- Developer

- OneTwoApps

- Version

- 9.10.1

- Content Rating

- Everyone

- Installs

- 0.10M

- Price

- 4.99

- Ratings

- 4.8

My Budget Book: your friendly financial companion

An intuitive app designed to help users effortlessly track, manage, and plan their personal finances with clarity and security.

Meet the Team Behind the Curtain

Developed by FinTech Innovators, a dedicated team committed to creating user-friendly financial tools that bridge the gap between complex budgeting concepts and everyday usability. With a focus on privacy and data security, they aim to empower users to take control of their financial journey confidently.

Top Features That Make Budgeting a Breeze

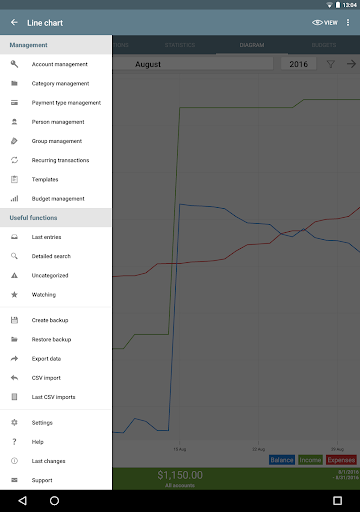

- Smart Expense Categorization: Automatically sorts transactions into relevant categories, saving time and reducing manual input.

