- Developer

- Road Dogs

- Version

- 1.21

- Content Rating

- Everyone

- Installs

- 0.01M

- Price

- 17.99

- Ratings

- 4

MyCard - Contactless Payment: Effortless, Secure, and Smart Transactions

MyCard is a modern contactless payment app designed to streamline everyday transactions with a blend of security and user-friendly features. Developed by a dedicated team focused on innovative financial solutions, it aims to transform how users handle payments, loyalty, and account management in a seamless digital environment.

Key Highlights of MyCard

- Contactless NFC-based payments for quick and hygienic transactions

- Robust security protocols including tokenization and biometric verification

- Integrated loyalty and reward management within the app

- User-centric interface designed for both tech-savvy and beginners

Who Is It For?

MyCard targets busy urban dwellers, frequent shoppers, and anyone seeking a reliable alternative to carrying physical cards. It's particularly suited for those who appreciate convenience, enhanced security, and the ability to manage their finances digitally without sacrificing control or safety.

A Dynamic Introduction to the Future of Payment

Imagine standing in a bustling café, tapping your phone gently on the payment terminal, and voilà—your order is paid, your rewards are credited, and you're ready to groove to the next adventure. MyCard makes such moments effortless, turning the complexity of transactions into a simple, smooth experience. Unlike traditional wallets stuffed with cards, this app is your digital sidekick—ready to pay, save, and safeguard just with a tap and a glance.

Core Functionality: Speed and Security in Your Pocket

The hallmark of MyCard lies in its ability to blend swift contactless payments with ironclad security. Using NFC technology, transactions are completed within seconds, reducing waiting times and elevating convenience. The app's security measures stand out: employing tokenization minimizes the risk of data breaches, while biometric authentication—such as fingerprint or facial recognition—ensures only you can authorize payments. This dual-layered protection grants peace of mind, even in crowded retail environments or when handling sensitive financial data.

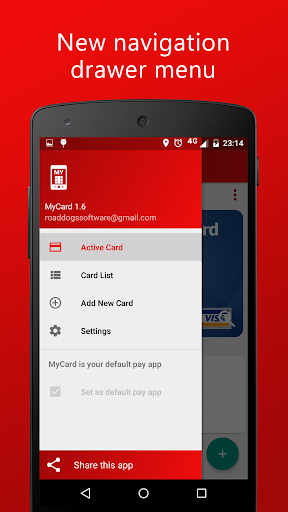

Seamless User Interface and Intuitive Experience

Upon opening MyCard, users are greeted with a clean, visually appealing interface that guides them effortlessly through their options. Managing cards, checking balances, or launching payments requires just a few taps—no steep learning curve here. The app's design emphasizes clarity and minimalism, making it accessible for users of all ages and tech abilities. The smooth responsiveness—thanks to optimized coding—ensures that transitions between screens are fluid, akin to flipping through a well-crafted digital magazine rather than fighting with sluggish software.

Unique Differentiators: Security and Transaction Comforts

While many financial apps promise security, MyCard elevates this aspect with its comprehensive approach. Its tokenization techniques replace sensitive card information with encrypted tokens during transactions, almost like giving a masked ID to each process, significantly reducing fraud risks. Furthermore, its integrated reward system is not an afterthought; it's embedded to motivate continuous use, turning everyday spending into earning possibilities. Compared to peers, MyCard's focus on a frictionless, secure experience—especially with biometric safeguards—sets it apart, making transactions feel less like a chore and more like a smart, personalized service.

Final Verdict & Recommendations

Overall, I find MyCard to be a thoughtfully crafted contactless payment application that balances ease of use with robust security. It's particularly advantageous for users who prioritize swift transactions and peace of mind. If you're someone who often finds traditional wallets cumbersome or worries about digital security, this app could become your new trusted companion. For casual users or those new to mobile payments, the intuitive interface reduces barriers to adoption. I recommend it to anyone seeking a modern, secure, and efficient way to handle daily transactions—think of it as upgrading from a paper map to GPS navigation on your financial journey.

