- Developer

- NetSpend

- Version

- 2.0.4

- Content Rating

- Everyone

- Installs

- 0.50M

- Price

- Free

- Ratings

- 4

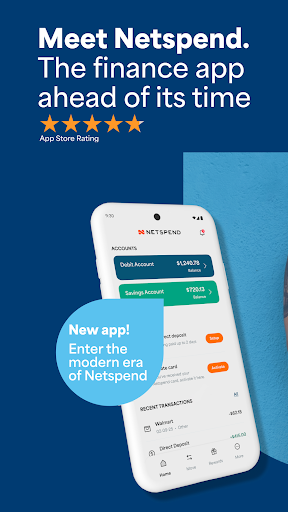

Netspend Wallet: A Secure and User-Friendly Prepaid Card Management App

Netspend Wallet is a versatile mobile application designed to streamline prepaid card management, offering users a secure and efficient platform to handle their financial transactions with ease.

Developed by a Dedicated Financial Technology Team

Created by the innovative team at Netspend Corporation, a leader in prepaid card solutions, the app embodies their commitment to providing accessible digital financial services tailored to everyday users.

Key Features that Stand Out

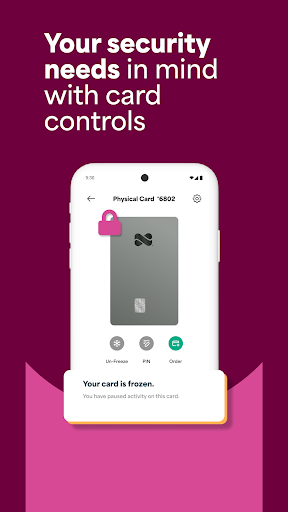

- Robust Security Measures: Multiple layers of security including encryption and fraud monitoring ensure user funds and personal data are well protected.

- Comprehensive Transaction Management: Users can easily load funds, monitor expenses, and manage recurring payments through an intuitive interface.

- Real-time Notifications and Alerts: Stay updated on transaction activities and account changes instantly, promoting transparency and oversight.

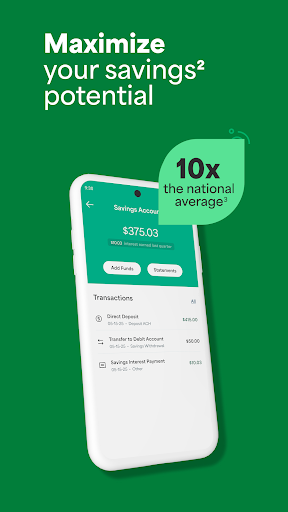

- Budgeting and Savings Tools: Built-in features assist users in tracking spending limits and setting financial goals.

A Friendly Introduction: Navigating the Digital Wallet Landscape

Imagine managing your money as smoothly as scrolling through your favorite social media feed—Netspend Wallet aims to make this a reality. Whether you're seasoned in financial apps or just dipping your toes into digital banking, the app's clean design and user-centric features feel like catching up with an old friend who always has your back financially. Its sturdy security ensures peace of mind, letting you focus on your day-to-day purchases or savings goals without a hitch.

Core Functionality Deep Dive

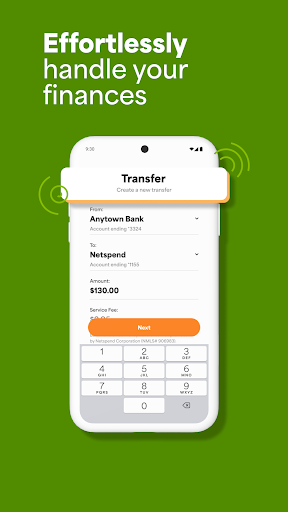

Seamless Card Management and Load Options

One of the app's shining stars is its streamlined approach to managing prepaid cards. Users can instantly activate, freeze, or replace cards directly within the app. Adding funds is straightforward—link your bank account, use direct deposit, or deposit checks via mobile capture—saving you trips to the bank or ATM. The interface guides you through each step, making financial input feel almost effortless.

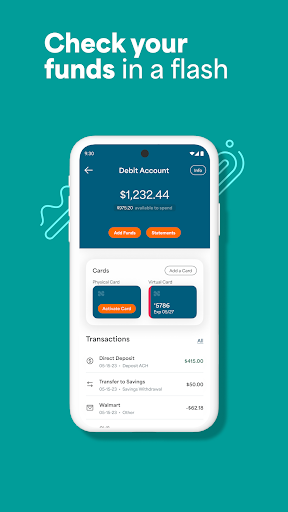

Transaction Experience: Clarity and Control

Monitoring your spending shouldn't feel like deciphering ancient scripts. Netspend Wallet provides clear transaction histories, categorization, and instant updates. Each purchase, bill payment, or reload is displayed in real-time, giving you full control and insight. The app's visual cues and notification system act like a financial dashboard—informing you before you overspend, and helping you stay aligned with your budget.