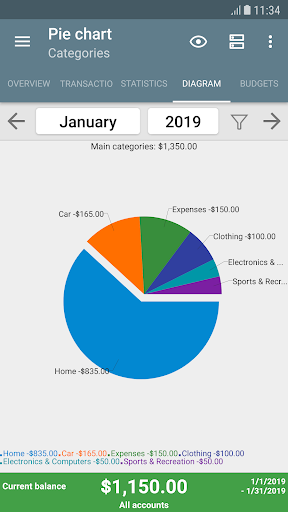

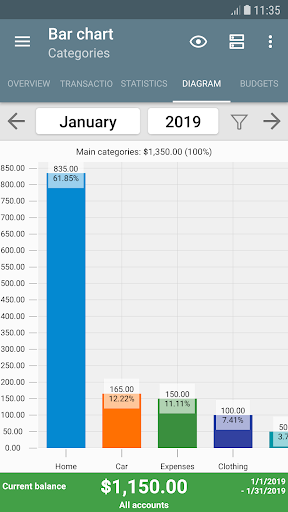

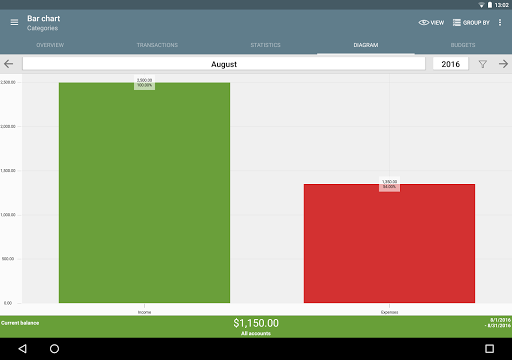

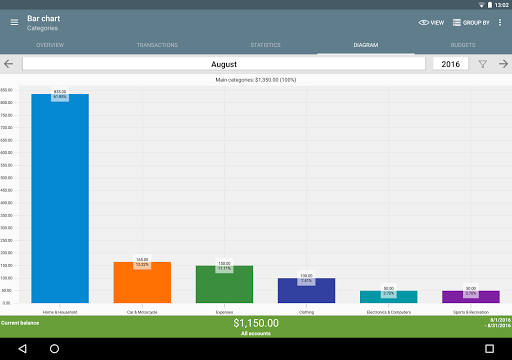

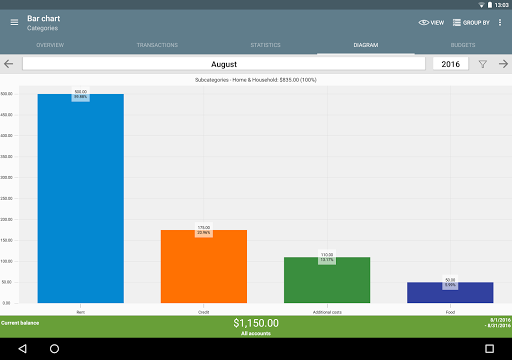

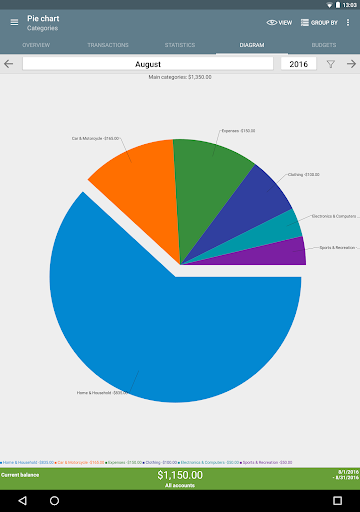

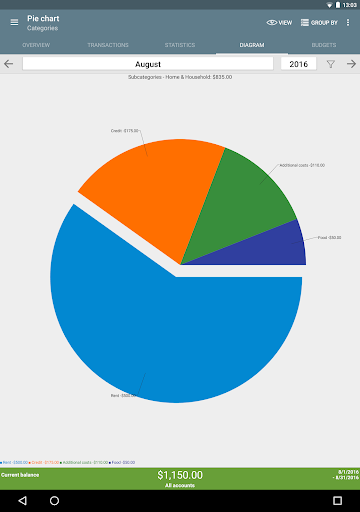

- Visualized Spending Insights: Offers colorful, easy-to-understand charts that reveal spending patterns over days, weeks, or months.

- Secure Data Sync & Backup: Ensures your financial data remains safe through encrypted cloud backup options, compatible across devices.

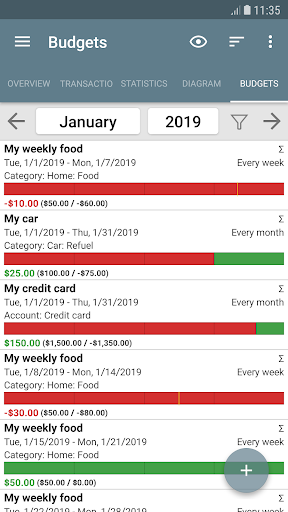

- Budget Planning & Alerts: Enables setting personalized budgets with real-time alerts to keep spending in check.

Engaging the User: A Journey Into Financial Clarity

Picture this: You're standing at the crossroads of your financial life, unsure which path to take. My Budget Book acts like a trusty GPS, guiding you through the maze of expenses with colorful maps and timely signals. Its lively yet intuitive interface transforms what could be a dull chore into an engaging daily ritual, making budgeting feel less like a burdensome task and more like a personal game of financial mastery.

Core Functionality Deep Dive

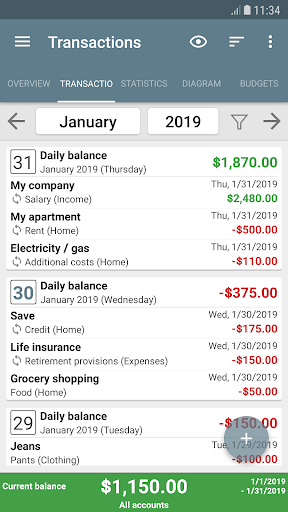

Seamless Expense Management

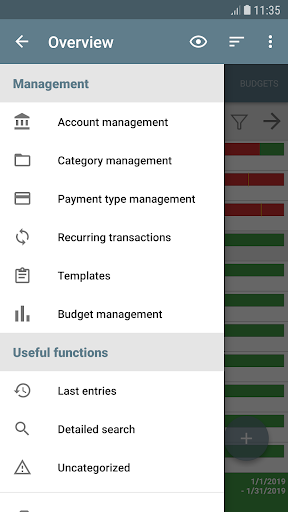

The app's automatic expense categorization is a standout feature. Once linked with your bank accounts or credit cards, transactions flow in smoothly, and the app intelligently assigns categories such as Food, Transportation, or Entertainment. This not only reduces manual entry but also provides instant clarity on where your money is going. Users often praise how this reduces the stress of monthly reconciliation and helps identify overspending areas quickly.

