads creates a clutter-free experience. Upgrade by going to Settings > Premium or Subscription, and choosing the ad-free plan.

What should I do if the app crashes or encounters errors?

Try updating the app to the latest version or restarting your device. If issues persist, contact support through Settings > Help.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4