Security and Privacy: Fort Knox in Your Pocket

Compared to many finance apps, Netspend Wallet emphasizes user security as its core ethos. Encryption protects all your data, while features like multi-factor authentication and real-time fraud alerts act as vigilant guards. What's more, the app offers the ability to lock your card remotely if you misplace it, preventing unauthorized use. This layered security approach combines robust backend safeguards with user-friendly controls, setting it apart from less vigilant competitors.

Design, Usability, and Learning Curve

The app sports a modern, intuitive interface reminiscent of sleek consumer tech—bright icons, simple navigation tabs, and contextual hints make onboarding smooth. Even if you're new to digital wallets, the learning curve is gentle; tutorials and help sections are thoughtfully integrated. The overall experience is fluid—transitions are snappy, and menu options are logically arranged. This thoughtful design ensures that users of varying tech skills can comfortably adopt and benefit from the app without frustration.

Unique Selling Points and Comparative Edge

The standout feature of Netspend Wallet lies in its combined emphasis on transaction transparency and security. Unlike some fintech solutions that prioritize experience over security, or vice versa, this app offers a balanced approach. Its real-time alerts act like a financial guardian angel, ensuring you're always in the know. Additionally, its focus on prepaid card management suits a broad demographic—from students to budget-conscious consumers—who prefer controlled spending and quick access to funds, all within a protected environment.

Recommendation and Usage Advice

All in all, Netspend Wallet earns a solid recommendation from me, particularly for users seeking an accessible prepaid card management tool with strong security safeguards. It's ideal for those who value transparency, control, and peace of mind, especially in a digital age where financial safety is paramount. While it may lack some advanced investment features or extensive rewards programs found in comprehensive banking apps, its straightforward design and security focus make it a reliable choice for everyday use. I suggest new users start by linking their cards, experimenting with transaction tracking, and enabling alert notifications to maximize the app's potential.

Pros

- Wide Acceptance and Compatibility

- No Cheque or Credit Check Required

- Budget Management Tools

- Physical and Digital Card Options

- Fee Transparency and Alerts

Cons

- Limited International Usage (impact: high)

- Customer Service Response Times (impact: medium)

- Higher Fees on Certain Transactions (impact: medium)

- App Interface Could Be More User-Friendly (impact: low)

- Limited Rewards or Cashback Offers (impact: low)

Frequently Asked Questions

How do I sign up and start using Netspend Wallet?

Download the app, register with your details, link your bank account or load funds, and activate your card following the onboarding instructions within the app.

Can I access Netspend Wallet on my mobile device?

Yes, the app is compatible with both iOS and Android devices for convenient on-the-go access.

What are the main features of Netspend Wallet?

It offers balance checking, bill payments, real-time transaction notifications, budgeting tools, and easy fund management through mobile and payment integrations.

How does the budgeting tool help me manage my money?

You can categorize expenses, track spending in real-time, and review transaction history to stay within your budget easily within the app.

What security measures does Netspend Wallet have?

It uses advanced encryption, allows you to suspend your card if lost, and provides real-time alerts to monitor suspicious activity.

Does Netspend Wallet support Google Pay and Apple Pay?

Yes, you can link your Netspend account with both Google Pay and Apple Pay for quick and secure mobile payments.

Are there any hidden fees with Netspend Wallet?

No, Netspend offers transparent fee structures; you can check the fees in the app's Settings > Fees section for clarity.

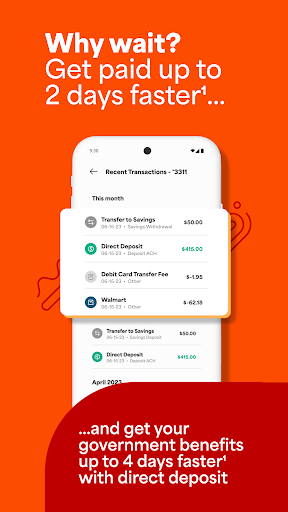

How can I receive my paycheck earlier via Netspend?

Set up direct deposit in the app under Settings > Direct Deposit, and your paycheck can arrive up to two days early.

Does Netspend Wallet require a credit check to open an account?

No, there is no credit check required during sign-up, making it accessible for unbanked or underbanked users.

What should I do if I encounter issues using the app?

Visit the Help section in the app or contact customer support directly through Settings > Support for assistance.

Capital One Mobile

Finance 4.9

Trust: Crypto & Bitcoin Wallet

Finance 4.7

Intuit Credit Karma

Finance 4.8

Investing.com: Stock Market

Finance 4.6

Revolut: Spend, Save, Trade

Finance 4.7

Coinbase: Buy BTC, ETH, SOL

Finance 4.7

Venmo

Finance 4.9

TrueMoney

Finance 3.4

Walmart MoneyCard

Finance 4.1

Current: The Future of Banking

Finance 4.5

LifeLock Identity by Norton

Finance 4.4