- Developer

- FICO

- Version

- 4.0.16.1

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.3

One-Stop FICO Score Monitoring and Insights

MyFICO: FICO Credit Check stands out as a comprehensive tool that provides users with real-time access to their FICO scores, credit reports, and personalized insights—all packed into a sleek, intuitive app. Whether you're a credit novice or a seasoned financial navigator, this app aims to demystify credit management and empower users to make smarter financial decisions.

Developed by MyFICO, a Trusted Name in Credit Monitoring

Created by the team behind the official FICO scoring system, MyFICO offers a trusted and accurate snapshot of your credit health. With decades of experience in credit scoring and a reputation for reliability, the developers have crafted an app that marries professionalism with user-friendliness, making it accessible to a broad audience.

Major Features That Make a Difference

- Real-Time FICO Score Updates: Receive your latest FICO scores regularly, allowing you to track your credit health dynamically instead of relying on outdated reports.

- Detailed Credit Reports & Insights: Dive deep into your credit report to understand factors affecting your score, such as payment history, credit utilization, and new credit inquiries, with tailored tips for improvement.

- Credit Monitoring & Alerts: Get instant notifications for any significant changes or suspicious activities, acting like a vigilant guard for your financial reputation.

- Score Simulator & Personalized Advice: Experiment with different scenarios—like paying down debt or opening new accounts—to see how they could impact your credit, along with customized advice based on your profile.

The app targets individuals who want transparent, actionable insights into their credit status—ranging from young adults establishing credit, to homebuyers, to those simply wanting to keep a close eye on their financial standing.

Engaging and User-Friendly Experience

Opening myFICO feels like stepping into a well-organized personal finance dashboard—clean, modern, and inviting. The color palette and icons are carefully designed to guide users effortlessly through complex credit information, much like a GPS navigating you through a bustling city. Operationally, the app responds swiftly, with smooth transitions between sections, making the experience seamless, even for first-time users.

Intuitive Interface and Ease of Use

From login to transaction, the app's design minimizes clutter and emphasizes clarity. The main dashboard presents your current FICO score front and center, with visual cues like color-coded indicators (green for healthy, yellow for watch, red for caution) that immediately communicate your credit status. Navigating to detailed reports or alerts requires just a couple of taps—no complex menus or confusing options. For users new to credit management, the learning curve is gentle, with helpful tooltips and explanations integrated throughout the platform.

Performance and Security Highlights

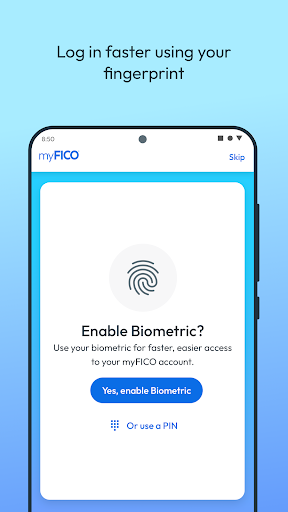

Performance-wise, myFICO shines with rapid load times and minimal lag. Security is robust; the app employs encryption and secure login protocols, giving users peace of mind in an era where credit data is highly sensitive. The emphasis on data protection makes it slightly more reassuring than some competitors, especially for those concerned about account security and transaction safety, as the app proactively maintains account integrity.

What Sets MyFICO Apart from the Crowd

While many finance apps offer credit score tracking, myFICO distinguishes itself through the depth and accuracy of its data. Its integration with the official FICO scoring model means users aren't just seeing generic scores but are getting the same metrics lenders evaluate. Moreover, the app's emphasis on Account and Fund Security—through timely alerts—and a transparent transaction experience ensures users not only monitor their credit but also feel confident that their data and accounts are protected.

The Score Simulator is another unique feature, empowering users with foresight—helping them understand the potential impact of financial decisions before making them. This proactive approach makes myFICO not just a monitoring tool but a personal credit advisor.

Recommendations and Usage Tips

For individuals who prioritize credit transparency and wish to stay vigilant about their financial health, myFICO is highly recommended. Its detailed insights are particularly valuable for those planning major financial moves, such as purchasing a home or refinancing a loan. However, users should be prepared for a modest subscription fee, as some features are behind a paywall, unlike free credit score apps that often offer limited data.

To maximize benefits, I suggest regular check-ins—perhaps monthly—to observe trends and catch potential issues early. Combining this app with solid credit habits, like paying bills on time and keeping credit utilization low, can truly help users enhance their financial standing over time.

Overall, myFICO: FICO Credit Check is like having a trusted financial counselor in your pocket—delivering precise data, security, and actionable insights in a beautifully crafted interface. If you value accuracy and peace of mind in your credit journey, this app deserves a prominent spot on your device.

Pros

- Comprehensive Credit Monitoring

- User-Friendly Interface

- Personalized Credit Insights

- Free Basic Services

- Identity Theft Alerts

Cons

- Limited Credit Report Details (impact: Low)

- Subscription Costs for Premium Features (impact: Medium)

- Data Refresh Delays (impact: Medium)

- Limited Credit Score Types (impact: Low)

- In-App Notifications Can Be Overwhelming (impact: Low)

Frequently Asked Questions

How do I get started with myFICO: FICO Credit Check?

Download the app, register with your details, then follow prompts to link your credit bureaus and securely access your FICO scores and reports.

Does checking my own credit score on myFICO hurt my credit?

No, checking your own credit score is considered a soft inquiry and will not negatively impact your score.

What exactly can I monitor with myFICO?

You can view your FICO® Scores across different loan types, track score changes over time, and get detailed credit reports from Experian, TransUnion, and Equifax.

How does the FICO Score Simulator work?

Access the Simulator from the menu to simulate how actions like paying off debt or opening accounts might affect your FICO Score, helping with financial planning.

What alerts does myFICO provide?

The app notifies you of significant account changes, inquiries, or suspicious activities, enabling quick responses to potential issues.

Can I see my credit report from all three bureaus?

Yes, the app provides instant access to credit reports from Experian, TransUnion, and Equifax for a comprehensive view.

Is there a subscription fee to use myFICO features?

Basic features are free, but advanced tools and detailed reports require a myFICO subscription, accessible through the app's settings under Account > Subscription.

What are the costs associated with myFICO subscriptions?

Pricing varies based on the plan you choose; details are available in the app under Settings > Account > Subscription to find an option that fits your needs.

How do I cancel myFICO subscription if needed?

Go to Settings > Account > Subscription, and follow the prompts to cancel or modify your subscription directly within the app or your device settings.

What should I do if I encounter login issues?

Try resetting your password or enabling biometric login via Settings > Security. If problems persist, contact myFICO support through the app's help section.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4