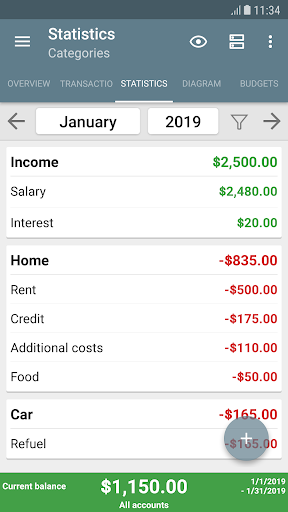

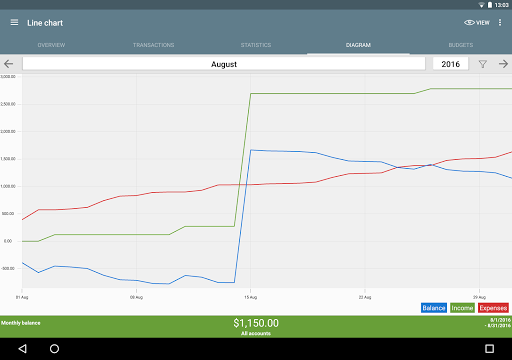

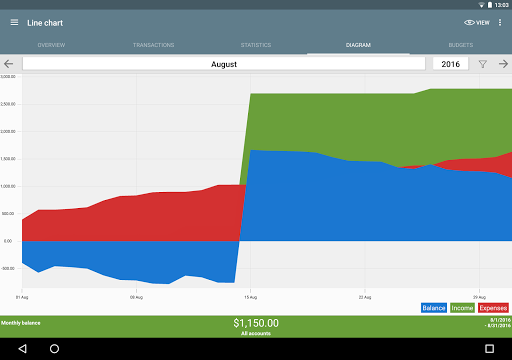

Visual Analytics That Speak Louder Than Words

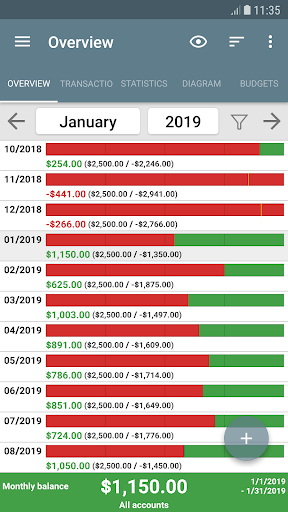

Next, the visualized insights turn raw data into compelling stories—think of colorful pie charts and trend graphs that jump off the screen. With a few taps, you can see your monthly spending patterns, compare income versus expenses, and adjust your habits accordingly. This visual feedback makes complex finances approachable and encourages more mindful spending habits, much like having a friendly coach guiding your financial decisions.

Robust Security and Syncing Capabilities

In an era where data security is paramount, My Budget Book shines with encrypted cloud backups and cross-device synchronization, ensuring your data is both safe and accessible wherever you go. Unlike some competitors that struggle with lagging updates or shaky security, this app prioritizes your privacy, reassuring you that your financial footprint is protected—giving peace of mind akin to having a vault guard for your personal data.

How It Stands Out in the Crowd

While many finance apps focus solely on expense tracking, My Budget Book emphasizes not only transaction management but also data security—placing a strong spotlight on account and fund security, making it a standout choice. Its real-time synchronization coupled with encrypted storage means your privacy remains intact, a significant advantage over less secure options. Additionally, the app offers a smooth transaction experience; entering expenses feels natural, with minimal steps, akin to doodling in a notebook rather than filing endless forms.

Recommendation and Usage Tips

For anyone seeking a reliable, user-friendly budgeting tool, especially those concerned about data privacy, My Budget Book is a strong candidate. It's particularly suited for users who prefer a straightforward, visual approach to managing finances without heavy technical learning curves. We recommend starting with a small monthly budget, utilizing the alerts to develop discipline, and exploring the graphical insights to discover your unique spending habits. Whether you’re a budgeting novice or a seasoned financial planner, this app can be a helpful partner on your journey towards financial well-being.

Pros

- User-friendly interface

- Comprehensive expense tracking

- Customizable budgets

- Data synchronization

- Visual reports and analytics

Cons

- Limited export options (impact: low)

- Few customization features for reports (impact: middle)

- No multi-currency support in the free version (impact: low)

- Occasional sync delays (impact: low to middle)

- Limited customization for app themes (impact: low)

Frequently Asked Questions

How do I start using My Budget Book for the first time?

Download the app, open it, and follow the onboarding guide to set up your accounts, currencies, and basic categories to begin tracking your expenses and income.

Can I backup and restore my financial data easily?

Yes, go to Settings > Data Management to manually back up or import your data via CSV, HTML, or Excel files for safekeeping and recovery.

How do I add a new expense or income transaction?

Tap on the ‘Add’ button on the main screen, select transaction type, input details, choose categories, and save. Use templates for faster entry if needed.

How can I view my spending patterns visually?

Navigate to your dashboard or Reports section to see dynamic charts and graphs that illustrate your expenses over time and by categories.

How do I set a monthly budget limit?

Go to Budget Mode, choose your period (monthly), set your spending limit for specific categories, and enable rollover if desired for ongoing tracking.

Can I customize the app’s appearance and categories?

Yes, access Settings > Appearance to choose themes or dark mode, and customize categories/subcategories to suit your needs.

Is there a free trial or any paid features?

The app offers a free version with essential features; advanced features may require a one-time purchase or subscription, which you can find in Settings > Premium.

What is the cost for premium features or subscription?

Pricing details are available under Settings > Premium. The app may offer a one-month free trial before subscription charges apply.

How do I cancel my subscription if I no longer want it?

Go to your device’s app store subscriptions management page, find My Budget Book, and select Cancel Subscription to terminate automatically renewal.

What should I do if the app crashes or doesn’t respond?

Try restarting your device, ensure the app is updated, and if issues persist, contact support via email for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4