Pros

- User-friendly interface

- Fast transaction process

- Wide acceptance

- Secure encryption

- Mobile wallet integration

Cons

- Limited offline functionality (impact: medium)

- Occasional compatibility issues (impact: low)

- Battery consumption (impact: low)

- Limited customization options (impact: low)

- Initial setup complexity (impact: medium)

Frequently Asked Questions

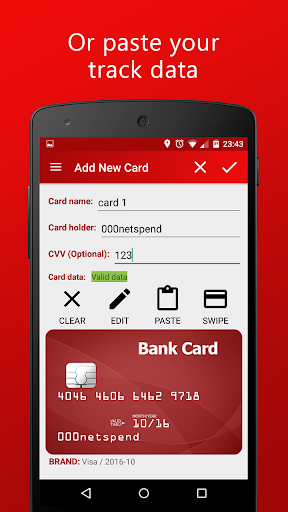

How do I get started with MyCard - Contactless Payment?

Download the app, register your device, and add your cards using a magnetic stripe reader or paste your track data. Ensure NFC is enabled for contactless payments.

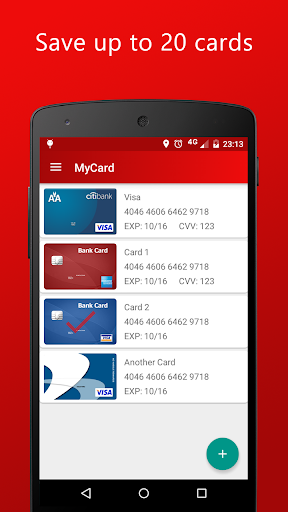

Can I add multiple cards to MyCard?

Yes, you can store up to 20 cards securely on your device. Navigate to the 'Cards' tab and follow the prompts to add each card.

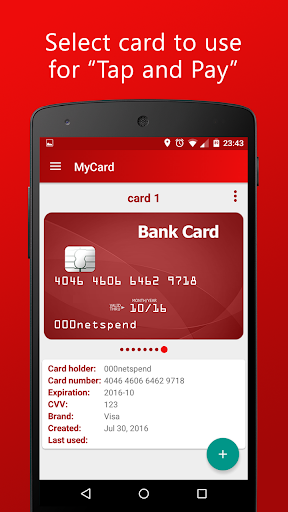

How do I make a contactless payment with MyCard?

Open the app, select the card, unlock your device, and tap your phone on the NFC reader. Make sure NFC and screen lock are active for successful transactions.

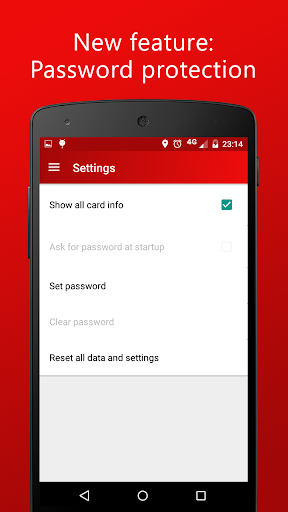

What security features does MyCard provide?

MyCard uses encryption and supports biometric authentication like fingerprint or face recognition for secure transactions. Enable biometrics in settings under Security.

Is an internet connection required to use MyCard?

No, MyCard works offline after card setup. Payment data is stored locally, ensuring your information remains private and secure.

Can I use MyCard on both Android and iOS devices?

Yes, MyCard supports both platforms. Download the app from Google Play Store or Apple App Store and follow the setup instructions.

How do I update or upgrade my subscription?

Go to Settings > Account > Subscription within the app to view or change your subscription plan and manage payment options.

Does MyCard support premium features or paid upgrades?

The basic functionality is free. Check the app's subscription section for premium features, which can be purchased to enhance your experience.

What should I do if MyCard isn't working properly?

Ensure NFC is enabled, your device is unlocked, and your card data is properly added. Restart the app and test the payment process again.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4