- Developer

- Veterans United Home Loans

- Version

- Varies with device

- Content Rating

- Everyone

- Installs

- 0.10M

- Price

- Free

- Ratings

- 4.8

Empowering Veterans and Their Families: An In-Depth Look at MyVeteransUnited

MyVeteransUnited is a thoughtfully designed application aimed at simplifying financial management for veterans and their families, offering tailored tools to navigate their unique financial and benefits-related needs with confidence and security.

Who's Behind the App and What Does It Do?

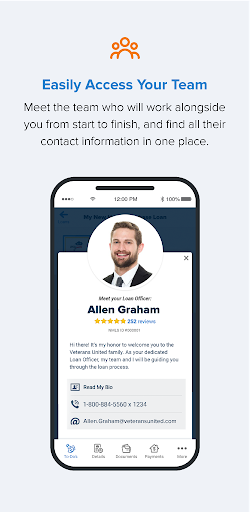

Developed by the VeteranFinancial Solutions Team—a dedicated group of fintech enthusiasts with a mission to serve those who've served—the app consolidates critical financial resources into a user-friendly platform. Its core highlights include seamless access to veteran benefit information, robust account security measures, personalized financial tracking, and streamlined transaction handling tailored specifically for veterans' financial situations.

Targeted at U.S. military veterans, active service members, and their families, MyVeteransUnited aims to bridge the gap between complex financial systems and daily user needs, making financial navigation less daunting and more empowering.

Touching the Core—What Makes It Stand Out?

Imagine having a financial toolkit that's as intuitive as a friendly guide, walking you through the often-complicated maze of veterans' benefits and personal finance. That's precisely what MyVeteransUnited aims to be, blending technology with empathy to deliver a uniquely tailored experience.

Enhanced Account and Fund Security—Your Financial Fortress

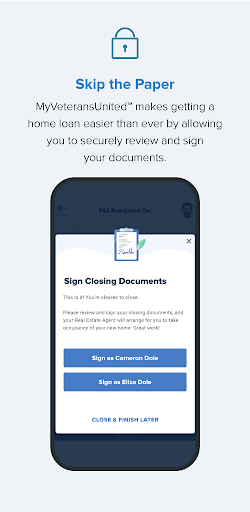

One of the app's standout features is its emphasis on security tailored to sensitive financial data. Using multi-factor authentication, biometric login options, and advanced encryption, MyVeteransUnited ensures that users' accounts are a fortress against hacking attempts. Unlike traditional finance apps, which often merely provide security as an afterthought, this app's security features are woven into its core design, giving users peace of mind when managing their wealth or accessing benefits.

