- Developer

- Synchrony

- Version

- 5.1.0

- Content Rating

- Everyone

- Installs

- 1.00M

- Price

- Free

- Ratings

- 4.5

MySynchrony: A Seamless Financial Companion for Modern Users

MySynchrony is a versatile and user-friendly financial management app designed to empower individuals with secure, intuitive access to their accounts and financial transactions, all wrapped into a sleek digital experience.

Developed by a Dedicated Team of Fintech Innovators

Created by Synchrony Financial, a leader in consumer financial services, the app reflects their commitment to combining security, innovation, and user-centric design in digital money management solutions.

Highlights That Make MySynchrony Stand Out

- Enhanced Account Security: Top-tier encryption and biometric authentication ensure your financial data remains protected.

- Streamlined Transaction Experience: Effortless transfer processes and real-time updates keep your finances at your fingertips.

- Personalized Financial Insights: Customized recommendations help users better understand and optimize their spending and saving habits.

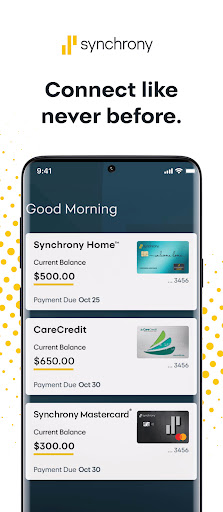

- Multi-Account Management: Manage multiple credit cards, savings, and digital wallets within one unified platform.

Captivating Beginning: Navigating Your Financial Universe

Imagine stepping into a cockpit where every switch, dial, and indicator is designed to guide you smoothly through your financial landscape. MySynchrony offers that cockpit— intuitive, responsive, and crafted to make managing your money as engaging as navigating a well-charted map. Whether you're tracking expenses, making payments, or reviewing your credit health, this app transforms mundane tasks into an effortless journey, almost like having your personal financial assistant by your side.

Secure and Reliable Account Access

The cornerstone of any financial app is trust, and MySynchrony excels with its robust security measures. It employs bank-grade encryption and biometric verification—think of it as a high-tech vault door that only you can open. Setting up your account is straightforward, involving familiar login checks or fingerprint scans, making access both safe and quick. The app's security protocols transparently run in the background, providing peace of mind so that your sensitive information stays locked away from unwanted eyes.

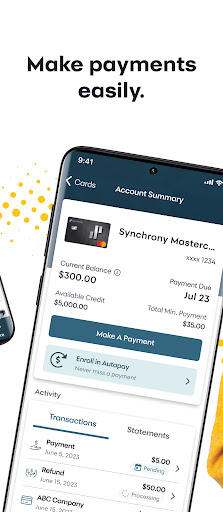

Transaction Experience: Fast, Fluid, and Transparent

When it comes to moving money, speed and clarity are king. MySynchrony shines by offering near-instant transaction processing, whether transferring funds between accounts, paying bills, or managing rewards. Its interface mimics a sleek dashboard—each transaction flows seamlessly, with automatic updates and confirmation prompts that make you feel in control, without the usual tangled menus or confusing steps. Plus, real-time alerts inform you immediately of any activity, much like a security camera keeping watch over your financial frontiers.

Personalized Insights and Effortless Management

Beyond the basics, MySynchrony offers a layer of intelligence that feels akin to having a financial advisor whispering suggestions in your ear. It analyzes your spending patterns, identifies areas to save, and even suggests optimized payment schedules. Managing multiple accounts and cards becomes simpler than ever—think of it as a virtual conductor harmonizing all your financial instruments into a symphony of efficiency.

What Sets MySynchrony Apart from Peers?

While many finance apps aim to bundle security and convenience, MySynchrony distinguishes itself with its focus on user trust and transaction transparency. Its biometric security measures are particularly noteworthy, providing a seamless yet secure login experience that elevates user confidence. Beyond that, its real-time transaction updates and personalized insights foster an engaging sense of financial mastery—making users feel more in control than traditional, static banking apps. This dual focus on security and user engagement makes it a compelling choice for those who want both peace of mind and active financial involvement.

Final Thoughts: A Recommendation for the Mindful Money Manager

If you're seeking a finance app that balances security, efficiency, and a dash of personalization—think of it as a trusted financial sidekick—MySynchrony is worth considering. Its unique emphasis on biometric security and real-time transaction feedback positions it as a particularly reliable platform for users who value both safety and transactional fluidity. I would recommend it especially for users who manage multiple accounts or prioritize secure, quick access to their financial data.

In essence, MySynchrony isn't just another app—it's a thoughtfully designed tool that turns financial management into a smooth, almost enjoyable task, much like having a reliable navigator charting your fiscal voyage.

Pros

- User-friendly interface

- Strong security measures

- Wide device compatibility

- Reliable synchronization

- Helpful customer support

Cons

- Occasional slow sync speeds (impact: medium)

- Limited customization options (impact: low)

- Free version has restrictions (impact: medium)

- Occasional app crashes on older devices (impact: low)

- Inconsistent notification alerts (impact: low)

Frequently Asked Questions

How do I initially set up and log into MySynchrony on my Android device?

Download the app from Google Play, open it, follow the registration prompts, and choose secure login options like TouchID or fingerprint within Settings > Security.

Can I access my Synchrony credit accounts after the app transition?

Yes, existing account holders can log in using their current credentials to continue managing their accounts through MySynchrony.

How do I view my account balance and recent transactions?

Log in to the app, then tap ‘Accounts' to see your balance and transaction history on the main dashboard or under ‘Transaction History.'

How can I make a payment or schedule future payments?

Navigate to ‘Payments,' select your account, choose ‘Make Payment,' enter details, or select ‘Schedule Payment' to plan future payments easily.

How do I add multiple bank accounts for payments?

Go to Settings > Payment Methods, tap ‘Add Bank Account,' and follow prompts to securely link your bank accounts for seamless transactions.

What features help me manage and track my credit card spending?

Use ‘Balance & Limits' to check limits and spending, and ‘Transaction History' to review detailed purchase records within the app.

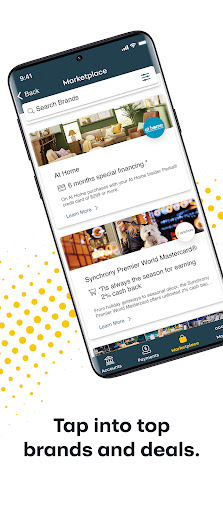

Are there any offers or discounts accessible through MySynchrony?

Yes, browse the ‘Deals & Offers' section to access savings programs, special discounts, and promotional deals from our partners.

Are there any subscription fees for using MySynchrony?

No, the app is free to download and use, with no subscription fees; your bank or credit provider may impose charges for transactions.

What should I do if the app encounters technical issues or lag?

Try restarting your device, update the app, or reinstall it. For persistent problems, contact customer support through ‘Help & Support' in Settings.

Can I manage my savings accounts through MySynchrony?

Currently, savings accounts like Synchrony Bank Savings aren't supported; focus on private label credit account management within the app.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4