- Developer

- Bambu

- Version

- 4.8.5

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.5

Introducing MyBambu: A Smarter Banking Companion

MyBambu - Better than Banking is an innovative financial app designed to seamlessly blend traditional banking features with cutting-edge technology, offering users a more personalized and secure financial management experience. Developed by the forward-thinking Bambu Tech team, this app aims to redefine how individuals handle their money by prioritizing security, ease of use, and insightful financial insights. Whether you're a tech-savvy millennial or an experienced investor, MyBambu strives to become your go-to financial partner.

Core Features That Stand Out

At the heart of MyBambu are features that make it not just another banking app but a comprehensive financial ecosystem. First, its advanced security protocols leverage biometric authentication and real-time fraud detection, ensuring that your assets are safeguarded at all times. Second, the app offers an intelligent transaction experience with instant AI-powered transaction categorization and personalized suggestions, making managing expenses a breeze. Third, users benefit from a unique integrated investment advisory service that provides tailored investment suggestions based on their financial goals and risk appetite. These features underscore MyBambu's commitment to security, usability, and personalized financial guidance.

User Experience: Navigating a User-Friendly Financial Space

If you've ever felt overwhelmed by a sea of confusing menus in financial apps, MyBambu might just change that perception. Its interface is clean, intuitive, and designed with a friendly aesthetic—think of it as a sleek dashboard in your car that makes navigating financial routes smooth and enjoyable. The app responds swiftly, with smooth transitions between sections—whether you're checking your balance, analyzing spending patterns, or reviewing your investment portfolio. The learning curve is gentle; even first-time users can comfortably explore all its features within a short time, thanks to clear onboarding guides and contextual help prompts.

Differentiators: What Makes MyBambu Truly Stand Out?

Compared to many other finance apps, MyBambu's standout feature is undoubtedly its focus on “Account and Fund Security.” Its multi-layered security approach combines biometric login, encryption, and AI-driven fraud monitoring—providing peace of mind that your assets are under a digital lock and key. Additionally, its transaction experience is notably enhanced by automatic categorization and real-time alerts, enabling users to understand and control their spending effortlessly. Unlike standard apps that merely display transactional data, MyBambu offers actionable insights—highlighting unusual expenditure patterns or potential saving opportunities—making your financial management smarter and more proactive.

Recommendation and Usage Suggestions

Based on its features and user experience, I'd recommend MyBambu especially to those seeking a balanced combination of security, simplicity, and intelligent financial features. If you're tired of juggling multiple apps for banking, investments, and expense tracking, this integrated solution could significantly streamline your financial life. For novice users, the app's approachable design minimizes hesitation, while experienced users will appreciate its depth, particularly the AI-driven insights and advanced security features. To get the most benefit, I suggest pairing MyBambu with regular financial reviews, leveraging its recommended savings plans, and exploring its investment advisory tools to grow your wealth with confidence.

Pros

- User-Friendly Interface

- Competitive Interest Rates

- Instant Transfers and Payments

- Robust Security Measures

- Personalized Financial Insights

Cons

- Limited Account Types (impact: medium)

- Few Investment Options (impact: medium)

- Occasional App Glitches (impact: low)

- Customer Support Response Time (impact: low)

- Limited International Support (impact: medium)

Frequently Asked Questions

How do I open a MyBambu account for the first time?

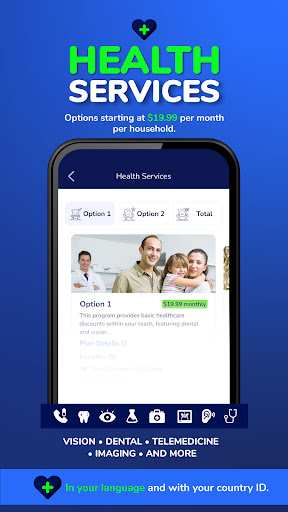

Download the app, follow the onboarding instructions, and submit your ID from your home country to open an account directly within the app.

Can I use MyBambu without a U.S. address?

Yes, you can open an account using your official ID; however, a U.S. mailing address is required to receive physical cards and for certain services.

What features are available for daily banking needs?

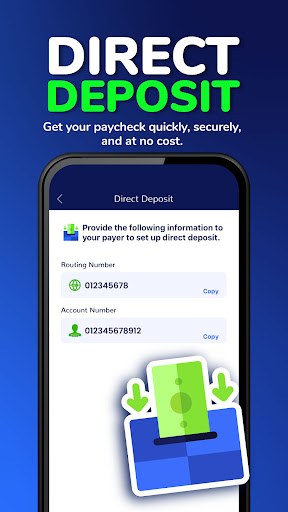

You can access checking accounts, debit cards, mobile top-ups, cash deposits at major retailers, and ATM withdrawals through the AllPoint network.

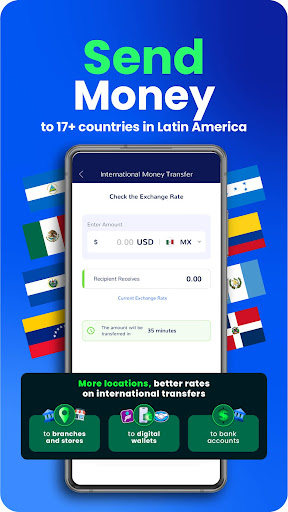

How do I send international money transfers?

Go to transfers > International, select the recipient country, enter the amount, and pay fees starting at $0.85; first four transfers are free.

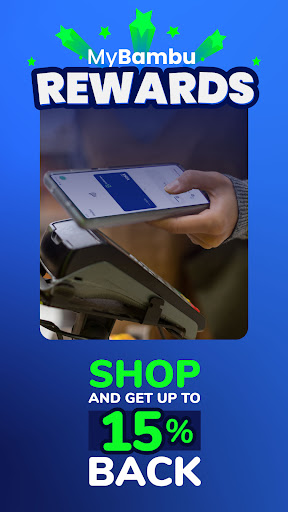

What is the process to get cashback rewards?

Shop with linked merchants like Disney+ or CVS; cashback is automatically credited to your account based on qualifying purchases.

How can I participate in the Spin & Win feature?

Access the Spin & Win section from the home screen, spin to win prizes up to $1,000 or tickets, and check results immediately.

Are there any subscription fees or hidden charges?

No, MyBambu has no minimum balance requirements or hidden fees; all costs are transparently displayed before transactions.

How do I check my account balance and transaction history?

Open the app, navigate to the dashboard, and view your balance and recent transactions on the main screen or under the 'Account' tab.

What should I do if I encounter login issues?

Use the 'Forgot Password' option on the login page or contact customer support via chat or phone for assistance.

How secure is my personal and financial data on MyBambu?

Your data is protected with advanced encryption and biometric login options; funds are FDIC insured up to $250,000.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4