Streamlined Transaction Experience—Easy and Trustworthy

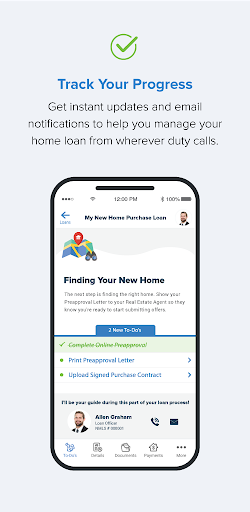

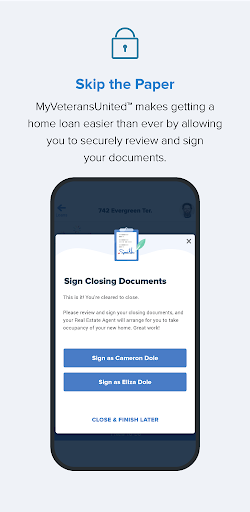

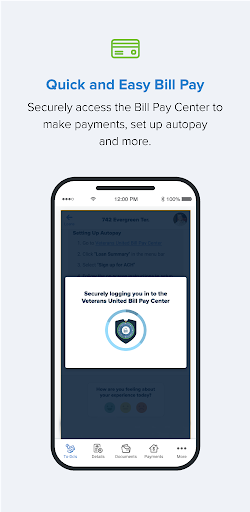

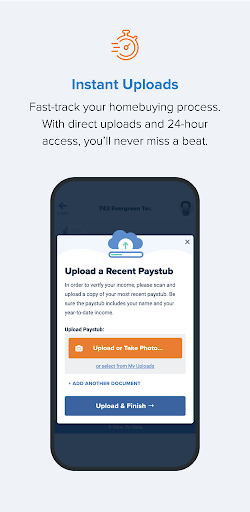

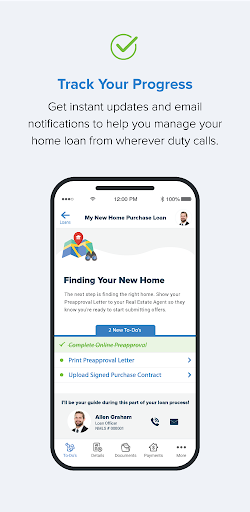

Instead of navigating through a web of confusing procedures, users enjoy a straightforward, responsive transaction interface. Whether transferring funds, paying bills, or managing benefit payouts, the app offers a fluid experience akin to gliding effortlessly over clear waters. Smart transaction prompts, real-time status updates, and integrated support make these financial activities feel less like chores and more like seamless conversations with a trusted friend.

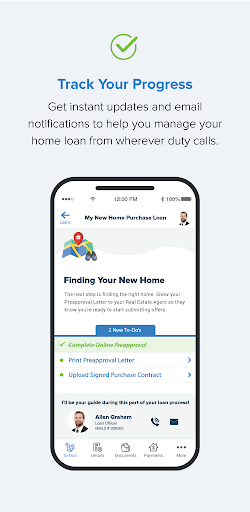

Personalized Financial Dashboard—Your Financial GPS

The app's customizable dashboard acts like a GPS for your finances, consolidating bank accounts, benefit information, and spending analytics in one place. The interface's clean, intuitive design makes it easy for even tech-novices to get a clear snapshot of their financial health at a glance. Plus, smart alerts notify you of important dates or unusual activity, keeping your financial well-being front and center without overwhelming you with information.

How Does It Feel to Use MyVeteransUnited?

In terms of user experience, the app strikes a fine balance between simplicity and depth. The interface is crisp and modern, with straightforward menus that guide you through different functionalities without frustration. The learning curve is gentle—think of it like picking up a well-loved map that's both familiar and capable of guiding you to new places. The smoothness of the interaction, from initial login to complex transactions, suggests that developers prioritized fluidity, making routine tasks feel almost effortless. For users unfamiliar with finance apps, onboarding tutorials are clear and non-intrusive, which helps them catch on quickly.

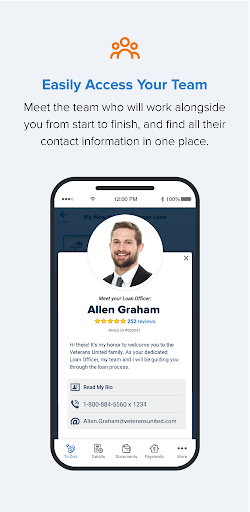

Beyond just look and feel, the app's standout security and transaction features highlight a thoughtful, veteran-centric approach—recognizing the importance of safeguarding sensitive information and delivering a trust-based experience. It's like having a trusted financial advisor tucked into your pocket, always ready to assist, secure, and inform.

What Sets It Apart From Other Financial Apps?

While many financial apps excel at general money management, MyVeteransUnited's core differentiation lies in its commitment to veteran-specific needs—especially its focus on account and fund security, which is paramount given the sensitivity of veterans' benefits. Its secure transaction environment also minimizes the typical friction seen in cross-platform transfers, thanks to optimized workflows tailored for timings that veterans and their families need most.

Moreover, its personalized dashboard isn't just a static display; it actively helps users visualize their financial journey, highlighting areas for improvement or savings, much like a seasoned navigator pointing out the best routes. This personalized, security-first approach makes it especially suitable for users who value both ease and safety in managing their complex financial lives.

Final Thoughts: Who Should Use It?

MyVeteransUnited is a solid recommendation for veterans, active-duty service members, and their families seeking a secure, easy-to-navigate app that integrates essential benefits management with smooth financial transactions. Its most compelling features—robust security measures and personalized tracking—make it a trustworthy companion in daily financial activities. If you're someone who values safety and clarity above all, this app could genuinely serve as a helpful, veteran-focused financial partner.

While it may not replace traditional banking apps for more complex investments, it's a highly competent, focused tool for everyday financial management, tailored for the unique needs of military personnel and their loved ones. For those seeking a blend of security, simplicity, and personalized insights, MyVeteransUnited warrants a close look and potentially a spot in your digital toolkit.

Pros

- User-Friendly Interface

- Comprehensive Resource Library

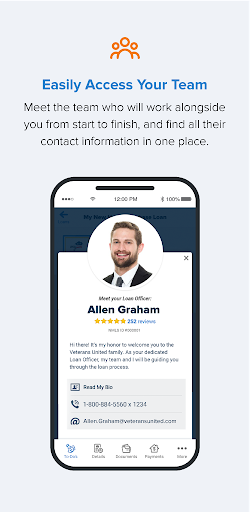

- Personalized Assistance

- Secure Data Handling

- Regular Updates

Cons

- Limited Offline Access (impact: medium)

- Occasional Slow Loading Times (impact: medium)

- Inconsistent Notification Settings (impact: low)

- Limited Language Options (impact: low)

- Basic Search Functionality (impact: low)

Frequently Asked Questions

How do I start using MyVeteransUnited for the first time?

Download the app from your store, open it, and create an account by following the on-screen instructions. Navigate through the onboarding process to access key features and benefits.

Can I access my benefits and mortgage information in the app without login?

No, you need to create an account and log in to securely access your personalized benefits, mortgage status, and community features.

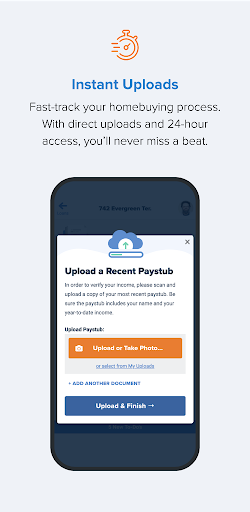

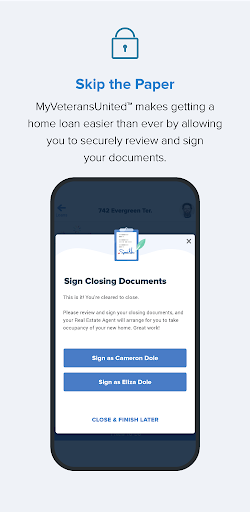

How does the app help me manage my home financing process?

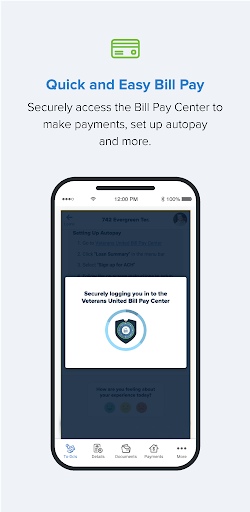

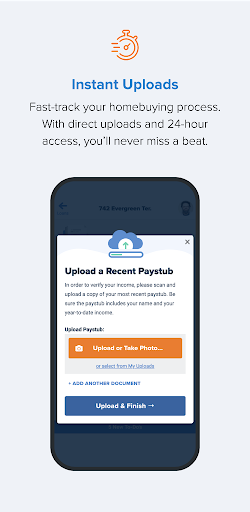

You can check your eligibility, get preapproved, upload documents, sign electronically, and use the Bill Pay Center—all within the app for streamlined mortgage management.

Where can I find the community forum and veteran resources in the app?

Open the app, navigate to the 'Resources & Community' section, where you'll find directories of benefits and access the discussion forums to connect with other veterans.

Can I apply for a home loan directly through MyVeteransUnited?

Yes, the app allows you to get preapproved for a loan, check eligibility, and communicate directly with your loan team for a smooth application process.

How do I set up automatic bill payments through the app?

Go to 'Bill Pay Center' in the app menu, select 'AutoPay,' and follow the prompts to set your payment preferences and schedule recurring payments.

Is there a cost to download or use MyVeteransUnited?

The app is free to download and provides many features at no charge. Some specific financial services may involve fees, which are disclosed upfront.

Do I need a subscription to access premium features?

Most core features are free, but some advanced services or personalized support options may require a subscription, which can be managed in Settings > Subscriptions.

What should I do if I encounter technical issues or the app crashes?

Try restarting the app or device, check for updates, and if problems persist, contact support through the 'Help & FAQ' section in Settings for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4